“In this type of environment, superior returns are more likely to be earned through minimizing mistakes than through stretching for yield. Rather than behaving aggressively, the search for return should involve risk control, caution, discipline and selectivity.” – Howard Marks

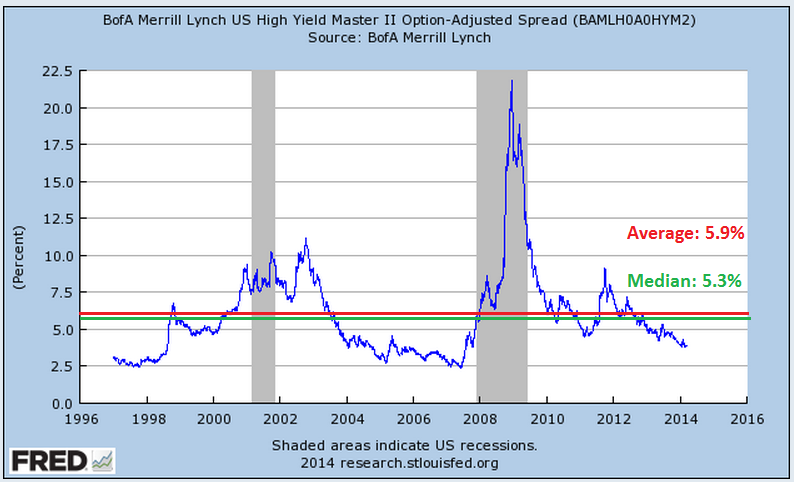

The following graph has some people on Wall Street worried at the moment:

This shows the interest rate spread between U.S. Treasuries and high yield corporate bonds, which currently sits at around 3.9%. This is below the average and median by a decent amount and is causing concern that things may be on their way to getting out of hand.

For the uninitiated, this spread is used as a measure of risk aversion. When the spread is wide, investors are shunning risk by selling junk bonds and buying treasuries. When it’s narrow, that means investors are less risk averse.

Lower spreads could also be a reflection of corporate credit quality, with the possibly lower default risk, chasing yield or a signal of a strengthening economy. It all depends on how you look at it. You could make a number of conclusions from this information, but the only thing we know for sure is that interest rates in the sector are down and returns are up.

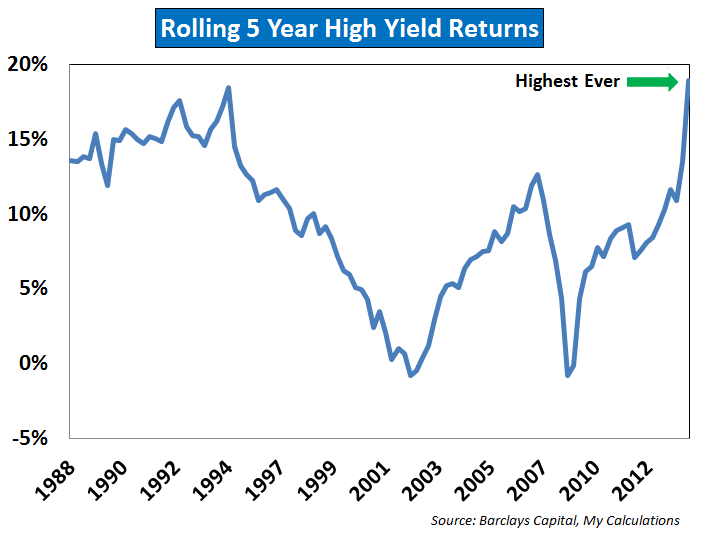

Stocks get all of the publicity, but high yield bonds have also been on fire during the current bull market.

High yield bonds weren’t up nearly as much as stocks in 2013 (roughly 30% vs. 8%), but they’ve had extraordinary performance numbers over the past 5 years.

To put the recent returns on high yield bonds in perspective, the Barclays Capital High Yield Bond Index goes back to the middle of 1983. I looked at the five year rolling returns on a quarterly basis going back to the inception of this index. In those 30+ years, there has never been a higher 5 year return than the 18.9% annual performance earned in the most recent 2009-2013 period.

Let me repeat that for dramatic effect. We just had the highest 5 year returns EVER for high yield bonds.

For those of you that are visual learners, here’s a chart of the rolling 5 year returns for high yield:

Of course, those returns are coming off of losses in excess of 26% during the 2008 financial crisis. Bigger gains and bigger losses are one of the main reasons high yield resembles more of an equity risk profile even though they are technically bonds.

I’m not a huge fan of fear-mongering and calling for a huge crash every time markets rise. I don’t think that’s productive for anyone, especially since the general trend is usually higher.

A crash can happen, but that doesn’t mean it always will happen. We could just as easily see a leveling off over time or a very slow rise in rates or the spread.

Just because you see valuations, spreads, interest rates or returns outside of their past averages doesn’t mean they have to revert back to the mean right away. These types of indicators can help you put the current market environment into context, but that doesn’t mean you can use past averages to time your purchases or sales with any precision. Markets never follow the exact same script as they have in the past.

The danger for investors in high yield is that they will extrapolate recent performance and assume it will continue indefinitely going forward. Now is not the time to pile in after we’ve witnessed an unprecedented rise.

My advice would be to temper your return expectations going forward.

The Barclays High Yield Bond ETF (JNK) currently yields around 5.9%. At this point in the cycle, investors in high yield should be happy to simply clip this coupon on a regular basis since spreads don’t have room to much fall further.

High yield bonds have a large spread over government bonds for a reason. You don’t get a higher yield without accepting higher risk of loss. That means returns could be lower than the stated yield if investors get nervous and decide they want out.

One other point to remember — bonds exhibit much higher volatility at lower interest rates. As rates move, these bonds will now fluctuate much more than they would if yields were higher.

I’m not saying you should dump all of your high yield bonds here (because I can’t predict the future). I am saying that understanding the risks involved in the high yield sector are much more important than looking back at past returns.

Now for the best stuff I’ve been reading in the past week:

- Maybe U.S. stocks expensive for good reason (Philosophical Economics)

- 3 questions to ask an adviser (Rick Ferri)

- Setting expectations through honest communication is one of the most important aspects of being a good financial advisor (Reformed Broker)

- How much should you pay a financial advisor? (Oblivious Investor)

- Cheap & simple beats costly & complex (Big Picture)

- “If the market is expensive, the correct thing to do is not to sell out, but to adjust your expectations.” (Brooklyn Investor)

- Tadas Viskanta: “Hot markets have a tendency to distract us from our goals.” (Abnormal Returns)

- Why it’s important to understand what types of investments are in your bond funds (Bason Asset Management)

- Why asset allocation helps you avoid debates on the small trends in the market (PragCap)

- How U of M coach John Beilein delegates like a good CEO (SI.com)

- 11 Powerful Bruce Lee Quotes (motivationgrid)

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] We just had the highest five year returns for high yield bonds…ever. (A Wealth of Common Sense) […]

[…] of Common Sense: – Time for a check-up on high yield bonds. – The interest rate spread between U.S. Treasuries and high yield corporate bonds, which […]

I personally believe a crash in bonds is brewing. This is why I’m studying Municipal bonds as quickly as I can so I can identify the most stable bonds and funds as they get thrown out with the bath water.

Hi Ben,

What would you make of structured credit? Do you see value in AAA CLO’s that have performed through the mortgage, and European debt crises? They newer deals are paying L + 150, which compared to corporate debt seems to have a good degree of relative value.

Definitely not my area of expertise. I do follow the structured credit space to some degree but I couldn’t make a determination one way or another whether CLOs are a good deal. Although a spread of 150 bps sounds intriguing.

How has the performance of CLOs looked against HY the ast 5 yrs or so?

I will look into finding an index that might shed some more light – returns would differ by tranche substantially. I’m hoping there will be an aggregate out there…will be in touch.

Hey Ben. This is a worthwhile read, and puts a good frame around the case for structured credit:

http://www.hedgefundintelligence.com/Article/3333310/The-case-for-investing-in-CLO-equity.html

I work for a credit hedge fund involved in this space. Do you think I could send you some materials, which would give you a lot more detail?