Happy 4th of July! It’s one of my favorite holidays for the simple fact that summer is my favorite season. Parades, lakes, boats, beer, BBQ and fireworks — I’m in.

In honor of America here is a post I wrote a couple of years ago (with some updated charts) about why I remain bullish on the old US of A.

*******

Following the Great Financial Crisis of 2008 a number of macro doom-and-gloomers began predicting a collapse of the U.S. dollar.

The Fed was “printing” trillions of dollars.

Interest rates had never been that low before.

It was an appealing narrative if you were someone stuck in the negative feedback loop of the biggest economic crash since the Great Depression.

In recent years, it was the crypto maximalists who began predicting the end of the global reserve currency status of the dollar.

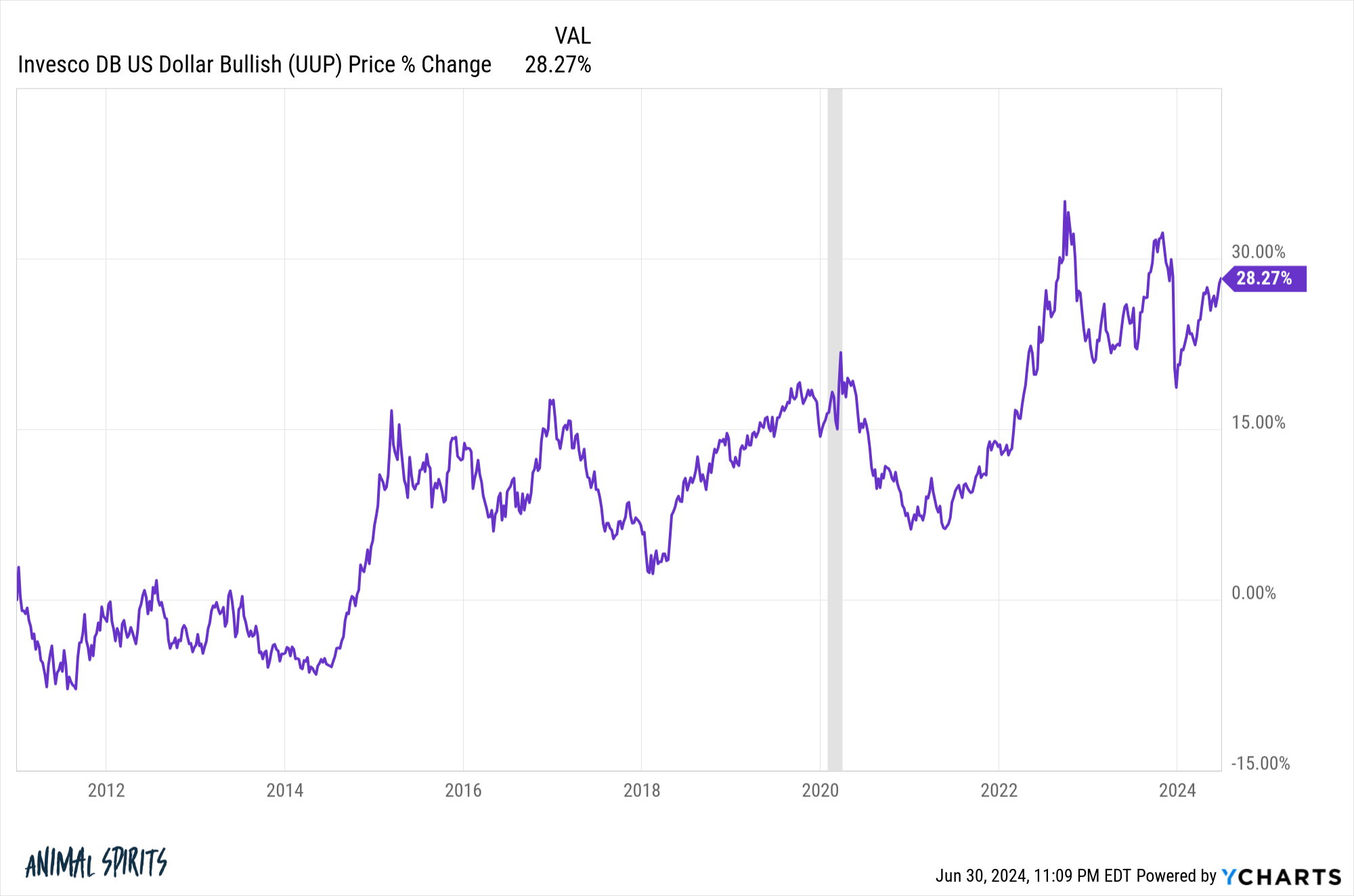

Alas, the U.S. dollar has been strong for years:

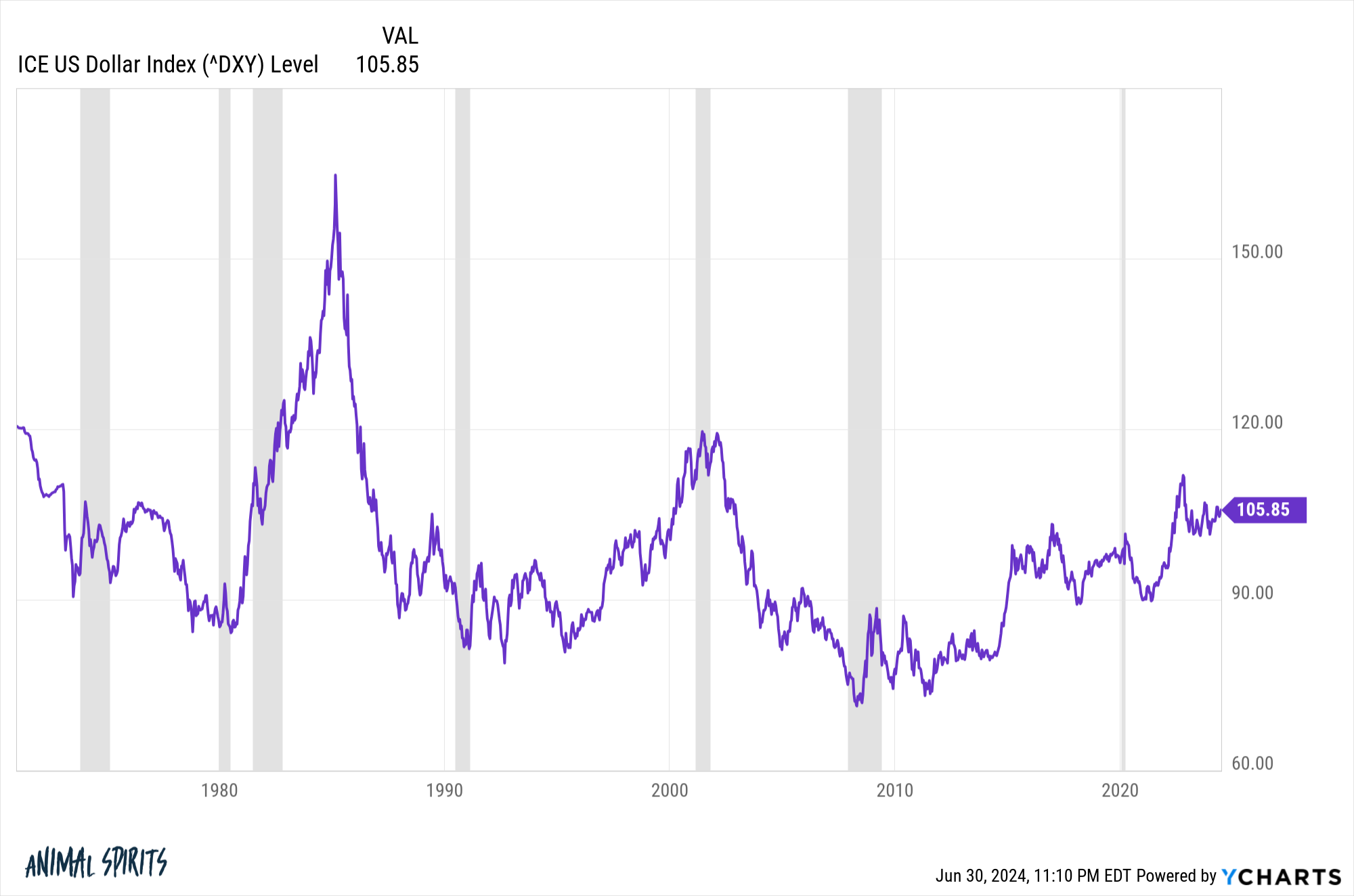

Now it’s important to remember that currencies, in general, are cyclical.

You can see the dollar has more or less gone nowhere against a basket of other developed market economy currencies over the past 5 decades or so:

Said another way, a basket of other developed market economy currencies over the past 5 decades or so has gone nowhere against the dollar.

But the main takeaway here is every prediction about an imminent collapse of the U.S. dollar has been a terrible bet.

Could the dollar be surpassed someday by some other currency or digital equivalent?

Of course.

But a total collapse of the U.S. dollar?

This seems unlikely to me anytime soon.

Why?

Well, this country has an abundance of natural advantages over the rest of the world that help give us that global reserve currency status.

Let’s count the ways:

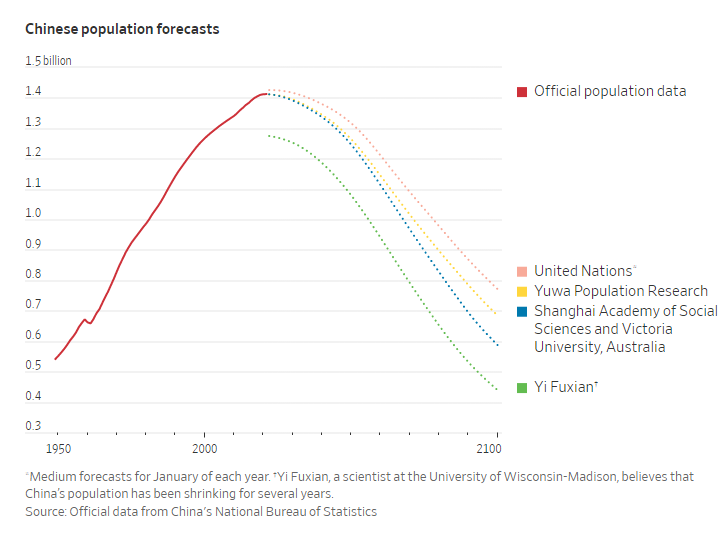

There aren’t any natural heirs to the throne. In the 1980s it was Japan that was going to overtake the U.S. as a global power.

Now China is nipping at our heels.

China has seen immense economic growth in recent decades and they have more than a billion people.

But look at China’s demographic outlook:

Economic growth is basically a function of population growth and productivity.

China might be in trouble in the decades ahead.

Geography. European countries are within spitting distance of a crazy dictator who went to war for no reason.

We have a large ocean to the east, a large ocean to the west and friendly neighbors to the north and south.

We dominate consumer technology. The Internet and the smartphone are two of the biggest innovations of the past 50 years or so and American companies dominate these technologies.

We have Apple, Amazon, Facebook, Microsoft, Google, Nvidia and more.

And that’s not to mention how a company like Tesla has forced the entire automobile industry to change its entire business model going forward.

Energy independence. Europe is in the throes of one of the worst energy crises they’ve ever faced. European citizens are facing extraordinarily high energy bills at a time when there aren’t many great solutions.

The U.S. is not immune to rising energy prices but we are in much better shape than our neighbors across the pond. We have plenty of oil, natural gas and coal.

No one likes higher gas prices but we’re in much better shape than the rest of the developed world when it comes to an energy crisis.

We still have the global reserve currency backed by the most powerful military in the world. Currencies are weird when you consider they’re more or less backed by faith and not much else.

But the U.S. dollar is also backed by an enormous tax base along with the most powerful military on Earth.

Maybe that doesn’t mean as much as it once did if we don’t have a world war, but it doesn’t hurt to have a military force that keeps your currency strong.

People still want to live here. Our immigration policies aren’t perfect at the moment, but people from around the globe still want to live here.

Immigrants have founded more than half of all start-ups that are valued at a billion dollars or more. Almost 80% of those start-ups either have an immigrant founder or an immigrant in a key C-suite role.

As long as we don’t screw things up too bad in the years ahead people from other countries will still want to live here and start businesses.

The United States rules pop culture. The world is getting flatter when it comes to entertainment but America remains the biggest exporter of wonderful TV shows, movies, celebrities, music, and professional sports.

The U.S. doesn’t set every trend in the world but we have a pretty strong track record of producing the best content bar none.

(OK this one probably doesn’t belong on our resume but it’s icing on the cake.)

We have the biggest, most dynamic economy in the world. The U.S. is not dependent on any single industry or commodity like many of the other developed and emerging economies.

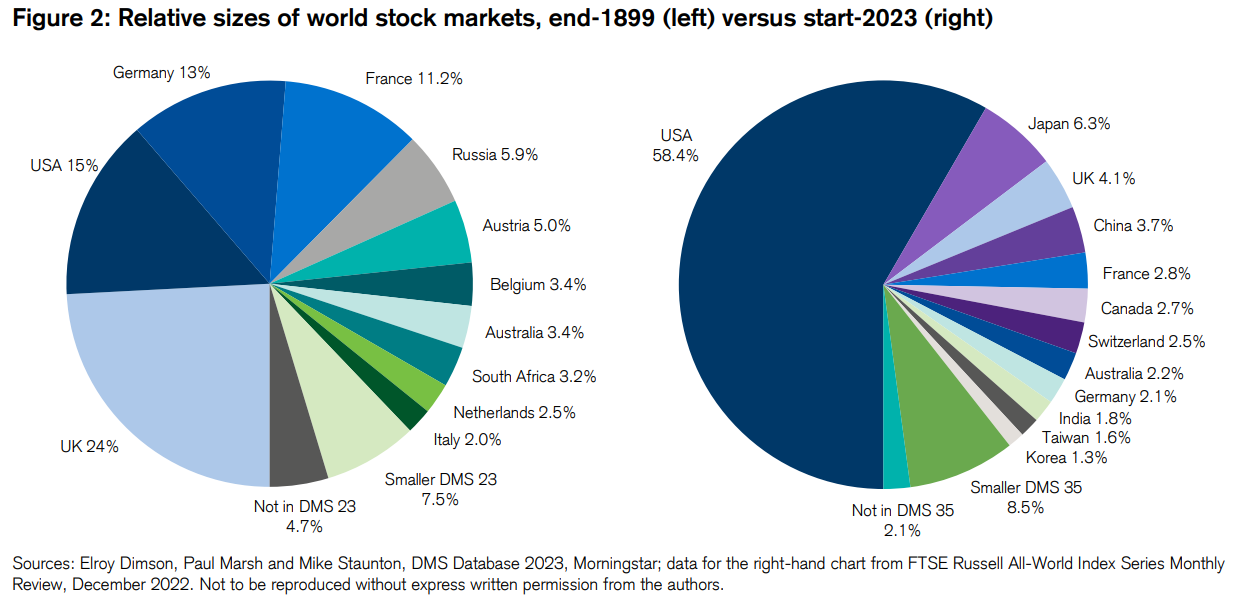

We have the biggest, most diverse stock market in the world. The United States has been around for a few hundred years now but we’ve only been a true power for less than 100 years.

Just look at the relative size of global stock markets in 1900 and the change ever since then:

The U.K. has fallen on hard times in recent years but they ruled the globe for hundreds and hundreds of years.

I’m not sure many people would have predicted the U.S. would dominate the 20th century as we did.

Is the fall of Rome here possible? Yes of course.

But it’s not like our reign has been going on for centuries.

American economic dominance only truly began following World War II so we’re talking maybe 70 years or so.

Being bullish on America doesn’t mean I’m bearish on the rest of the world.

On the contrary, I think technology has leveled the playing field and offers people in other countries far more opportunities than they had in the past.

I’m a global bull in the long run as people in other countries will surely wake up every day wanting to improve their station in life.

But I wouldn’t want to bet against the United States, even if we don’t dominate the 21st century like we dominated the second half of the 20th century.

Further Reading:

50 Ways the World is Getting Better