On this week’s Animal Spirits with Michael and Ben we discuss:

- Ray Dalio’s thoughts on debt cycles.

- Taking financial advice from billionaires.

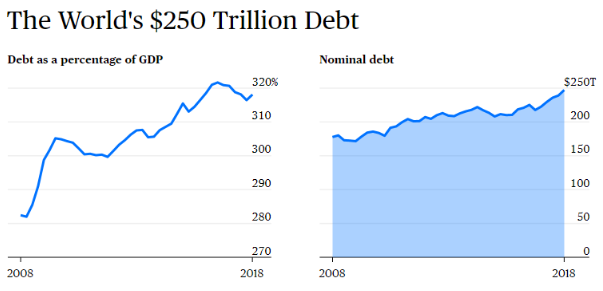

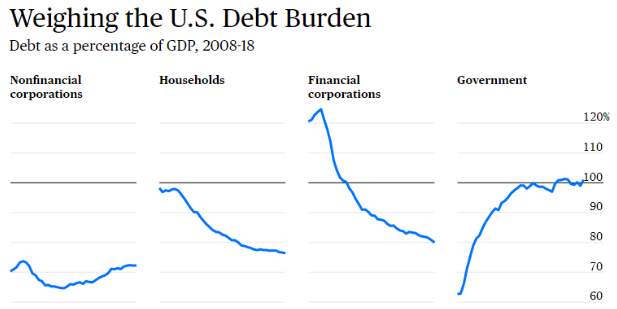

- The world’s $250 trillion in debt.

- How much debt is too much for the world’s governments?

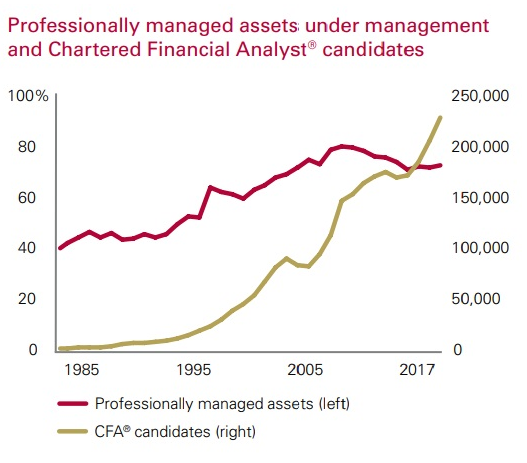

- Why no one really knows how many assets are indexed.

- How lotteries can help people save more money.

- JP Morgan wants more millennial customers and they’re willing to pay.

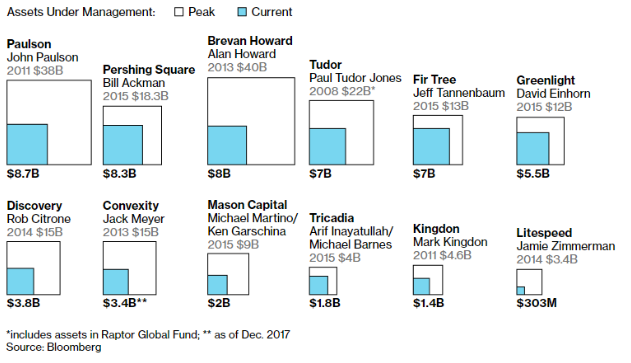

- Many of 2008’s star hedge fund managers have seen assets evaporate.

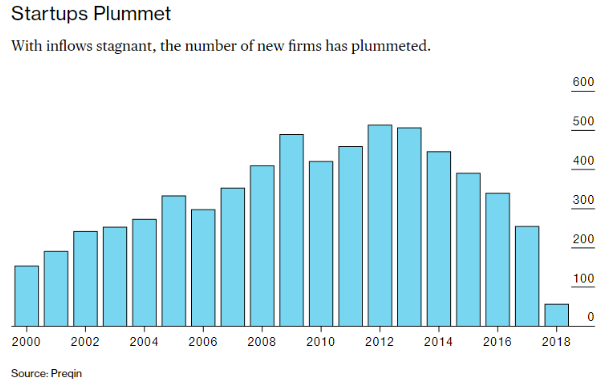

- Why there are fewer new hedge funds being opened today.

- When rules-based investing backfires.

- Can international markets hedge your portfolio during a U.S. recession?

- Lump sum or dollar cost average?

- Our thoughts on using a stop-loss and much more.

Listen here:

Stories mentioned:

- Ray Dalio says the next financial crisis could be worse than the last one

- Don’t take asset allocation advice from billionaires

- $250 trillion in debt

- The problem for active management

- Lotteries are doing more damage to those who can least afford it

- Using the lure of lotteries to spur savings

- JP Morgan goes after rich millennials

- The incredible shrinking hedge fund

- Breakout

- The lump sum vs. dollar cost averaging decision

Books mentioned:

Charts mentioned:

Podcasts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: