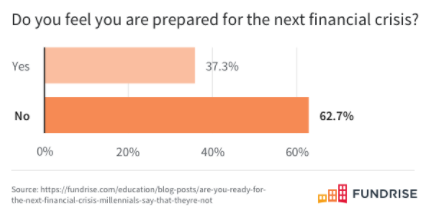

Last week I received a report from Fundrise that included a survey on the preparedness of Millennials for the next financial crisis. The majority of young people aren’t too confident:

They also found that nearly half of this group feels there’s nothing they can do about it. Maybe for some there is nothing they can do about it but I’ve never been a big fan of throwing your hands in the air and playing the woe is me card.

Here are some things millennials can do to prepare the next economic downturn, whenever it may be:

Keep your lifestyle inflation in check. It’s important to establish good spending habits at an early age because once lifestyle creep begins to seep into your personal finances it’s a tough habit to kick. Keeping a relatively constant standard of living is a great way to inoculate yourself from the vicissitudes of the business cycle. Not getting too far ahead of yourself is the easiest way to avoid being forced to cut back later.

Avoid bad debt. Carrying credit card debt is a great way to learn about compound interest but in reverse. It rarely ever makes sense to carry a credit card balance considering you pay an annualized interest rate somewhere in the 15-20% range. But trying to survive a financial crisis with credit card debt is just asking for trouble and a potential bailout from your parents.

Have an emergency savings back-up plan. Saving 6-12 months of expenses sounds like great advice in a personal finance column but it’s probably unrealistic for the majority of young people. Those who have the ability to save that much probably don’t need to. If a well-funded emergency savings stash is not in the cards, you better have some other options — Roth IRA savings, a home equity line of credit, zero percent interest credit card offers, etc. Having a good credit score is key here.

Take control of your career. I remember getting together with a bunch of college friends in the summer of 2009. It wasn’t a foregone conclusion that the worst of the financial crisis was over at that point so we were discussing the severity of the downturn. I made the comment that it was the worst crisis since the Great Depression. My friends who held onto their jobs didn’t see it that way but the ones who weren’t so lucky completely agreed with me.

We came to the conclusion that if you kept your job and were able to put money into the stock market at very low prices the recession was just a minor speedbump. But if you lost your job things only got harder from there as the job market wasn’t exactly inviting at the time.

Recessions seem universal but they’re really personal depending on the situation. Those who can become indispensable to their employers or customers should be able to better weather the storm.

Diversify your income streams. Young people are more equipped than anyone to diversify their earnings by using their skills and technological know-how to create sources of income that extend beyond their day job.

Although technology is disrupting a number of industries it also makes it easier than ever for people to start a side business. Creating multiple income streams isn’t easy (don’t listen to what the life hack gurus tell you — it requires plenty of hard work) but it is possible if you’re willing to put in the time and energy.

I recommend reading Your Move: The Underdog’s Guide to Building Your Business by Ramit Sethi for a framework on how to approach the idea of a side hustle (I’ll likely have more to say on this one in the future as I thought it was one of the more useful business books I’ve read in a long time).

It’s easy to blame the system when these things happen because it’s completely out of your control. Young people especially have to avoid this mindset because they will be dealing with recessions, market crashes, and economic calamities on a number of occasions in the decades ahead.

A recession doesn’t have to be a bad thing. And every recession won’t be as severe as the last one. But business cycles are called cycles for a reason. There will continue to be ebbs and flows, upturns and downturns, expansions and contractions. This is the way the economic machine works.

The trick is focusing your energy on those things you can control since no one has control over the business cycle.

Source:

Are You Ready For the Next Financial Crisis? (Fundrise)

Further Reading:

Are Millennials Doomed in a Low-Return Environment?