A reader asks:

Have you ever written anything about getting a late start to saving for retirement? My wife and I are in our early 50s and have very little saved. What do we do?

This reader is definitely not alone in this situation. According to the Employee Benefit Research Institute, around half of all workers age 55 or older have less than $100,000 saved while a third have saved less than $25,000.

It would be nice if everyone started saving money early to take advantage of time and compound interest but I can see how people could fall behind when you consider the typical financial lifecycle: paying off student loans, saving up for a down payment on a house, having children, saving for college and all of the expenses that come along with raising a family.

I’m sure there are plenty of parents who reach the empty nest phase of their life once the kids are out of the house and finally realize they are woefully unprepared for retirement.

Not everyone goes this route, but it seems like there’s always something that gets in the way of saving for your future self.

The good news is you still have some time to figure things out. Here are a few positives for people in this situation:

- The kids should be out of the house and (hopefully) out of the budget. This means you should be able to funnel the majority of the money you were spending on them into retirement savings. It also means your lifestyle might not have to change as much as you think to hit a reasonable savings target as long as you don’t use those funds elsewhere.

- There are catch-up provisions on retirement savings vehicles you can take advantage of. The annual contribution limits for 401(k)s and IRAs are $18,000 and $5,500, respectively. But for people 50 or older, those limits jump to $24,000 and $6,500. That’s an extra $7,000 in total that you could be saving on a tax-deferred basis.

- You should be in your peak earning years.

The biggest issue for most people is turning saving into a habit, but I think the sense of urgency that you get from inching ever closer to retirement age can have a huge impact on this.

The bad news is you’re going to have to save a lot. The good news is it’s not out of the question to build up a reasonable amount of savings in a relatively short amount of time.

Let’s take a look at an example to see how the numbers could potentially work. Let’s say you’re a couple earning $100,000 a year and have nothing saved for retirement at age 50. Not the ideal situation but all is not lost if you’re able to ramp up your savings.

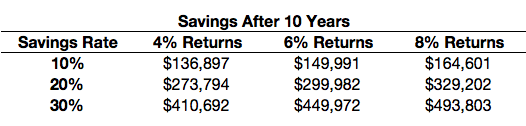

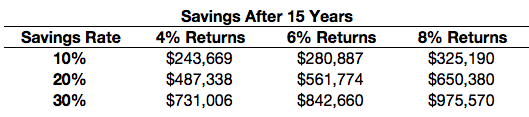

Assuming you keep a steady savings rate but see a 3% rise in salary every year here’s how your ending balances would look after ten years of saving:

And here’s what things look like if you work a little longer and build up your savings for fifteen years:

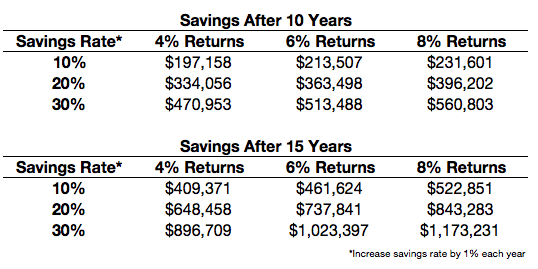

One more slight change you can make is to increase your savings rate each year by just 1% (so if you start at 10% the next year you bump it up to 11%, then 12% and so on):

A few things stand out from this simple exercise:

- How much you save will have a much larger impact on your bottom line than your investment returns. Doubling your investment returns resulted in a much smaller bump to your savings than a doubling of your savings rate. For example, 8% returns at a 10% savings rate gave us a smaller balance after ten years ($164,601) than 4% returns at a 20% savings rate ($273,794).

- Saving more money is something you actually have control over, unlike returns in the financial markets. This is where you should focus your energy, especially since there isn’t nearly as much time to allow the markets to work in your favor. And saving just a little more each year can really help ease into the process.

- Working longer gives you a huge bang for your buck in a number of different ways. First, and most obvious, it gives you more time to compound and build your savings. But it also helps by deferring spending down your portfolio. If you spend the typical 3-5% of your portfolio in retirement, each year you hold off not only adds value to your savings but reduces the impact of portfolio distributions. And as long as you’re working you may as well hold off on taking social security, which is another way to increase your future spending.

Getting a late start on retirement savings can be a scary prospect, but it’s a position many baby boomers find themselves in today. The simple solutions are:

- Get the kids off your household budget.

- Take advantage of tax-deferred retirement savings accounts and catch-up provisions.

- Worry more about your savings rate than your investment performance.

- Save a little more each year.

- Work a little longer.

Each step used individually may not help all that much, but when you add them all up there’s still time to make a difference.

Your future self will thank you.

Further Reading:

The Retirement (Expectations) Crisis