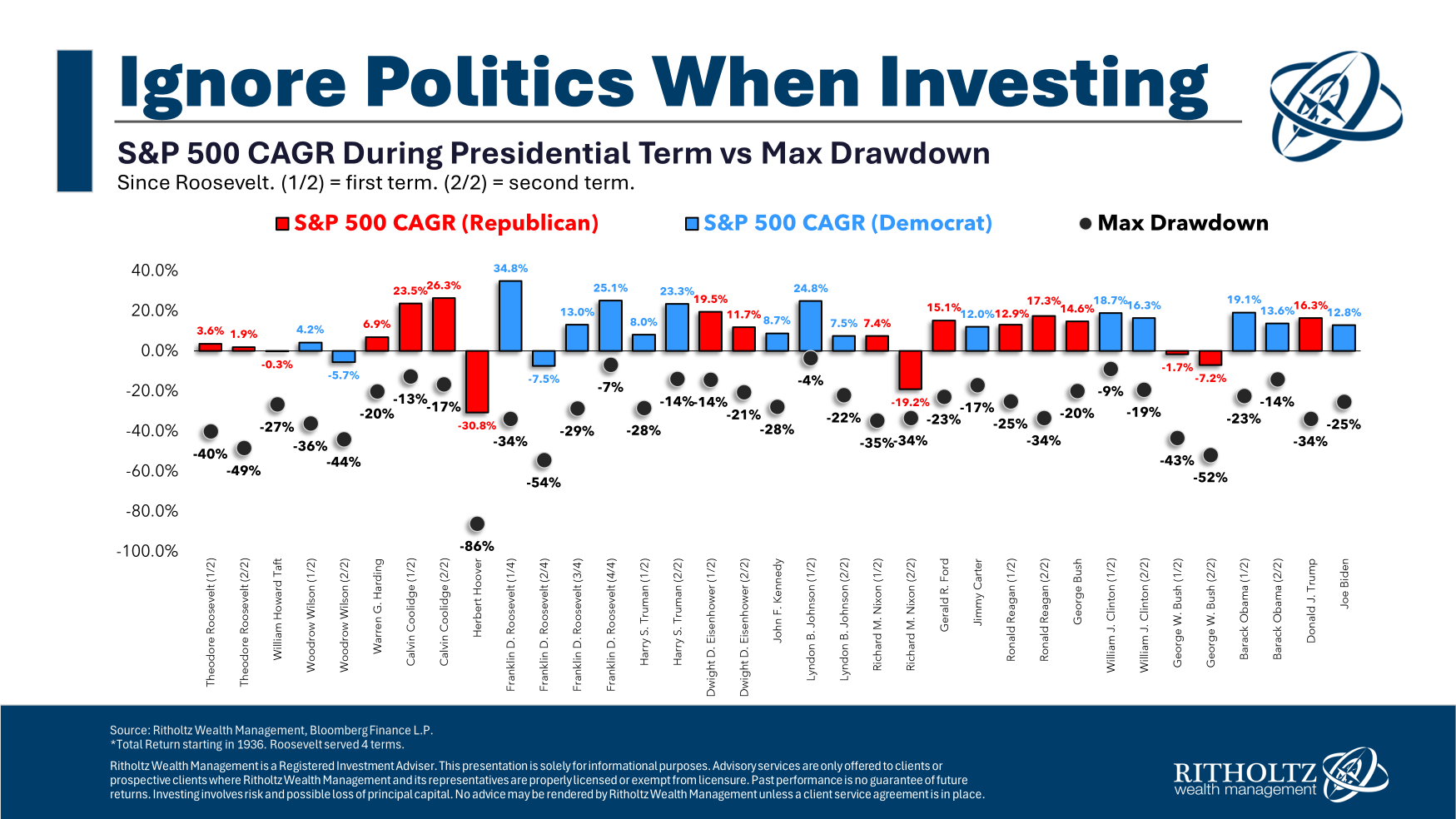

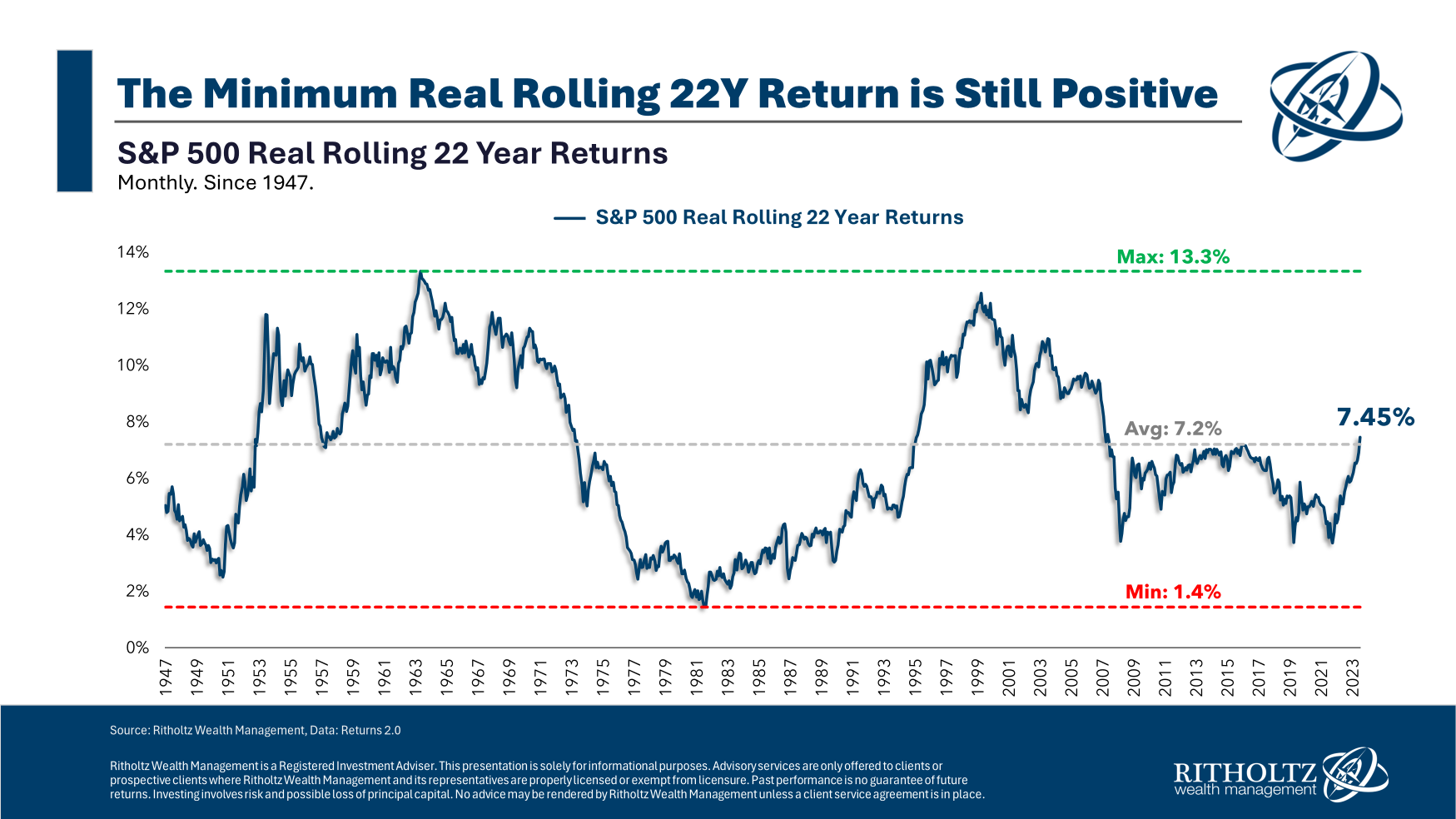

Keep politics out of your portfolio.

Keep politics out of your portfolio.

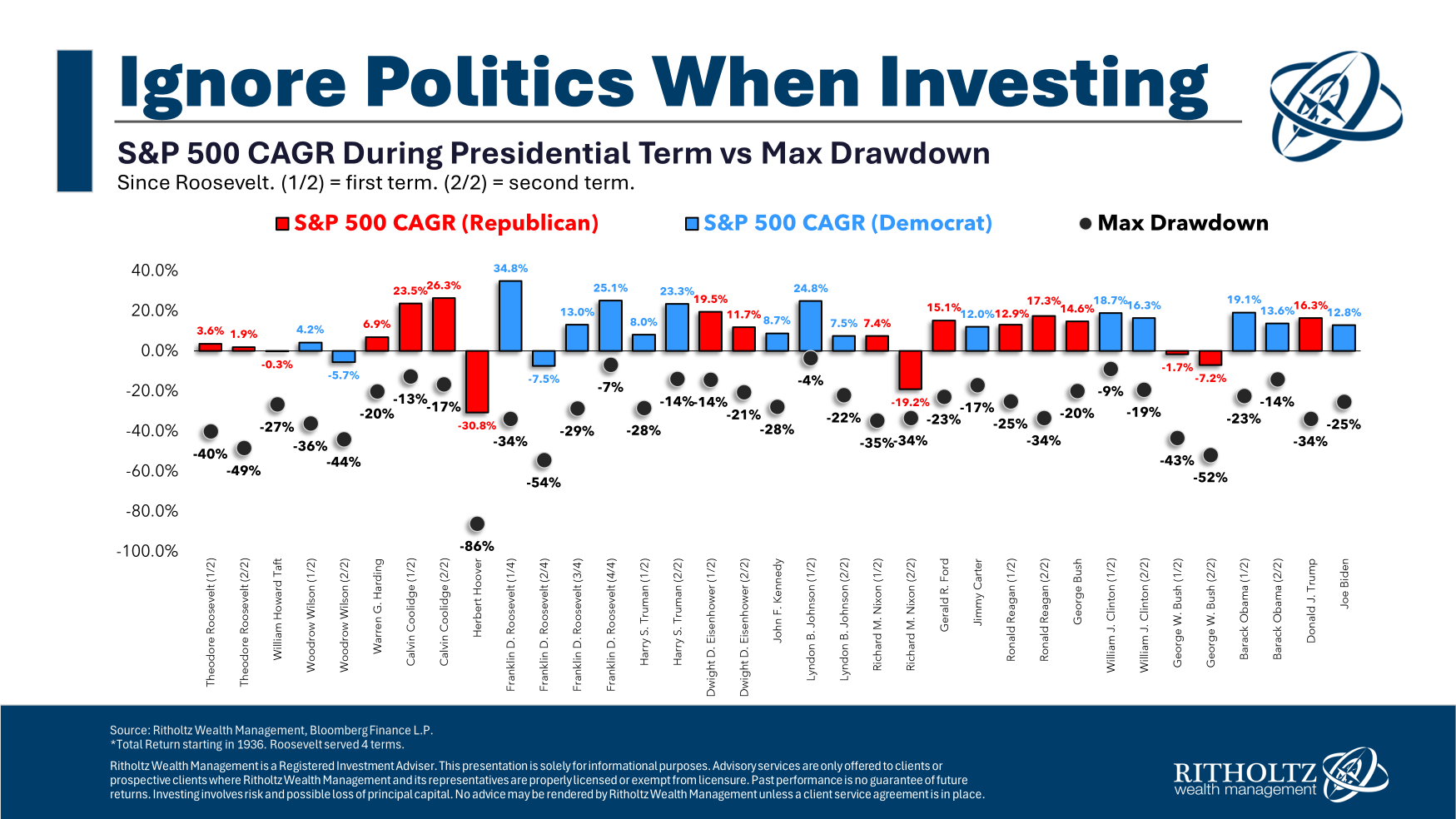

A historical look at long-term real returns on the U.S. stock market.

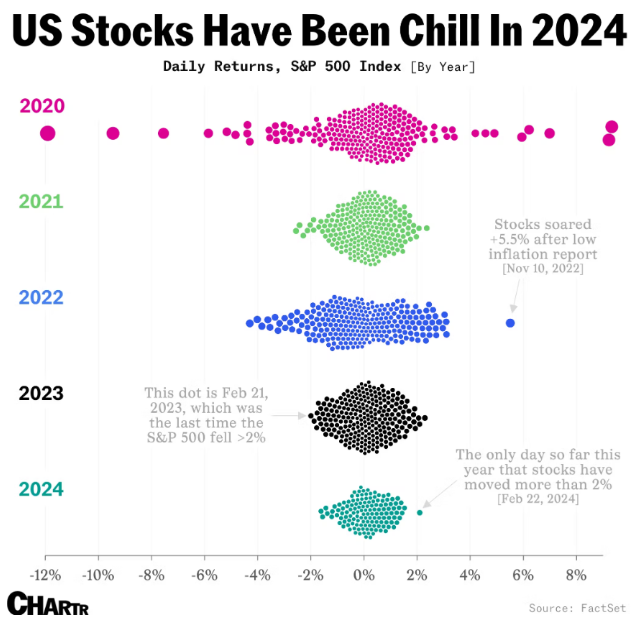

On today’s show, we discuss why the stock market doesn’t care who the president is, the U.S. stock market is having a boring year, the biggest winners in stock market history, the economics of a martini, the best comedy movies of all-time, the broken beer bottle economy, Nvidia employees are rich and much more.

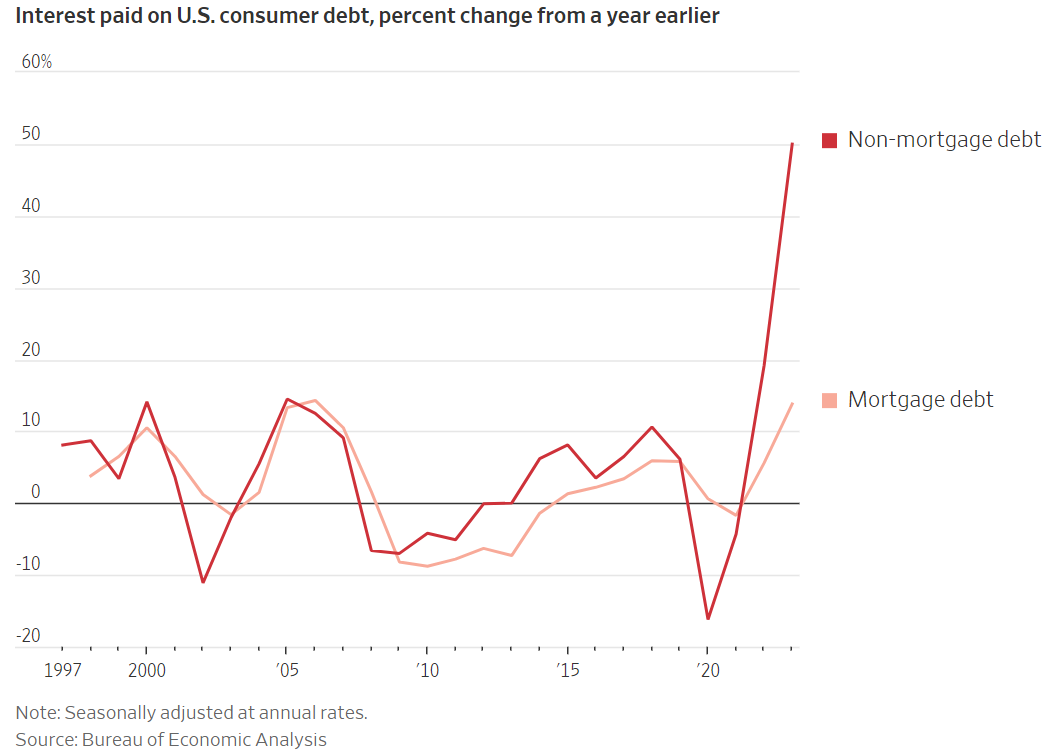

An update on the state of the U.S. consumer balance sheet.

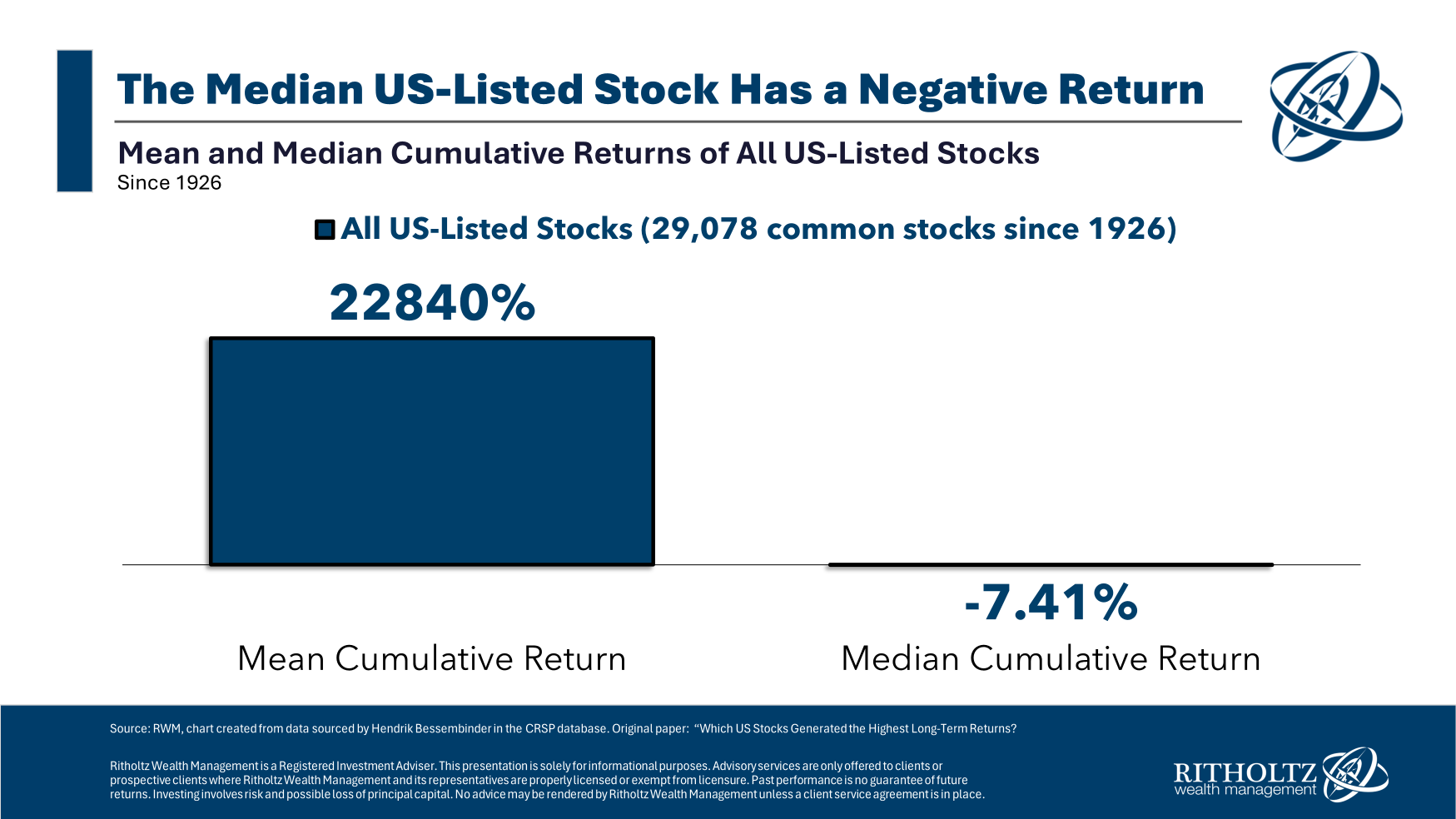

The biggest winners in the stock market from 1926-2023.

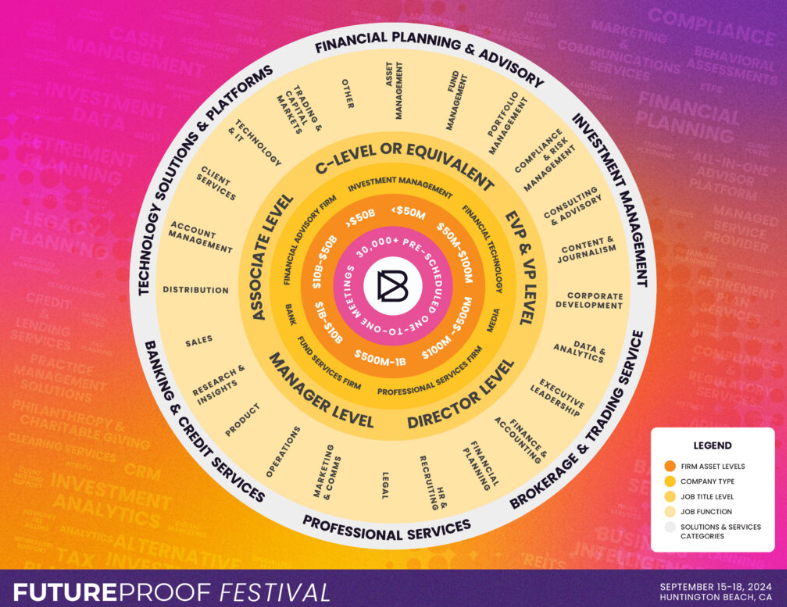

On today’s show, we spoke with Matt Middleton, Founder and CEO of Future Proof to discuss changes and updates to Future Proof 2024, breakthru meetings and experiences, the updated fintech demo alley, who should attend Future Proof, Third Eye Blind, and much more!

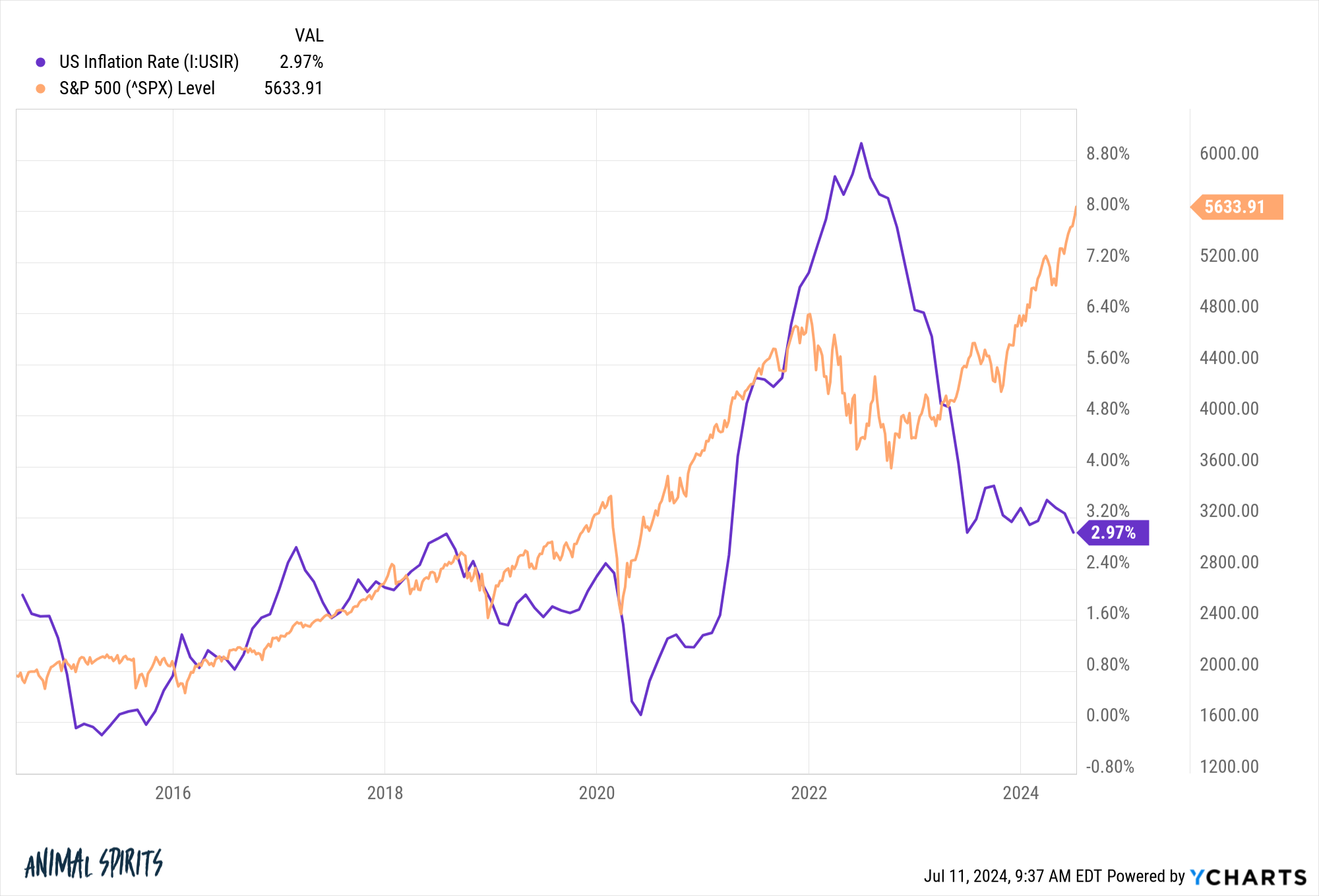

Some thoughts on inflation and bear market bottoms.

Some thoughts about out experience owning a second home.

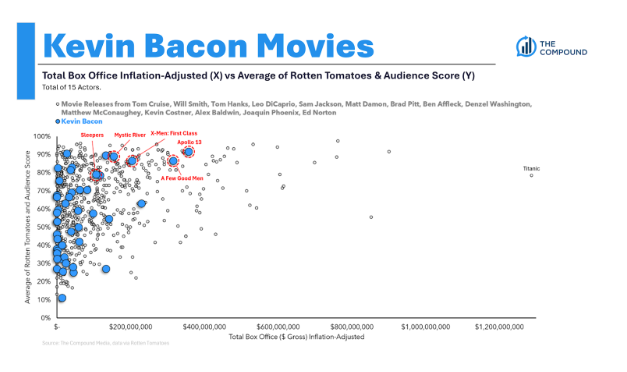

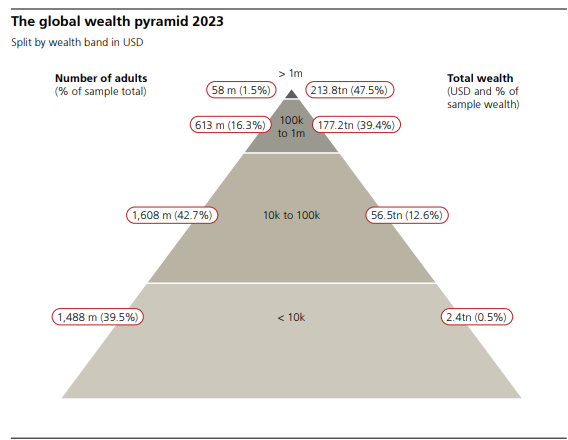

On today’s show, we discuss the two types of Fed rate cuts, a positive outcome from high inflation, the stock market was right again, the number of millionaires worldwide, Wingstop vs. Chipotle, how many renters could afford to buy a home, how much it costs to build a new house, why private markets aren’t in a bubble, Kevin Bacon movies and much more.

Some thoughts on inequality, progress and enough.