In the latest edition of Stocks For the Long Run, Jeremy Siegel offered up a great stat on the small cap premium. From 1926-2012, small cap stocks returned 11.5% per year while the large cap S&P 500 returned 9.7%. But if you were to exclude the 1975-1983 period, which coincides with ERISA laws that made it easier for pensions to diversify into small caps, the annual returns for both large and small caps would be almost identical at around 8% per year.

Of course those returns did happen and you can play that game with most historical data-sets, but the small cap premium has been called into question more and more as of late. You can look at historical data going far back into the past, but I prefer to look at actual products in the small cap space since it would have been quite difficult to put together a cost effective small cap portfolio before the 60s or 70s.

Surprisingly, the Vanguard Small Cap Index Fund (NAESX) has a performance history dating back to 1960. The annualized return through March 31 of this year is 10.84%. In that same time the S&P 500 returned 10.19% per year so there was a slight premium in this particular fund. DFA has a small cap fund (DFSTX) that goes back to 1993. The annual returns through the end of 2014 show this fund outperformed the S&P 500 by over one-and-a-half percent (10.94% vs. 9.36%).

So there are real funds that have shown an edge over longer time frames in small caps. People offer many reasons for the historical small cap premium — more risk, less liquidity, a smaller following by Wall Street analysts, not as easily investable by large institutional funds, etc. And these reasons make sense on the surface. But that doesn’t mean they’ll work going forward. No one really knows how these dynamics will change over time.

The days of making easy money in stocks are over (if they ever really existed). I don’t believe you’re not going to be able to make a minor tilt to a simple factor and watch huge profits roll in anymore. They’re too widely known and easier to invest in than ever. Small caps are just one example. Premiums will still exist, but my guess is they’ll get compressed. Maybe I’m wrong. It could be that investors just have to be willing to show more patience going forward.

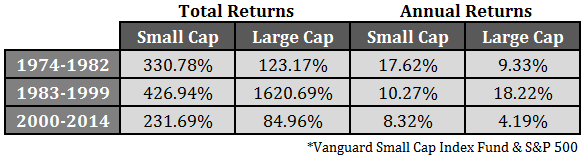

But I think it makes sense to invest in small caps whether they earn a premium over large caps in the future or not. This is because they provide diversification benefits. Take a look at the cyclical nature of the return numbers on the Vanguard Small Cap Index Fund and the S&P 500 over the years:

Markets are messy, but to a diversified investor these numbers are beautiful. When one segment of the market had a relative string of underperformance, the other was there to pick up the slack. I don’t see this changing anytime soon as large cap stocks continue to become more global while small caps are more U.S.-centric.

There are other ways to invest in smaller stocks that have shown an even more impressive historical return record including a tilt to value or quality stocks within the small cap universe. Again, no one really knows how those risk premiums will fair in the future. But a portfolio with an allocation to small cap stocks should continue to provide a nice diversification benefit to investors that are able to look past the inevitable periods of relative underperformance.

That’s how diversified portfolios work. There’s always going to be something that’s doing better and something that’s doing worse. The payoff is that the disciplined investor earns a more balanced risk-return profile for their troubles.

Source:

Stocks for the Long Run

Further Reading:

What Happens When the Umbrella Shop Gets Too Crowded?

The Small Cap Value Cycle

The Small Firm Affect is Real and It’s Spectacular (AQR)

It is also worth considering the dispersion of returns generated by different market participants. In my experience, within the small caps segment there tends to be both more overvalued and more undervalued companies. This increases the rewards to active stock selection, without necessarily implying a passive small cap premium.

That’s true. Also a larger universe of stocks to choose from.

[…] other small-cap news this week, there might be no “small-cap premium,” but it still makes sense to invest in them because they provide diversification benefits, wrote Ben […]

A related mystery is why the S&P 400 Midcap Growth has trounced the S&P 400 Value index by about 2 percent annually since May 1990 — contrary to the usual wisdom that value beats growth in the long term.

All of the outperformance in the S&P 400 Growth occurred in the brief period between October 1998 and March 2000. Was it due to a bumper crop of tech stocks growing huge capitalizations and graduating into the S&P 500, which the same tech stocks then proceeded to drag down during March 2000 to October 2002? I don’t know. A selection of four hundred frequently changing stocks is a morphing target that’s not easy to analyze.

Backtesting over 25 years would tell you to favor the S&P 400 Growth over Value. But longer term evidence from other indices consistently says that value should win in the long term, and that the S&P 400 growth vs value anomaly should be corrected.

Sheesh — time to design my own indexes!

Mid caps are one of the anomolies no one can really explain. My theory is that it’s just a reall overlooked space since most people focus either on LCs or SCs only.

Since inception, the S&P MC 400 has outpaced the S&P SC 600 by well over 100 bps/yr. Funny how there are always these instances where you can point to things that don’t or shouldn’t make sense. Lesson is it’s never going to be easy.

And join the club with your new indexes. Everyone else seems to be making their own these days.

This is a new Golden Age of indexes. Just as Adobe Illustrator made everyone a graphic designer, and Pro Tools made everyone a recording engineer, with Excel or Python you can roll your own indexes.

Of course, S&P probably still maintains the S&P 500 on a coal-fired, steam-powered mainframe.

Yup and many people think that owning different ETFs is a strategy. They forget that a portfolio is not a process.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2553889

Thanks. I saw that one. Don’t you love the Asness/AQR paper titles?

Yup, very readable too.

[…] What if there is no small cap premium? (awealthofcommonsense) […]