In one of my favorite psychology books, Mindless Eating, there are a number of interesting studies that show how the way food is presented or described can have a huge impact on they way it’s viewed or rated.

For example, a group of researchers took two pieces of day old cake. One was simply labelled “chocolate cake” while the other was given the much fancier title of “Belgian Black Forest Double Chocolate Cake.” They were exactly the same, but when given the choice, a majority of people chose option number two with the fancy name. Not only did they choose it more often, but they actually rated that it tasted better too.

This is why restaurants are always trying to come up with new and exciting ways to describe their menu options, even though the food is mostly the same in many places. The financial industry tries to take a similar approach by using complex jargon to get people to invest in their products or services.

According to a new study, it turns out this is the wrong way to go about this. Finance people love to push complexity, but what people crave is simplicity, especially in how something is presented or explained to them. Yesterday the Wall Street Journal highlighted a study undertaken by Invesco Ltd. about alternative funds:

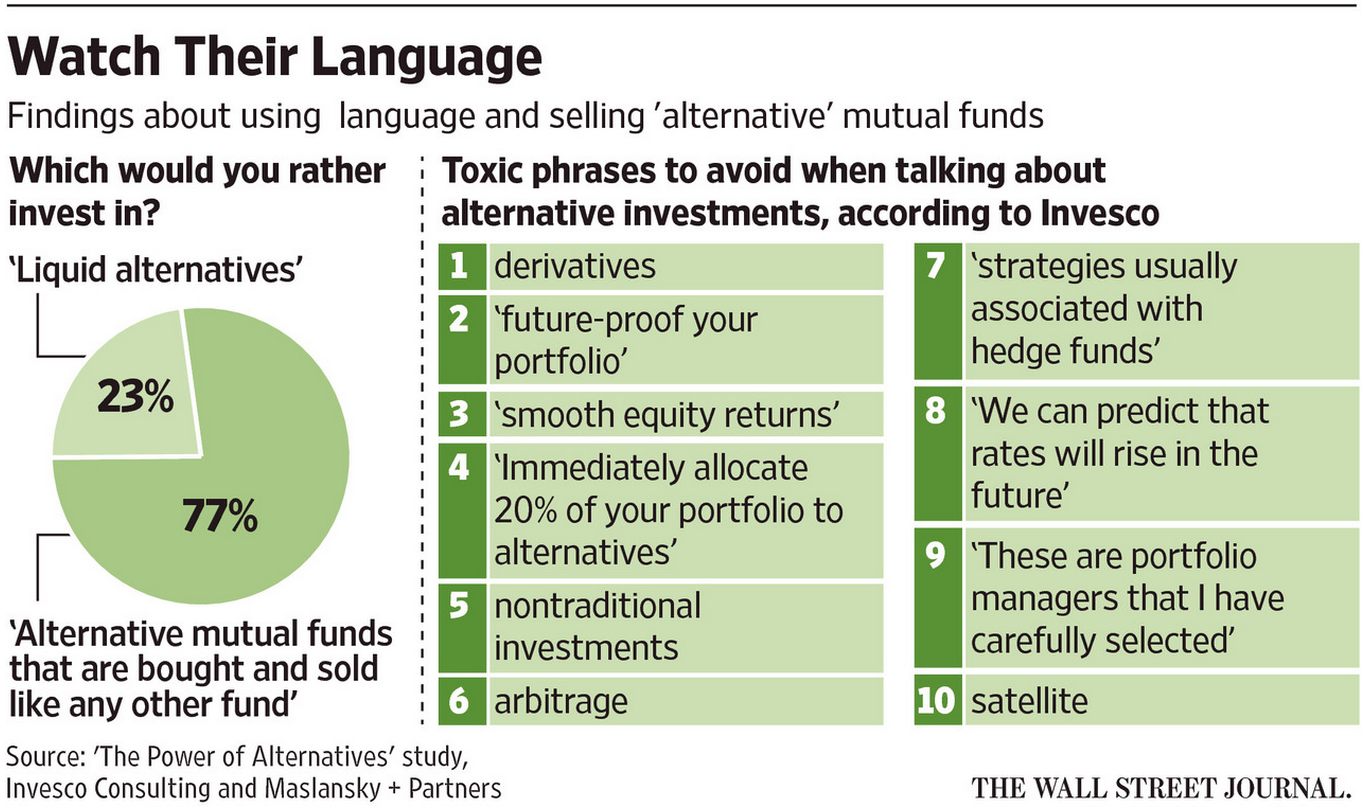

The findings seem to show a preference for simplicity over jargon. For example, the study found that investors respond better to the phrase “alternative mutual funds that are bought and sold like any other fund” instead of “liquid alternatives,” even though they are technically the same thing.

This is like a version of the chocolate cake study turned on its head. The research focused on liquid alternatives, a fast growing segment of the fund management industry that can be confusing for both clients and the advisors or consultants trying to sell them. Here’s a nice graphic from the same story that shows the words to avoid when talking about these products:

We’re still in the early stages of liquid alt funds. The fund companies are still trying to figure out the correct message to attach to this group. Advisors are looking for ways to comfort worried clients by providing access to different portfolio strategies. I’m sure there are a number of advisors out there using these products who don’t understand the risks involved. Investors are always searching for solutions to a potentially difficult market environment. Many of these investors will end up investing in products they don’t understand or shouldn’t be involved with in the first place. There will be growing pains.

One of the biggest reasons I think non-finance people have a difficult time with the markets is because it’s rare that those in the industry can explain how it all works in plain English. Part of this is because many on Wall Street are incentivized to sell a seemingly endless supply of new products to unsuspecting buyers. It’s not in their job description to tell the truth. But another reason for this disconnect is the fact that communication is generally a skill that’s lacking for those who aren’t part of the sales or marketing department.

Plenty of finance people assume their clients or potential clients are looking for proof of their brilliance, so they shower people with jargon to try to impress them. In the process most end up talking over the head of the person they’re trying to impress, leaving everyone worse off. Little do they realize that what their clients really need is for someone to tell them the truth in a way that actually makes sense and resonates with them. Clients don’t help themselves in this respect because many are looking to be sold something that just doesn’t exist, so both sides are at fault here.

My friend James Osborne says the era of “trust me” finance is dying. I hope he’s right, because that style of advice does no one any good on either side of the aisle. I think to get there we need to have more people in the industry who are willing and able to effectively communicate in an honest and transparent way. I may be biased by my surroundings but I’m definitely seeing a push for this in a majority of the younger up and comers in the world of finance that I interact with. Most of the people I talk to don’t like the old way of doing things that is shrouded in sleight-of-hand sales tactics. I’m hopeful more people will see that there’s a better way of doing business.

When you mix good client communication skills with people who are looking to do right by their clients, everyone wins.

Sources:

An Alternative Investment by Any Other Name is Still… (WSJ)

Mindless Eating

I read your friend’s essay. a few comments

— the paternalism / autonomy parallel between medicine and financial advising is strong. I’ve found that a strong materialistic hand works best for many. People talk autonomy. They won’t admit it, but when they’re scared they want someone else to make the decisions.

–Eric Topol is the best.

–my daughter uses Henrietta Lacks’ cancer cells in her research ; no shame there at all.

I’m not familiar with Topol so I guess I’ll have to check out his book. I agree with you that many people need the guidance of others. Lots of people know what they’re supposed to do, but just can’t change their habits (or they need an expert). Very cool that your daughter does cancer research. I work at the Van Andel Institute where that’s one of our scientist’s main research focus areas.

the VAI influence shows. You have a wonderfully scientific mind.

Thanks, I’ll take it but I don’t have anything to do with the science work there. But the scientific method is a great starting point for many other fields.

As usual Ben, thoughtful piece. (How do you produce all this stuff week in and week out?) Unfortunately, I am too cynical about this. After 20 years in the business, I think much of the complexity in communication is intentional and necessary to support fees and revenue. I have worked hard to try and distill our messages to clients and prospects in a simplified way. It has really improved my job satisfaction and I can tell that the people I work with find it refreshing. They like “getting” it. When you go to the other side and eliminate all the nonsense as you work with investors and consumers, it is very liberating. Unless they are true believers in the complexity, I am sure many industry practitioners would be relieved to talk with their clients in far simpler terms.

In fact, a few years ago I was at a conference and the speaker, Mitch Anthony, was sharing how, as he worked with advisers, one of the common themes he heard from them was, over time, how they dreaded their client reviews because they would go over the same market, performance, economic nonsense. A part of his guidance was to help them steer the conversation in another direction.

Here’s a good one for you on why jargon feeds on lazy minds:

http://scottberkun.com/2012/why-jargon-feeds-on-lazy-minds/

Excellent. I will check it out,

Interesting! I second Mark’s comment pondering how you can come up with so many interesting pieces every week.

Just to add to that thought, in my profession (law), the process and procedure is complex and bewildering to people without that experience, even if there’s usually a method to the madness. The rules developed after many years of experience (consider it an example of the Chesterton’s Fence Paradox), so I always try and explain it to clients as though I were only able to speak in “Wikipedia Simple English”.

As far as I can tell, clients appreciate the demystification.

Makes sense. I’ve heard similar things from doctors about their bedside manner with patients. It can make a huge difference, but it something most people don’t think about enough.

[…] Wall Street hides behind a wall of technical language. (awealthofcommonsense) […]

[…] Further Reading: The Need For More Effective Communication in the Investment Business […]