Bond investors are in constant fear of a replay of the 1970s when interest rates exploded higher in concert with sky high inflation, a double whammy of bad news for fixed income securities. But it doesn’t make much sense to compare the current set-up with that scenario. By 1970 the 10 year treasury yield was all the way up to 7.8%, eventually reaching over 15% in the early 1980s. That’s not even close to today’s rate levels.

A much better comparison, if you want to make one, would be the 1950s. At the start of 1950 the 10 year yielded 2.3%. It rose throughout the decade and finished at 4.7%. Inflation was relatively mild in throughout the 1950s — close to 2% annually. The 10 year currently yields just shy of 2.1%. Inflation also remains subdued for the time being.

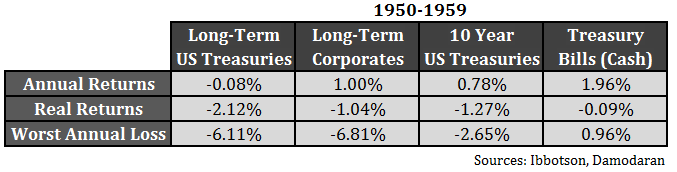

The question for investors is how did various fixed income sectors perform in that type of rising rate environment? Here are the stats for long-term treasuries, long-term corporate bonds, 10 year treasuries and cash:

Nominal returns were muted while real returns were negative across the board. The total real returns over this entire period were losses of 19.97%, 10.60%, 12.38% and 1.33%, respectively. It’s interesting that holding cash in short-term t-bills turned out to be the best performing fixed income holding. The fed funds rate was under 1% a couple of times in the 1950s but it was never zero as it is now so I wouldn’t expect the cash returns to outperform like they did back then if rates do rise from here.

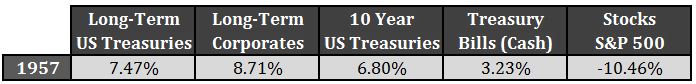

So why would an investor choose to hold bonds if this type of market is a possibility from current yields? Although those after-inflation losses sound painful, bonds still served a purpose. The 1950s witnessed a strong bull market in stocks, but when the S&P 500 fell double digits in 1957 bonds held up really well. Here are the returns from that year:

When risk strikes and stocks get hit, investors will almost certainly switch to the perceived safety of high quality bonds. In a risk-off scenario that’s generally how markets work. The worst annual returns for 10 years treasuries was minor compared to the losses in the stock market.

Although bonds could potentially lose purchasing power over the long run from current yields they can still serve a purpose in a well-diversified portfolio. Bond act as both a volatility-minimizer for those investors that can’t stomach a large stock allocation and a source of stability during stock market sell-offs for either spending purposes or liquidity for those that need to rebalance into lower stock prices.

No two markets are ever the same, so these numbers are for risk planning, not return forecasting. Rates don’t have to rise in such an orderly fashion. They could scream higher in a short period of time or just go sideways for a while. Or we could be the next Japan and see low rates for much, much longer (unlikely, but if that’s the case it’s not going to be a very fun market for U.S. stocks either).

Whatever happens to rates from here it makes sense to reign in your expectations as a bond investor based on today’s low starting yields. Bonds can still serve a purpose in a diversified portfolio, but it’s unlikely they will enhance your returns until we see much higher yields. You just have to pay attention to the duration and make sure you understand what purpose they serve.

Further Reading:

What About the 1970s?

Why Own Bonds in a Portfolio?

Short term corporates might have even beat T-bills during 1950-1959, if such funds had existed then.

Funds such as Pimco’s MINT, which beats the bushes for bonds just outside the reach of money market funds with their 397-day maturity limit. Vanguard just launched an Ultra Short Bond Fund last month, with a similar focus.

Trouble is, while short-term credit bonds might maximize returns once rates rise, they won’t provide the same uncorrelated protection against stock selloffs that long Treasuries do. One either needs a mix, or else a viable model to adjust average maturities. If this were easy, any idiot could do it. 😉

Funny how that works. I’m on board with a mix of different bond sectors & durations to spread your bets. Whatever happens to rates in the future you can be sure the scenario won’t play out exactly like it did in the past.

Hi Ben,

Interesting post.

You have ignored duration. What was the duration of the bond market back in the 1950s? What is it now?

My guess is that the duration is currently a lot lower, which means that the potential for bonds to be a buffer if equities sell off is reduced.

Negative real yield, low or negative nominal yield and a reduced buffer if the market crashes. So why would you hold bonds?

Why would the duration be that much different? It obviously depends on the maturity or bond proxy you are using. When there’s a stock market sell-off the yield situation matters far less than the percieved safety of treasuries. Until proven differently, treasuries will continue to be the play when the market goes into risk aversion mode.

During 1952-54, when the 10-year Treasury yield averaged about 2.5%, its duration was only slightly less than today’s 10-year Treasury at 2.00% yield.

Ibbotson’s 1993 book on Treasury yields shows a longest maturity in the low 20s (years) until Feb. 1955, when a 40-year Treasury was issued. Max. maturity remained in the 30s (years) for the rest of the 1950s, longer than is available today.

Nevertheless, one can compare 20-year constant maturities from the 1950s and today, with the yields and durations not being that different.

Most of the corporate data from the 1950s (e.g. Moodys and Dow Jones Corporate Bond index) is for 20 to 30 year maturities. One could wish for intermediate term corporate data from the 1950s, but it does not appear to exist.

Obviously if you look at the duration of US 10y in 1950 and US 10y in 2015 there’s not going to be much difference.

Look at the duration of an aggregate benchmark. For example in Australia it has gotten much longer. Modified duration is now 4.5 years instead of 3.

In other words, the index is now 50% more sensitive to a rise in yields.

How can a negative real yield ever be called safe? Saying that its safer than equity volatility is like saying death by a thousand cuts is safer than a firing squad.

That’s true. It’s something of a pick your poison proposition right now. I’d say it’s more of a behavioral thing. Volatility doesn’t matter very much unless it causes you to abandon your plan at the worst times. Although most investors w/a very long time horizon should be 100% in equities, most can’t handle the short-term pain that comes along with that position so they diversify to hedge emotionally.

I agree w/you that bonds will be a death by a thousand cuts, but I still think high quality bonds can serve a purpose in a diversified portfolio, especially for those investors that have spending needs in the next 5 years or less.

Agreed. To compare, say, today’s BarAgg with its 1970s values, duration is significant. Unfortunately indexers tended to report maturity rather than duration back then.

I side with Ben in the sense that if one is trying to exploit negative correlation between equities and Treasuries, the yield is a secondary point.

Indeed, the negative correlation became positive in periods such as the late 1970s. So the mostly negative correlation since 2008 is the most reliable during low-yield periods.

[…] when US rates rise? Three Scenarios (Medium) see also The Blueprint for a Bond Bear Market? (A Wealth of Common Sense) • Janet Yellen, Forecasting Ace (Real Time Economics) • Passive management vs. saving more […]

[…] The Blueprint for a Bond Bear Market? (awealthofcommonsense) […]

I could have told you the outcome shown in your chart of returns for decade of the ’50’s given where rates started and where they ended. This next decade will likely be similar. Why hold any fixed income given what rates are now when cash has zero nominal downside? Cash is my fixed income and has been for a couple of years.

True, but I think not enough investors understand this point as everyone has spent 3-4 years freaking out about higher rates. I have no problem with your barbell approach by using cash as the fixed income proxy. Bonds will be much more volatile from here so if you don’t want to take that risk I see no problem with using cash or cash equivalents. My personal favorite is a simple online savings account (pays around 0.75% right now).

If you are looking for a little extra yield, I like this strategy from Allan Roth that buys longer-term CDs with zero int rt risk:

http://www.wsj.com/articles/SB10001424127887324392804578360640918272434

Check back tomorrow…you’re not the only one who has commented to me that they’d rather be in cash. I’ve been doing some testing on a stock/cash portfolio.

Could you elaborate further on stocks and cash vs stocks and bonds? How about half cash half bonds for the income vs all cash, any diversification benefit with that?

Take a look at this one:

https://awealthofcommonsense.com/an-alternative-to-the-6040-portfolio/

The benefit of any cash or high quality bond allocation is that it provides that part of your portfolio with dry powder for spending or rebalancing during a market shake-up. Cash more liquid but bonds you’ll get a better yield and more of a flight to safety during the down times (usually).

[…] from their current low yields that they could still serve a purpose as a portfolio diversifier (see here and […]

[…] What does a bond bear market look like? Probably not a 1970s-style clobbering. Here’s what happened in the 1950s. […]

[…] What does a bond bear marketplace demeanour like? Probably not a 1970s-style clobbering. Here’s what happened in a 1950s. […]

[…] The blueprint for a bond bear market? – A Wealth of Common Sense […]

[…] The Blueprint For a Bond Bear Market […]