How to know when you can retire.

How to know when you can retire.

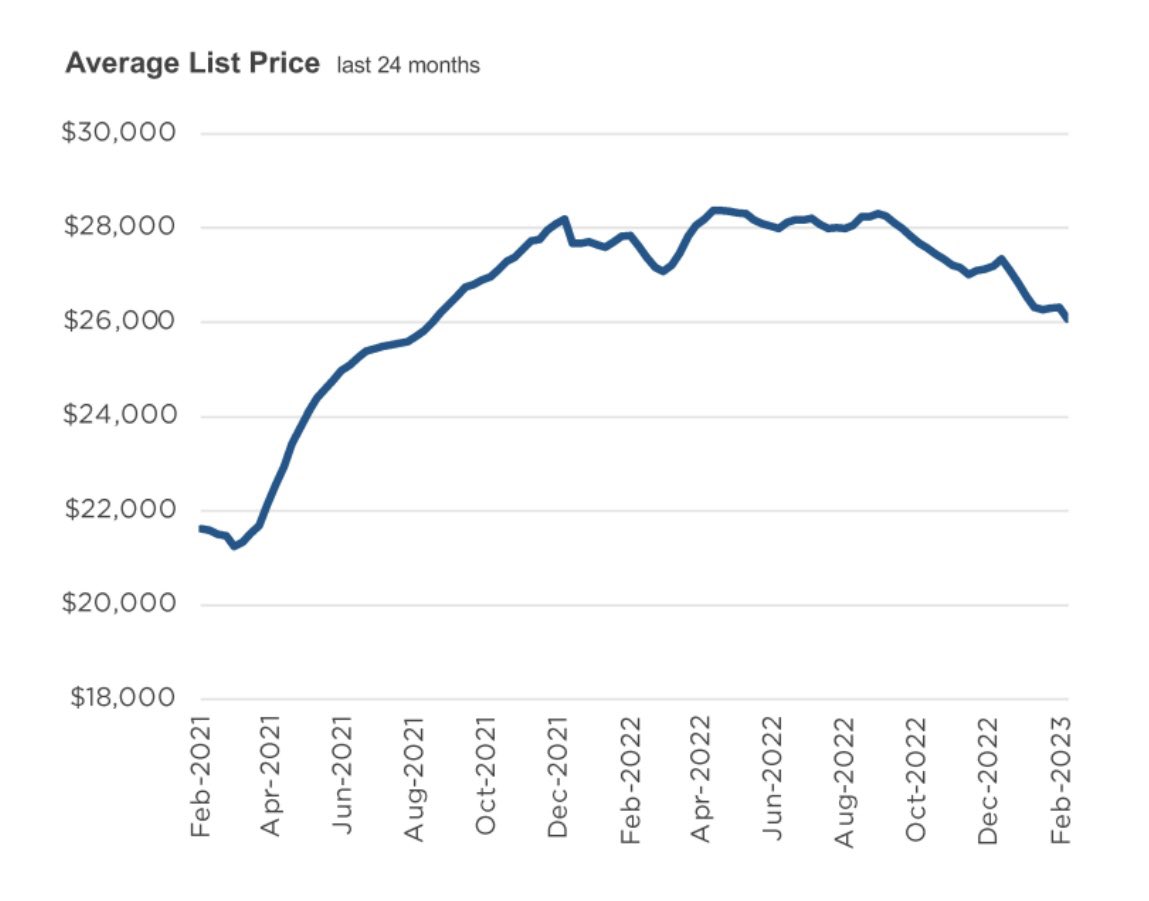

On today’s show, we spoke with Tom Miller, CEO and CIO of USQ to discuss real estate in Manhattan, the hottest sectors of commercial real estate, office space investing in the next few years, and much more!

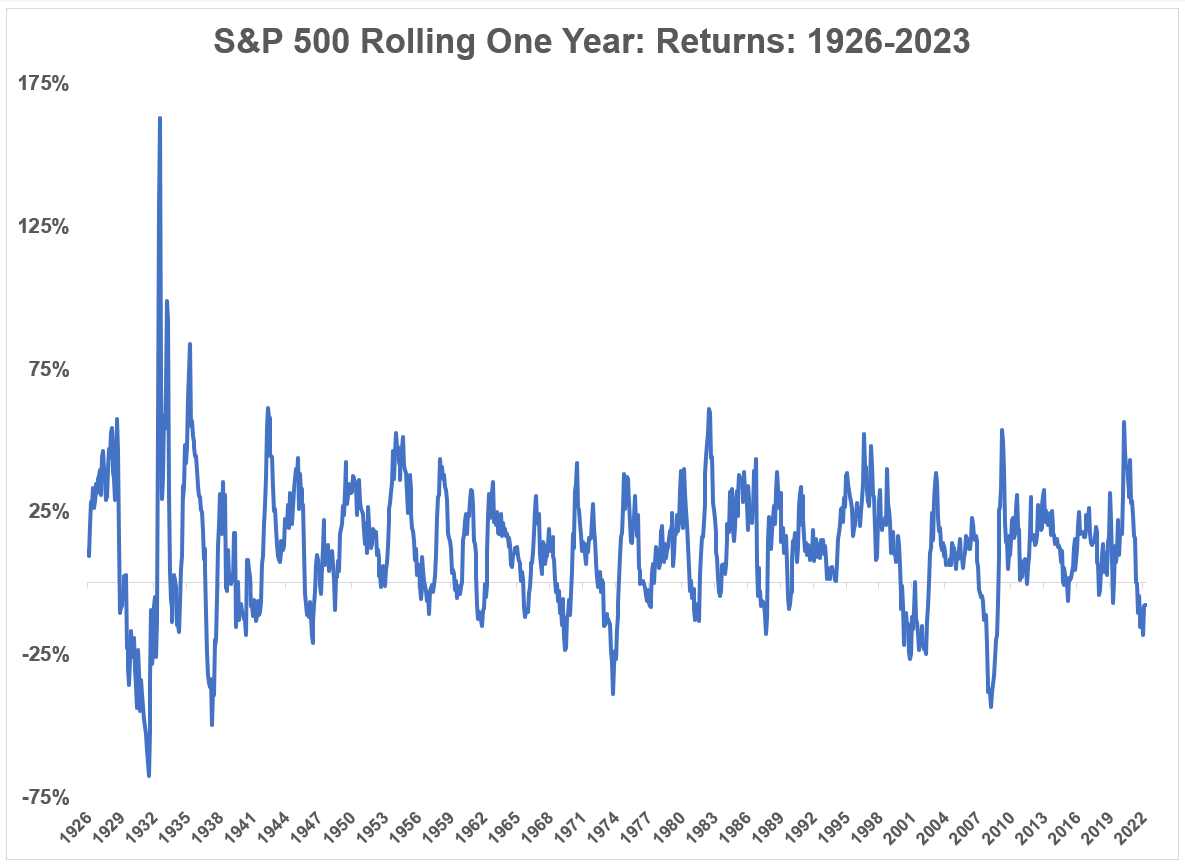

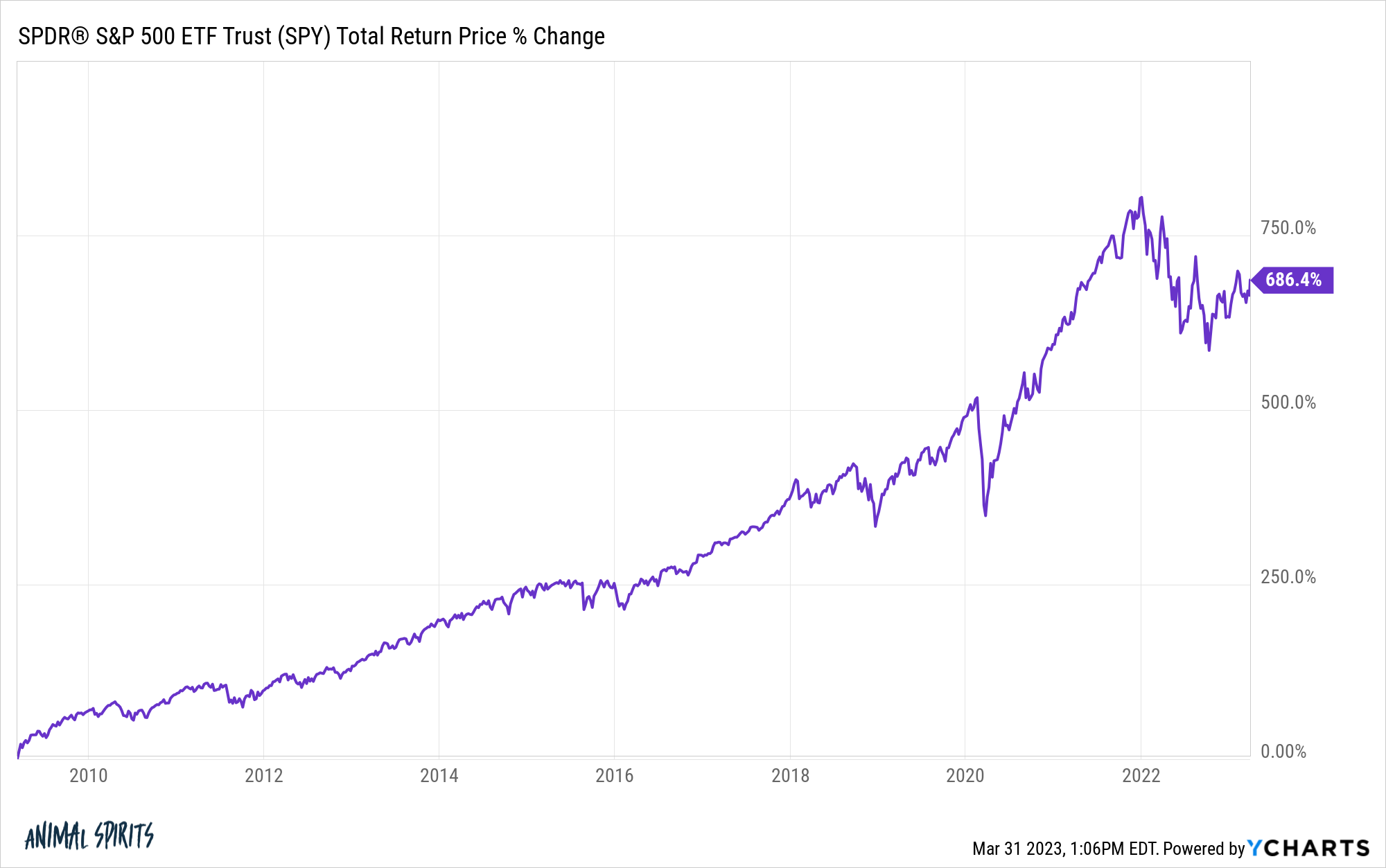

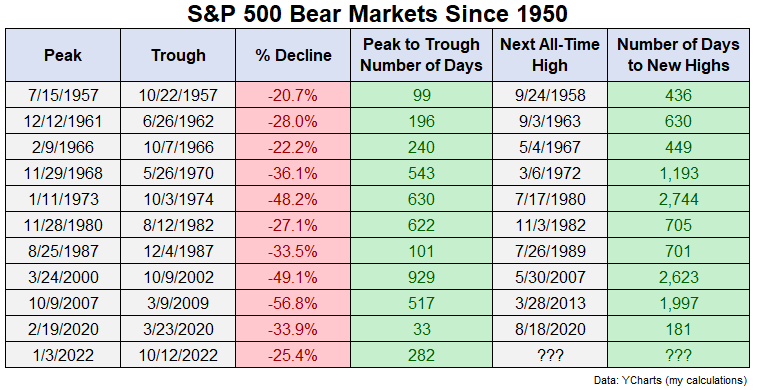

How bull markets more than make up for the bear markets.

On today’s show, we are joined by CarDealershipGuy to discuss buying a car in 2023, buying v leasing, the downfall of Carvana, the electric car market, and much more!

Why selling after a crash can be such a painful investing mistake.

How financial advisors will use AI.

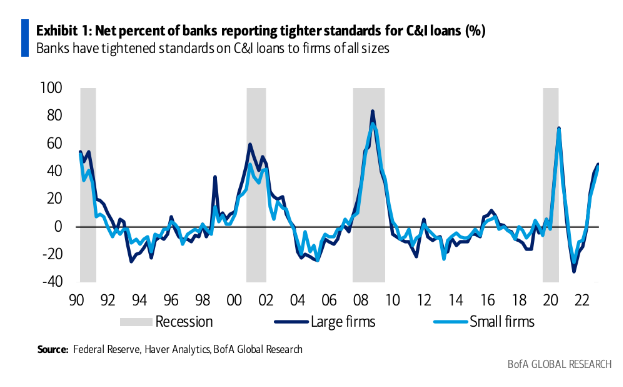

On today’s show, we discuss why investing is so hard, the time between all-time highs in a bear market, why the Fed is in such a tough spot, ramifications from the banking crisis, low supply in the housing market, why people think their children will be worse off, the psychology behind the AI boom and much more.

How long does it take to earn your money back from a bear market?

On today’s show, we are joined by Brandon Arvanaghi, Founder and CEO of Meow, and Devon Drew, the CEO and CIO of DFD Partners to discuss tools for business owners and treasury cash management, and distribution solutions for advisors and asset managers.

Why Jeremy Strong might be this generation’s Dustin Hoffman.