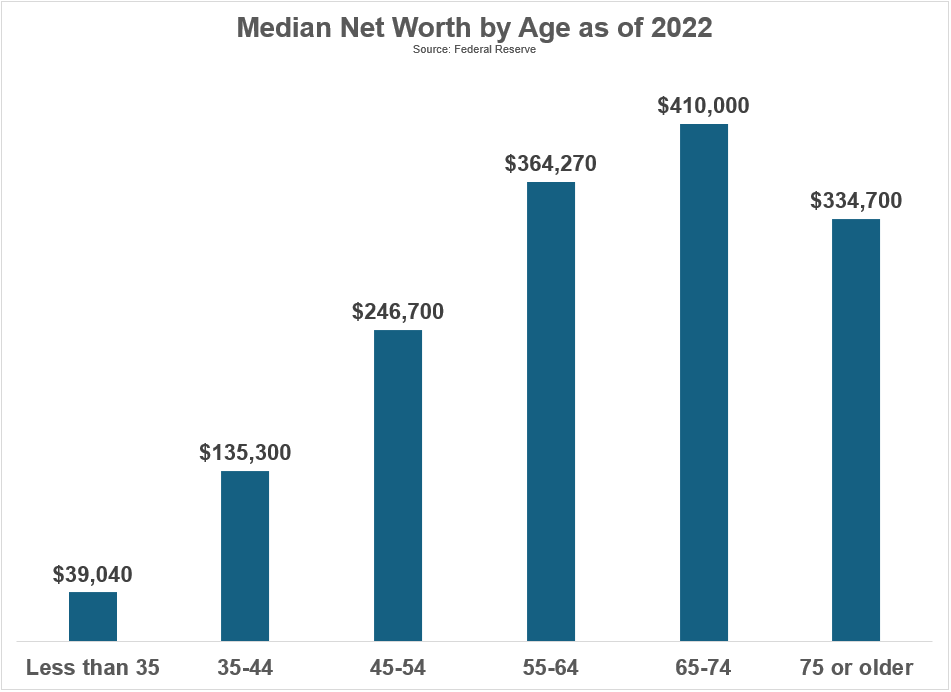

Are older Americans more prepared for retirement than people think?

Are older Americans more prepared for retirement than people think?

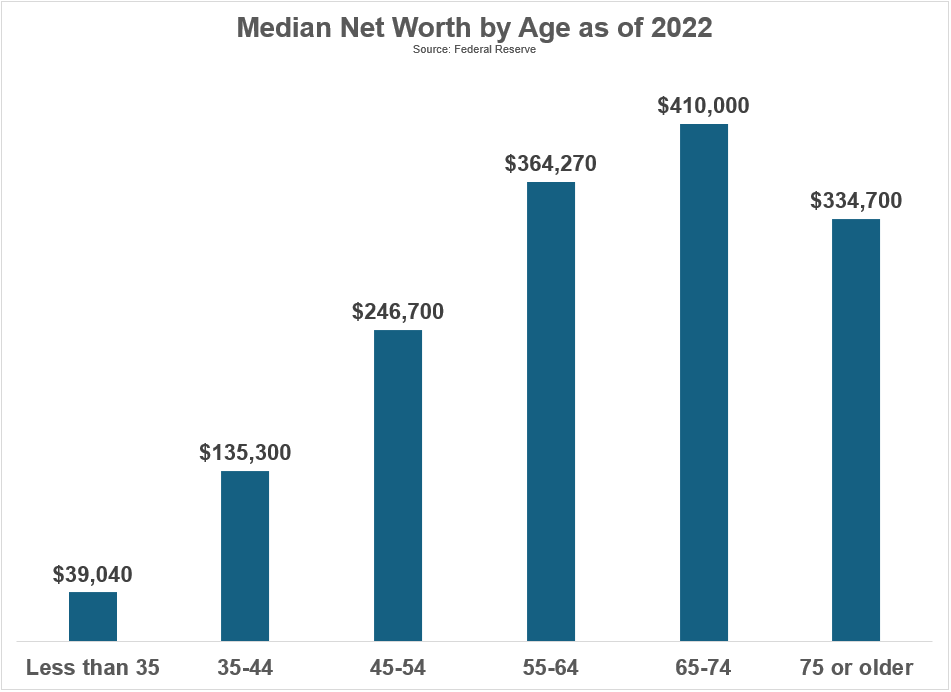

Comparing returns on stocks, bonds, cash and gold to the U.S. housing market.

On today’s show, we discuss:

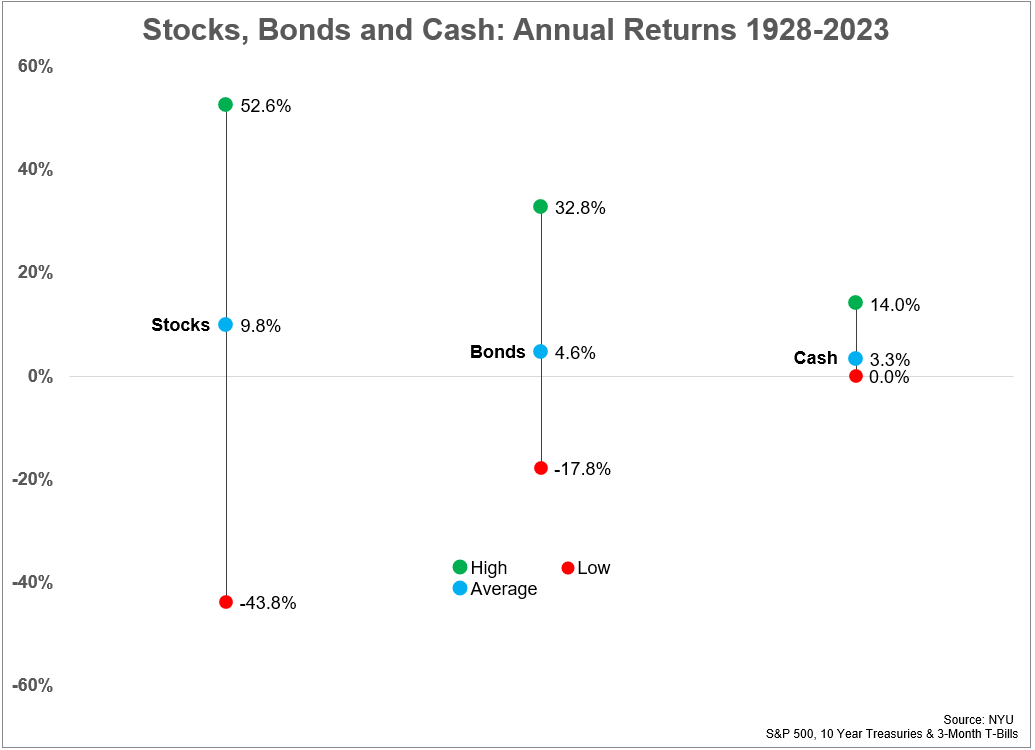

– Setting return expectations moving forward

– US Large Cap stocks generating a ton of cash

– A bear market in used cars

– An update on Bitcoin ETFs

– Great Quarter Guys

– Driving in a blizzard, and much more!

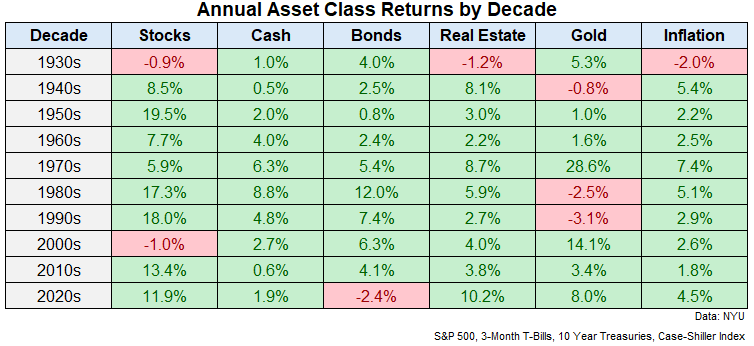

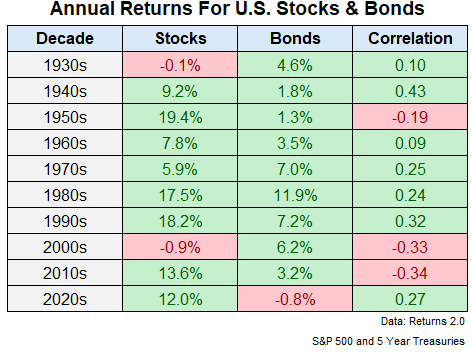

Why I’m not worried about higher stock and bond correlations.

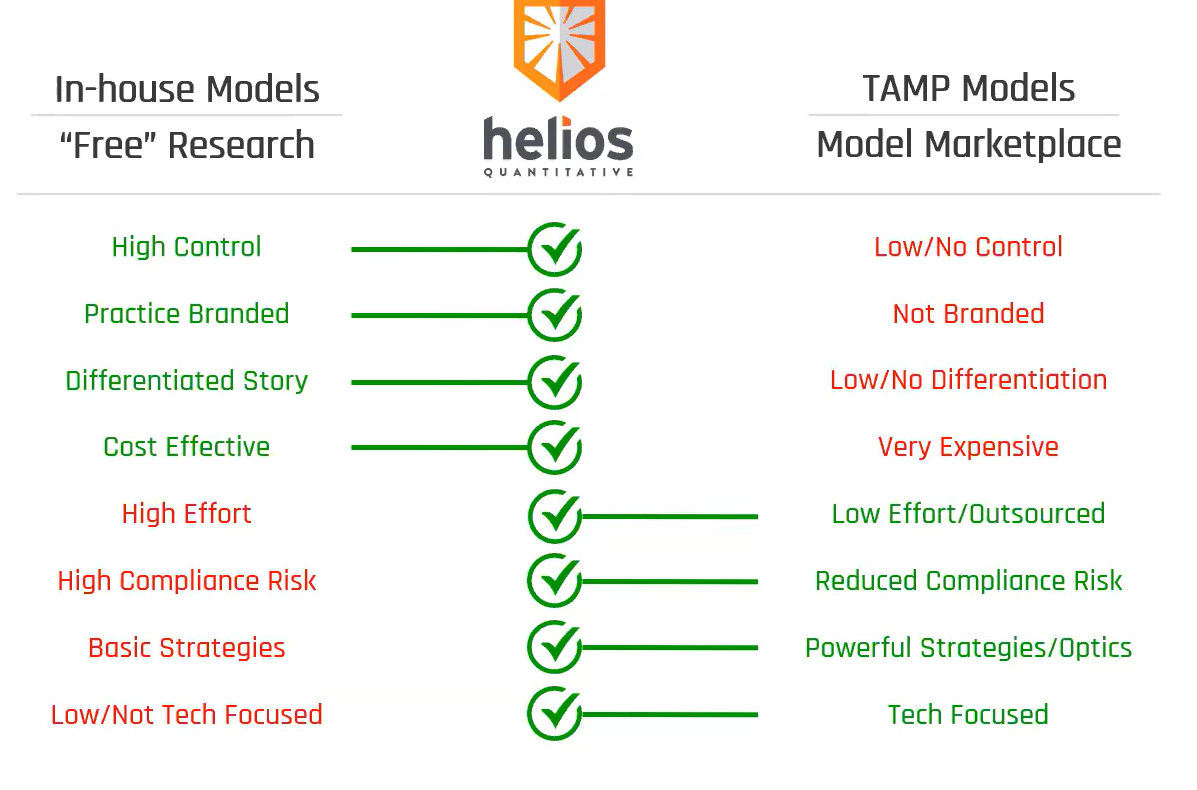

On today’s show, we are joined again by Chris Shuba, Founder and CEO of Helios Quantitative Research to discuss:

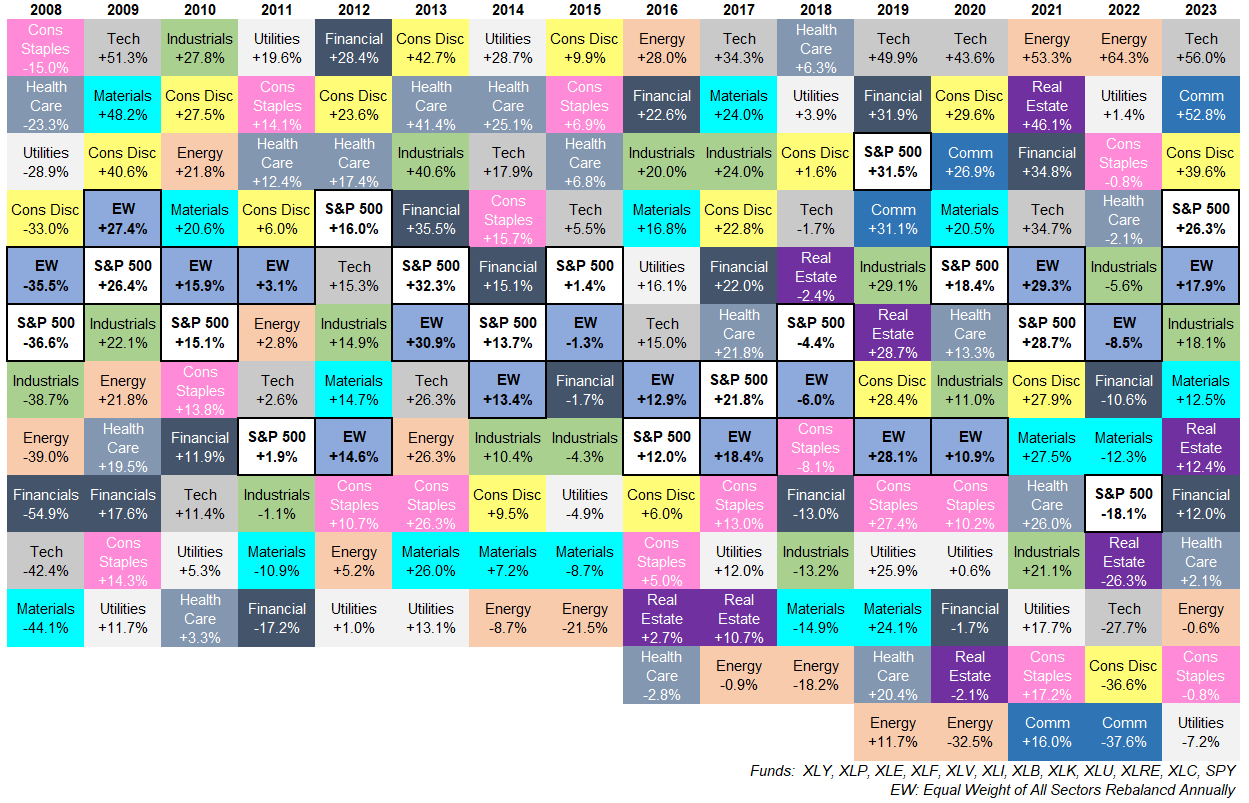

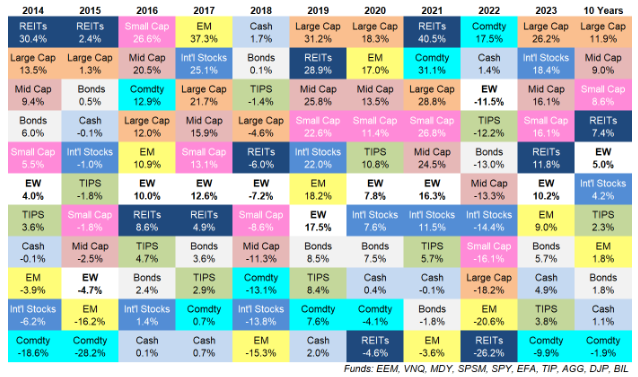

– The experience of a diversified investor in 2023

– Utilizing AI to build portfolios for advisors

– Helios’ latest trading service offering, and much more!

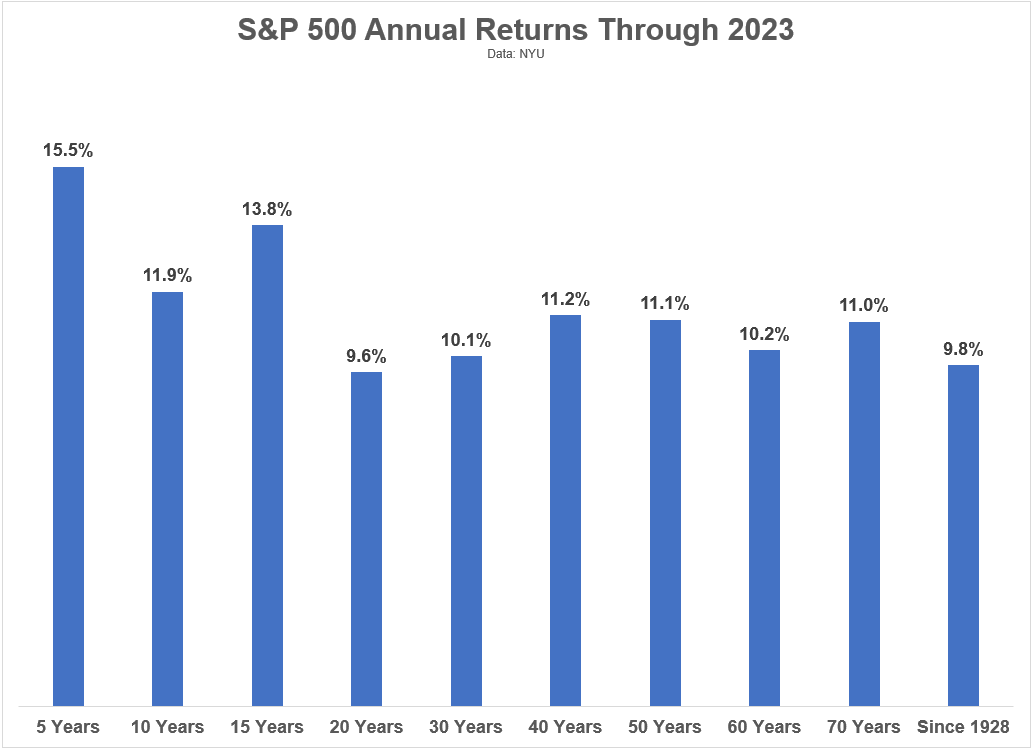

Historical returns for stocks, bonds and cash from 1928-2023.

The gool old days weren’t as great as you think.

Investing in sectors, the S&P 500 or equal weight S&P 500.

On today’s show, we discuss:

– The biggest winners and losers of 2023 in the markets

– Short-term vs. long term returns for stocks

– Why the U.S. dominates financial markets

– The problem with being right once in a row

– Bitcoin ETF fees

– Americans are richer than you think, and much more!

A look at some updated historical U.S. stock market return data.