The stock market vs. fundamentals in the short run.

The stock market vs. fundamentals in the short run.

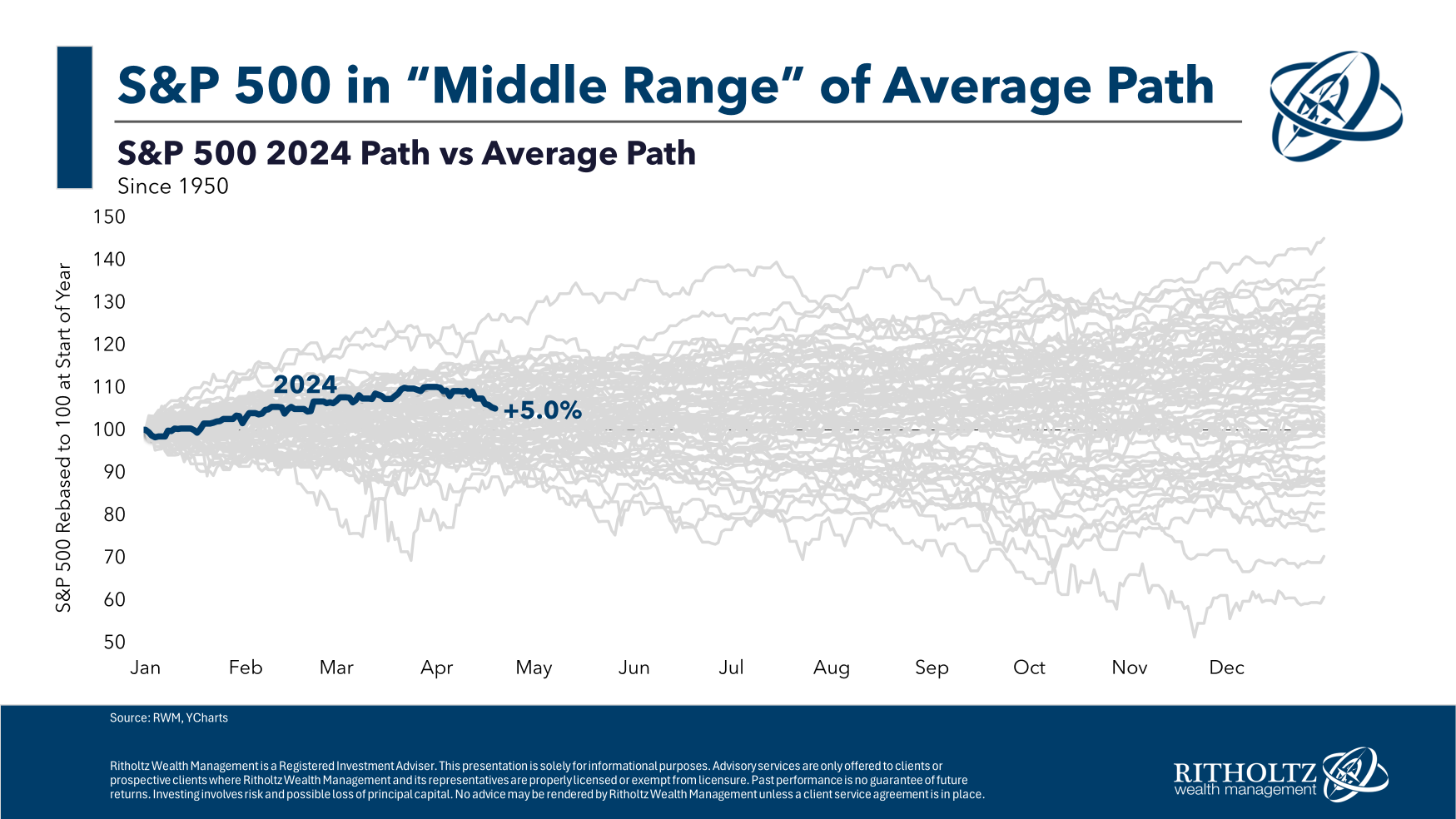

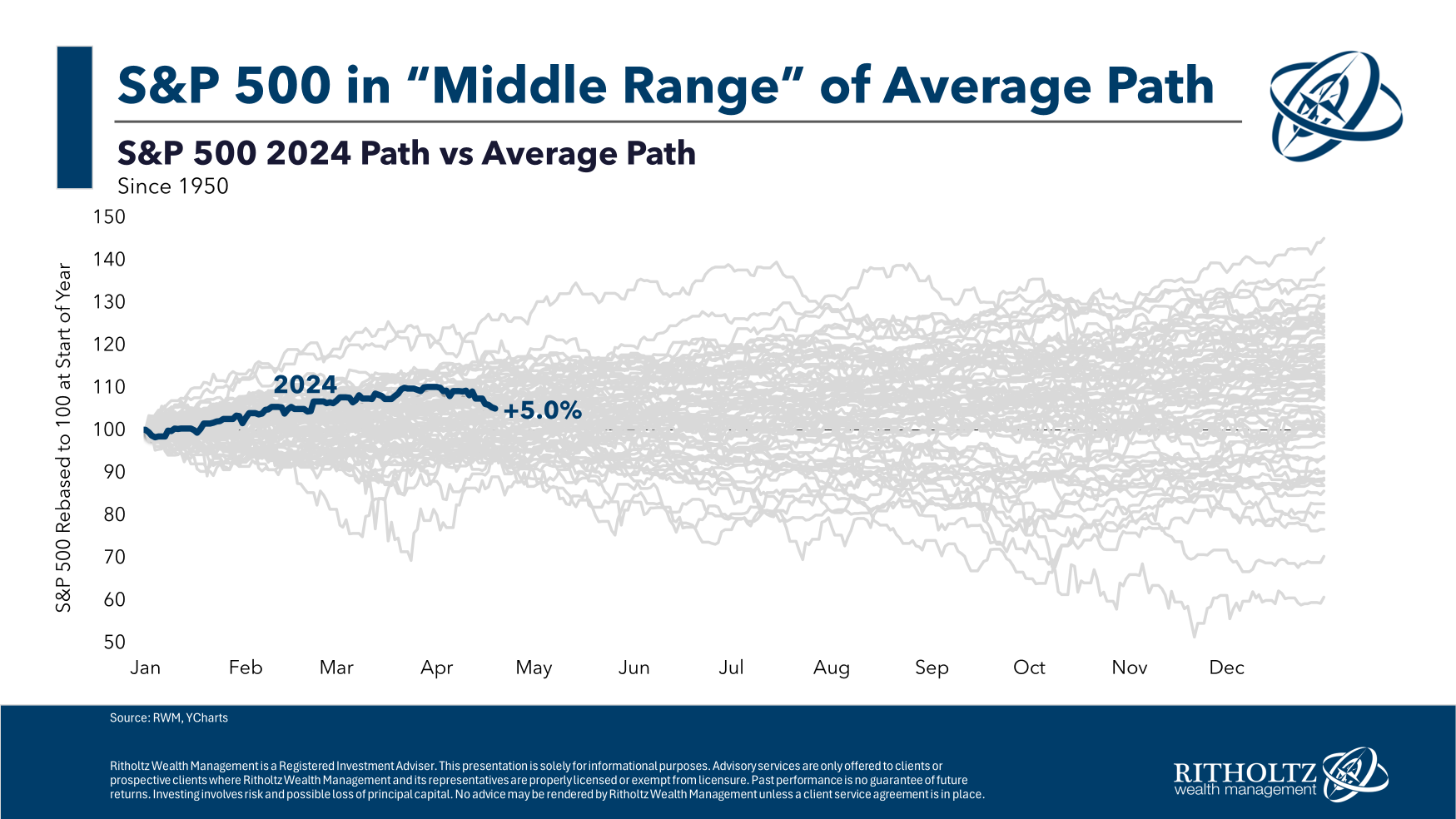

Comparison is the thief of joy.

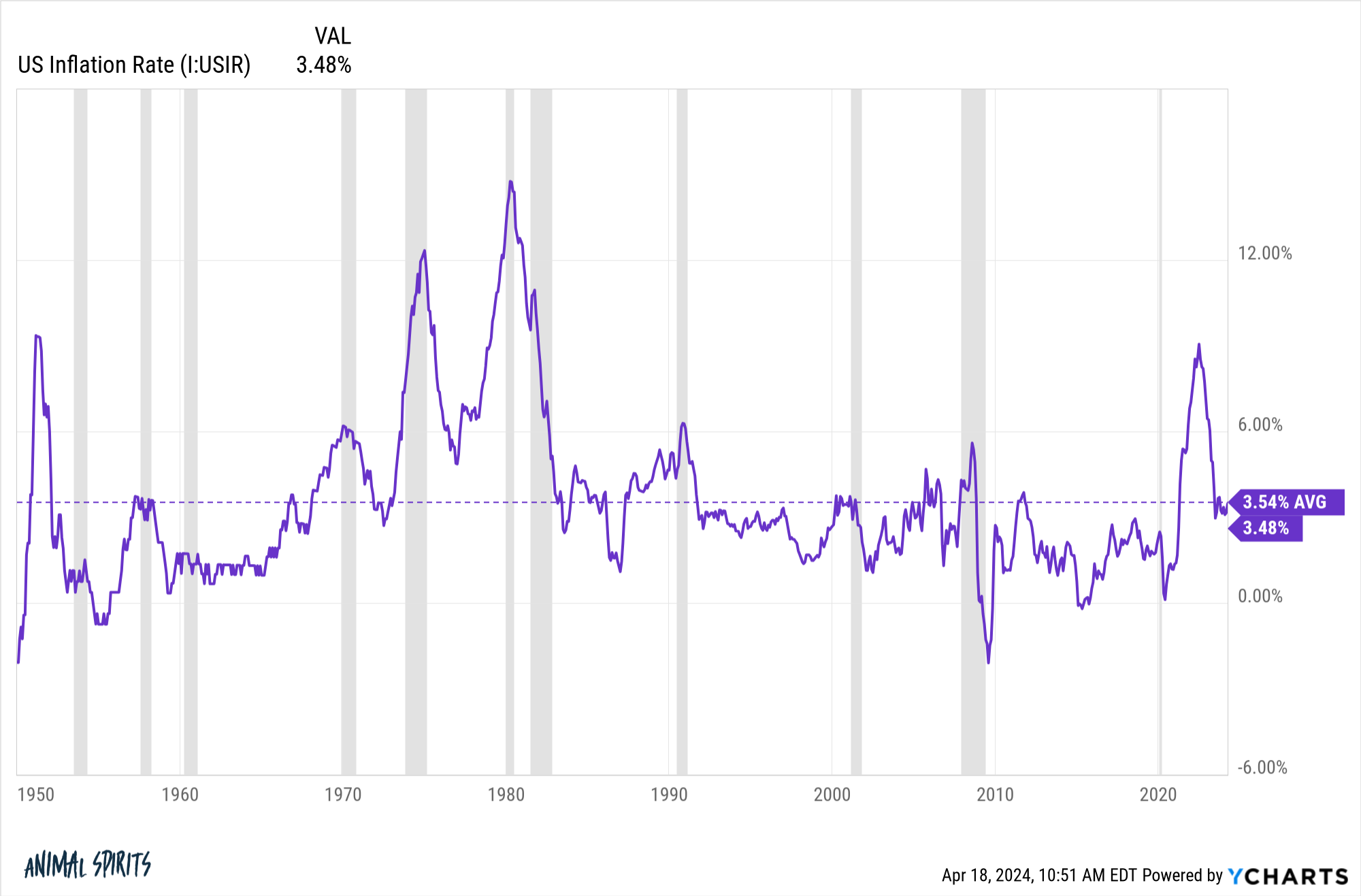

Inflationary loss aversion stings.

On today’s show, we discuss:

– Why the stock market isn’t down more

– Why the price of oil isn’t up more

– Improvements in investor behavior

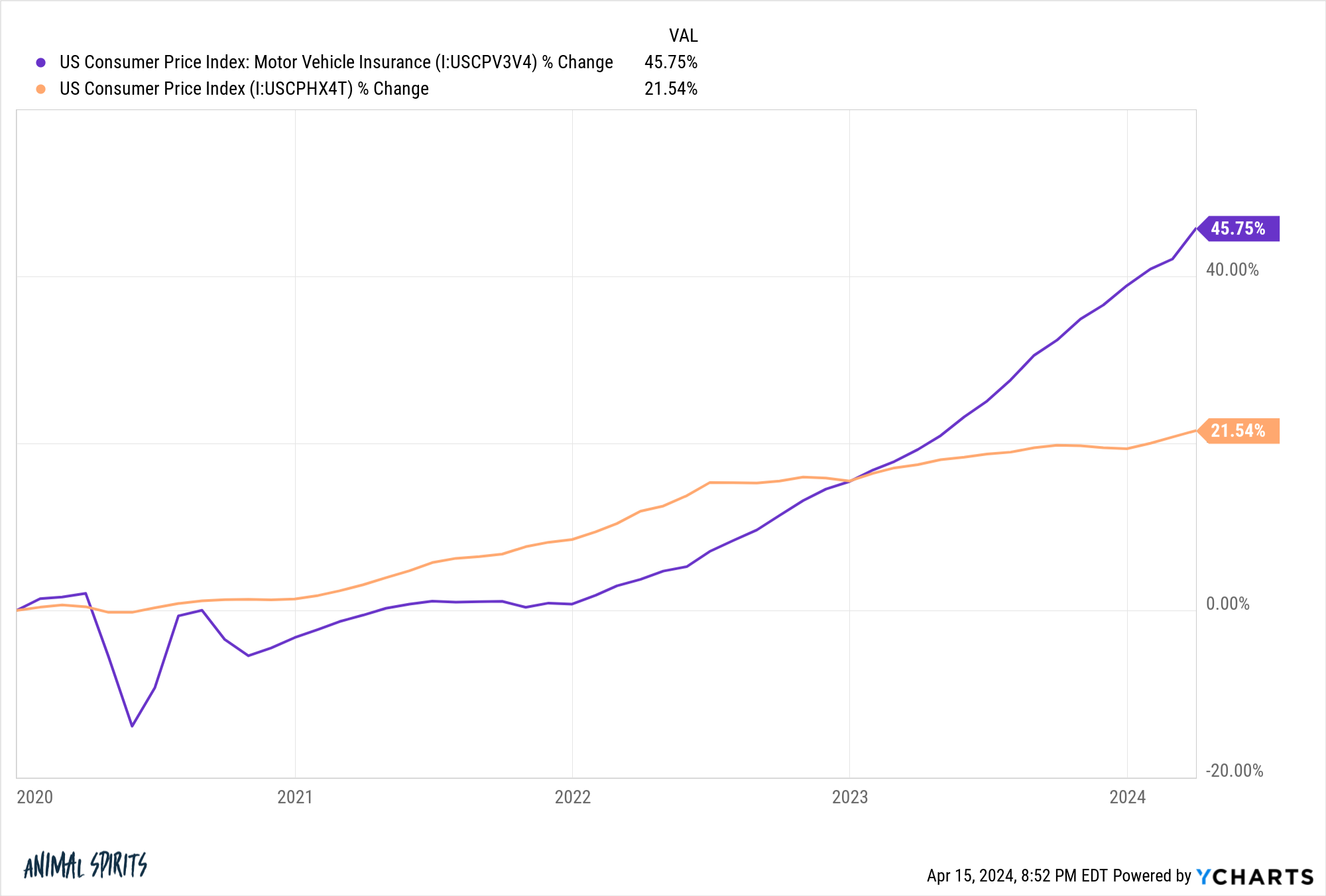

– The auto insurance crisis

– Why home insurance is rising

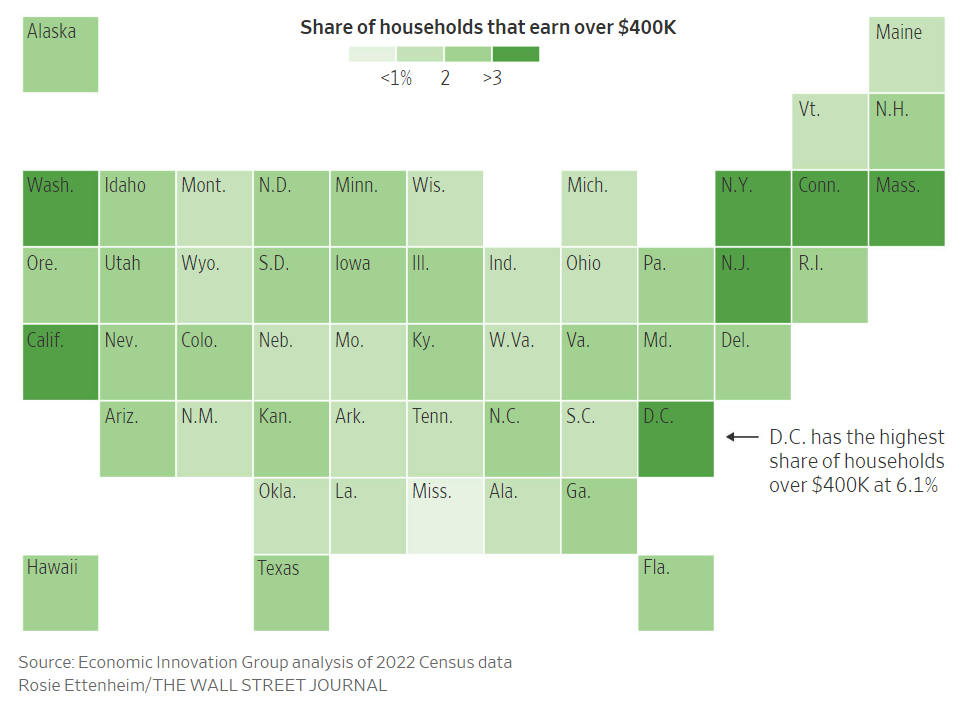

– Why rich people don’t feel rich

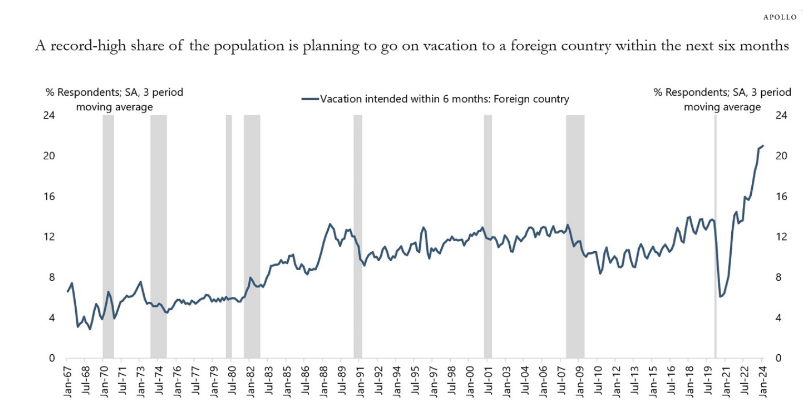

– Millennials and Boomers powering the economy

– Higher for longer mortgage rates

– Customer service nightmares, and much more!

Why are auto insurance rates screaming higher?

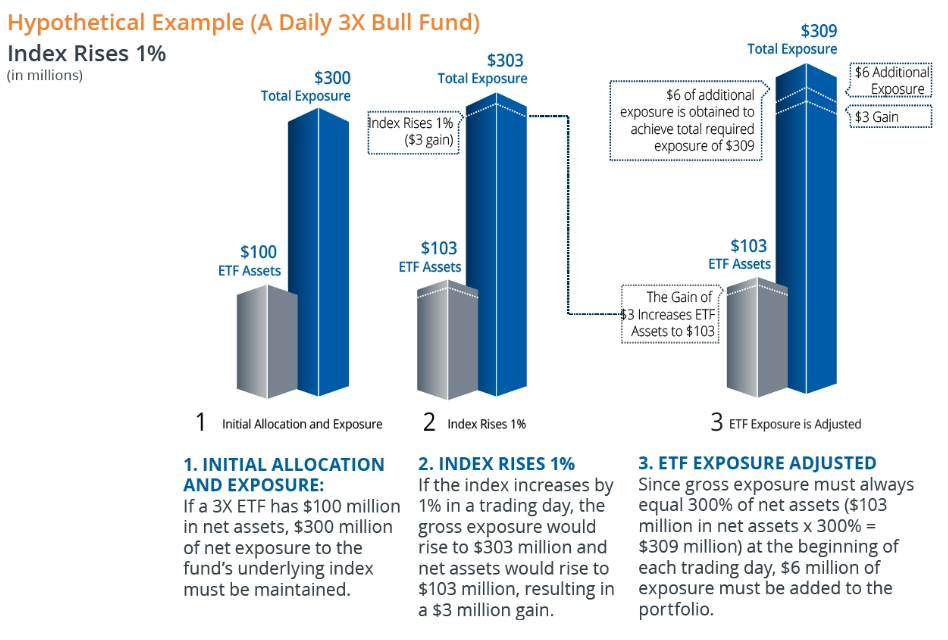

On today’s show, we spoke with Ed Egilinsky, Managing Director, Head of Alternatives, and Head of Sales and Distribution at Direxion to discuss:

– Flows into bullish and bearish levered funds

– Diversifying away from large-cap tech

– Utilizing the Nasdaq equal-weight ETF

– The appropriate time period to hold leveraged products, and much more!

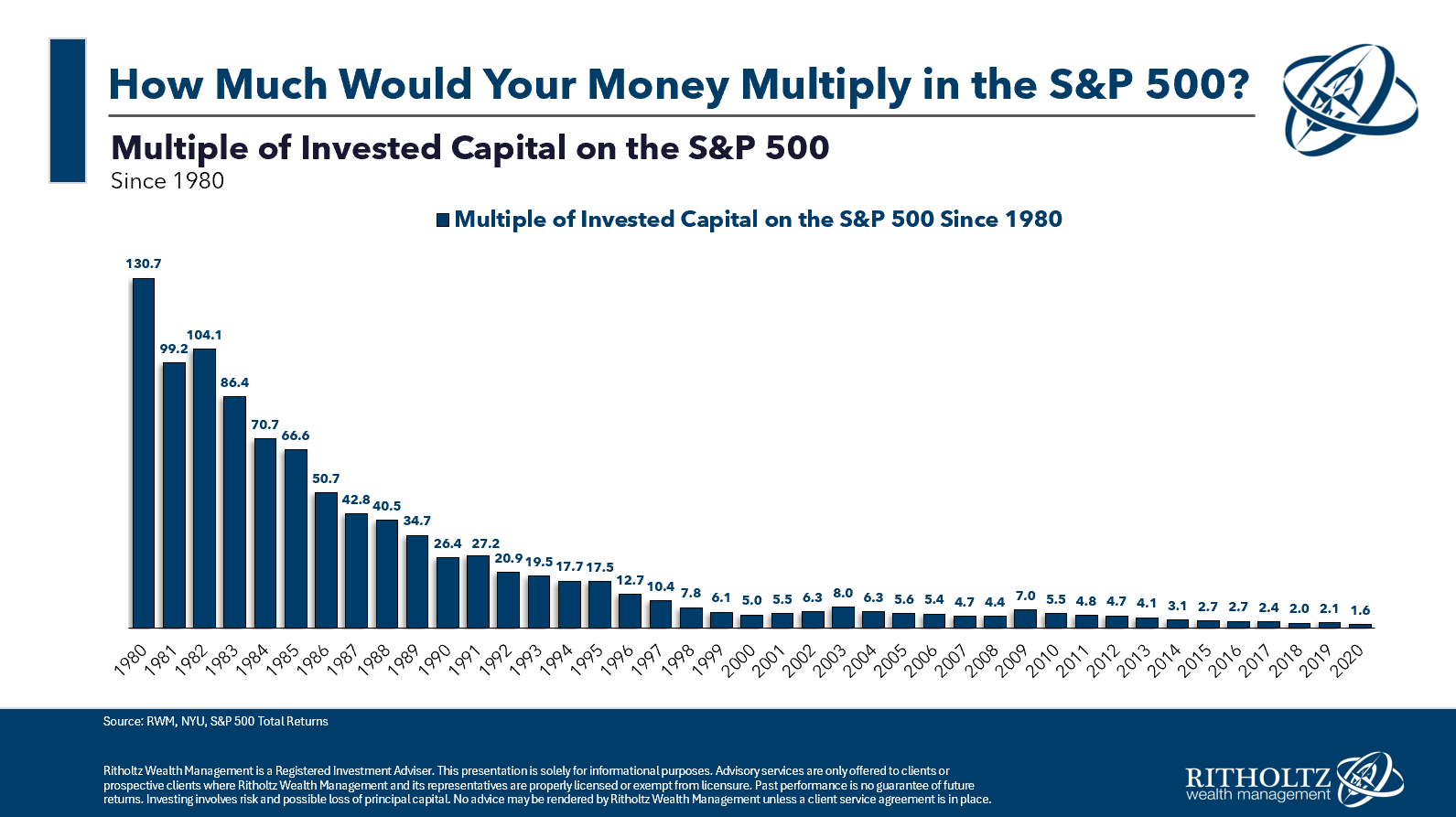

The virtues of long-term investing.

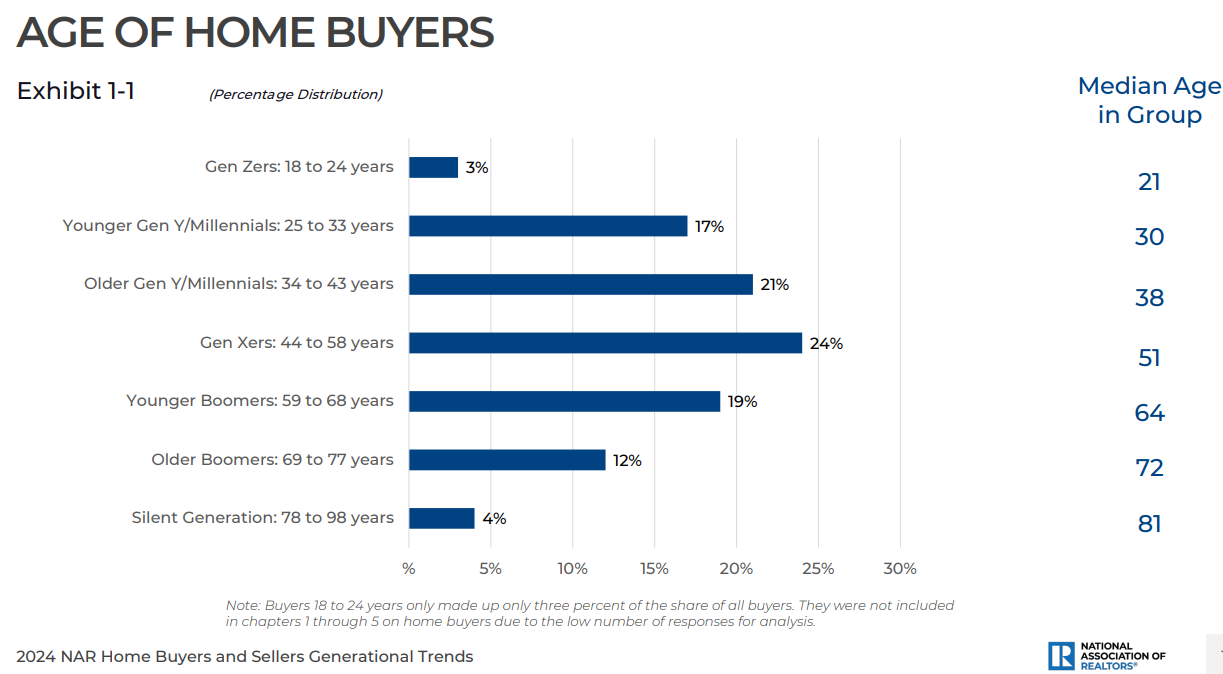

A look at the breakdown of homebuyers by generation, income and more.

How many investors have the ability to change their behavior?

On today’s show, we discuss:

– How we prioritize our spending

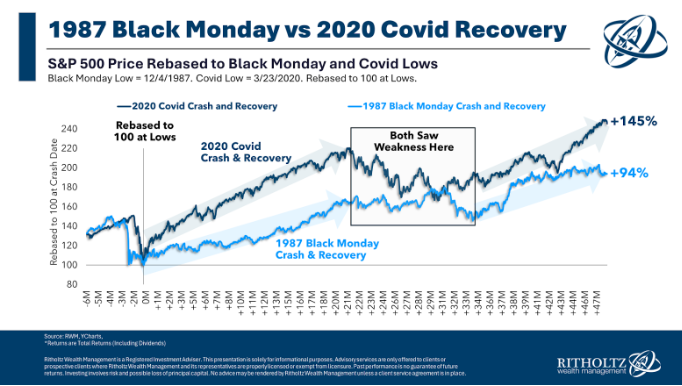

– 1987 vs. the Covid crash

– Crazy index fund flows

– Stock market concentration

– Panic about government debt

– The tech recession in California

– Will Millennials move to Florida in retirement

– The most streamed shows, and much more!