How to determine if you are saving enough money.

How to determine if you are saving enough money.

On today’s show, we discuss:

– Michael vs. StubHub

– Inflation at Disney is undefeated

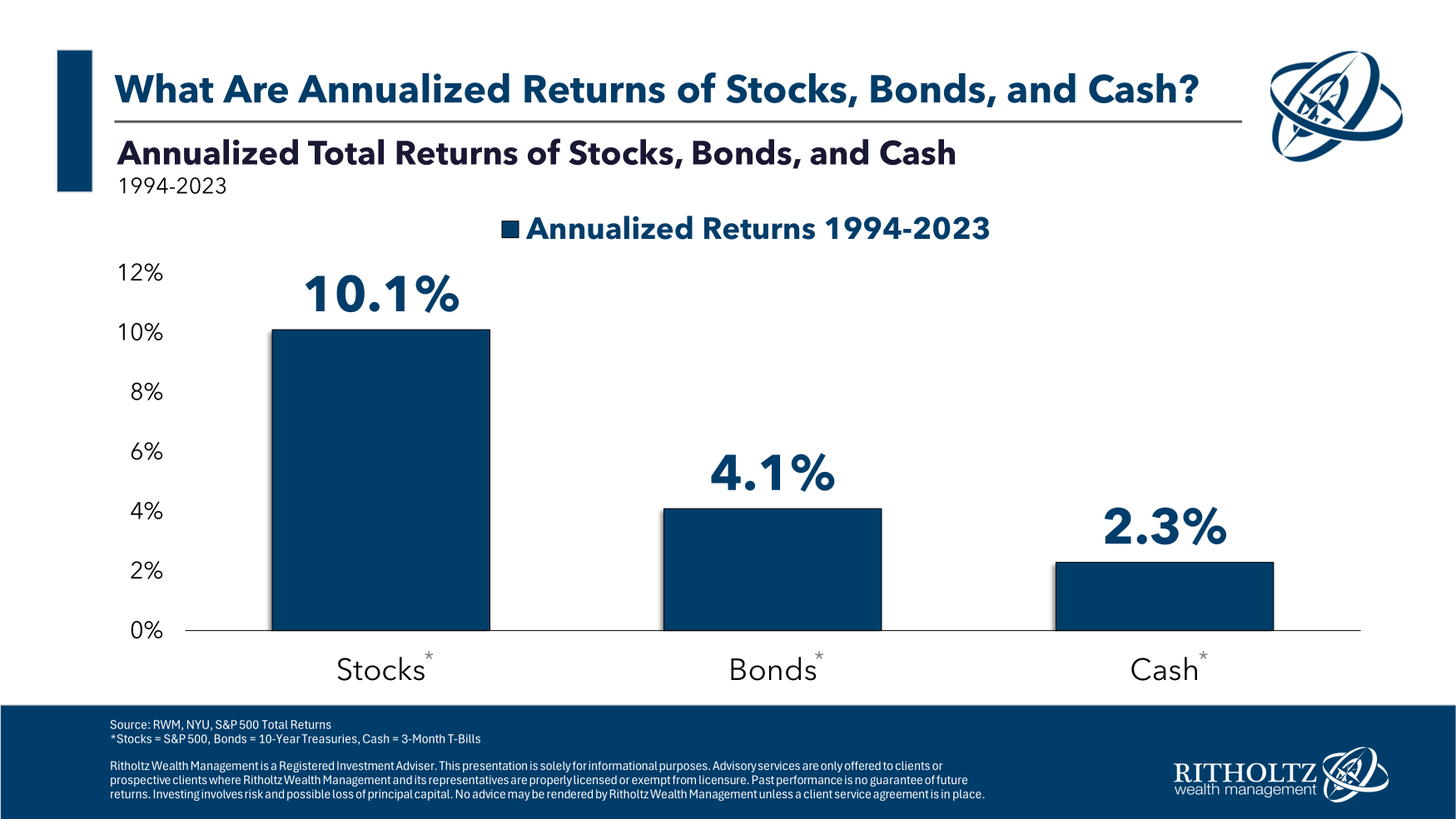

– 30 years of stock market returns

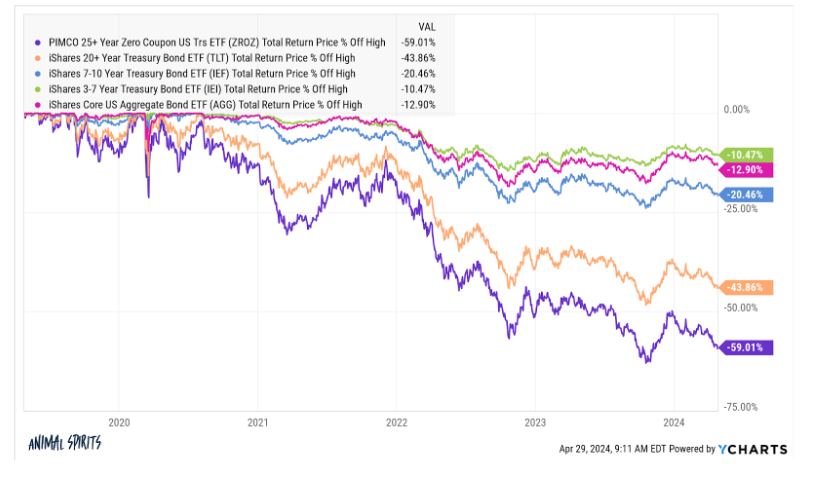

– The bond market correction rolls on

– ARKK is finally seeing an exodus

– Corporations are taking advantage of consumers

– The biggest AI winners

– The new normal of housing prices, and much more!

Some questions to ask yourself to gain the correct long-term perspective.

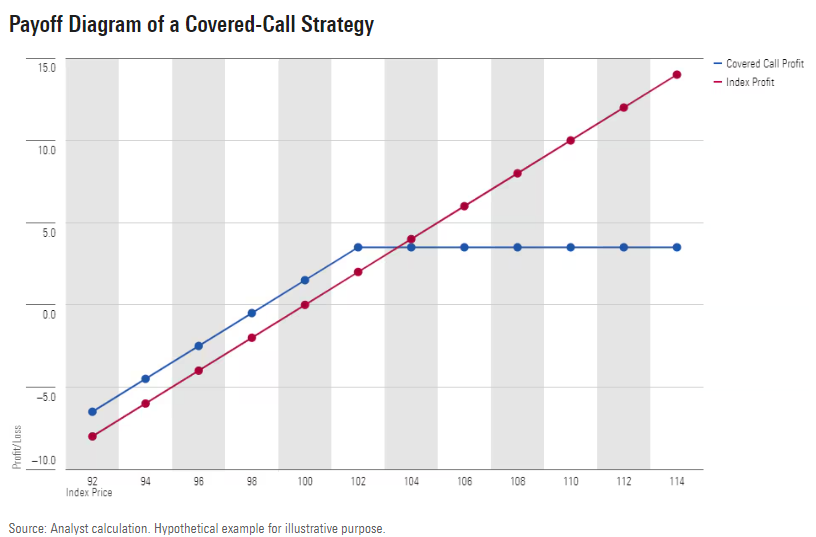

On today’s show, we are joined by Eric Metz, President, and Chief Investment Officer of SpiderRock Advisors to discuss:

– The pending acquisition by BlackRock

– Covered call performance in a bull market

– Tax benefits when utilizing options

– What’s driving option-overlay growth in todays market, and much more!

Dissecting 30 year returns for stocks, bonds and cash.

Billionaires don’t like paying taxes. Is it worth it?

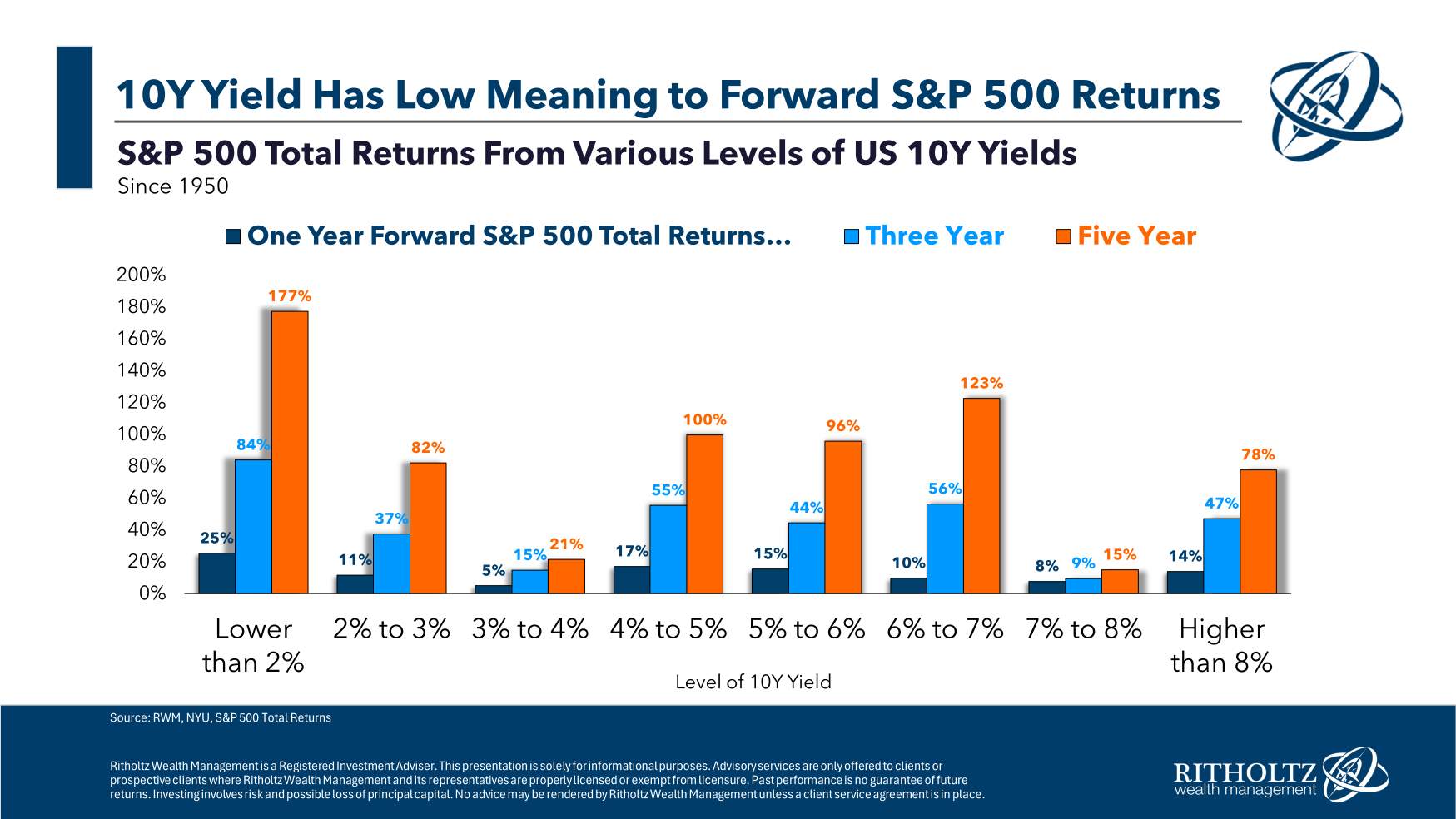

Why higher rates don’t necessarily spell doom for the stock market.

On today’s show, we discuss:

– Why the stock market needed a correction

– Why the 1990s is an outlier (in more ways than one)

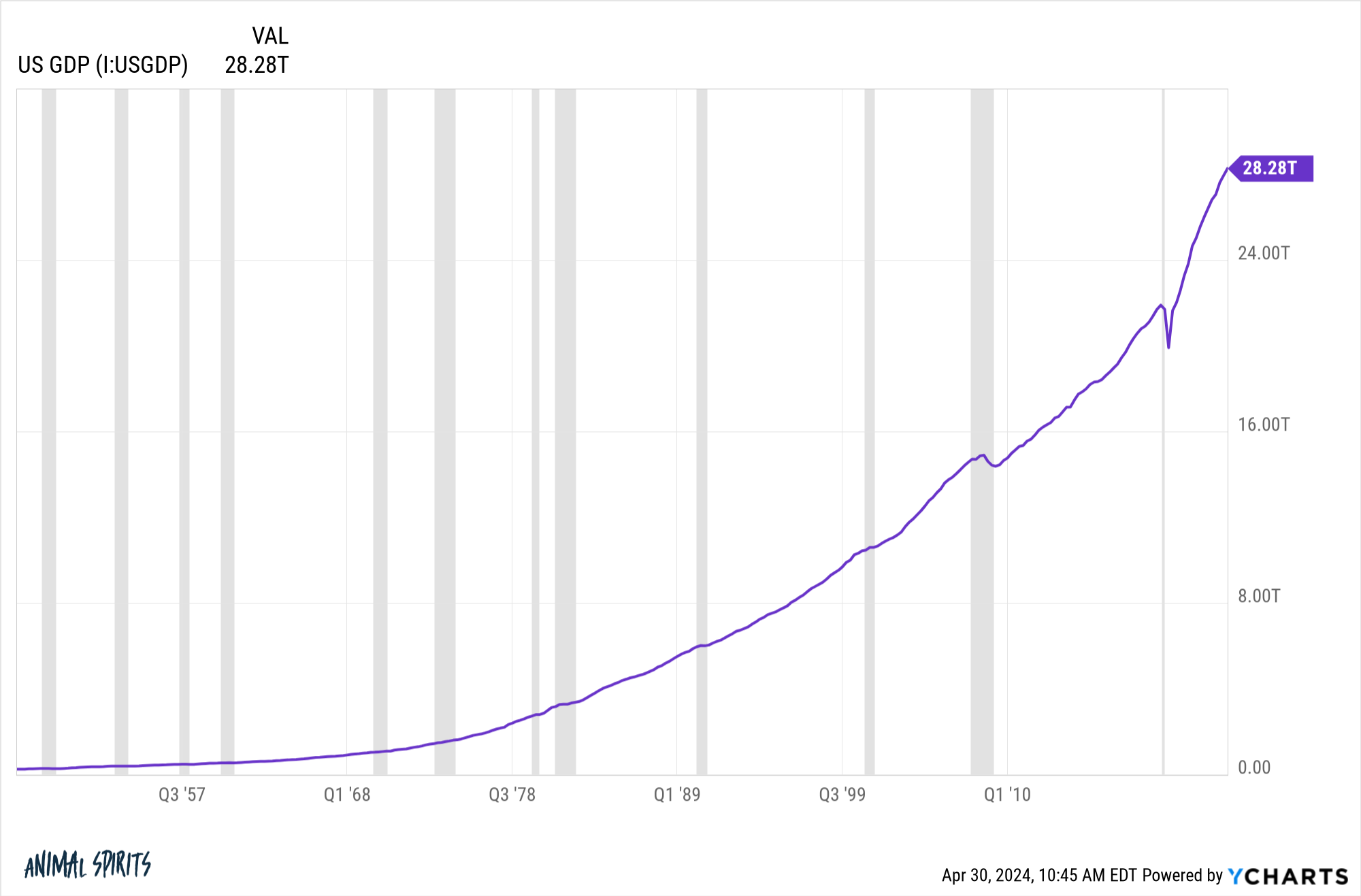

– Economic growth is a policy choice

– Gen Z is doing better than you think

– Living in the U.S. vs. Europe

– The number of households with a paid off mortgage

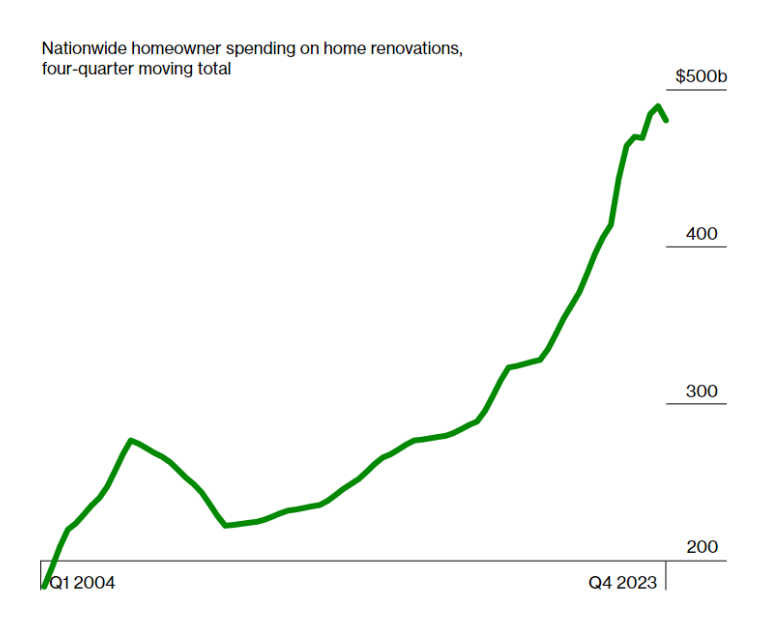

– The renovation boom, and much more!

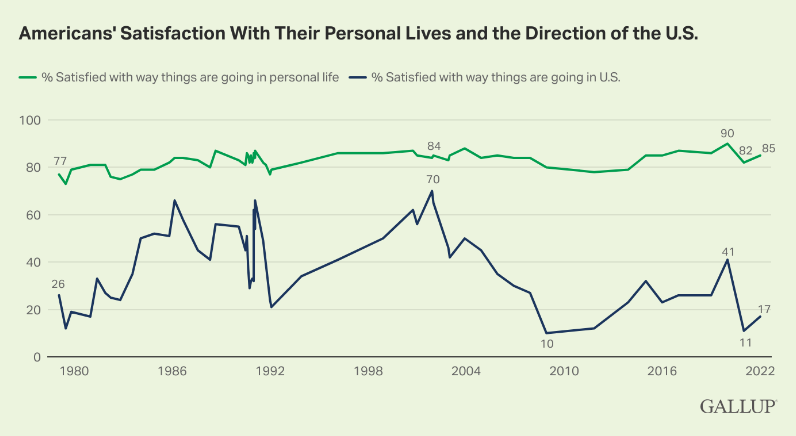

Negativity sells.

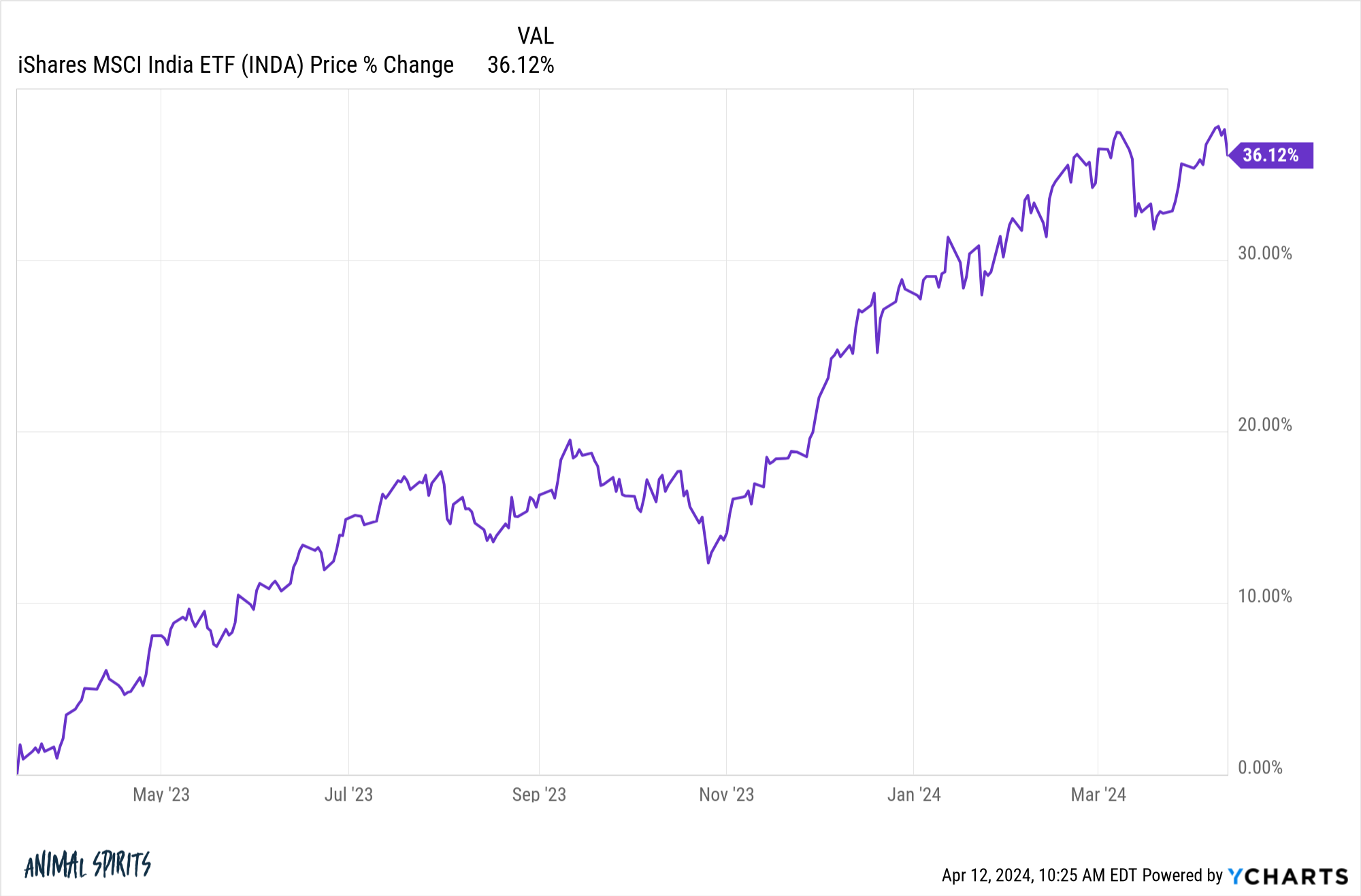

On today’s show, we are joined by Anupam Ghose, Managing Partner at System Two Advisors to discuss:

– Why the China story is different than the India of today

– India’s macro tailwinds

– How GDP growth translates to higher stock prices

– Risks involved when investing in India, and much more!