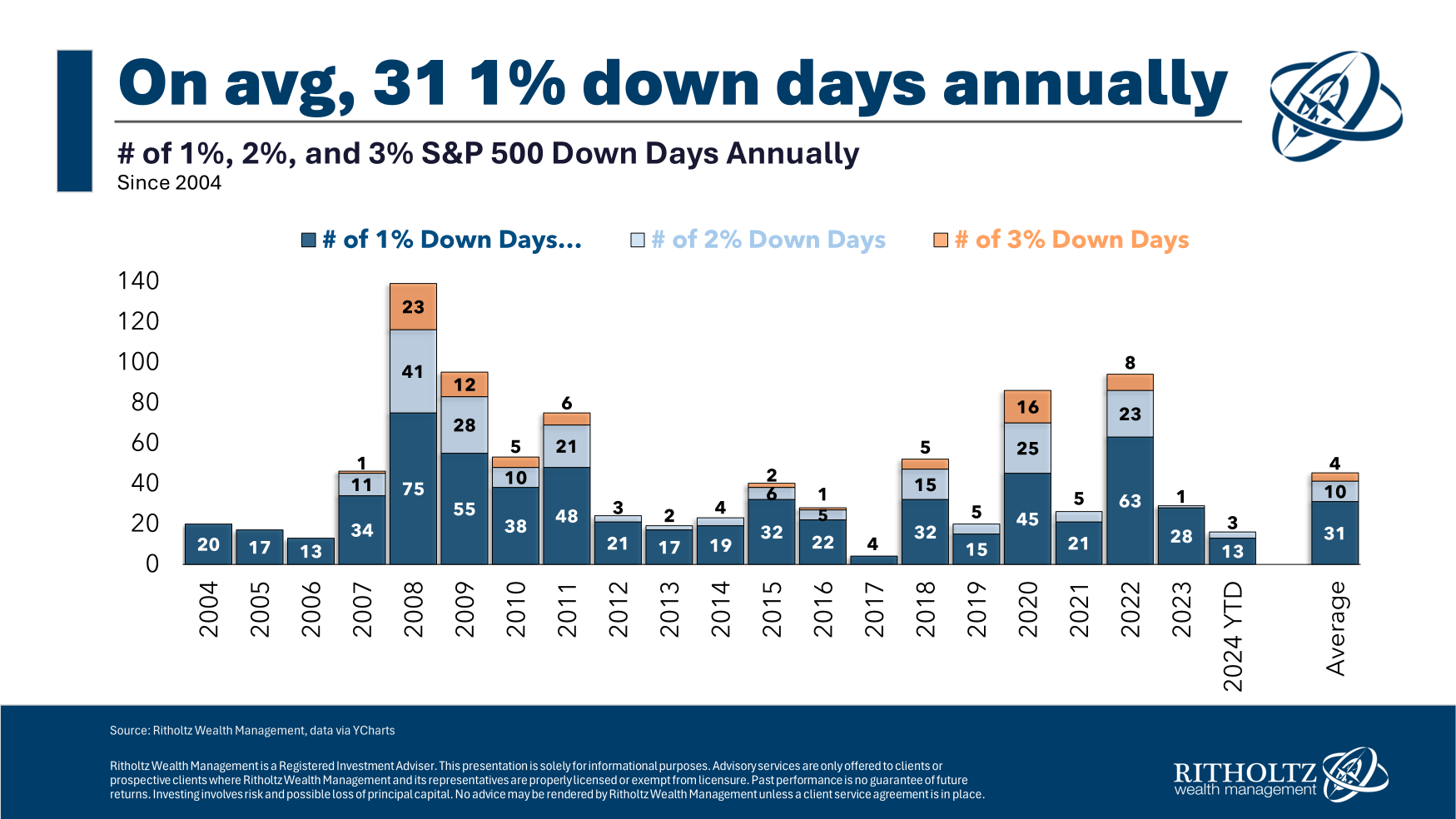

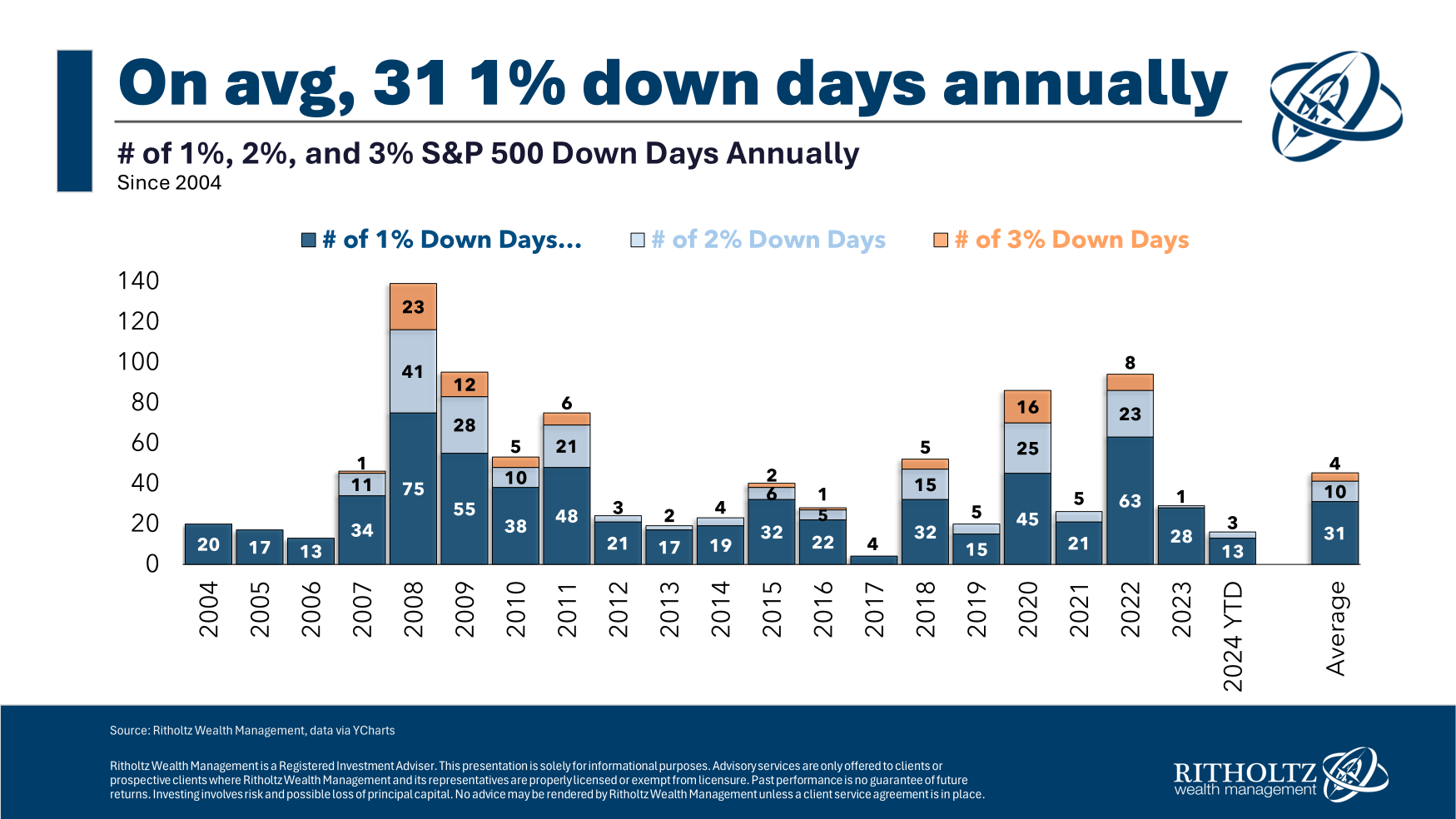

Are big down days a harbinger of worse things to come in the stock market?

Are big down days a harbinger of worse things to come in the stock market?

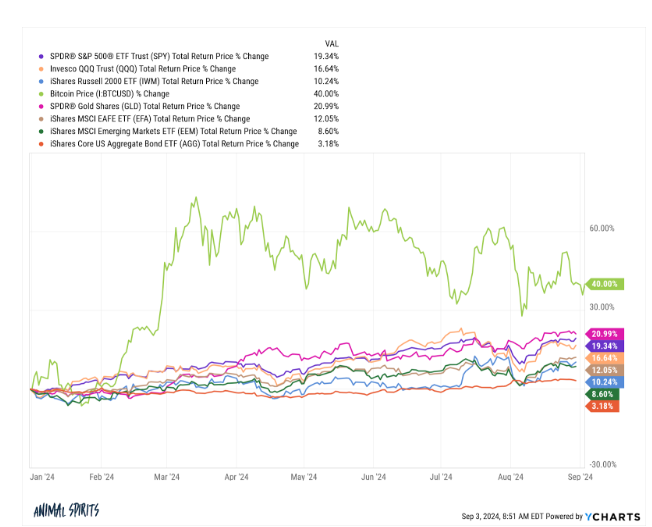

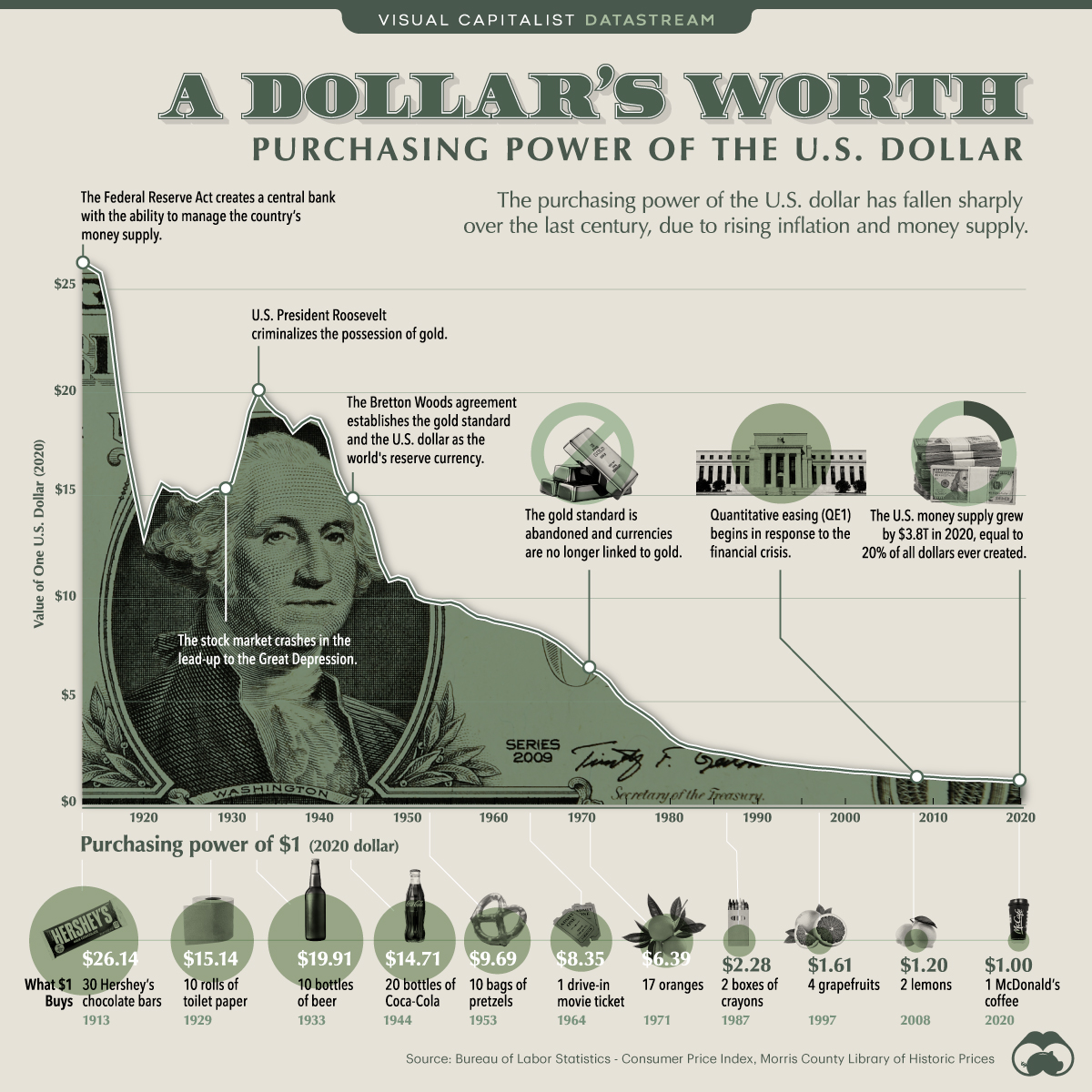

On today’s show we discuss Josh Brown’s new book, an excellent year for investors, how bullish investors are, a new record high in 401k millionaires, efficient markets, the nostalgia premium, inflation at the arcade, the wait-and-see housing market, the stresses of being a parent, drinking at the movie theater and much more.

On today’s show, we are joined by Priya Misra, Portfolio Manager for the JPMorgan Core Plus Bond ETF to discuss why private credit has gotten so popular, where corporate bond spreads are today, high quality companies within the high yield category, what a soft landing means for interest rates, and much more!

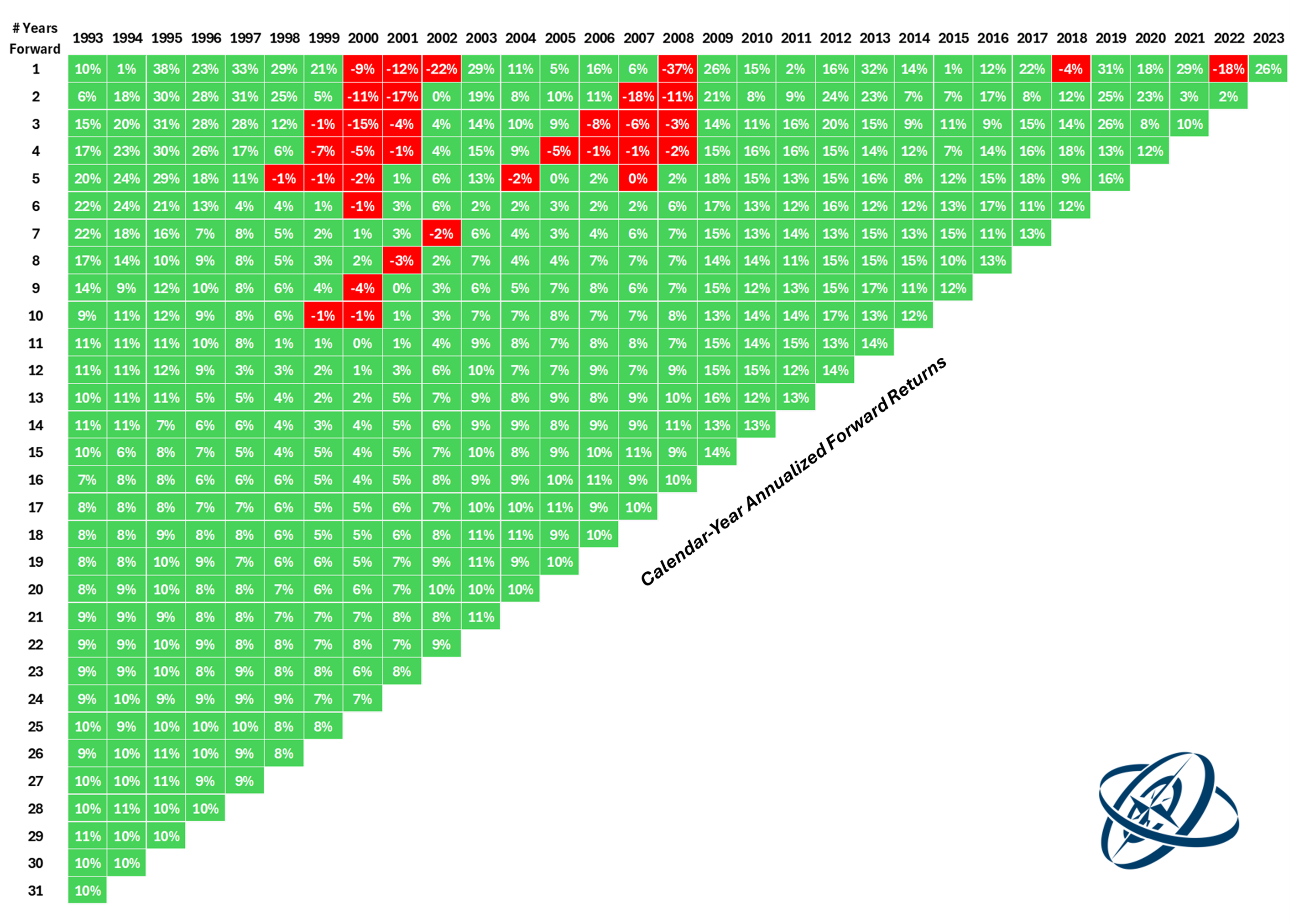

Historical returns for the S&P 500 from 1993-2023.

Maybe more money does buy happiness.

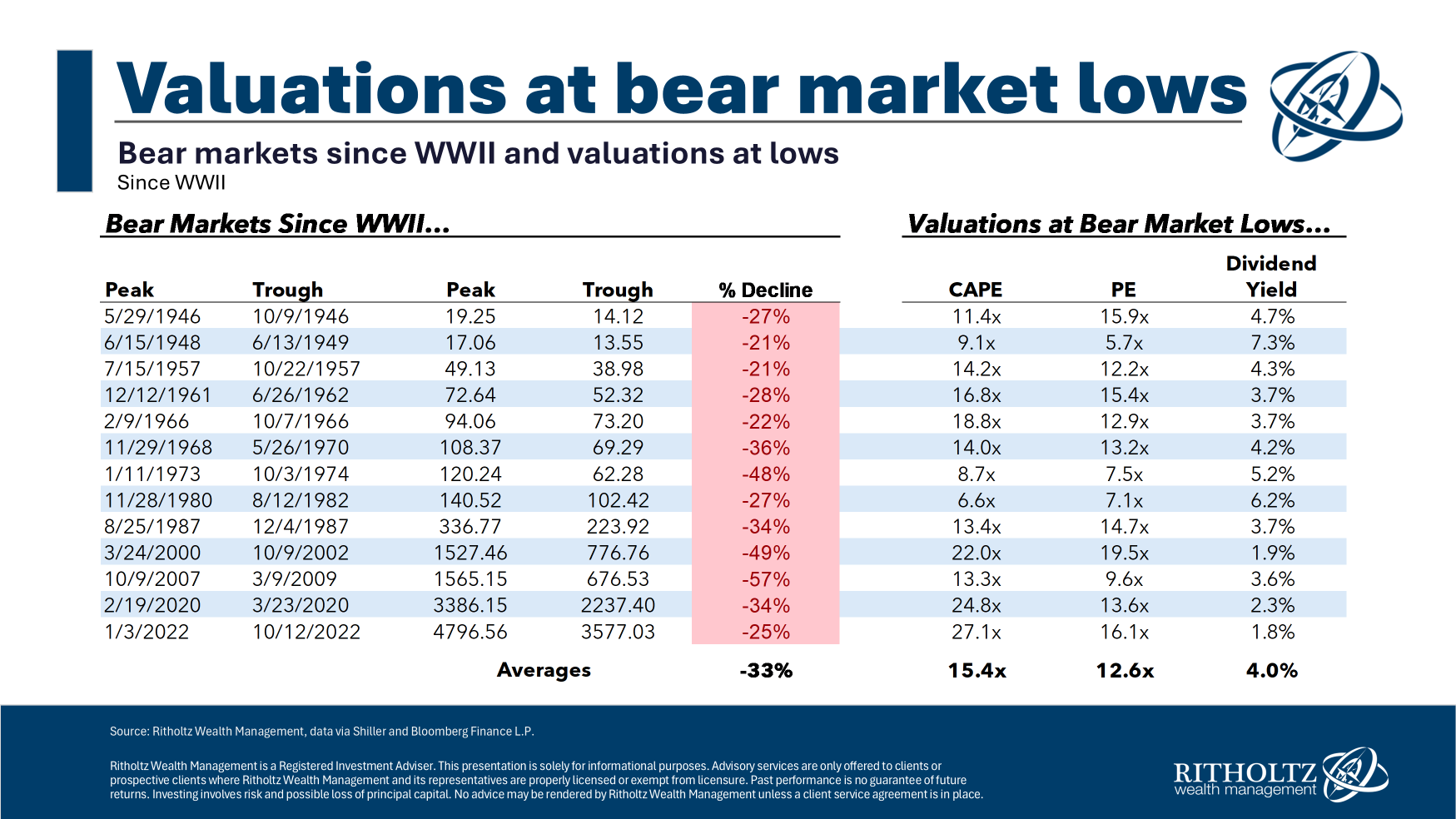

Can you use valuations to time the stock market?

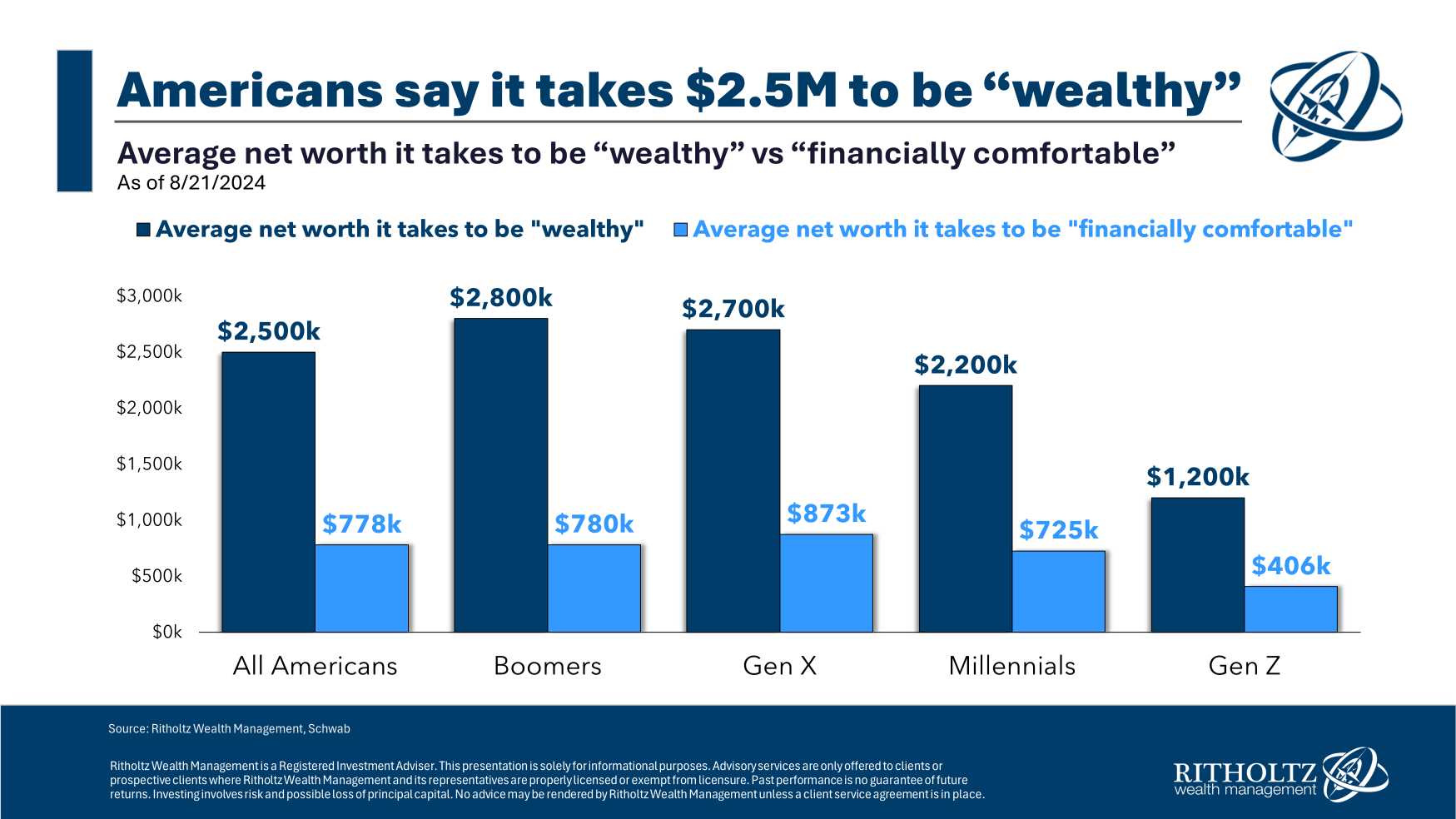

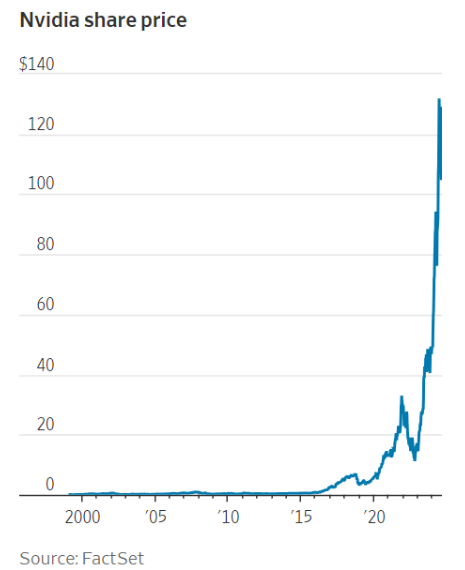

On today’s show we discuss Jerome Powell’s speech at Jackson Hole, Nvidia millionaires, financial voices you can safely ignore, housing affordability, what it takes to be considered wealthy, every generation thinks they have it bad, Michael’s college transcript and much more.

How I filter my sources of financial information.

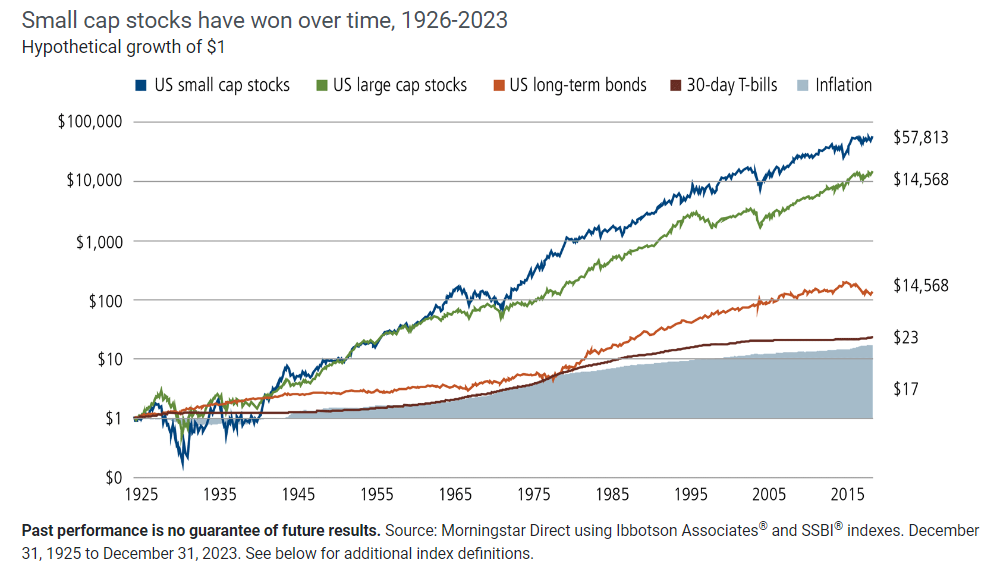

On today’s show, we spoke with Brandon Nelson, Senior Portfolio Manager for Calamos to discuss Calamos’ favorite small cap sectors, why small caps have flown under the radar, understanding the relationship between momentum and fundamentals, profitability of small cap stocks, and much more!

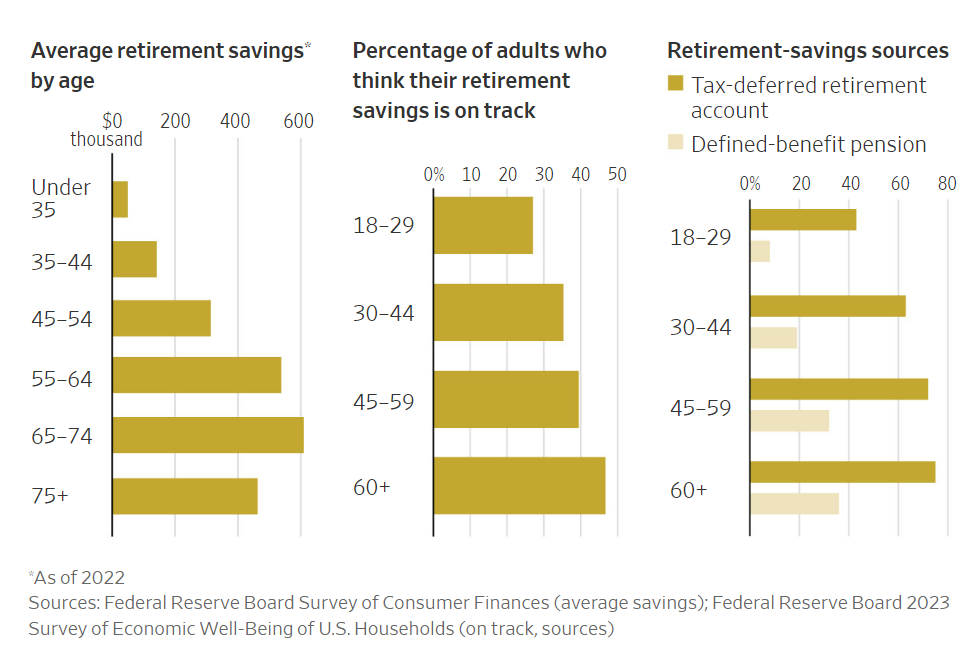

Some legitimate reasons many people don’t save enough for retirement.