The story of Bob, the world’s worst market timer.

The story of Bob, the world’s worst market timer.

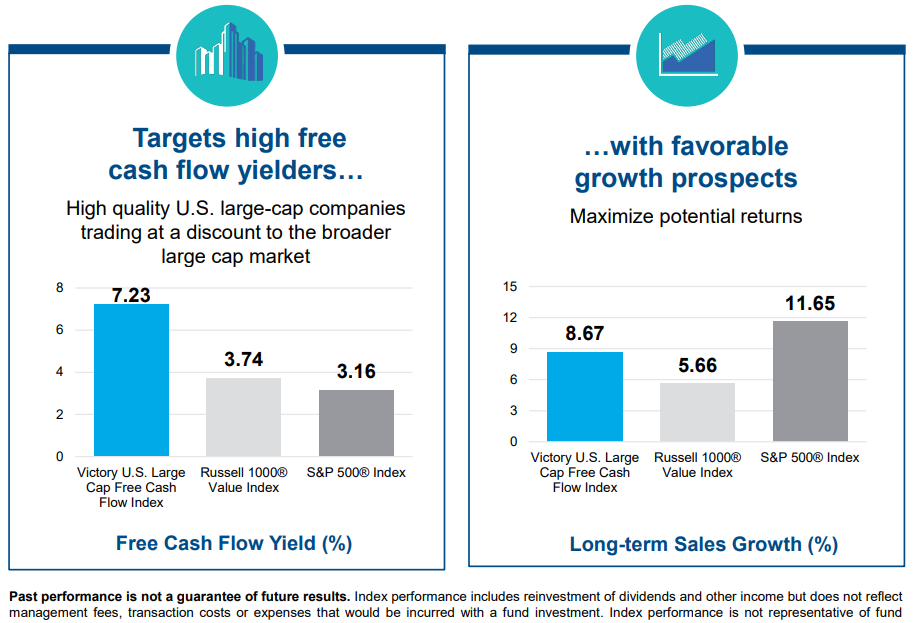

On today’s show, we spoke with Michael Mack, Associate Portfolio Manager for Victory Capital to discuss how to calculate free cash flow, if the Mag 7 would have shown up on a free cash flow screen, avoiding value traps, sector exposure within high free cash flow strategies, and much more!

Some money stuff I’ve been thinking about in middle age.

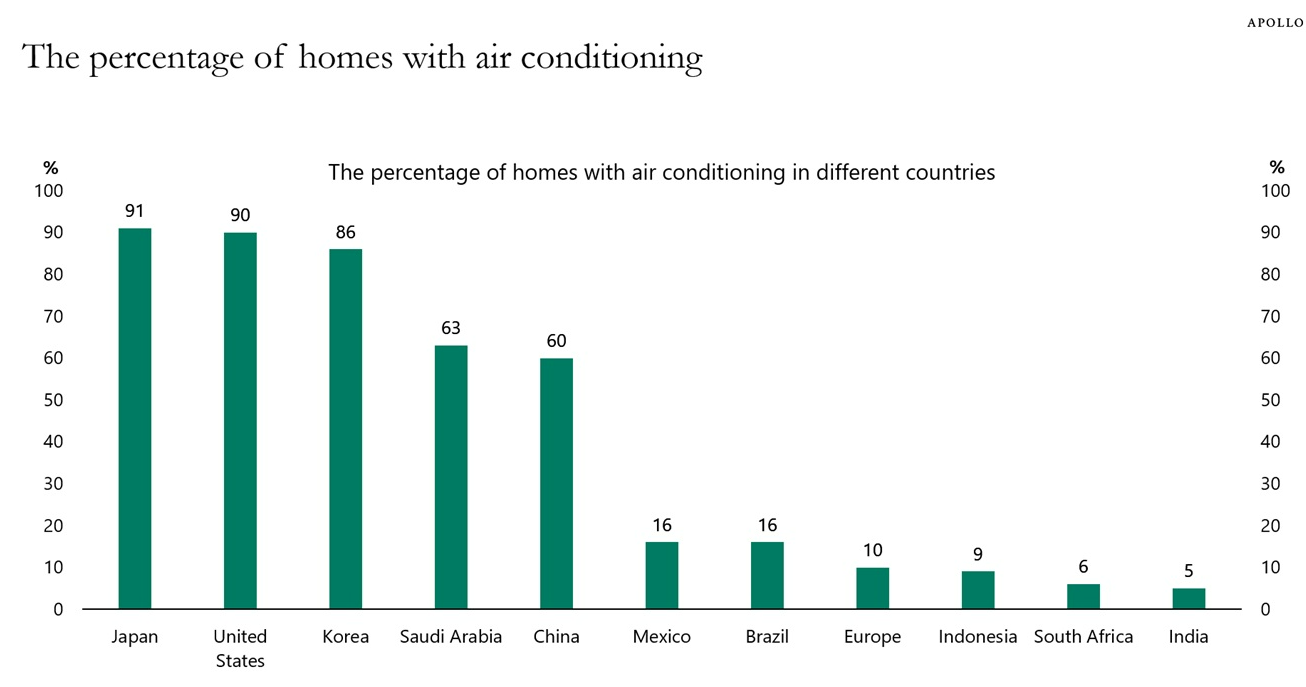

Why air conditioning is one of the most important economic innovations ever.

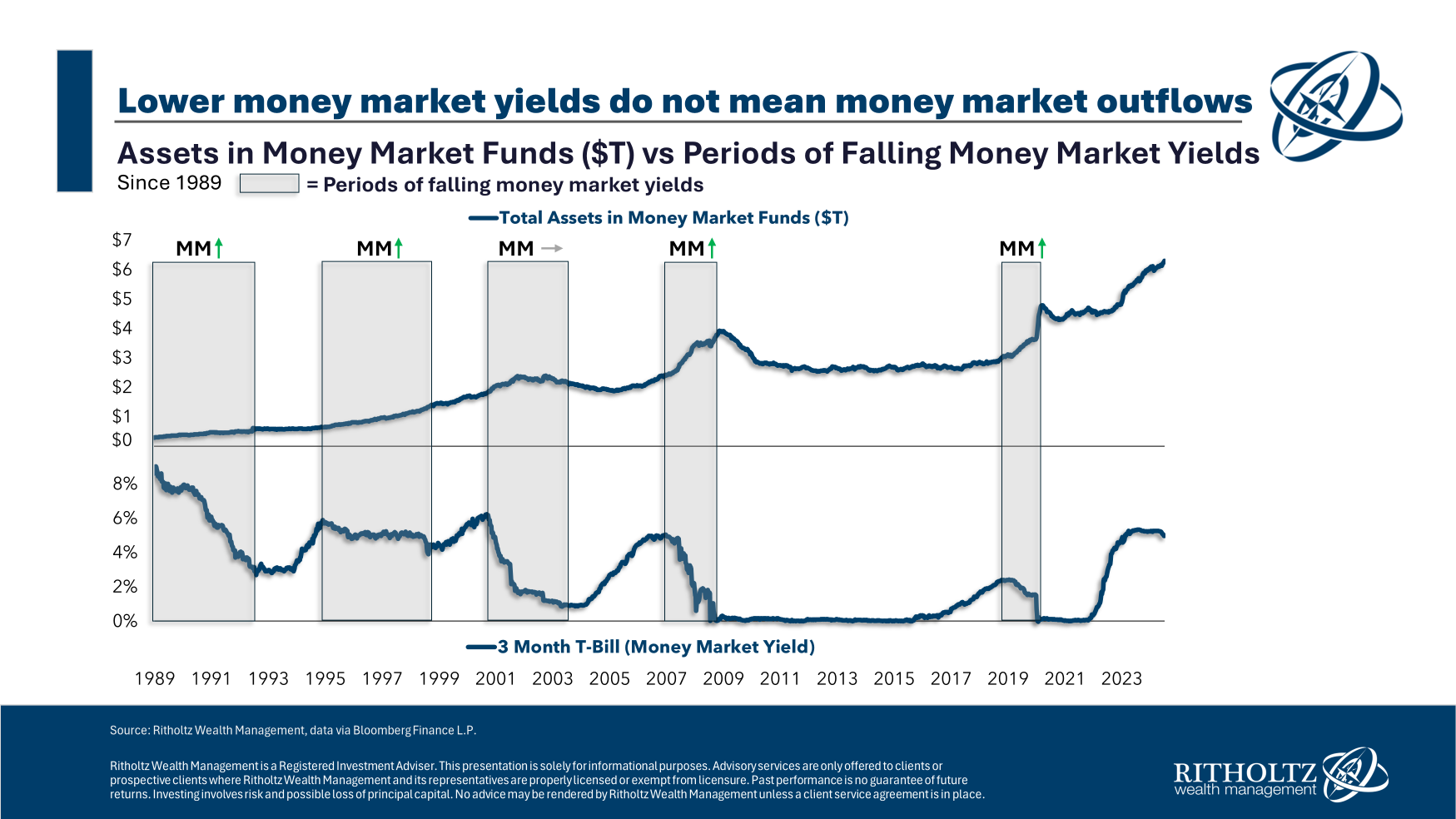

Are money market fund assets going to act as cash on the sidelines for the stock market?

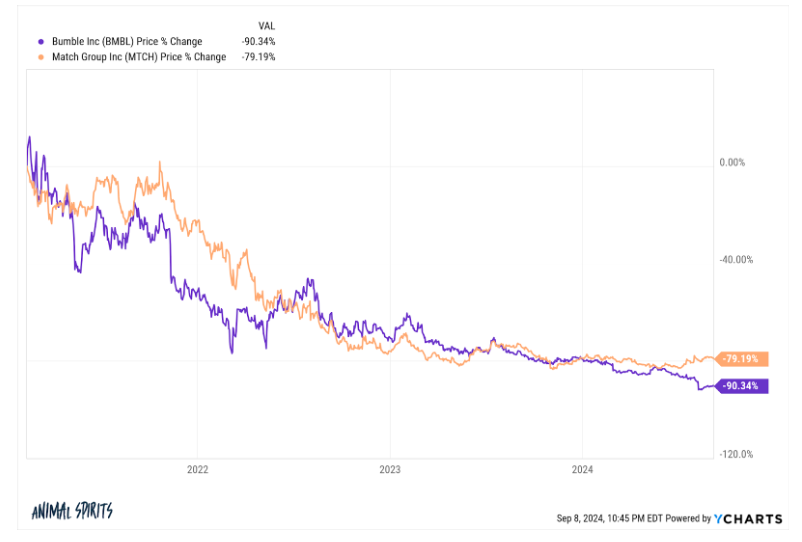

On today’s show we discuss a bad week for the stock market, why foreign stocks are so cheap, the state of America’s wallet, the coming HELOC boom, the finances of Only Fans, how to become a millionaire, next week’s live Animal Spirits from Future Proof and much more.

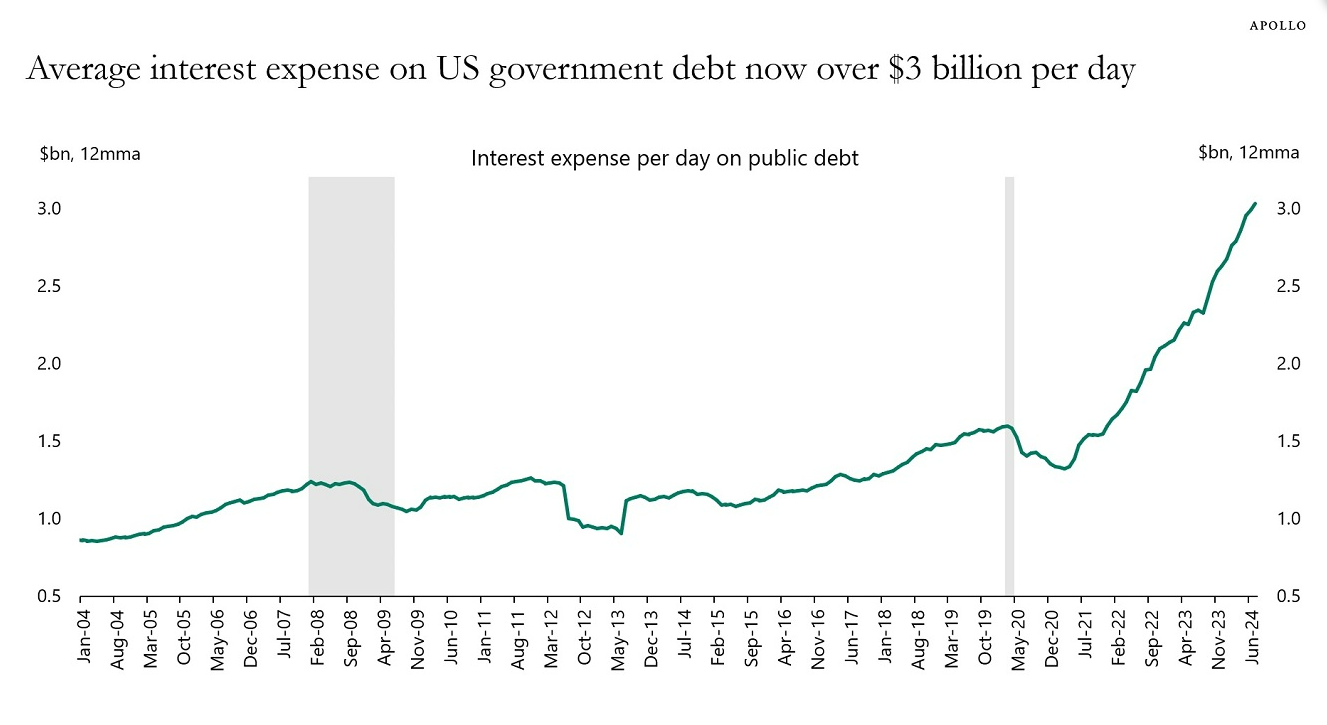

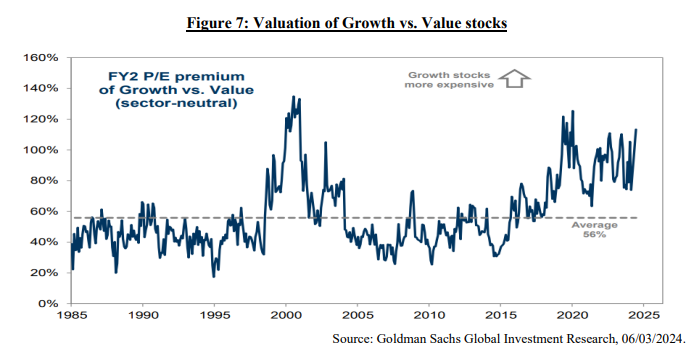

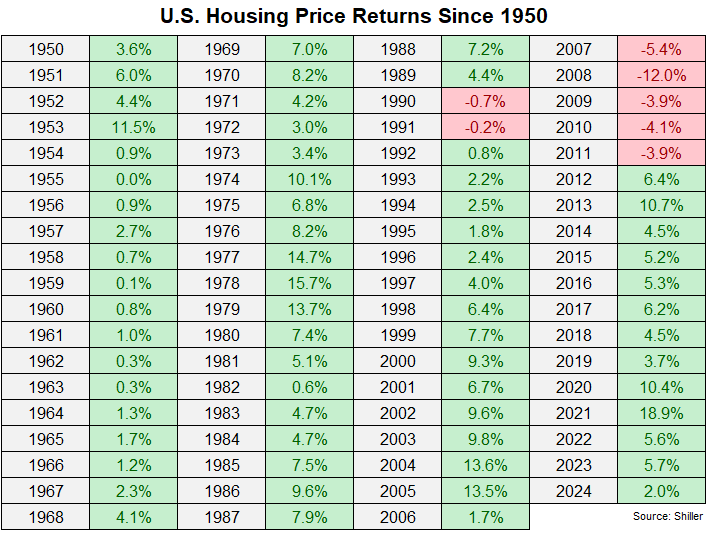

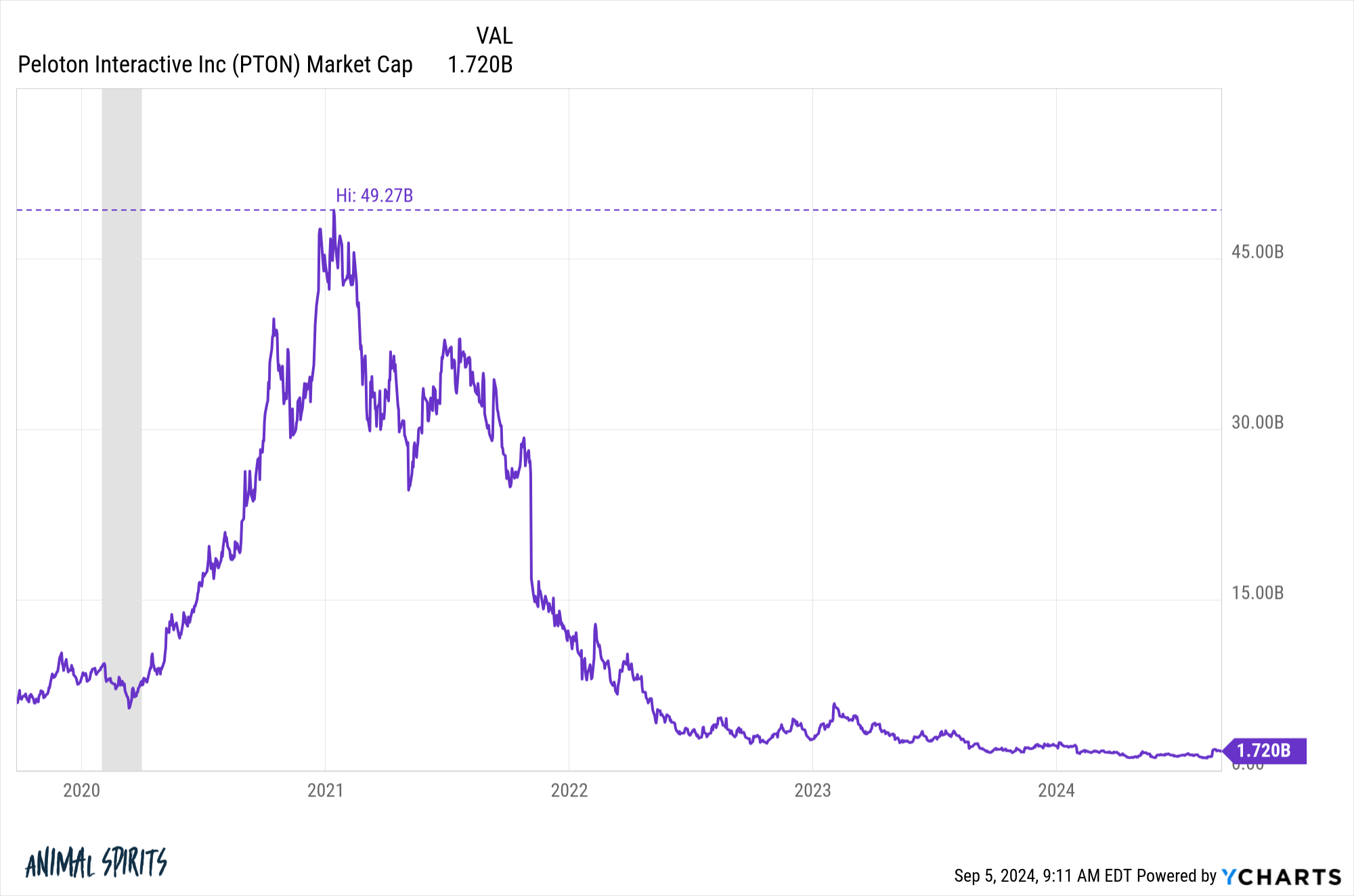

I have questions about U.S. government interest expenses, large cap stock outperformance, the Mag 7 and housing prices to rents.

On today’s show, we spoke with Jennifer Chang, Portfolio Manager and Executive Director for Schafer Cullen to discuss utilizing active management within dividend strategies, how dividend stocks are affected by rising rates, how Schafer’s call writing strategy differs from other popular income strategies, tax optimizing income strategies, and much more!

Why housing is the number one investment for Americans.

Are markets getting more or less efficient over time?