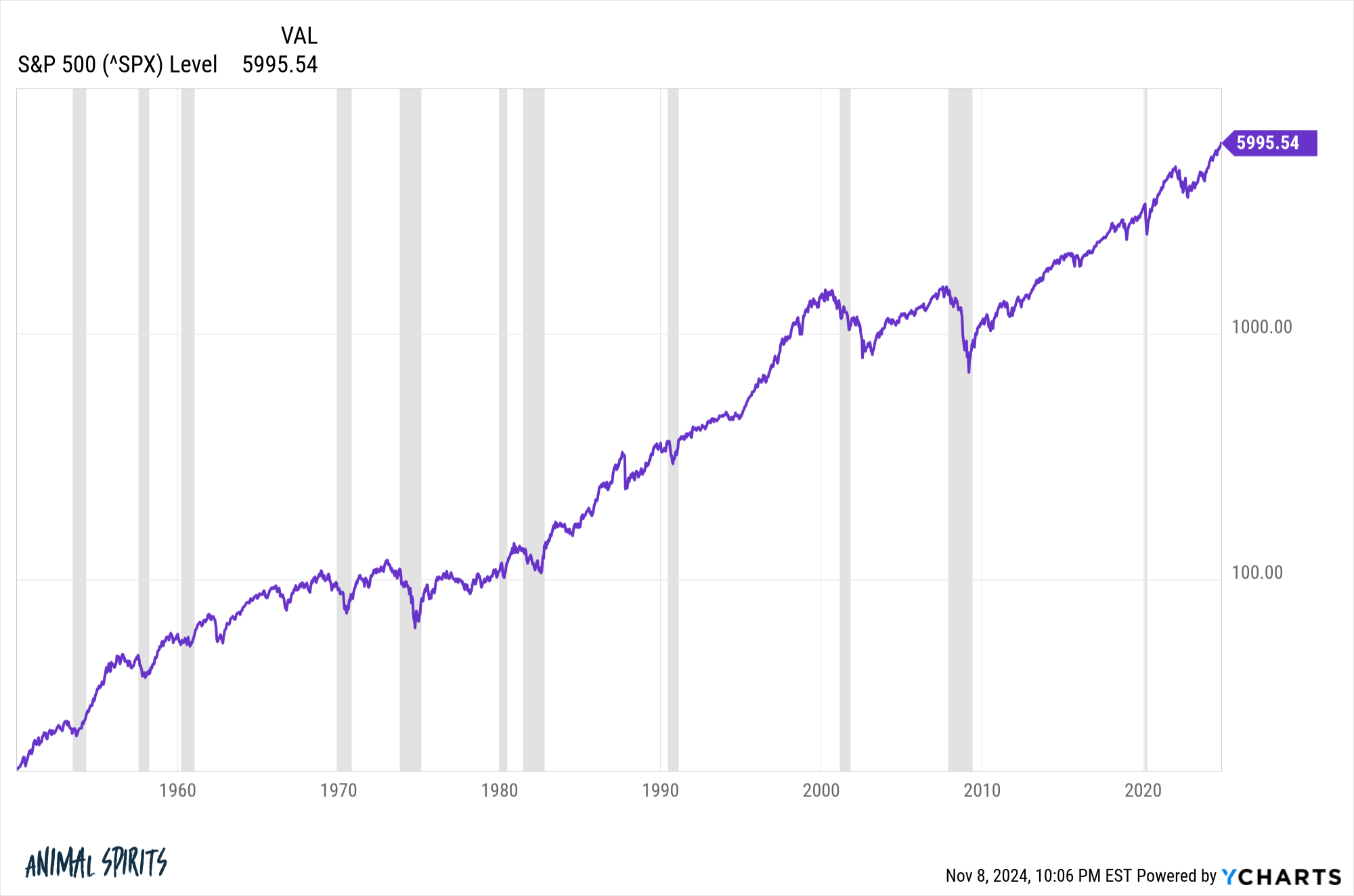

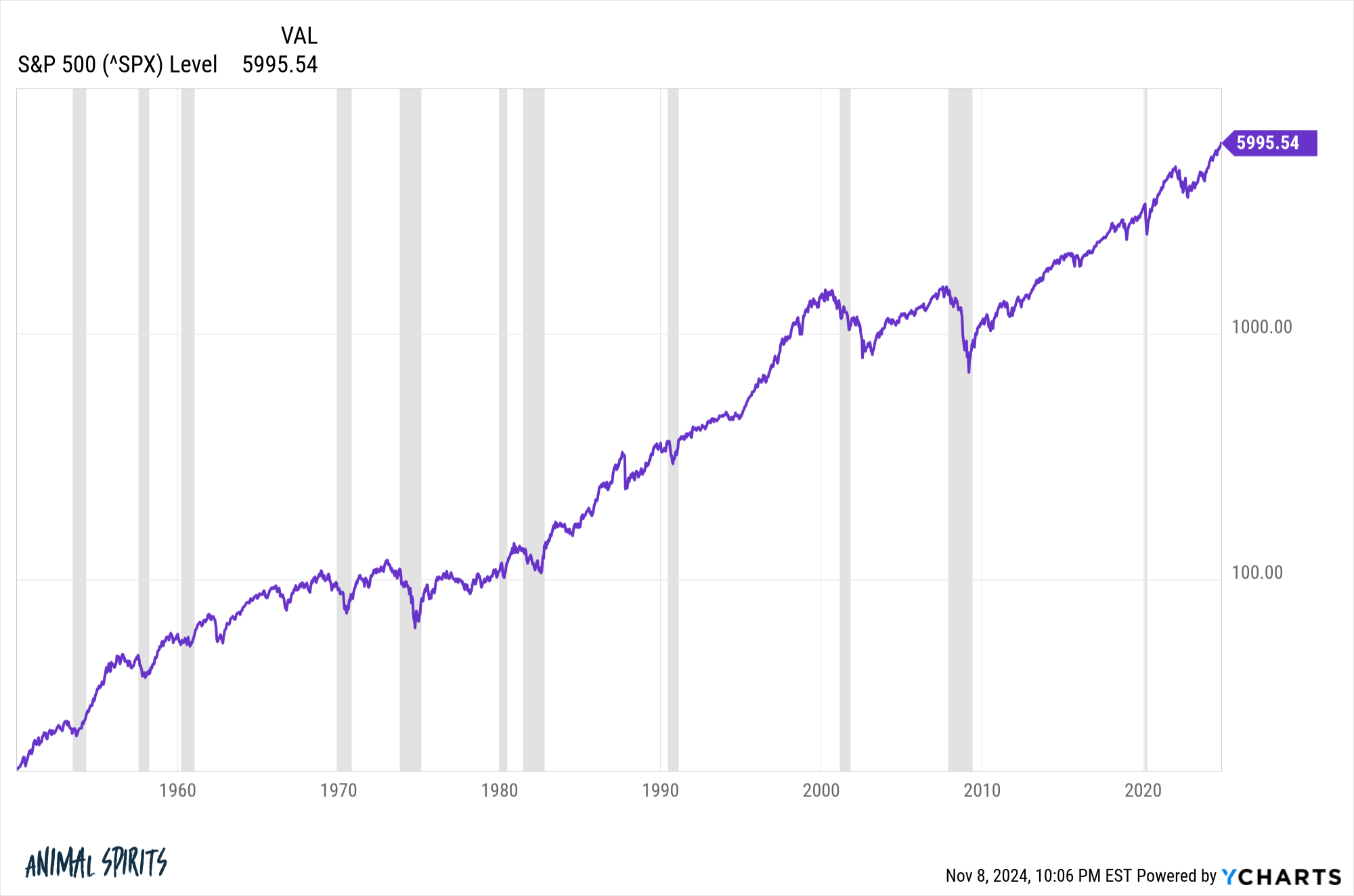

New all-time highs in stocks, gold, housing prices, GDP, household net worth, the Lions and hindsight bias.

New all-time highs in stocks, gold, housing prices, GDP, household net worth, the Lions and hindsight bias.

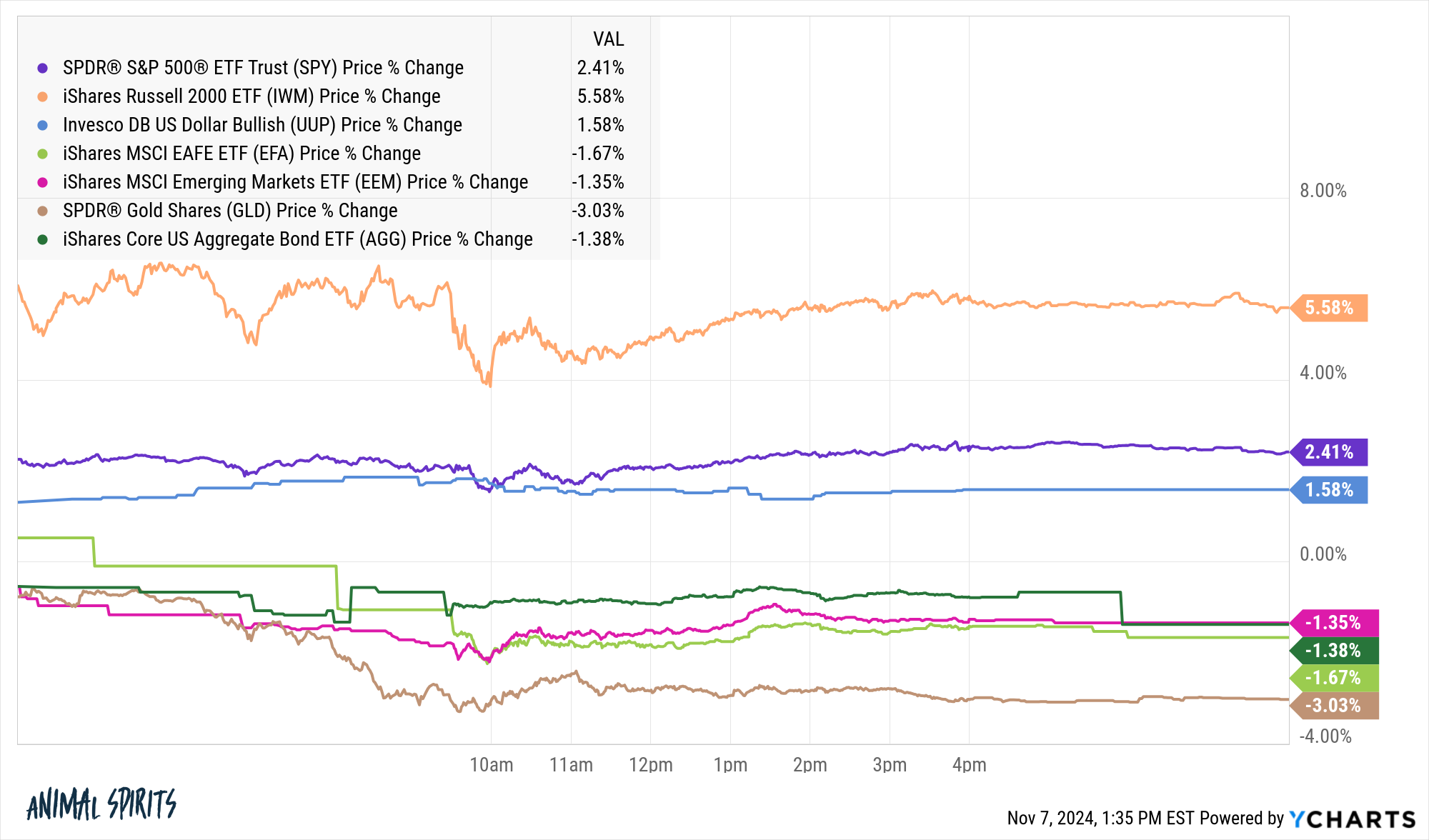

Some thoughts on overreactions after an election.

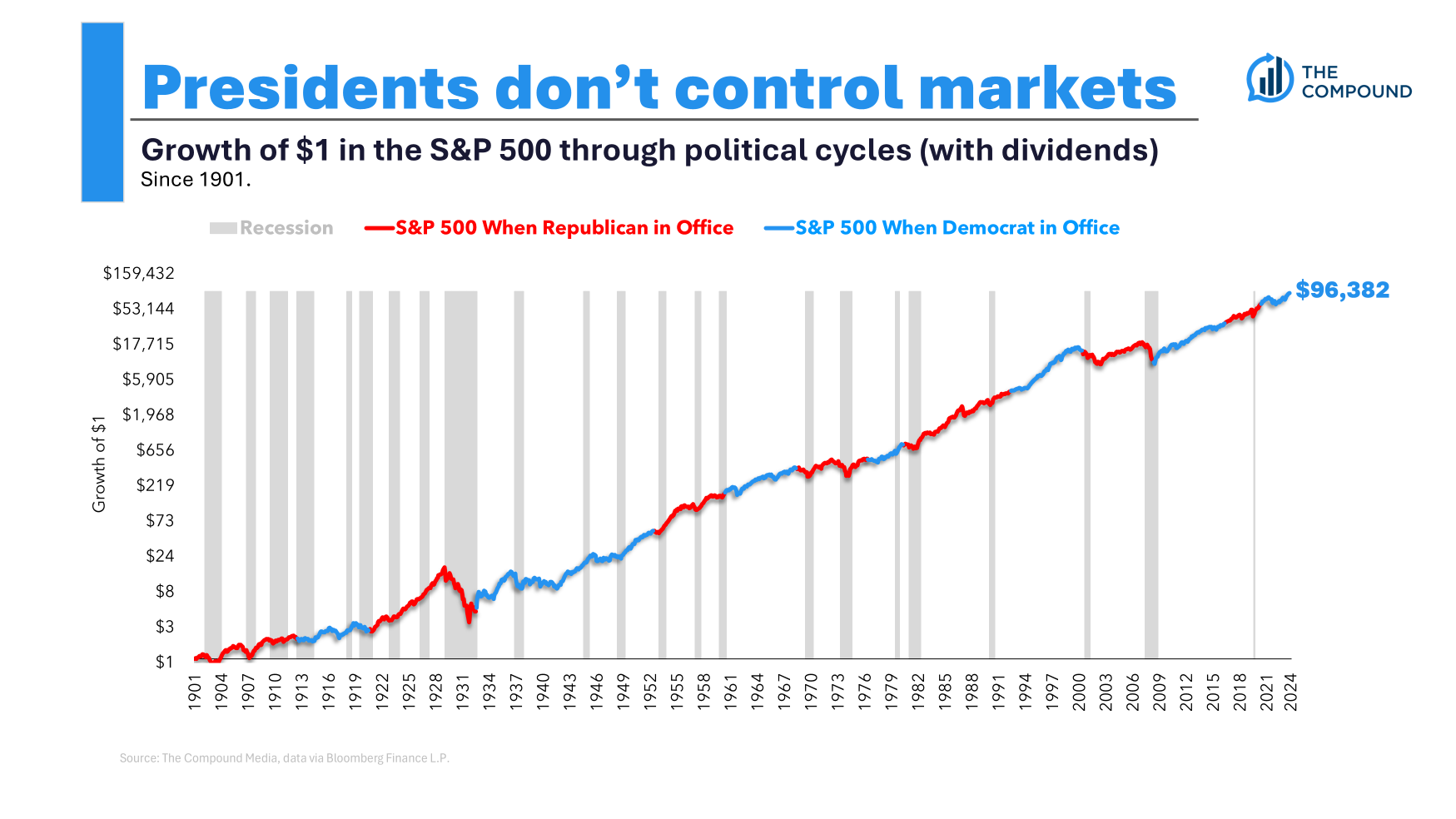

Some thoughts on the relationship between presidents, bear markets and recessions.

On today’s show we discuss Warren Buffett’s massive cash pile, the performance of the average stock this year, the Polymarket whale, markets in everything, Twitter replies now and then, the cost of college is going down, Bitcoin is still king, private equity in target date funds, politics vs. investing and much more.

Some thoughts on politics, Warren Buffett’s cash pile, alpha and more.

On today’s show, we are joined by Nate Conrad, Head of LifeX at Stone Ridge Asset Management to discuss how longevity income ETFs work, what LifeX is actually investing in, why matching spending with investment products is important, understanding the inflation adjustment for inflation protected income funds, declining LifeX fees over time, and much more!

A look back at the biggest winners in 1999 vs. the biggest winners today.

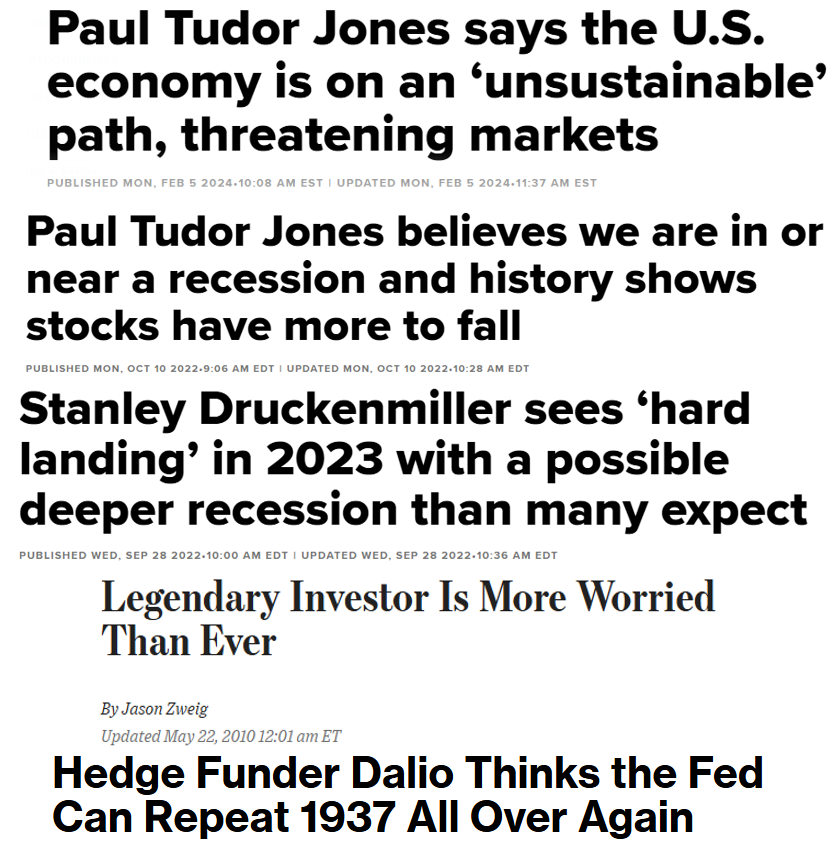

Some thoughts on a dire warning from Paul Tudor Jones.

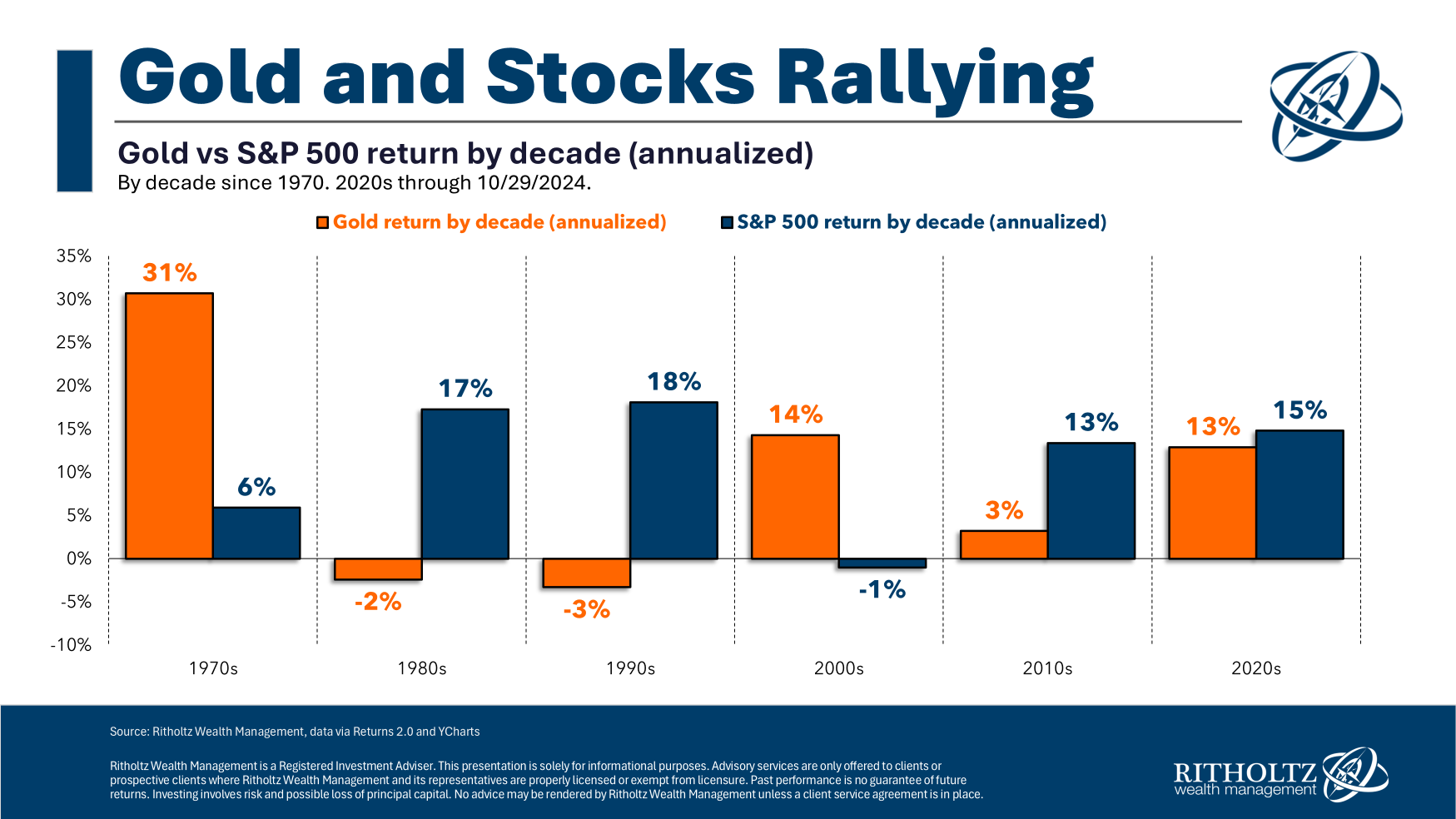

Some thoughts on the relationship between gold, stocks and inflation.

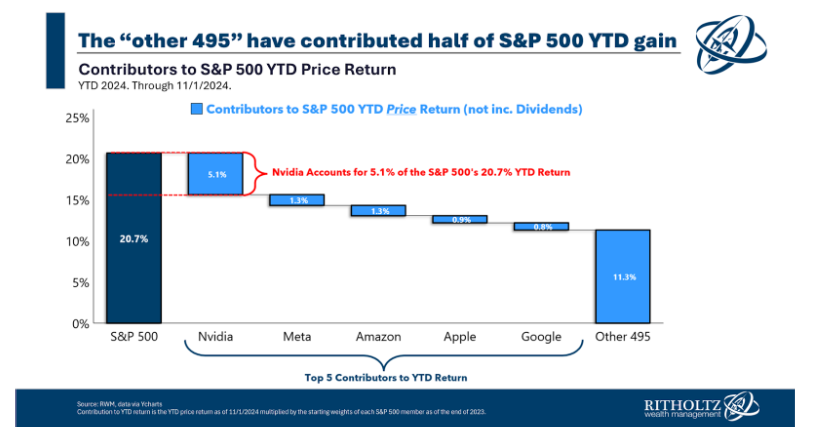

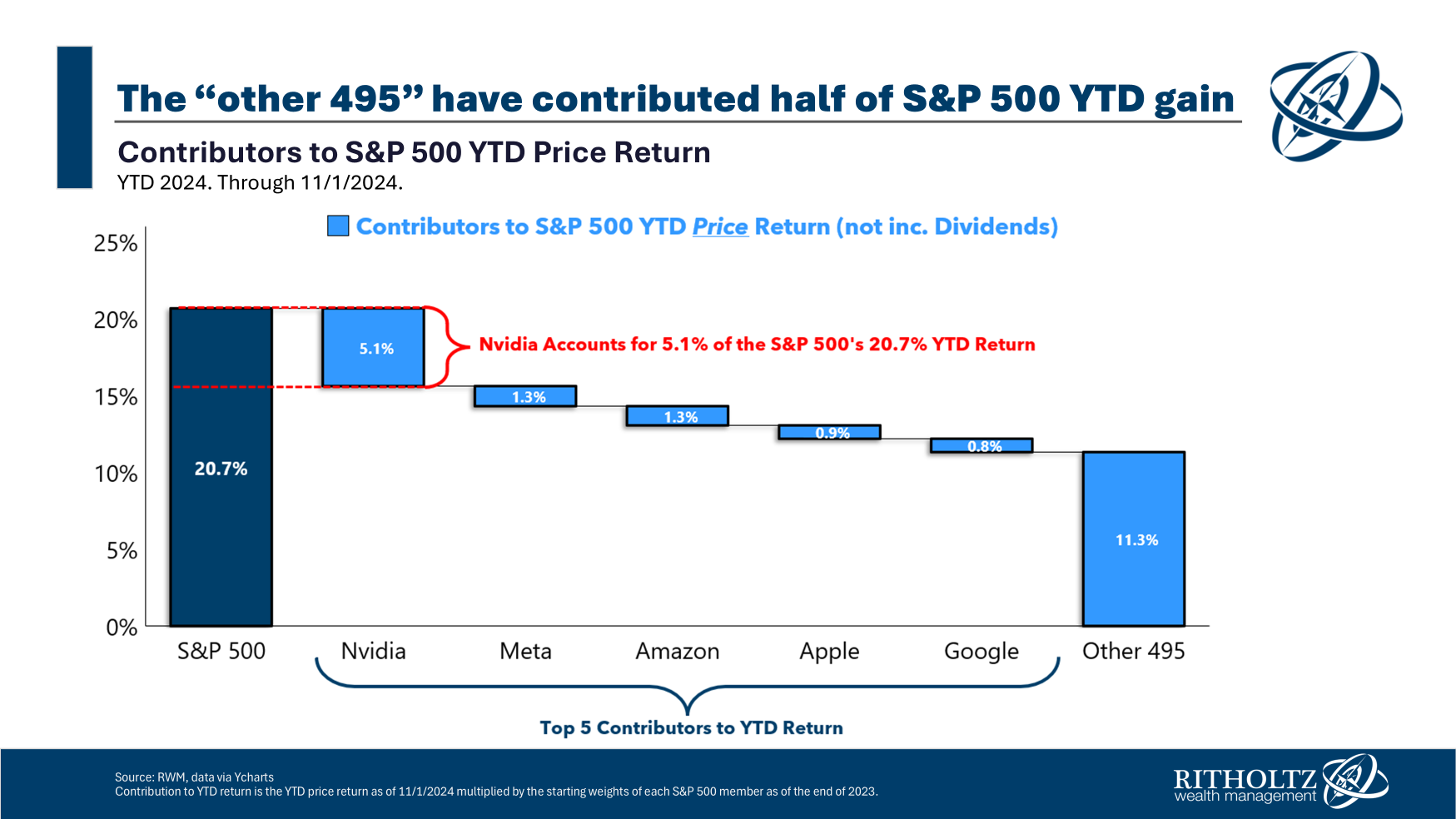

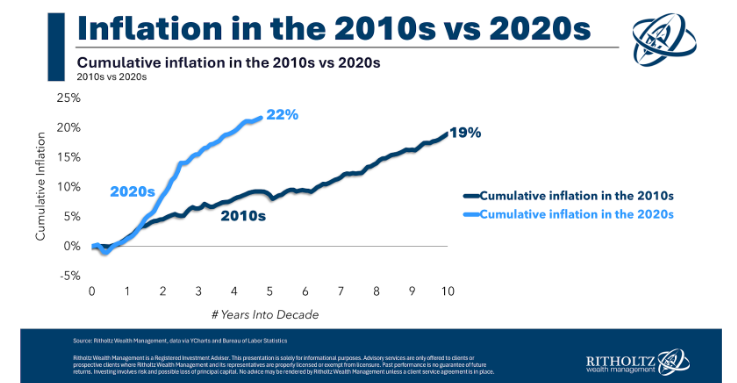

On today’s show we discuss changing narratives in the markets, why interest rates are rising, why you should never take macro advice from hedge fund managers, why the S&P 500 is so hard to beat, living paycheck-to-paycheck on $150k, why the 2020s inflation was so painful, 7% mortgage rates, the downside of Waymo and much more.