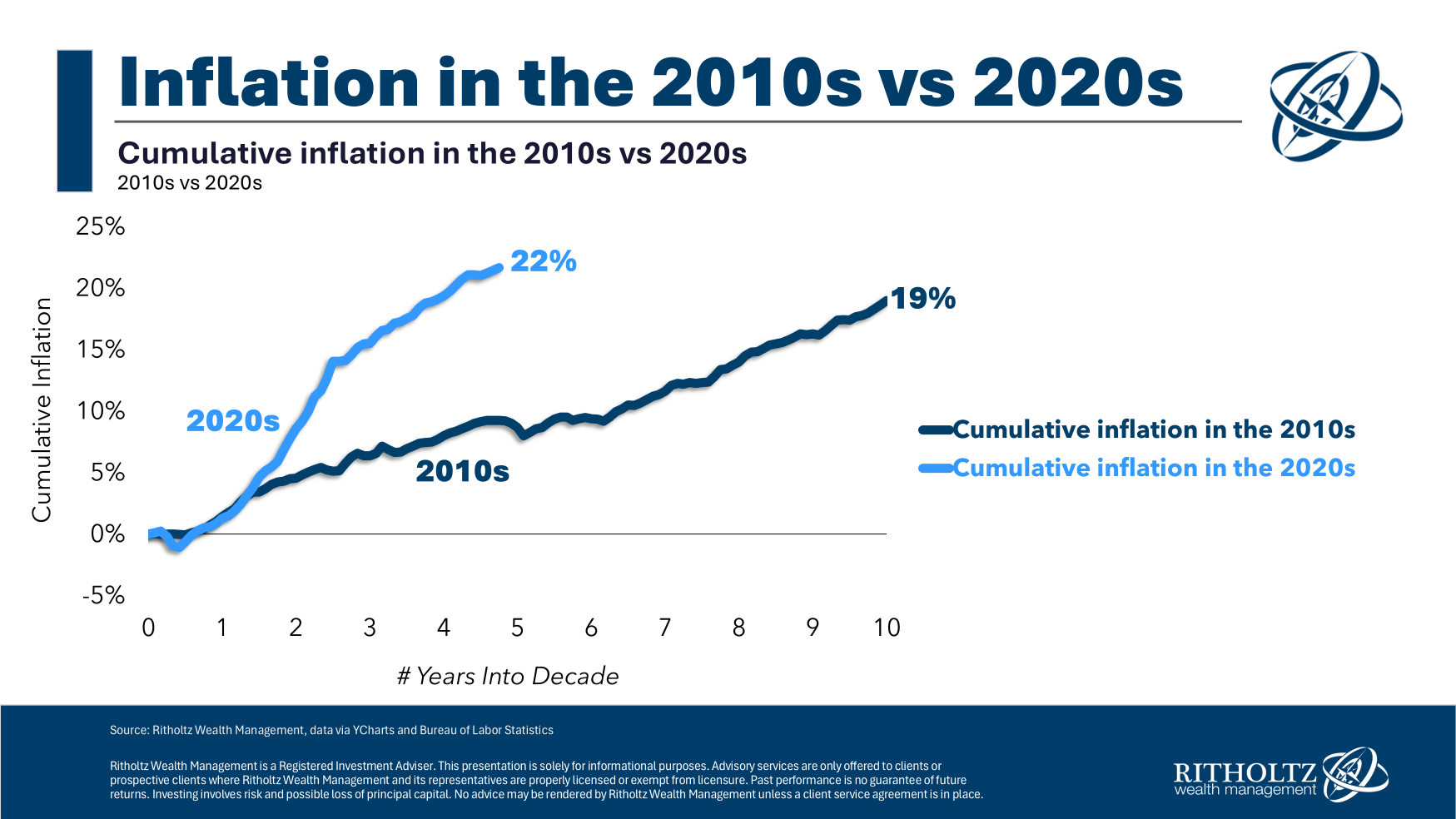

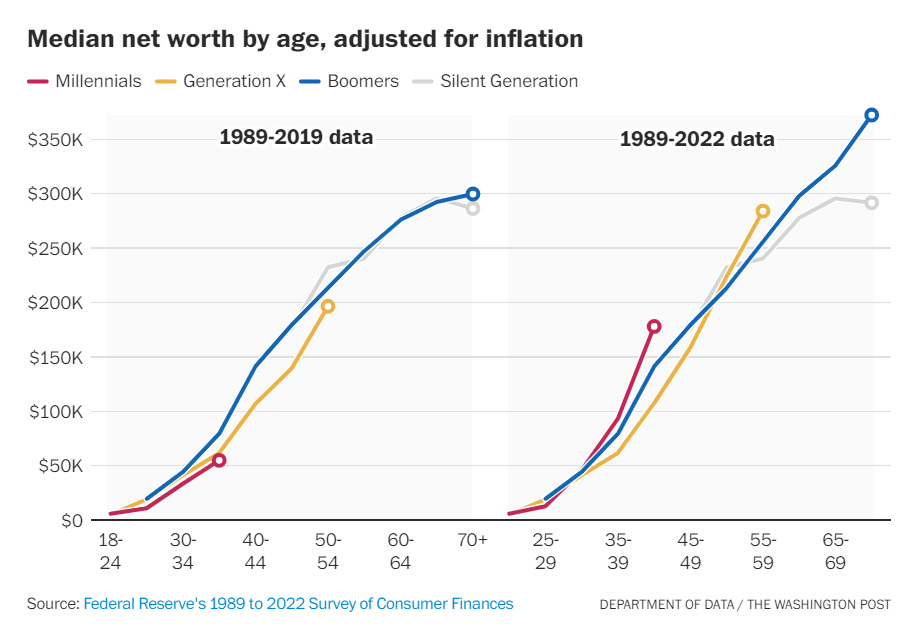

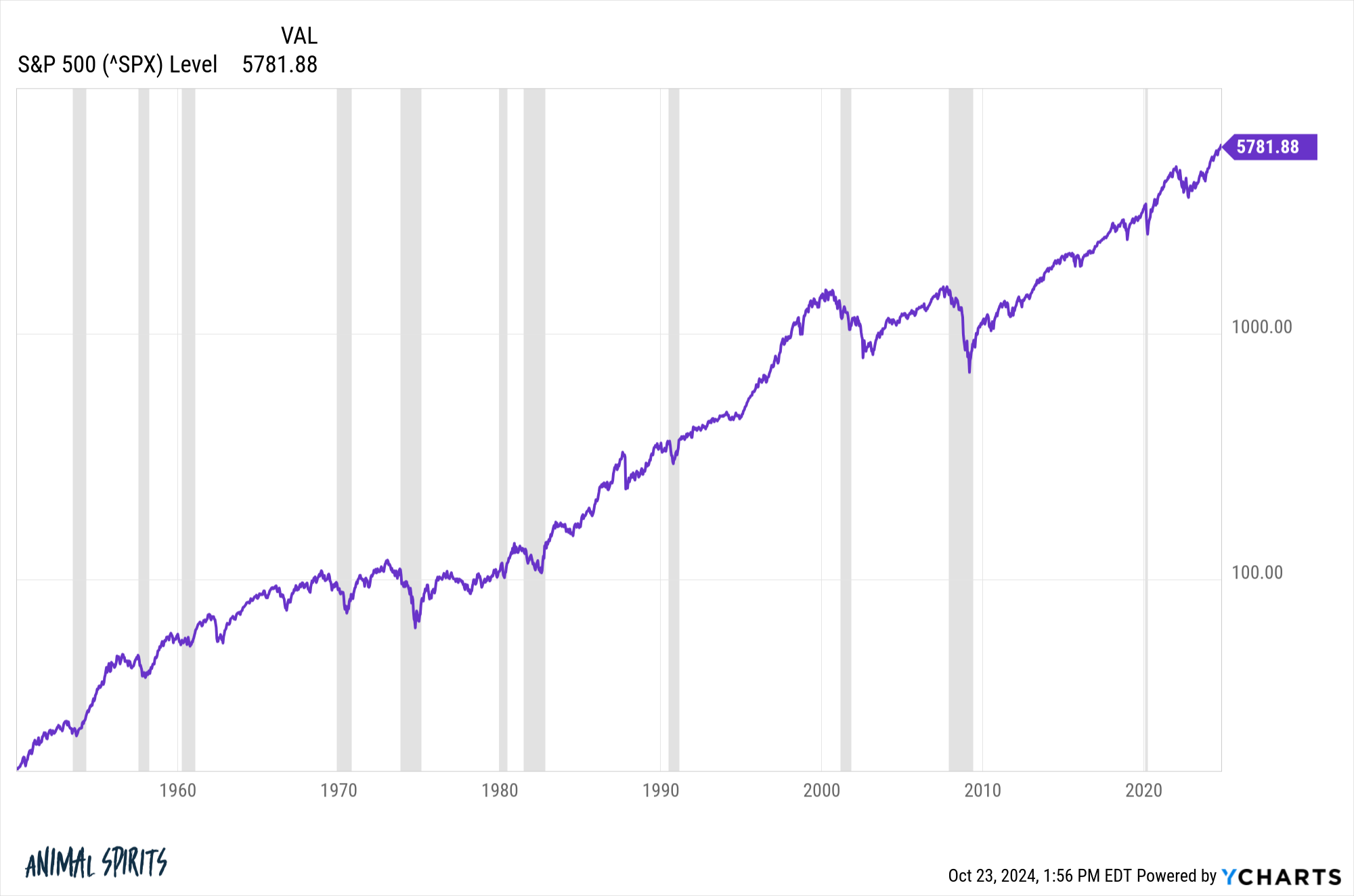

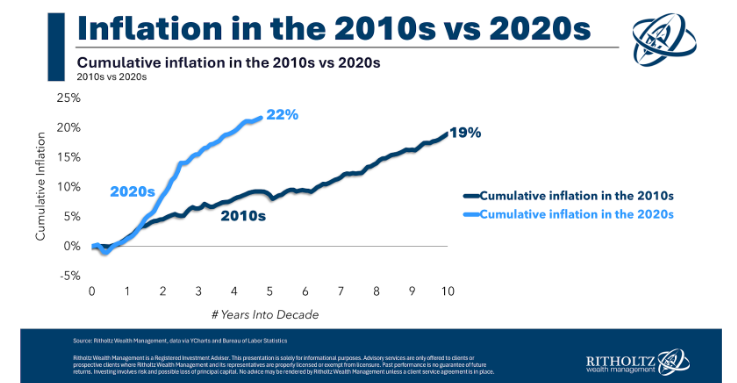

On today’s show we discuss changing narratives in the markets, why interest rates are rising, why you should never take macro advice from hedge fund managers, why the S&P 500 is so hard to beat, living paycheck-to-paycheck on $150k, why the 2020s inflation was so painful, 7% mortgage rates, the downside of Waymo and much more.