“The market might be crazy, but that doesn’t make you a psychologist.” -Meir Statman

“The market might be crazy, but that doesn’t make you a psychologist.” -Meir Statman

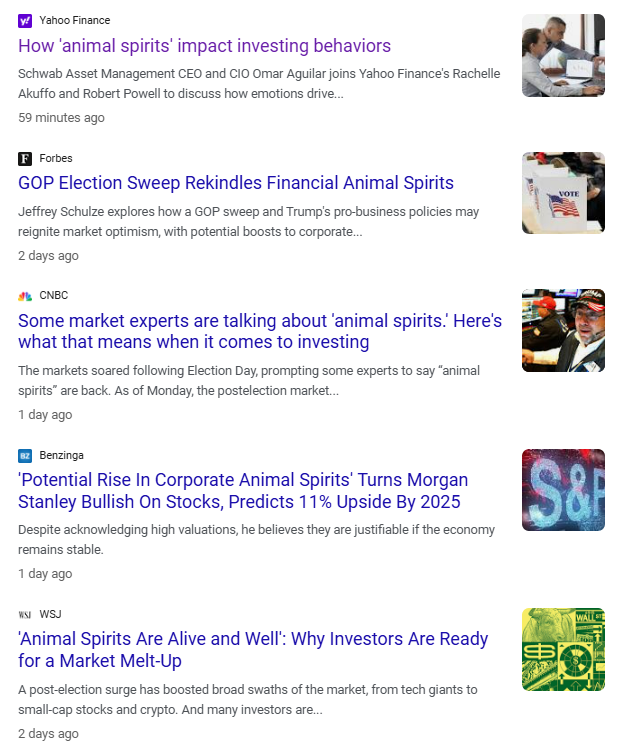

Timing the housing market is a bad idea.

On today’s show we discuss 7 years of Animal Spirits, the miracle of US equities, the wall of worry has fallen, S&P 10,000, massive ETF flows, vibes rule everything around me, are crypto winters a thing of the past, where the low housing price are, becoming a grandparent and much more.

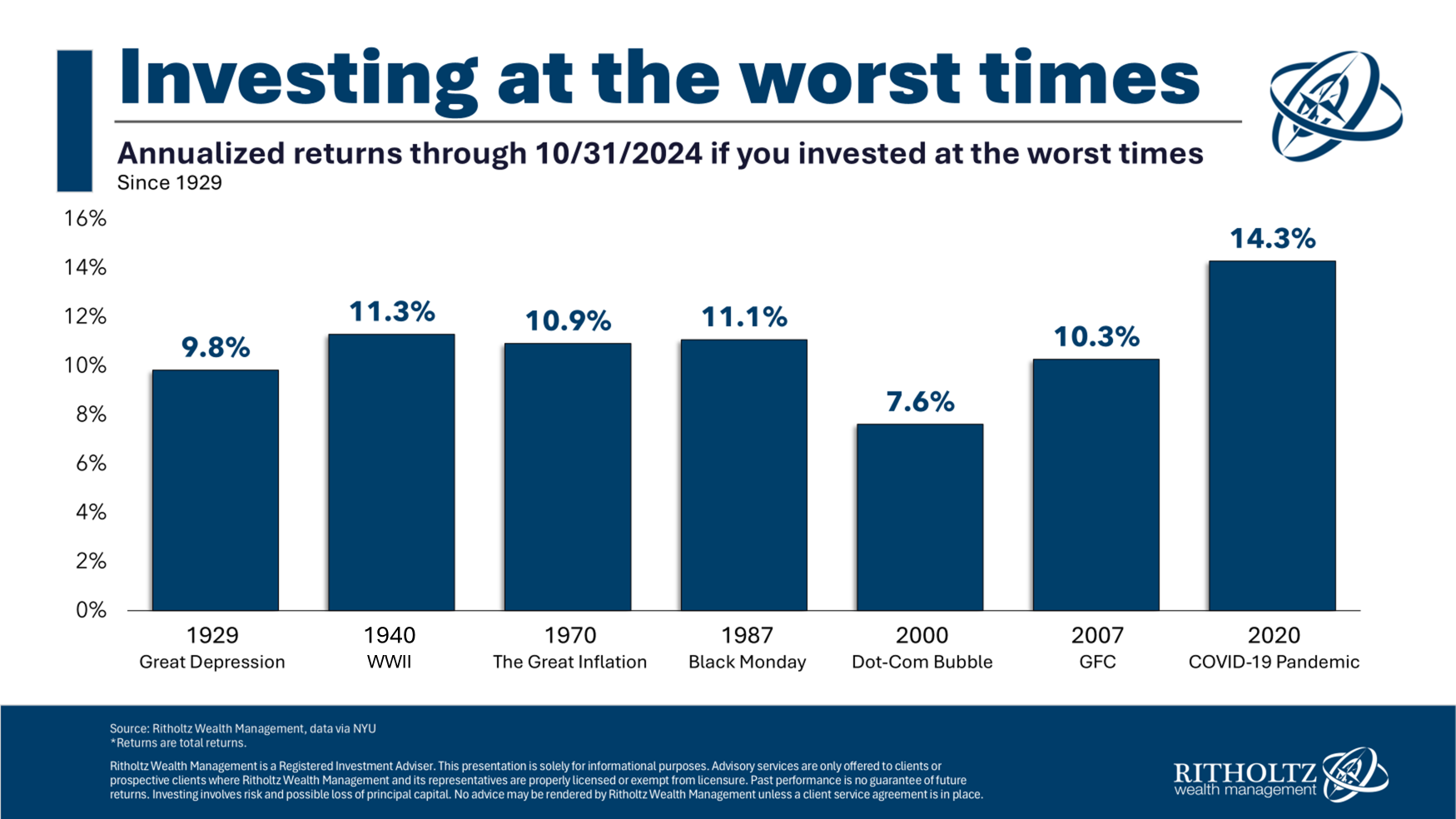

What if you invested in stocks in the worst possible years?

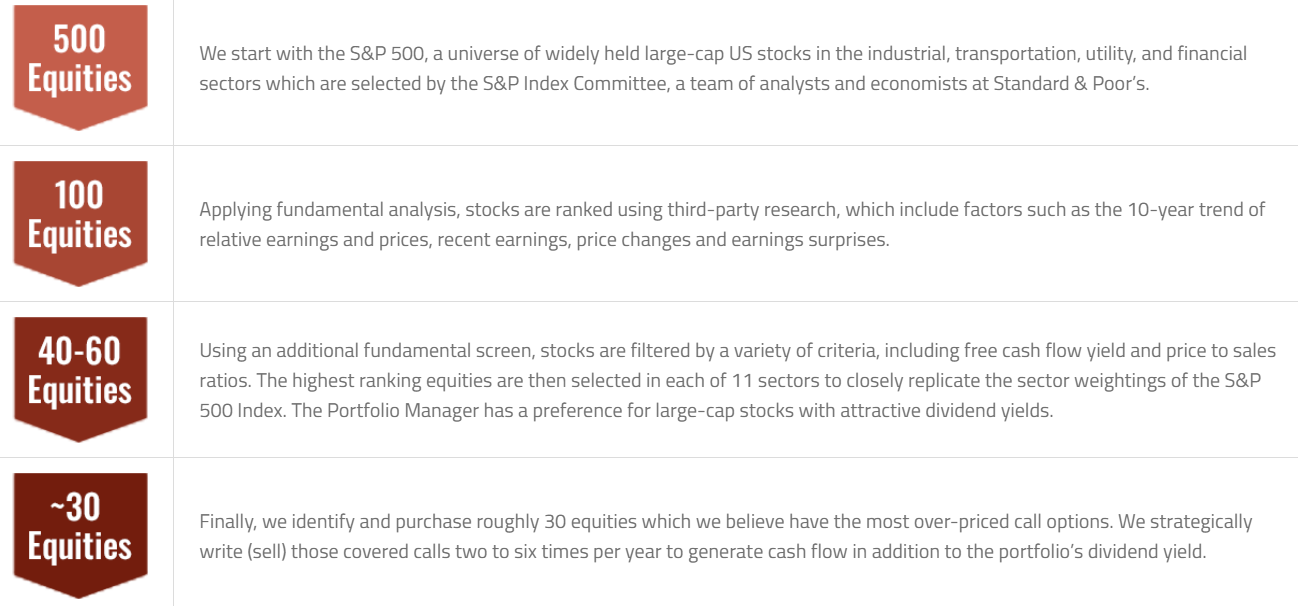

On today’s show, we are joined by Barry Martin, Portfolio Manager of Shelton Equity Income Fund to discuss what it means to have shares called away, what makes a good stock to write a call option on, understanding the relationship between volatility and option premiums, how rates affect call option strategies, and much more!

Some thoughts on asset allocation, when to buy/sell and how to make better investment decisions.

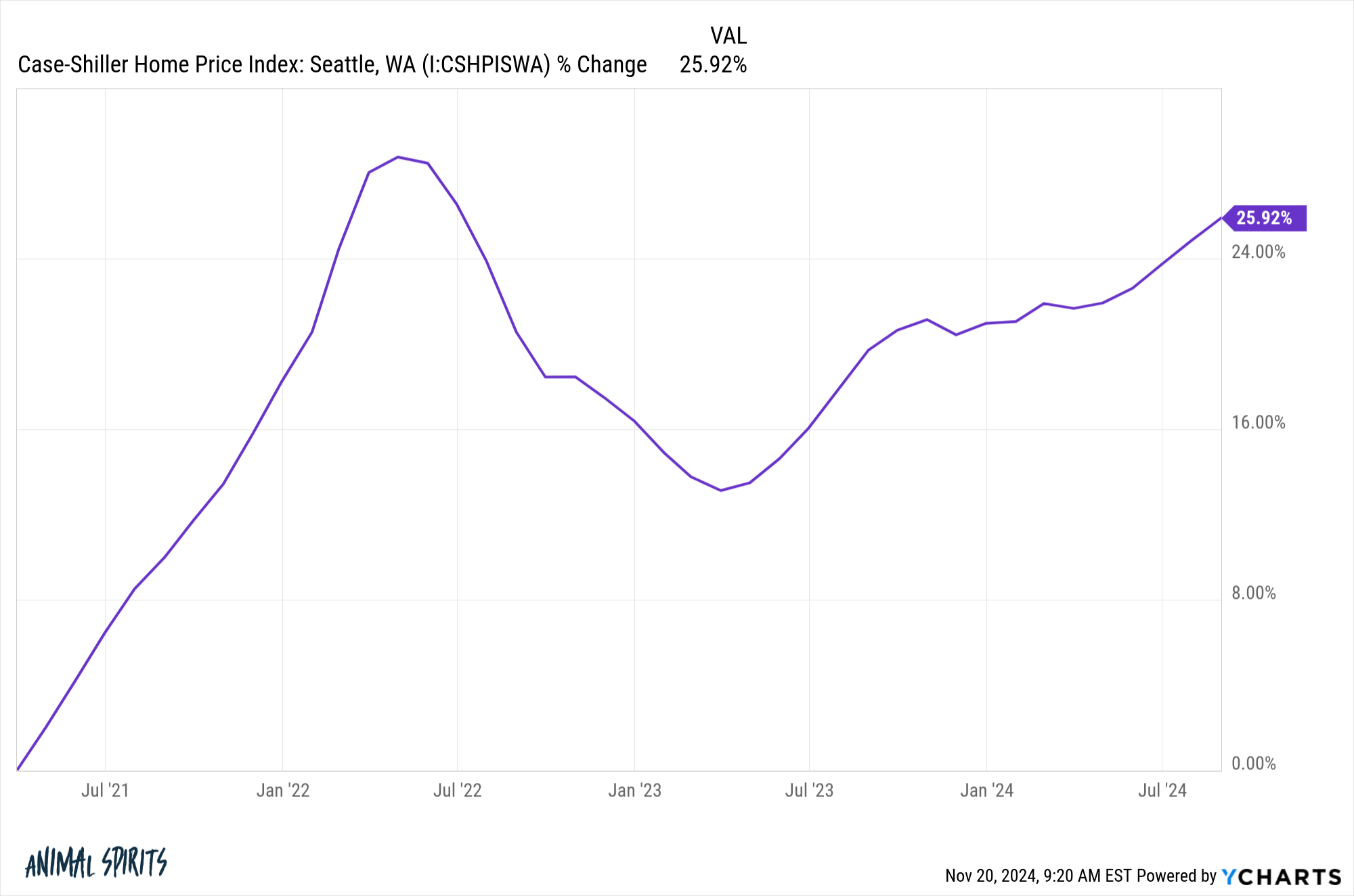

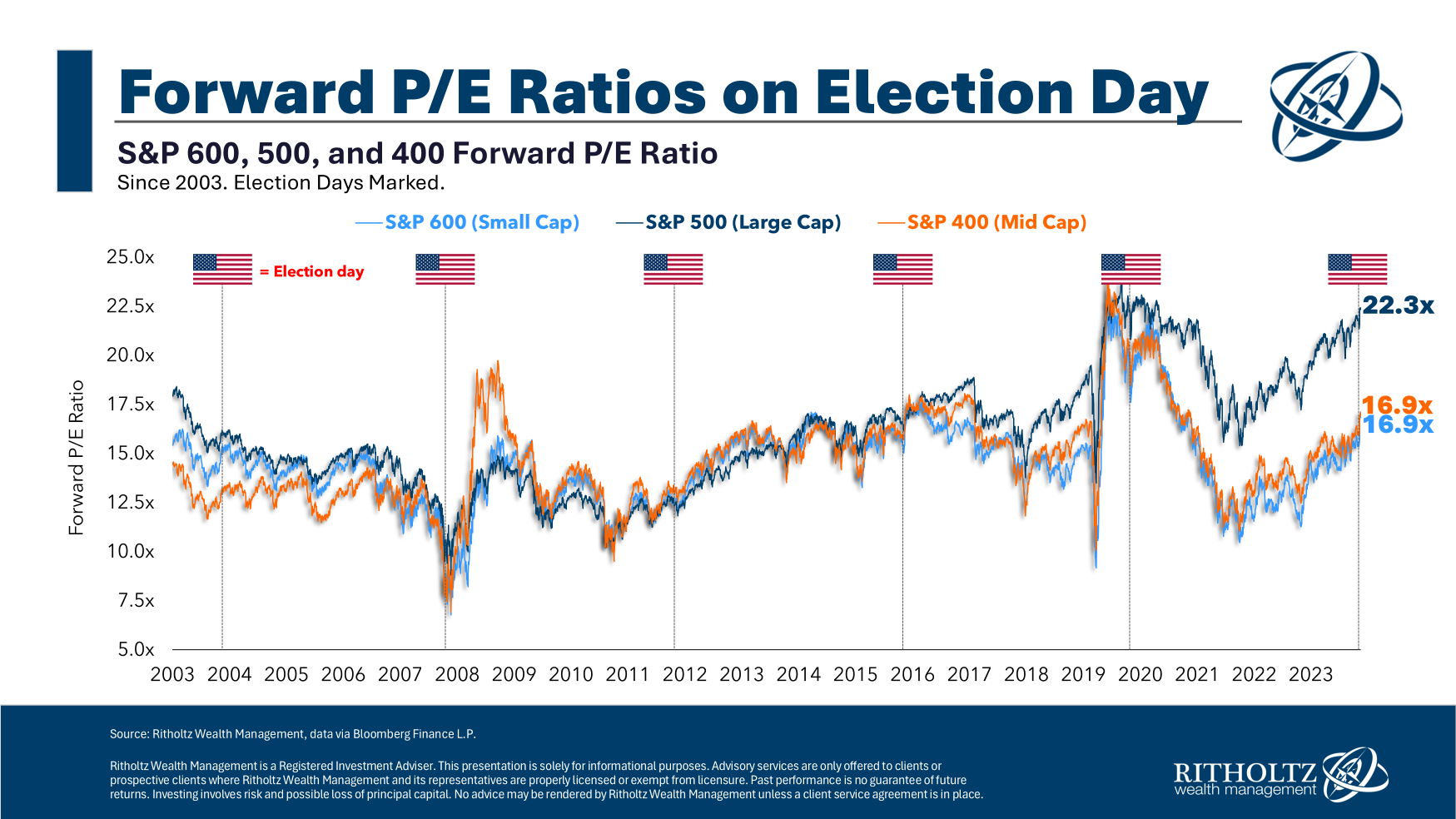

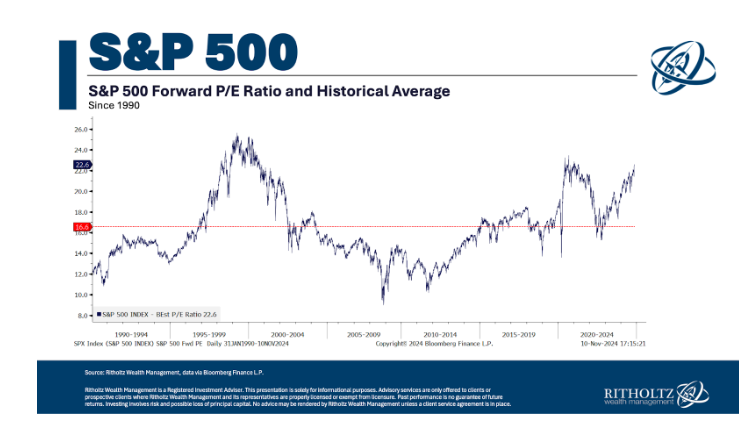

A valuation update on U.S. stocks.

Some thoughts on government debt levels.

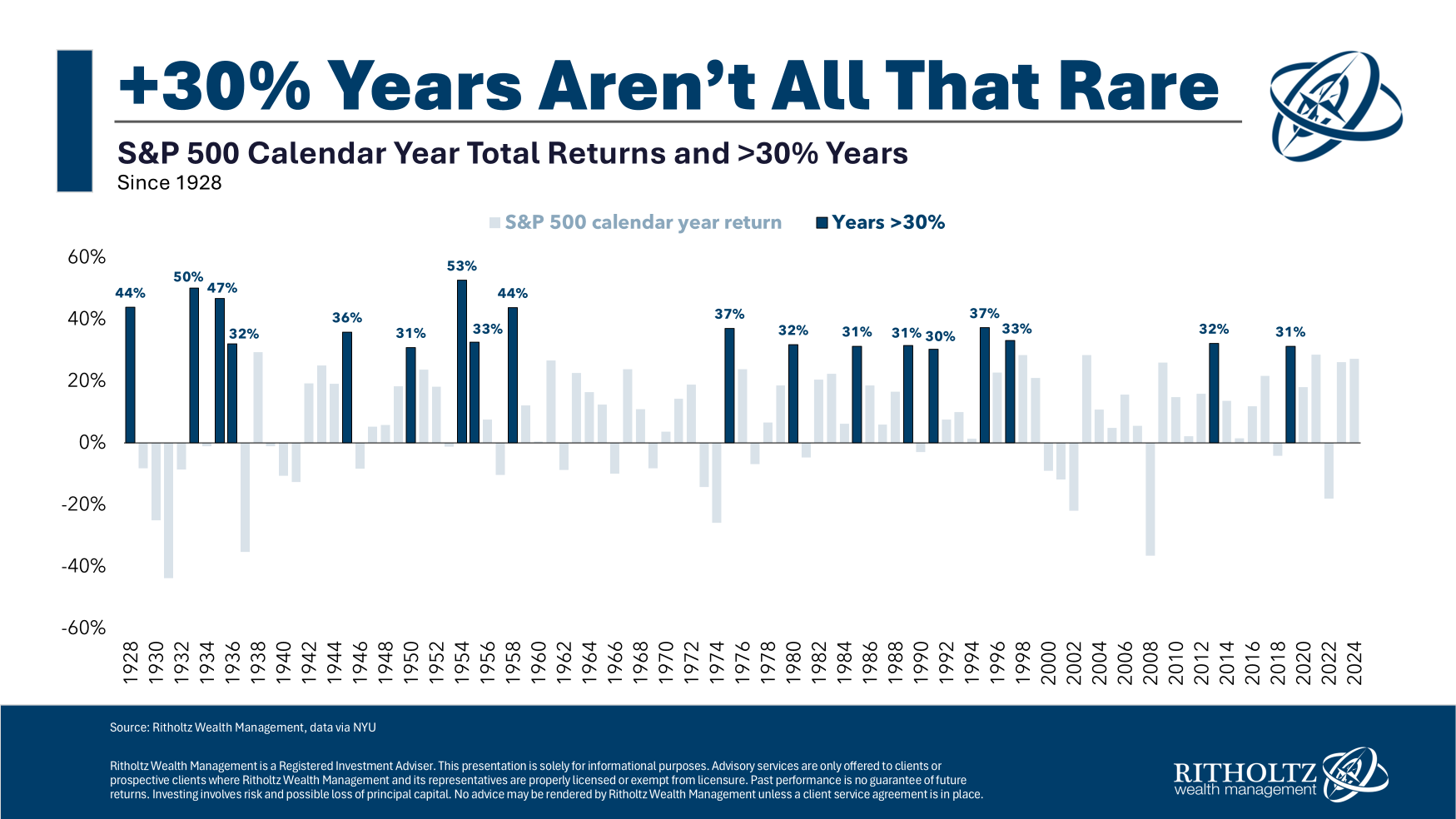

On today’s show we discuss why Trump won, how the Dems fumbled the economic messaging, how this will impact recession spending moving forward, 30% gains in the stock market, credit spreads, the reflation trade, how many people understand tariffs, how Bitcoin won, tiny houses, Mighty Ducks and much more.

How often is the stock market up 30% in a given year?