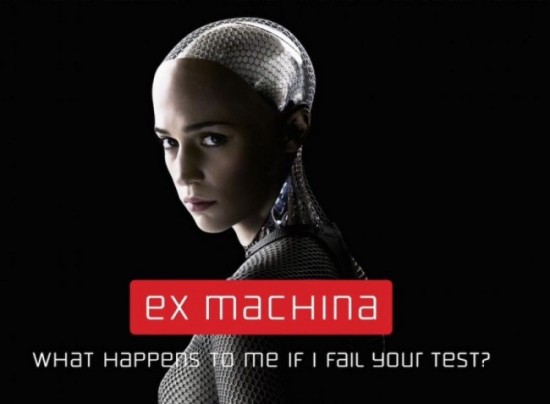

There’s a great scene in the movie Ex Machina where genius inventor Nathan describes how he was able to crack the code for creating artificial intelligence in a robot.

(Not sure if this is a spoiler alert, but if you haven’t seen the movie yet and want to go in blind, skip this next paragraph.)

He said the technology industry was using search engines all wrong by trying to extract advertising dollars and social media clicks from all the information they’re gathering. This search data doesn’t tell us what people think; it tells us how people think. That’s how he created functioning AI, by using people’s search habits to determine how they think, try to solve problems or make decisions. The result was a robot that became self-aware by harnessing the collective power of Internet search users. It’s a movie about robots, so of course things didn’t go as planned.

Betterment founder Jon Stein wrote an interesting piece recently that makes the case that we’re on the verge of creating the financial Ex Machina of sorts. Here he talks about the potential for technology to affect the future of financial advice:

Forward-thinking, tech-savvy policy makers recognize that government can play a crucial role as an enabler of progress. They are already working on a framework that will allow us to build seamless, ‘magical’ experiences. Your accrued Social Security benefits will be downloadable directly from the government. Algorithms will integrate this data into projections, and will give you automated advice on how to maximize your eventual benefits. Likewise, you’ll authorize for your tax returns to be securely downloaded directly from the IRS, and your personal tax rates will be used to optimize every transaction.

Once in retirement, each income payment will be funded from the most tax-efficient source (taxable, tax-deferred or Roth), factoring in required minimum distributions, along with your evolving lifestyle needs. Our Retirement Income service already advises you on how much you can safely take as income, and automates that cash flow, but this is only the beginning.

And what about behavior? To date, the nascent field of machine learning as applied to finance has largely been limited to detecting patterns in large datasets (e.g. fraud). In the not-so-distant future, algorithms will learn about you directly from your actions, goals, and circumstances. They’ll automatically customize your advice, dashboards, design and alerts to put the levers that matter most to you and your situation front and center. They’ll answer questions before you even ask them. The interface will be about your future, not the past.

I’m a huge fan of automating good financial decisions, so I can appreciate Stein’s sentiments here. These changes have the potential to make people’s financial lives much easier to deal with. Being able to aggregate your entire financial ecosystem in one place to be able to make more informed decisions would be a huge benefit to all.

But I’m skeptical that algorithms can ever fully take over our personal finances. Someone still has to input those upfront decisions into the algorithm for you when making suggestions or doling out advice. There can be unintended consequences when people utilize the wrong defaults too. Vanguard recently updated their How America Saves annual research report and I found this statistic interesting:

While automatic enrollment increases participation rates, it also leads to lower contribution rates when default deferral rates are set at low levels, such as 3% or lower.

Aggregate contribution rates have also declined slightly from 2007, again likely because of the impact of low default contribution rates for automatic enrollment.

Making people opt-out of a retirement plan instead of making them opt-in is a great idea because some people simply can’t or won’t force themselves to take that initial step to sign up. But in this case many employers have set the default saving rate so low that even with more participants in these 401(k) plans, people are savings a smaller percentage of their income than past averages.

There are simple and obvious fixes to this problem, including a higher default savings rate or automatic annual saving increases. But the point is that there are always going to be potential harmful side effects if the end user is too trusting of the automated decision-makers.

The biggest problem I see in the algorithm revolution is that financial decisions are emotional. A spreadsheet or calculator’s answer isn’t always going to be the one that an individual can or should follow. Many financial decisions don’t make sense on paper, but they do make sense for someone’s unique situation. It’s impossible to quantify peace of mind when determining whether or not to pay off your mortgage, save more for your child’s college fund or get rid of your student loan debt. I’m not so sure you can teach a computer program common sense.

Don’t get me wrong, I’m a huge fan of robo-advisors. They hit a hugely under-served segment of the market. I just think it’s possible to take the algorithm and automation craze a bit too far. And Stein even admits that these tools will be a huge help to financial advisors by making them more efficient when he said, “The same tools that empower an individual to build and maintain her own financial plan, will give a skilled professional the leverage to simultaneously service 100 complex clients instead of 10. Advisors flocking to our institutional platform recognize this immediately. Good advisors will flourish, and more clients will benefit.”

Most people approach their finances like the superficial search engine data aggregators in their focus — they’re paying attention to ad dollars (tactics) or social media (noise) while missing the big picture. Many still don’t consider how things works (developing a process) to be able to create their own intelligent financial system. Without the proper perspective and context around your decisions, advice from a machine doesn’t do much good.

I agree that it’s easier than ever to utilize technology to more efficiently and effectively run portfolios and manage your finances. But people need to remember that no matter how sophisticated our technology becomes it’s impossible to automate understanding. You can’t outsource everything.

Sources:

The Future of Financial Advice (Betterment)

How America Saves 2015 (Vanguard)

Further Reading:

Is Technology Speeding Up Market Cycles?

[…] Is Wall Street’s Ex Machina Moment Coming? […]