“The nature of human psychology is such that you’ll torture reality so that it fits your models, or at least you’ll think it does. To the man with only a hammer, every problem looks like a nail.” – Charlie Munger

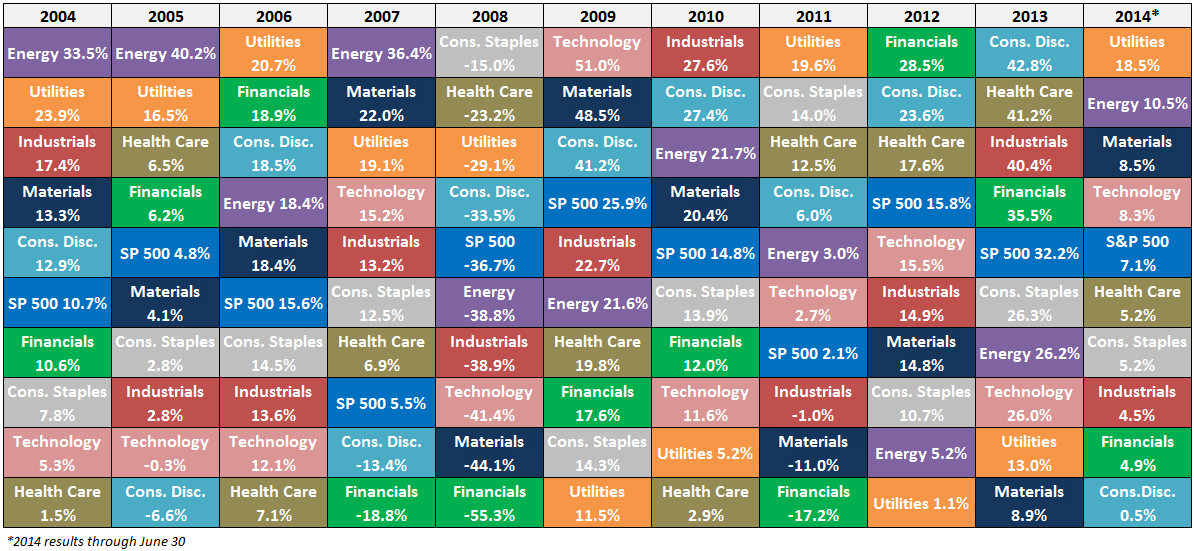

A few months ago I wrote a post about the S&P 500 sector quilt which you can see here updated through June 30, 2014 (click to enlarge):

Because of the wide range in sector returns from year to year I received a number of emails from people asking if I thought it made sense to simply own each of the individual sector ETFs and rebalance periodically to take advantage of this.

So I went back and looked at the numbers to see what an equal-weighted portfolio of these 10 S&P 500 sector ETFs would have looked like. From the beginning of 2004 through June 30 of this year the S&P 500 was up 7.7% per year. An equal-weighted portfolio of the sector ETFs rebalanced annually was actually up 9.2% per year, an annual outperformance of 1.5%.

(Wait why am I sharing this? I should be taking this idea to every fund company in the country and pitching a new equal-weighted sector ETF to play up the smart beta trend.)

Not bad. So that means this strategy is a no-brainer, correct?

As with any backtested results, there are plenty of caveats.

By running an equal-weighted portfolio of these sectors you are essentially saying you would like to overweight telecomm, utilities and materials and underweight technology, financials and healthcare.

While the current weightings are in no way static over time, some of these sectors are simply smaller industries while others play a larger role in the economy. And it’s difficult to predict with any certainty which ones will rise and fall in the future.

Certain areas like technology and financials have gotten far too large in the past and subsequently fallen back to earth, but there’s nothing that says any or all of these sectors will experience huge reversion to the mean as far as their weights go.

For example, utilities were one of the best-performing sectors in this particular period, returning over 10% a year. But the utilities weight in the S&P didn’t really change much in that time staying right around 3% the entire time. Plus the performance was aided in large part by a drop in interest rates as utility stocks are primarily high dividend-payers because of the way the companies are structured (so lower rates made their dividends look more attractive).

This equal-weighted strategy was also lucky enough to underweight financials which have performed terribly since 2004 (basically a 0% return). Who knows if that will continue?

A few other considerations for this and all backtested strategies:

- How much tracking error from the index are you willing to accept with this strategy because there would be periods of over and underperformance?

- Is there a legitimate reason for this outperformance to persist?

- Does this backtest take into account taxes, fees and trading expenses?

- Would I have had the intestinal fortitude to stick with such a strategy and rebalance in the past?

- Would it have made sense at the time to invest this way without the aid of hindsight?

- Doe this strategy make sense going forward or is this a case of data-mining?

- Is the increased complexity of this strategy worth the extra work and potential stress that it will take to execute?

Of course there are ways to improve upon the performance of the S&P 500. But it’s not easy. Plus much of the historical data you see on many strategies look great on paper, but only in hindsight and were never implemented in actual portfolios in real-time.

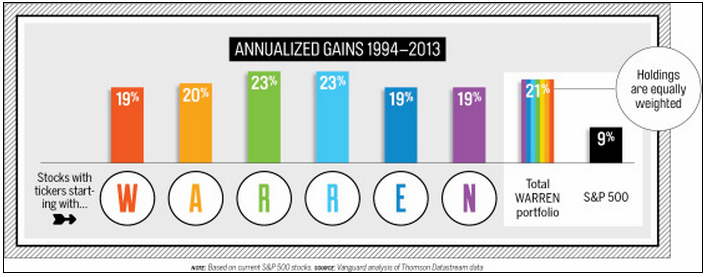

Vanguard had some fun with this a few months ago when they discovered that a portfolio of stocks chosen exclusively by the first letter in the ticker using the word “Warren” would have substantially outperformed the market. CNN Money’s Pat Regnier created this graphic on the WARREN portfolio:

Basically, if you’re going to tilt your investments away from any established index make sure your strategy (1) is based in reality, (2) takes into account net performance after all taxes fees and trading costs, not simply gross returns and (3) is a repeatable process you can use in the future over multiple investment cycles.

Even then you’re not guaranteed to outperform the S&P 500.

Guggenheim has offered an S&P 500 equal weight ETF that rebalances quarterly. It invests in all 500 companies equally.

It’s history has shown that it outperforms in a rising market environment but the decline in a falling market is steeper.

Yup, knew about the equal weighted ETF. The problem with the equal-weight sector approach is that the stocks within each ETF are not equal weighted so really you are overweighting some individual names and underweighting others. The Guggenheim ETF equal weights all holdings (which makes more sense in my opinion).

But fair point about over/underperformance. Makes sense because it picks up smaller stocks.

You can get a reasonable approximation to the Guggenheim Equal Weight (RSP) with a mix of 40% S&P 500 (eg IVV) and 60% iShares Russell Midcap (IWR). So the performance of the Equal Weight relative to S&P 500 should follow directly how Mid Cap is doing relative to Large Cap.

That makes sense. Probably lower fees too? Just have to make sure you rebalance.

[…] Equal Weighted SP 500 […]

worthy of another RT but i need to skip one now and then lol. bottom line is lot of room b/w cap and equal weights, though, keep sharing!

I’ve hit my quota? Agree and it’ll be interesting to see as these ETFs get more and more sophisticated with their weighting strategies. Costs continue to fall as well. All good for investment consumers. These types of quant-like strategies were impossible for so many smaller investors in the past and it’s great that the field of play has been leveled a bit.

[…] Backtests are fun but not necessarily very informative. (A Wealth of Common Sense) […]

There actually are people who sell this “smart” strategy – see ticker EQL.

A few people pointed that one out to me. In some ways I’m surprised it exists in others it doesn’t shock me at all. The 1, 3 and 5 years numbers are all just under the S&P 500 mostly because the fund has an expense ratio of .5% (the cost of complexity). Thanks for pointing this out.

Has anyone done an equal sector weight analysis going back further than 2004?

The primary advantages of the strategy are: (1) it prevents you from overweighting in overheated sectors and bubbles; and (2) it helps you capture gains when small sectors lead in performance. It’s basically a rebalancing strategy.

That’s only going to be helpful if (1) certain sectors actually get “overheated,” i.e. disproportionately larger over time; and (2) every sector is equally likely to lead or outperform in a given year.

In my opinion, a 10.5-year timeframe just isn’t enough to evaluate either of those things.

My assumption is that an equal-weight strategy is primarily useful for lowering volatility, which does help returns. But is that advantage enough to make up for the added cost of the EQL fund, or the cost of actually rebalancing all sector ETFs annually?

Something about this strategy seems inherently sensible, I’m just not sure that, even if it’s better, that it would actually be enough better to be worth the extra cost.

As with any investment theory, seeking an appropriate weight or balance for a portfolio can prove to be a daunting task for most individual investors. The time put in to merely select a particular stock let alone maintain that position outweighs the arbitrary are “correct” way to weigh a portfolio whether is be balanced or heavy in a certain sector. Thanks for sharing and showing us some back tested results for an equal weight portfolio.

Agreed. The most consistent questions I get from people are about what is the correct asset allocation for them. Tough one to answer w/o knowing a ton of info about their particular situation.

[…] back testing […]

[…] Image Source: A Wealth of Common Sense […]

Fidelity makes this strategy fairly easy to do. They have 10 US sector ETFs, commission-free, with only a 0.12% expense ratio.

Thus far my re-balancing has only involved adding new money to under-preforming sectors. Nothing has outperformed to the point where I can’t easily re-balance with new money only (saving a little money there on capital gains taxes). I’ve only been using this strategy for a relatively short time though. Takes more work than just simply investing in an S&P 500 ETF and leaving it alone, but so far I’m liking the flexibility this strategy allows me to have. Let’s see how this works out for me during the next major market downturn.

I just wish Fidelity had some commission-free international sector ETFs so I could do the same with the international ETF portion of my portfolio.