A single friend recently asked for some advice on life insurance. It seems that his insurance agent for his home and car was trying to talk him into getting a life insurance policy. Having no financial expertise he wanted my take. Obviously as a single male with no beneficiaries to worry about this was a really bad idea. Who would even get the payout if he died? But it makes you realize that we need a more structured process to determine whether life insurance makes sense for you.

There are plenty of options when it comes to life insurance but the common sense advice is to keep it simple and cost effective. The more complicated approaches (whole-life, universal, variable life, variable universal, etc.) sound interesting but in the end you pay higher fees and can get more than you bargained for. These options really only make sense for the wealthy who have complicated tax structures and estates to worry about. Keep it simple and stick with term life insurance.

Term life insurance is basic, easy to understand and generally inexpensive. If that’s not a common sense approach to life insurance then I don’t know what is. You buy a term life insurance policy for a specific period of time (hence the phrase “term”). It could be for 10 years, 20 years, 30 years, etc. The amount of coverage is generally in the $250,000 to $1 million range. If you die, your beneficiaries get the payout for that amount. If not (good for you), the policy expires worthless and all you are out is the premiums you paid. This would be the equivalent of paying for car insurance and never getting in an accident. It’s nice to know it’s there if you really need it but hope it never comes to that.

As with all financial decisions, everyone’s situation is going to be different. By answering a few simple questions you can make a more informed decision to see if you really need life insurance at this point in your life.

Here is a list of questions you can ask yourself to see if you fit the profile of someone who needs life insurance:

- Is my family solely, or mainly, reliant on my income for living expenses?

- Do I have a mortgage that cannot be paid off from savings or mortgage insurance?

- Are college tuition bills likely to arise at some point in the future?

If you go through this exercise and determine that you do need a policy the good news is that the cost of term life insurance is fairly reasonable, some say at historical lows, especially if you are in your 20’s, 30’s, and even 40’s. Life expectancy is on the rise because of improved healthcare and technology so this allows life insurance companies to lower the premiums they charge because the chance of a quicker payout has gone down.

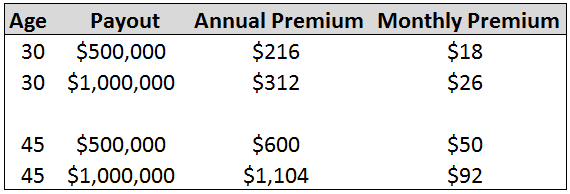

I did some research on the Internet and found it is very easy to get quote online in just minutes. I looked at quotes for a healthy 30-year old and a healthy 45-year old to see what the premiums would look like. In both cases I assumed it was a non-smoker because this can make a difference in the amount you pay. Here are the rates:

As you can see this is very cost effective. In your 30s, $18-26 a month is not even a night out to dinner. For those in their 40s and more likely to have children you can have peace of mind for less than $100 a month. This is a pretty good deal.

A general rule of thumb to figure out the coverage you need is 10 times annual earnings. An approach at age 30 would be to get a 15 year fixed premium policy. When that policy expires at age 45 you can check your circumstances to see where you are and make the decision again. If you still have a large mortgage and college tuition for several years to come, then price out a 10 or 15 year fixed term policy again.

After age 60 you probably will not need life insurance if: your mortgage is low or paid off; college tuition is done; you have been persistent in saving and investing prudently over the years.

To get a basic quote for your own situation google life insurance quotes. You just have to enter some basic information (age, health status, height, weight, etc.) and you get a host of options from different life insurance companies. Just be aware that once you send out your information for a quote you will be on the radar screen for life insurance companies to contact you. I actually received a call within minutes of my quote request. If you are ready to get life insurance, talk to a couple of agents to see how the process works. If not, tell them you are just getting an idea on the cost for different terms and payouts. They should be able to answer any further questions you have.

Another positive is that life insurance proceeds are not taxable to beneficiaries. One less thing to worry about if something unexpected happens. Obviously we all would hope we would never need to use this insurance but you will sleep better at night knowing that your family will be taken care of if something should ever happen to you.

[widgets_on_pages]

[…] if you got a large inheritance in that same range? Or had the unfortunate scenario of getting a life insurance check? Then what would you […]

Hi – what are your thoughts about permanent life insurance for those who may earn a decent income, with children and a mortgage? I do have excess funds around and am debating continuing investing in equities vs buying a permanent policy. I keep getting approached by salesman who tout the benefits of permanent life insurance and many of my colleagues have purchased it.

Thanks.

I would be skeptical of any life insurance plan that has an investment option. The majority of these plans have sky high fees and the results can be underwhelming.

You could find a life insurance investment plan that works but the odds are stacked against you. The higher probability move would be to keep your life insurance and investment plan separated. Term life insurance is cheap and generally easy to understand. The same applies to a low cost investment plan.

I gree with a majority of the information that you have on your site but I am going to have to disagree with you on the life insurance advise. Full disclosure I am a wealth management adviser who works for a mutual life insurance company. when discussing life insurance with a single person there are more things to consider than simply do they need it at that time. Insurance is issued based on medical insurability so if someone is single but is planning on having a family in the future it might make since to lock in the coverage while they are young and healthy.

I would avoid purchasing coverage from your property and casualty carrier though. there expertise is usually not in life insurance or financial planning.

Also, Whole life insurance can be a valuable asset in ones financial plan. You must be cautious though as there are only 3-4 companies in the market out of 1200 or so that I would recommend ever purchasing a whole life policy from.

Whole life can be used as your emergency fund pre retirement but it is most valuable as an asset in the distribution phase of retirement. This is something most advisers overlook when working with younger people. How to spend down the assets in retirement in the most tax efficient way to create the highest income stream not subject to most market volatility.

As you mentioned everyone’s situation is different and I would recommend that a person contact an adviser from a mutual insurance company for a face to face meeting. Calling a 800 number for term insurance will not get you the answers that you need and they will not ask the questions to help you out in the long run. Find someone you trust and build a relationship.