“In the world of finance, the only black swans are the history that investors have not read.” – William Bernstein

Following the 2007-09 financial crisis, many investors decided they needed insurance on their portfolio to protect against the possibility of another “black swan” event.

It’s hard to believe that this was ever the case considering where the markets stand at the moment, but investors tend to have a very short memory.

In the aftermath of the crash, the fund industry took full advantage of the change in sentiment and rolled out a host of new funds that were supposed to help investors if there was another downturn — long/short funds, tail risk strategies, absolute return funds, option hedging strategies, tactical asset allocation funds and the like. Investors poured money into these funds with a heavy dose of hindsight bias by allowing the recent past to shape their investment decisions.

Those who piled into these funds missed the idea completely. They were trying to plan ahead for uncertain events that could surprise everyone. Of course this is impossible, because you can’t hedge out the risks of unknown events…they’re unknown after all.

What investors are really afraid of is losing large chunks of money like they did during the crash. Losing money is a risk that you can define. Black swans are risks that you cannot define. We can work with the former, but not the latter.

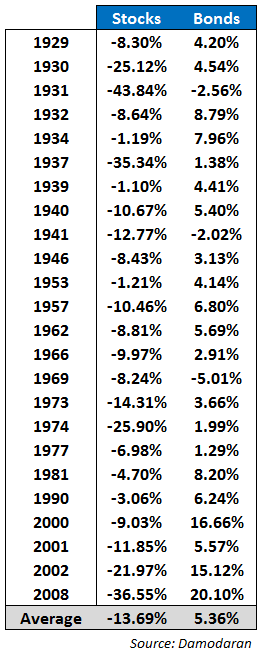

Since 1928, the S&P 500 has suffered 24 down years on a calendar basis, a hit rate of roughly 30%. Here is a table with each one of those losses along with the return for the 10 Year Treasuries during the down years:

We always assume that the most complicated solution will prove to be the best one. Wall Street salespeople and brokers will use this to their advantage and your detriment, to sell you complex and expensive products that play up to your most recent fears.

This was the basis for creating hedged strategies after a market crash.

Yet anyone with a solid grasp of market history could have told you that bonds generally perform well when stocks drop. In 21 out of the 24 years that stocks fell, bonds rose while outperforming stocks by an average of 19%.

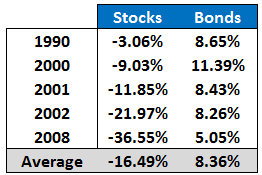

Data going back to the 1930s is mostly illustrative to show you how diversification has worked in the past. I don’t expect most investors to be investing directly in Treasuries for their bond allocation. The Vanguard Total Bond Market Fund is more diversified and allows easier access for investors.

The fund dates back to the late 1980s. Here’s how it held up against down years in S&P 500 since then:

Bonds have done their job. Of course, stocks still rose 7 out of every 10 years and dominated bonds in overall performance over that time frame, so you can’t completely give up on equities just because they lose money sometimes.

Even though interest rates are low and bond investors can’t expect huge returns going forward, bonds can provide a diversified portfolio the following attributes:

(1) Bonds can act as an insurance policy against poor economic conditions such as a crisis or deflationary period. Investors flock to high quality bonds during times of unrest.

(2) Bonds will be your dry powder to purchase equities during the periodic selloffs in stocks. The crash marked down stocks a great deal in price, but it didn’t matter if you didn’t have any cash to put to work.

(3) And bonds can help you sleep at night as a way to decrease your risk. This is probably the most important attribute for bonds. They add to your emotional diversification by allowing you to create a balanced asset allocation that you can handle based on your personal risk tolerance.

Following the crash there was also a steady stream of people claiming that diversification was broken. This never made any sense to me. Bonds did their job by providing stability in the face of an economic collapse. Stocks did what they always do when investors freak out — they got slaughtered, but eventually came back to life once everyone wrote them off for good.

This is how the investing cycle works.

[…] Black Swans […]

[…] Why bonds belong in a diversified portfolio. (A Wealth of Common Sense) […]

[…] Wealth of Common Sense: – Why bonds belong in a diversified portfolio. – Following the 2007-09 financial crisis, many investors decided they needed insurance on their […]

[…] Your Very Own Black Swan Strategy (Wealth of Common Sense) […]

[…] Ben Carlson: No need for fancy Black Swan strategies – just add some treasurys. (AWealthOfCommonSense) […]

You state: They were trying to plan ahead for uncertain events that could surprise everyone. Of course this is impossible, because you can’t hedge out the risks of unknown events…they’re unknown after all.

But how will you know the next time, bonds will perform adequately?

We never know anything for certain about the future, but the way that high quality, intermediate duration bonds are structured means that investors have a high probability to get paid their income on a periodic basis and receive par value at maturity. A diversified bond fund reduces your probability of failure even more. High quality bonds are not set up to crash like stocks are. They can go down in price if yields rise, but they still pay income on a regular basis. And if yields do rise, you eventually get paid a higher amount of income.

Probably the biggest risk to bonds is an increase in inflation, but that’s another unknown. Bonds act as a form of risk control, especially during times of economic unrest.

Bonds work fine when there is a growth related shock, but are likely to be “anti-insurance” in the event that there is an inflation related shock.

Even TIPS would negatively suffer from a real yield re-rating.

In those events, only those holding cash, or equity protection, or low exposure to real rates, will have enough “fire power” to respond to the market crisis

Not necessarily. It all depends on the pace of inflation. If it happens overnight, then yes, bonds get killed and cash is king. But if is takes a while, cash will lose money to inflation too. Both bonds and cash will have higher yields as rates rise, but in a big inflation-shock, nothing is truly “safe.” But good luck predicting if/when that will ever happen.

[…] awealthofcommonsense.com – Tagged: Beta View on Counterparties.com […]

[…] Beta The best Black Swan strategy is a boring bond fund – A Wealth of Common Sense […]

[…] at A Wealth of Common Sense describes the job of bonds in a portfolio. The most important attribute of bonds is that they lower volatility so you can sleep easier at […]

[…] Wealth of Common Sense: – Why bonds belong in a diversified portfolio. – Following the 2007-09 financial crisis, many investors decided they needed insurance on their […]

[…] it is true that bonds generally to very well when stocks fall (see Your Very Own Black Swan Strategy). But that doesn’t mean that bonds always fall when stocks rise and vice […]

[…] don’t need to get fancy with black swan disaster hedges. High quality intermediate-term bonds have been your best option for preserving […]

[…] Further Reading: To Win You Have to be Willing to Lose Your Very Own Black Swan Strategy […]

[…] Reading: Your Very Own Black Swan Strategy Advice Doesn’t Have to be Complicated to be […]