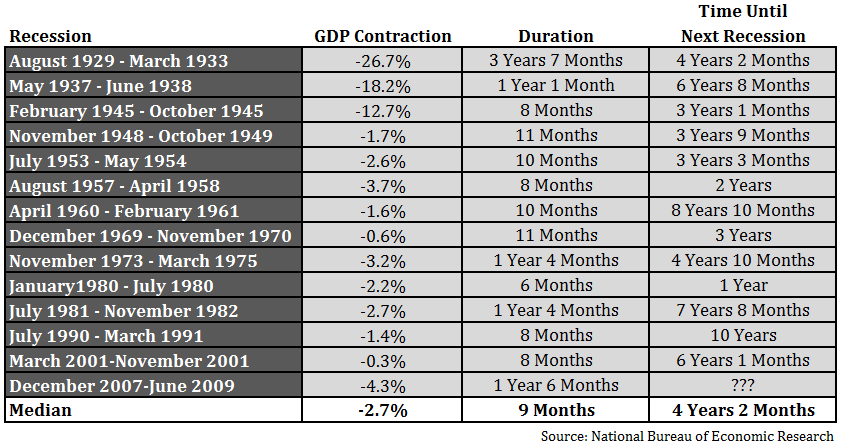

A few weeks ago I urged readers to get used to the fact that recessions are a fact of life that they need to get used to every 4-10 years or so. I shared the following table with each recession since the late-1920s:

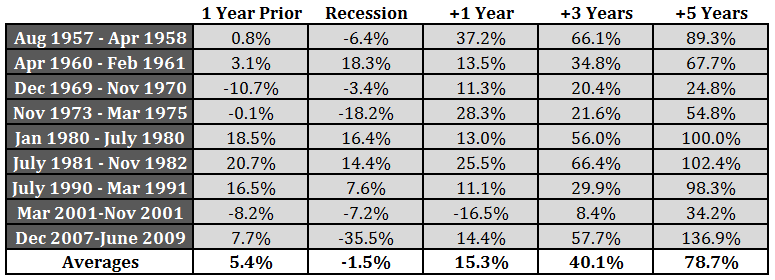

The next logical step from here is the see how stocks performed in and around these past recessions. I only have monthly S&P 500 returns going back to the mid-1950s, but that was good enough to show the total returns leading up to, during and after each of the past nine recessions:

This is another piece of evidence that shows why investing during periods of unrest usually pays off for investors. Three years out from a recession the annual returns showed an average annual gain of 11.9%. Five years out the average annual gain was 12.3%. Only one time since 1957 was the stock market down a year later following a recession, which occurred during the 2000-2002 bear market.

During the actual recessions themselves the total returns look much worse as they were negative, on average. But this average is made up of a wide range in results, as stocks have actually risen during 4 out of the last 9 recessions. And stocks were positive 6 out of the past 9 times in the year leading up to the start of a recession, dispelling the myth that the stock market always acts as a leading indicator of economic activity.

All of which is to say, what these numbers really tell us is that, in general, stocks tend to perform below average in the year leading up to and during a recession and perform above average in the 1, 3, and 5 years following the end of a recession (with the usual caveats that there are always outliers and this is a small sample size).

So all you have to do is figure out how to predict the next recession and you’ve got it made. Easy, right?

Brett Arends of MarketWatch (who himself was trying to figure out if we were already in a recession in late-2012) showed why it can be so difficult to predict recessions in real-time:

Remember the Great Recession that began in December, 2007? The economists at the National Bureau of Economic Research, who are basically the official scorekeepers of recessions, didn’t discover the recession until December, 2008 – a year late, and only a few months before the episode (officially) ended.

The previous recession began in March, 2001 – but the NBER didn’t call it a recession until November 26 of that year. By amazing coincidence, that was actually the month it ended (as they told us many months later).

The recession that began in July, 1990 wasn’t called until April the following year. The recession that began in July, 1981 wasn’t recognized until January of 1982. And so it goes.

We’ll go into another recession at some point. There’s a strong possibility that stocks could show underwhelming performance when it happens based on the strong gains U.S. stocks have shown over the past six years. Or maybe they’ll fall before the business cycle slows. We’ll see. Investor expectations are fickle.

Every market and business cycle is unique, as anyone who has been trying to handicap the current rally can attest to.

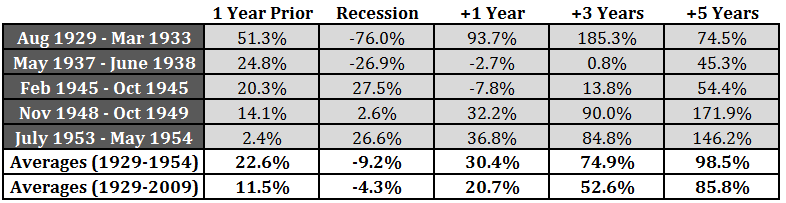

UPDATE: With a little help from Wes Gray at Alpha Architect I was able to put together the data set going all the way back to the Great Depression. Here are those results along with the averages over the entire period:

Source:

Are we already in a recession? (MarketWatch)

Further Reading:

When Will the U.S. Have Its Next Recession?

Inflation is a Relatively New Phenomenon

Great article, Ben. I was pretty sure about this, but now am very sure. As you know, with my Cash Reserve Method – what you named The Four Year Rule when you posted it last August 17 – calls for continuing to draw down the cash reserve for two years after a bear market ends and then to ratably selli shares to replenish the reserve over the following two years in order to take advantage of the significantly higher market prices that are likely to be in effect during those years. Your data plus my personal experience since 2000 supports my thinking regarding this. Thanks for the research.

[…] Stock Performance Before, During, and After Recessions — (A Wealth of Common Sense) […]

[…] How stocks perform before, during and after recessions. (awealthofcommonsense) […]

When the NBER announces a recession, they use a wide variety of data, including privately published data, to pin down the exact month it began. This is a dream for researchers, but it doesn’t meet the needs of businesses and consumers who need to know what’s going on in real-time.

Frustrated with this state of affairs, I constructed my own recession model using several leading indicators. It identifies the beginning of recessions with little lag. Although it lags by several months in pegging the end of recession, that’s somewhat less important. Usually a stock market low occurs before the recession is over.

For now, my homebrew recession indicator says ‘pedal to the metal’ — not a trace of weakness.

I think people were hopeful that the people at ECRI had things figured out but their call in 2011 of a recession was obviously way off. Keep me posted on your model.

Here’s some more data on stock performance coming out of a recession:

https://awealthofcommonsense.com/need-recession-meaningful-correction-stocks/

Very hard to accurately predict the start date when the data they have is often weeks old.

And based on what I’m seeing, I agree- we’re most likely 2 years away or more from a recession.

Very useful research no doubt, and I tend to agree with you, we’re most likely at least two years away from the next one, but then again, who knows really.

[…] Can Kill Investors (Stock Charts) • Stock Performance Before, During & After Recessions (A Wealth of Common Sense) • Commodities two-fer: …..-Gold Futures Fall to Four-Month Low Ahead of FOMC Meeting (WSJ) […]

[…] 9) A Wealth of Common Sense : Performance des marchés avant, pendant et après récession […]

[…] How do stocks perform during recessions? https://awealthofcommonsense.com/stock-performance-before-during-after-recessions/ […]

Another way of viewing it would be to measure returns of the investment process in question over 10 year forward time frames from the officially declared “end” to the recession. If the economy were to be in the midst of the recession and an investor was uncertain as to when to put “cash” to work, then this could provide another reassurance to the type of positive outcomes that they could expect for the process and allieviate the “fear of missing out” bias that typically occurs when the market has already moved higher by the time the recession has been declared “over”.

https://docs.google.com/presentation/d/1ABVnthgN3-zseRE9HGQOfu7nxjDgpoE09P6sXBNvGuU/edit?usp=sharing

[…] Don’t stop investing during recessions – AWOCS […]

Really powerful data. Thanks for putting it together.

[…] https://awealthofcommonsense.com/stock-performance-before-during-after-recessions/ […]

[…] Further Reading: How Stocks Perform Before, During & After a Recession […]