A reader asks:

What are we supposed to do over the next 4 years with the Administration’s continuous change in policies? I went heavy into cash before Trump took office. I trusted that he was going to keep his word, and break things. I just didn’t expect him to break the market. But now I’m stuck, fearful of this constant uncertainty that seems to never go away. It’s already been a long 3 months. I was planning to retire this year, but unlikely now. My Money Market is getting that decent 4% yield right now, and at least this helps me sleep at night.

Another reader asks:

I’m a 40 year old in good financial position at the moment. That said, I’m not bullish on the economic future. I’m not interested in hoarding gold bars, but would like to put a portion of my portfolio in investments that would do well, or at least better, in a world where income inequality, protectionism, AI advance, and America’s social fabric continues to fray. What would you recommend?

Each week I get a Google Doc full of questions from our audience at Ask the Compound.1

This was the collective sentiment from the questions this week:

There were numerous questions along the same lines. People are worried.

It’s crazy how quickly the narrative has shifted.

Just a few short months ago there was talk of Trump being the biggest pro-business, pro-stock market president ever:

Now people are questioning if this is the end of American exceptionalism:

Life comes at you fast.

If Trump keeps up the current trade policies it’s going to be bad for the global economy, supply chains, profit margins, consumer prices and corporate earnings. There is no sugar coating it. These are not pro-business or pro-stock market policies. They are the opposite.

But you can’t just go into the fetal position because this makes you nervous. You still have to invest in something.

These questions come from people at different life stages, so I’ll tackle them separately.

Let’s say the worst does come to pass and the next few years are bad for the economy and the markets. Take away the reason. The reason doesn’t matter.

When you’re in retirement, you have to expect economic slowdowns, bear markets and corrections.

A couple retiring today in their mid-60s has a 50-60% probability of at least one of them living until age 92. There will be a presidential election in 2028. That’s less than four years away. Your retirement could last 20-30 years.

Unless you have a giant pile of cash, that money market fund isn’t going to help you keep up with inflation over the coming decades. You have to take some risk in retirement if you wish to beat the increase in standard of living.

One of the big risks for retirement investors is sequence of return risk. You don’t want bad returns early in retirement to derail your investment plan. Therefore, you need to consider how many years’ worth of spending you have stashed away in safe, liquid assets to see you through the inevitable periods of disruption. That’s true regardless of who the president is.

Retirement planning still comes down to your time horizon, financial circumstances, and personal spending habits. Uncertainty in retirement never goes away but you have to focus on what you control and make course corrections to your plan along the way.

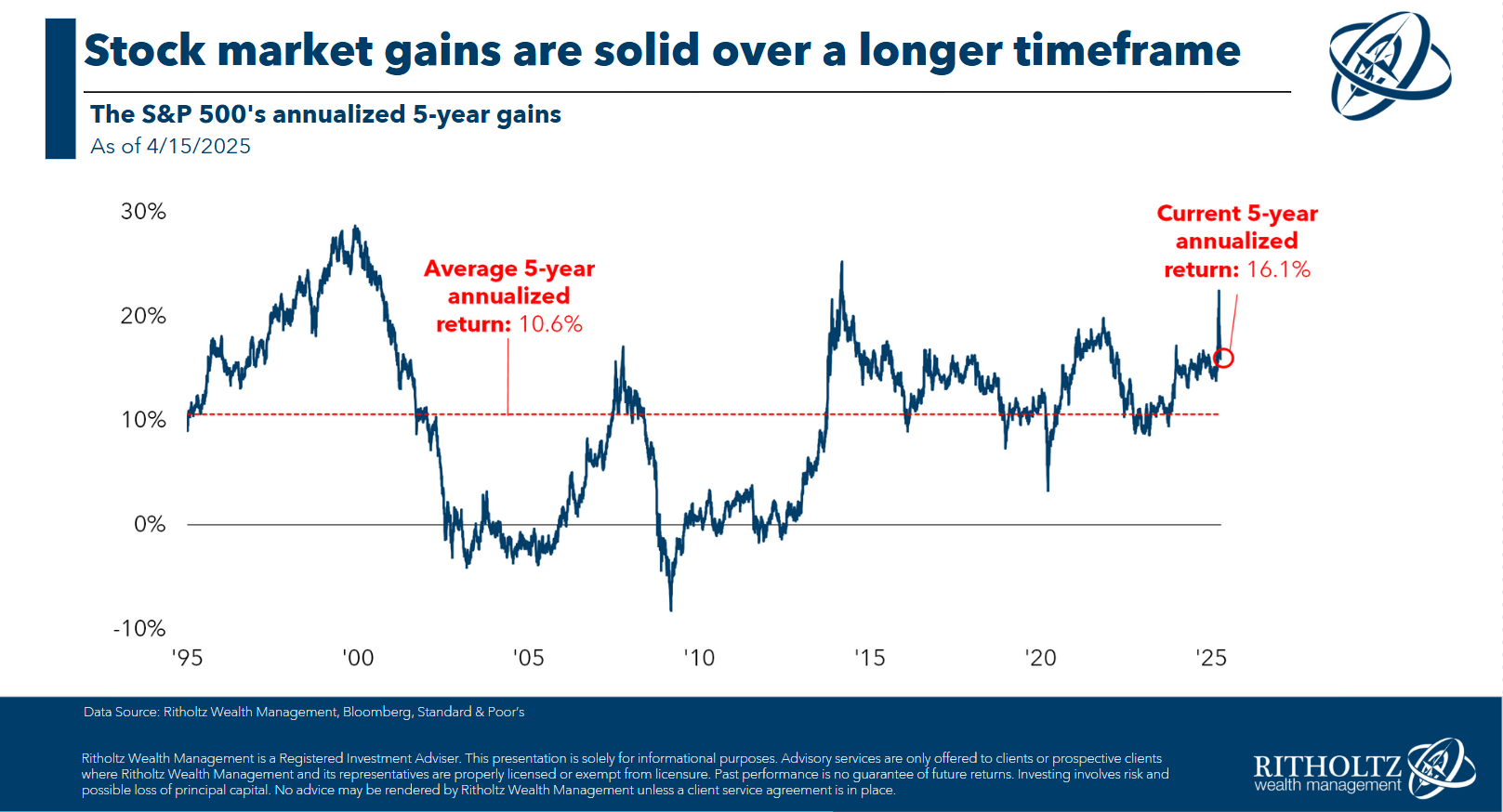

It’s also important to recognize that stock market returns have been fantastic even when you include the current correction:

Over the past 5 years, the S&P 500 is still up 16% per year.

The wrong question: Should I sell all of my stocks?

The right question: Should I change my allocation?

If you’re 100% stocks and this makes you that nervous maybe you should be more like 80/20, 70/30 or 60/40. I’m never a fan of going all out with no plan on the other side of that decision.

Asset allocation is more important than market timing.

Investing in middle age is often overlooked since personal finance experts tend to focus on young investors (stay the course) or retired investors. At 40, you should have some financial assets but you also have plenty of time left to save and invest.

It’s a balancing act.

I don’t know if you should be pessimistic about the future of our economy but bad times should be expected when you have a multi-decade time horizon.

I broke down various asset class returns by decade to get a sense of performance during the rough stretches:

The bad economic decades were the 1930s, 1970s and 2000s. Stocks performed poorly in all three of those decades.2

Gold did pretty well in all of those periods. Bonds held up well in the 1930s and 2000s but got crushed by inflation in the 1970s. Housing crashed during the Great Depression but performed phenomenally in the 1970s and 2000s.

Listen, I could give you a portfolio to protect your assets with a bunch of different strategies. Maybe it works, maybe it doesn’t. The perfect portfolio is only known in hindsight.

These are the times when diversification matters more than ever. It’s not only a risk management strategy but a way to ensure you invest in the eventual winners (which we won’t know until after the fact).

Your ability to stick with a strategy will be more important than the strategy itself.

If you’re really that nervous about the economy, save more money. Do your best to improve your career prospects and increase your income.

It’s also worth pointing out that predicting the future is hard. No one would have expected things to turn out so well after Covid hit. Just take a breath and see how this all plays out.

I’m not going to lie — I don’t have a lot of faith in our political leaders in either party these days.

But I still have faith in the American spirit of ingenuity and entrepreneurship. I still have faith corporations will do anything they can to turn a profit and grow.

That hasn’t changed.

Whatever you do with your money, just have a plan in place and don’t let your emotions drive your investment decisions.

Callie Cox joined me on Ask the Compound this week to discuss these questions and much more:

Further Reading:

Misbehaving in a Volatile Market

1Email us at askthecompoundshow@gmail.com if you have a question.

2Subtract inflation from the 1970s number and you get negative real returns.