Today’s Animal Spirits is brought to you by YCharts and Fabric:

See here for YCharts limited time deal for the YCharts platform

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

On today’s show, we discuss:

- Dalio Warns of US Debt Crisis ‘Heart Attack’ Within Three Years

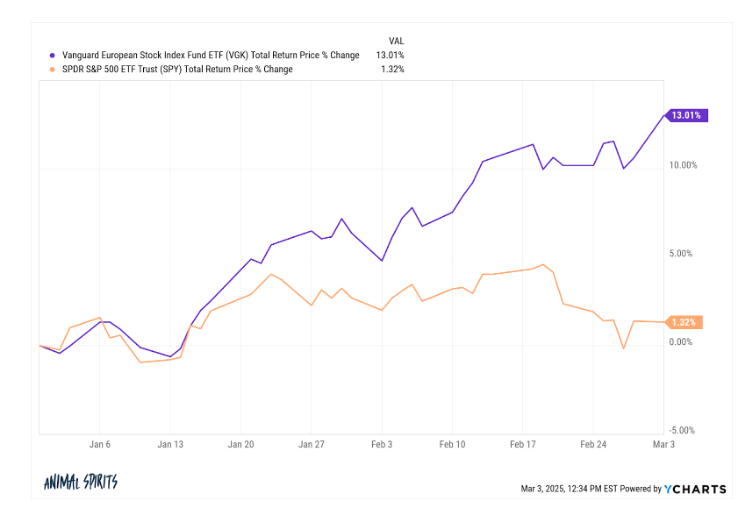

- The Wall of Worry is Dead

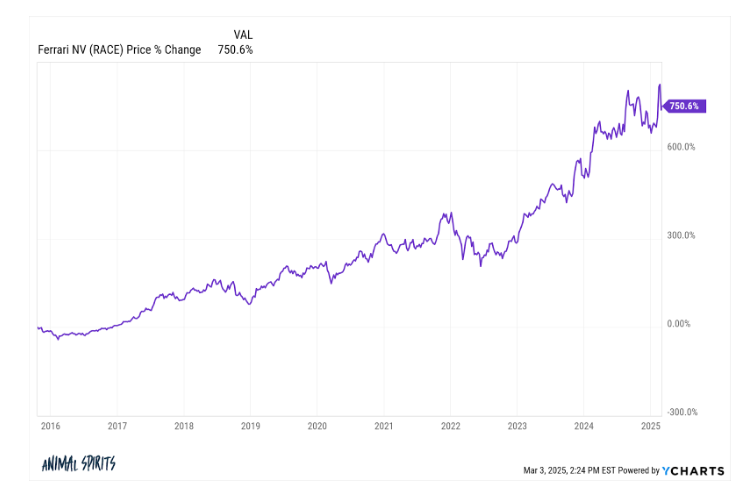

- The Wild Economics Behind Ferrari’s Domination of the Luxury Car Market

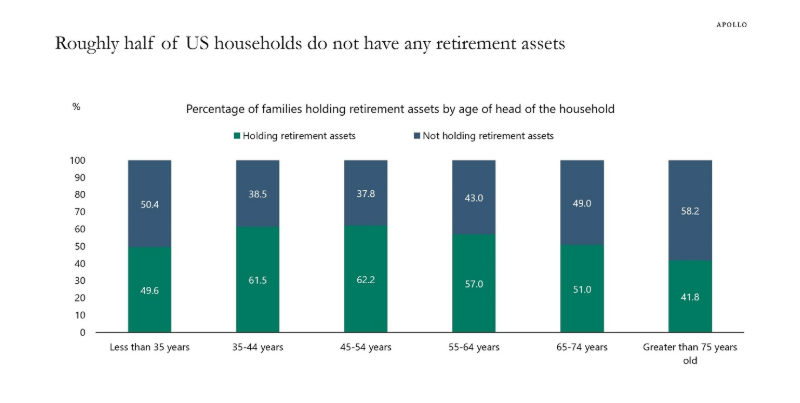

- There Is a Significant Need for Retirement Savings in the US

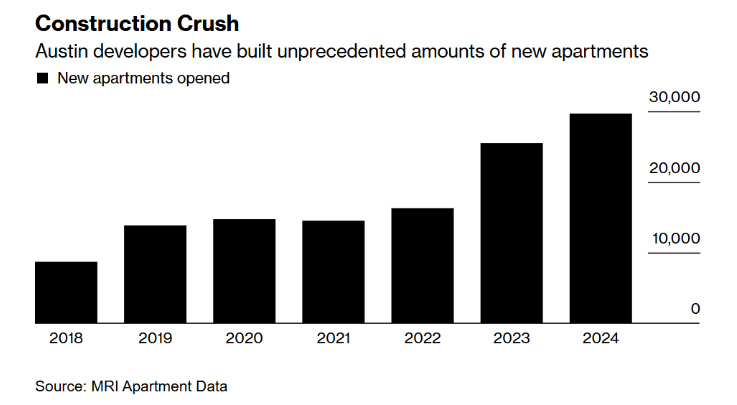

- Austin rents tumble 22%

- Stripe annual letter

- Personal and Family Income by Census Region

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

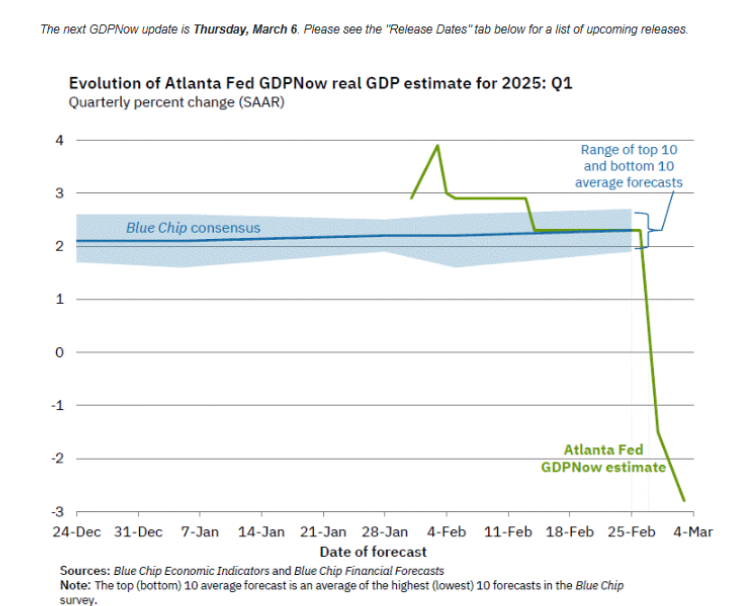

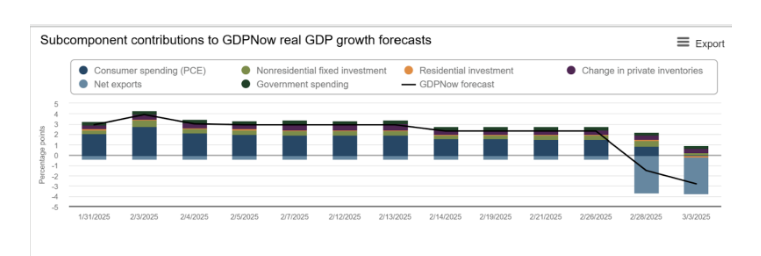

Unless we all wake up from this collective tariffs nightmare, the reality is recession. Recession with inflation, which is called stagflation. It's the worst kind of recession, because people lose their jobs and prices stay high along with interest rates.

— Daryl Fairweather ⛅ (@FairweatherPhD) March 4, 2025

Target: "In light of ongoing consumer uncertainty & a small decline in February Net Sales, combined with tariff uncertainty….the Company expects to see meaningful YoY profit pressure in its Q1 relative to the remainder of the year…" $TGT pic.twitter.com/lf5CrFCydP

— The Transcript (@TheTranscript_) March 4, 2025

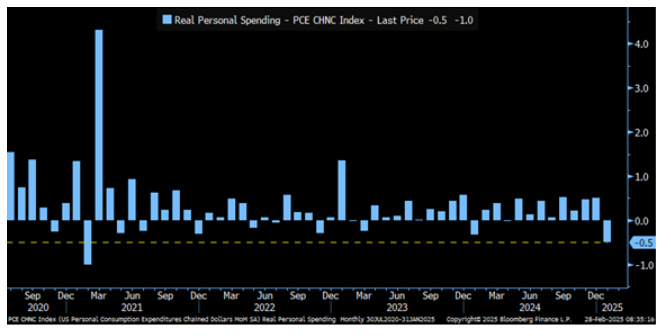

Real personal spending fell by the most since 2021. pic.twitter.com/s0sYzuaLuk

— Kathy Jones (@KathyJones) February 28, 2025

Americans saved 4.6% of their after-tax income in January, up from 3.5% in December.https://t.co/eDZgP9dKNk

— BEA News (@BEA_News) February 28, 2025

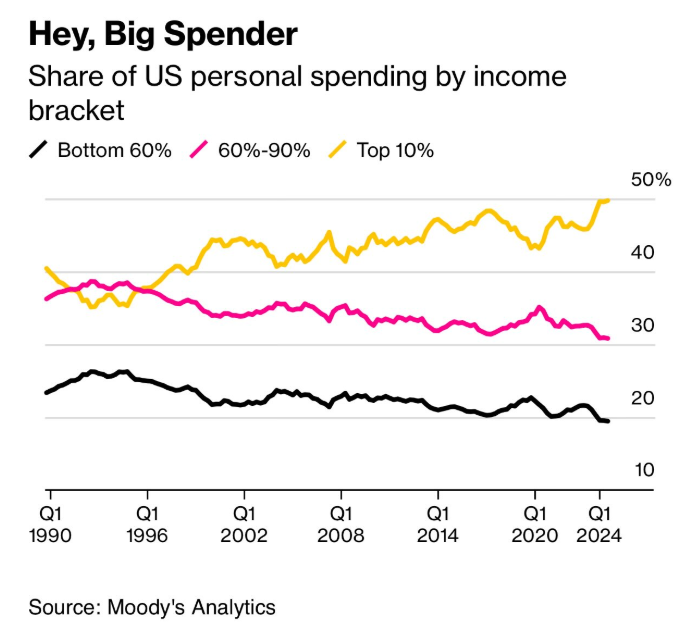

1. Trump is more popular with young people than old people. Most young people don’t own stocks or homes (aka they are asset-light).

2. Trump is also more popular amongst working and middle class folks. Most of these folks are also asset-light.

It stands to reason that a fall…

— Chamath Palihapitiya (@chamath) March 3, 2025

DoorDash has turned the corner to profitability and still continues to grow its order volume.

Total orders are now up 735% over the last 5 years.$DASH pic.twitter.com/fqdVuYwCeP

— FinChat (@finchat_io) February 11, 2025

Nobody announced a tax or a spending program. Maybe you should wait to find out what’s actually being proposed. https://t.co/TNBFxoYVjz

— David Sacks (@DavidSacks) March 3, 2025

Correct. I sold all my cryptocurrency (including BTC, ETH, and SOL) prior to the start of the administration. https://t.co/dN6nuGQUtu

— David Sacks (@DavidSacks) March 3, 2025

Saw the Trump statement today, same as everyone else —

I imagined a Strategic Reserve would be just Bitcoin. That makes the most sense to me.

Many crypto assets have merits, but what we're talking about here isn't a US investment portfolio — we're talking about a reserve, and… https://t.co/YwLBBCt55y

— Hunter Horsley (@HHorsley) March 3, 2025

U.S. pending home sales have fallen to a new all-time low pic.twitter.com/dxKfa5OA8n

— Kevin Gordon (@KevRGordon) February 27, 2025

Netflix has taken the biggest hit. eMarketer’s analysis (see chart below) makes that abundantly clear. Since the first quarter of 2024 (i.e. when Prime Video introduced ads), Netflix CPMs have fallen more than those of Prime Video, Disney+, Max, Peacock and Hulu. pic.twitter.com/k9xh0aZDOZ

— Kourosh (@kouroshshafi) February 25, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product