Today’s Animal Spirits is brought to you by ProShares and Fabric:

See here for more information on ProShare’s full range of ETFs

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

On today’s show, we discuss:

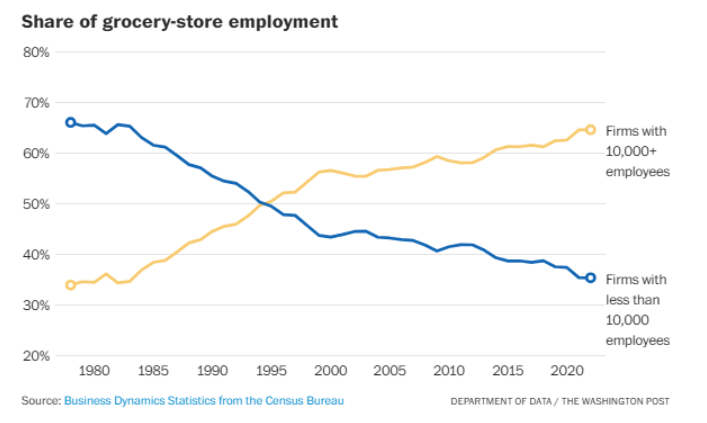

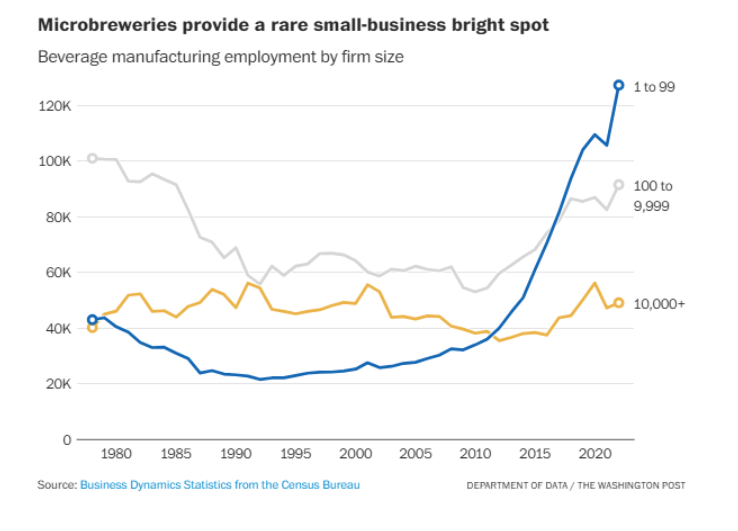

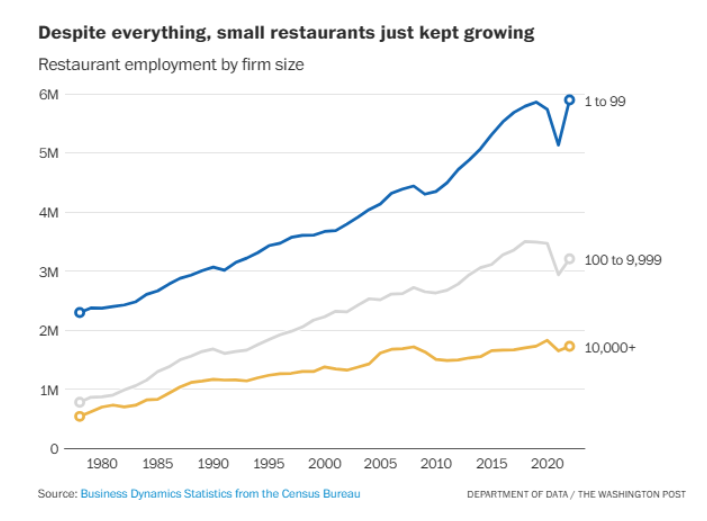

- Is America Still a Nation of Small Businesses?

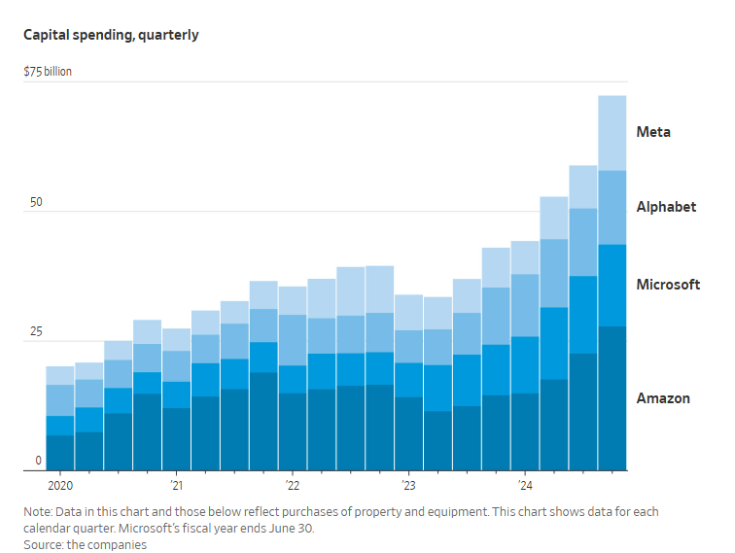

- Tech Giants Double Down on Their Massive AI Spending

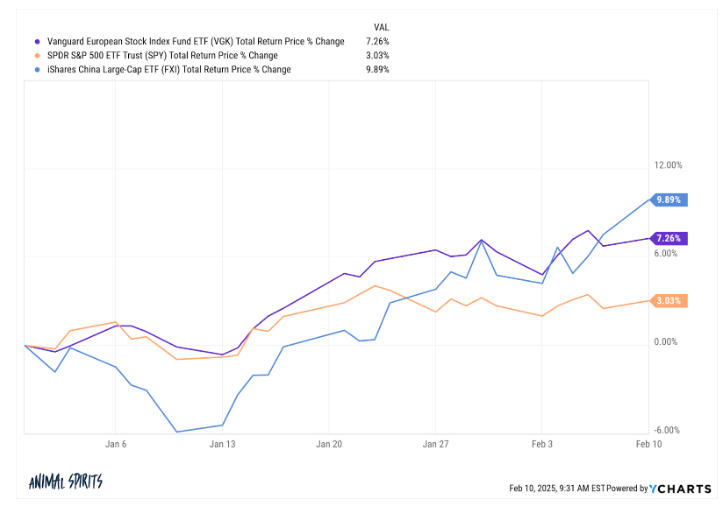

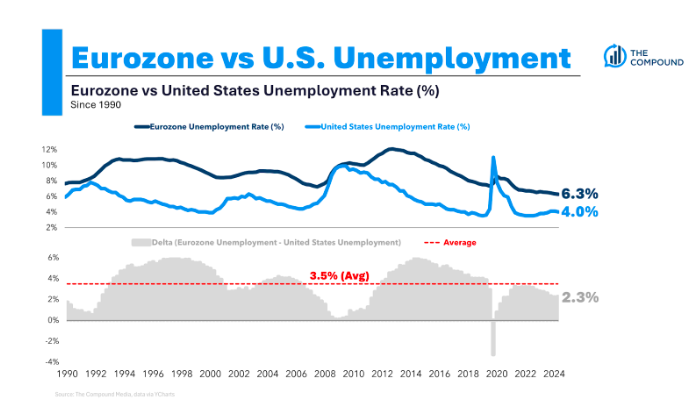

- Europe: The Slow and Steady Train

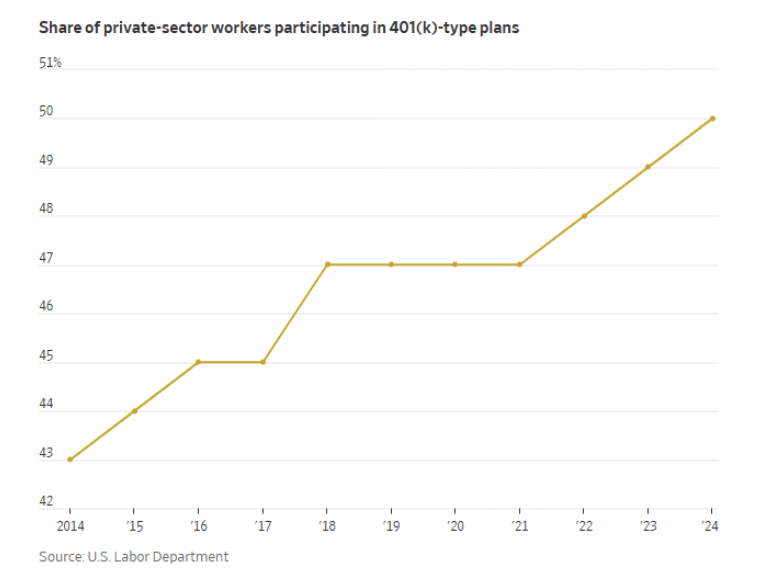

- The 401(k) Has Reached a Tipping Point in Its Takeover of American Retirement

- Blackstone’s BREIT hole keeps growing

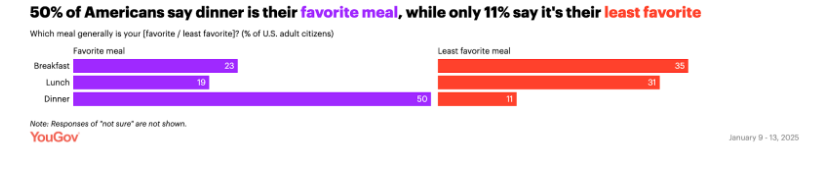

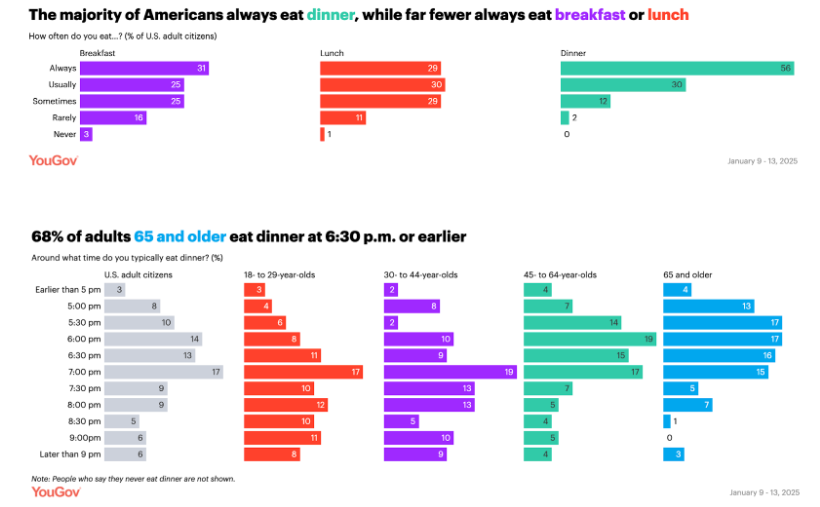

- Most Americans watch TV during dinner; 41% talk to the people they’re with

- RFK Jr. had up to $1.2 million in credit card debt — what experts say about tackling high balances

- Is $1 Million Still a Lot of Money?

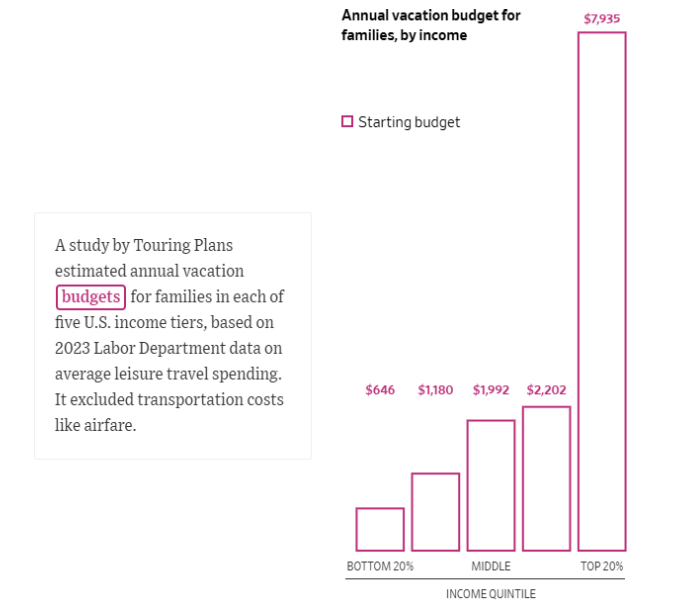

- Even Disney Is Worried About the High Cost of a Disney Vacation

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

— Dan (@robustus) February 7, 2025

This is a favorable development. Big businesses generally pay better, do more training, engage less in wage theft and other abuses and have more upward mobility. https://t.co/u318dPtPgq

— Jason Furman (@jasonfurman) February 8, 2025

$BABA acquiring 10% stake in DeepSeek pic.twitter.com/eVVM3i2lEG

— The Long Investor (@TheLongInvest) February 7, 2025

The median age of buyers increased to a peak of 56 years old, up from 49. The median first-time buyer age increased to 38, increasing from 35, while the typical repeat buyer age also increased to 61 from 58. These are all record highs. pic.twitter.com/E9S6MEDYDy

— NAR Research (@NAR_Research) February 7, 2025

“.. 17.2% of U.S. homeowners with mortgages have an interest rate greater than or equal to 6% … highest share since 2016 ..”- Liz Ann Sonders

— Carl Quintanilla (@carlquintanilla.bsky.social) 2025-02-07T12:54:22.971Z

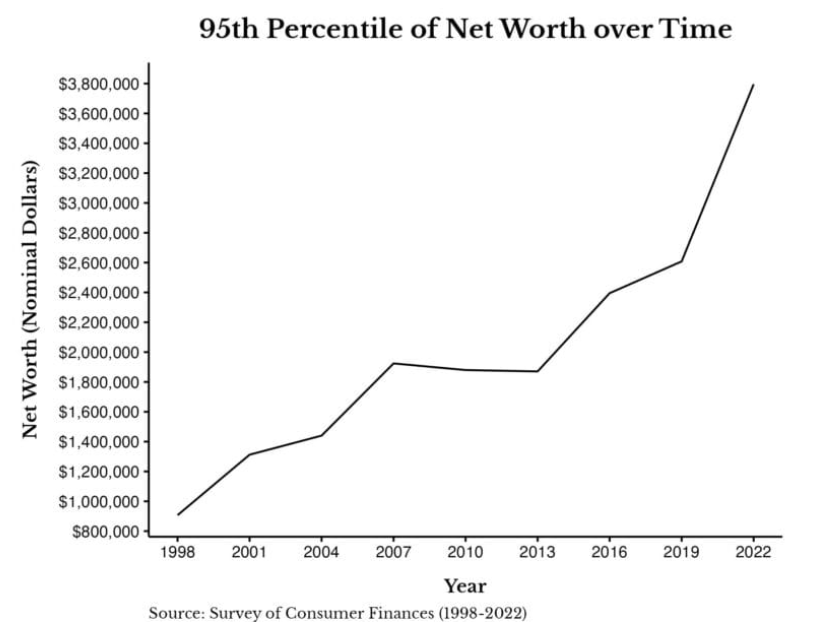

The easiest way to tell if someone is out of touch financially—ask them whether they think $1 million is a lot of money.

Hint: It is. It's not what it used to be, but it still is.

— Nick Maggiulli (@dollarsanddata) January 30, 2025

🎬'Billy Madison' starring Adam Sandler premiered in theaters 30 years ago, February 10, 1995 pic.twitter.com/QY8PJTmhYY

— RetroNewsNow (@RetroNewsNow) February 11, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product