Today’s Animal Spirits is brought to you by KraneShares:

See here to learn more about $KWEB and KraneShare’s full suite of China exposures

Come see us in Naples this February!

See here for more information on FutureProof Citywide and here if you are interested in the emerging manager showcase

Get a random Animal Spirits chart here

On today’s show, we discuss:

- Why Oaktree’s Howard Marks Is on the Watch for a Market Bubble

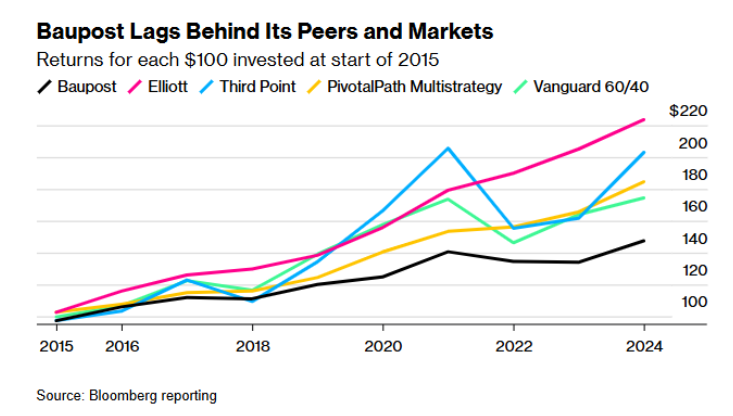

- Hedge Fund Clients Pulled $7 Billion From Elite Money Manager Since 2021

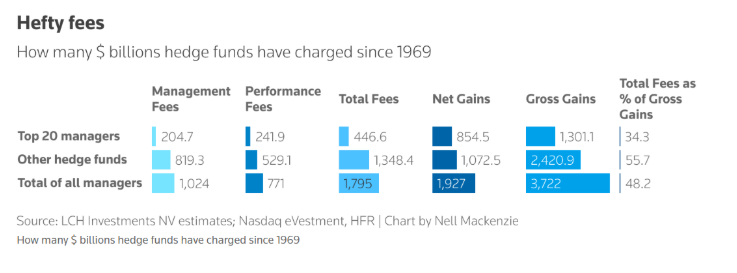

- Hedge funds have charged almost $2 trillion in fees since 1969, says LCH

- Three Things I Think I Think – Weekend Reading

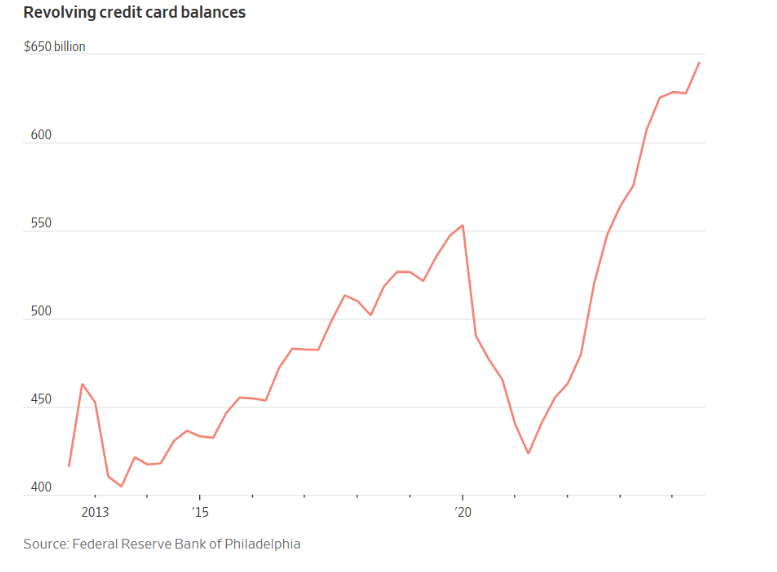

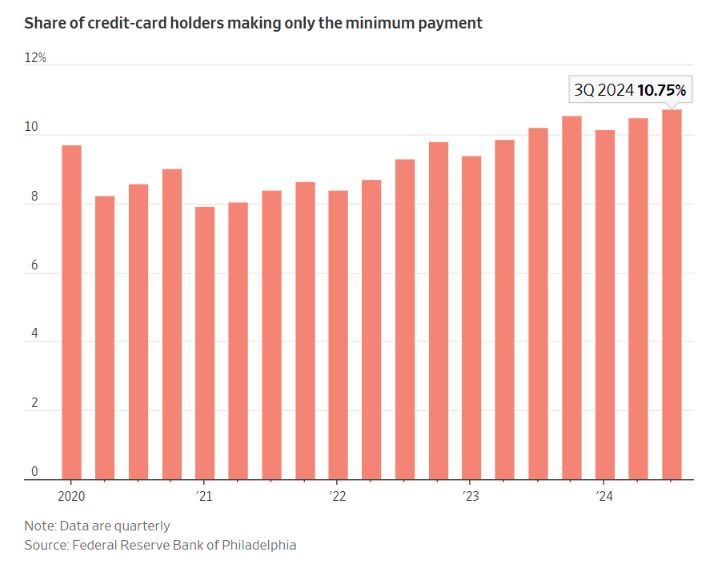

- Americans Are Carrying Bigger Credit-Card Balances

- Home Economics No. 1: Living in Brooklyn on $466k joint income

- ‘World’s first downside protected bitcoin ETF’: Calamos unveils a safer way to play crypto

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

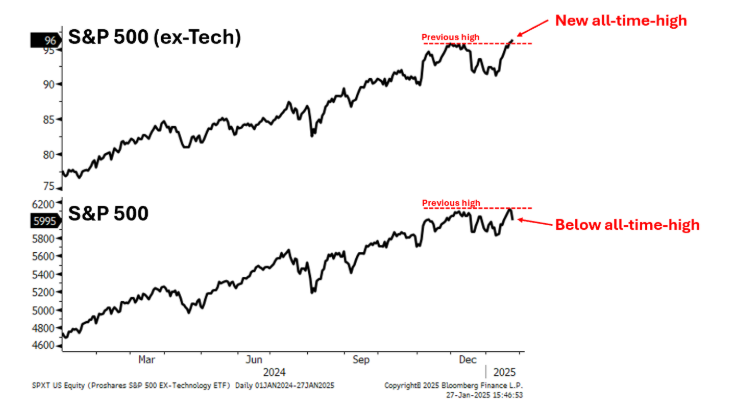

YARDENI: DeepSeek “might be bad news for the Mag-7 .. It might not be a happy development for Nvidia .. “.. On the other hand, it might mean that AI systems will be more accessible and cheaper. If so, the best way to play AI might be the S&P 493 companies that will be cutting their costs ..”

— Carl Quintanilla (@carlquintanilla.bsky.social) 2025-01-26T14:55:53.385Z

Value's best day vs Growth since October 2008 $SPYV $SPYG pic.twitter.com/x4j2sqc96A

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 27, 2025

Even with the S&P 500 losing nearly -1.5%, more than 300 of its stocks rose today.

Since the index became a 500-stock index in 1957, this had never happened before.

The only days with more than 250 advancers were:

• April 14, 1999

• April 19, 1999

• April 12, 2000— Jason Goepfert (@jasongoepfert) January 27, 2025

$NVDA – RETAIL INVESTORS BOUGHT RECORD $562.18 MLN NVIDIA STOCK DURING MONDAY'S DEEPSEEK-LED ROUT – VANDA RESEARCH

— *Walter Bloomberg (@DeItaone) January 28, 2025

The ETF S&Preakness started as a one-horse race in 1993.

Today, there are four in the field and the chase for market share is setting up for a photo finish among the top 3.

Source: @MorningstarInc Direct. Data as of Jan. 23, 2025. pic.twitter.com/acpLVQUWRr

— Ben Johnson, CFA (@MstarBenJohnson) January 24, 2025

So far this month, there were just 98 companies where at least one insider purchased the company's shares, vs. 447 at which at least one insider sold … that buy-sell ratio (0.22) is on track to be the lowest on record (going back to 1988) per Washington Service@business pic.twitter.com/sMx0OVRJ3y

— Kevin Gordon (@KevRGordon) January 24, 2025

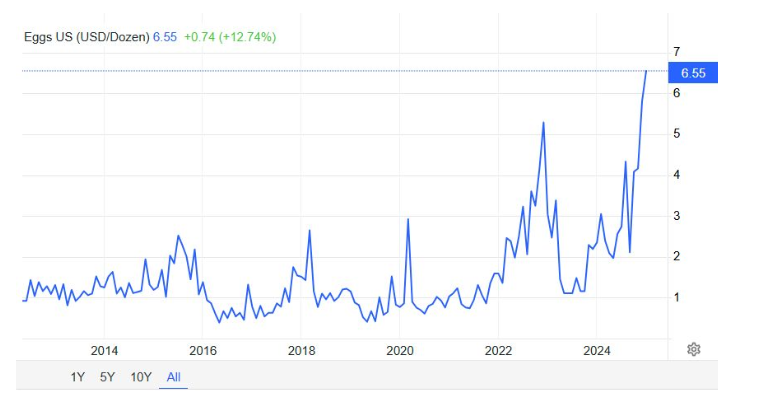

A dozen eggs +$4 YoY pic.twitter.com/uHh1dnkevb

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 28, 2025

We need to rethink our listing process at @coinbase given there are ~1m tokens a week being created now, and growing. High quality problem to have, but evaluating each one by one is no longer feasible. And regulators need to understand that applying for approval for each one is…

— Brian Armstrong (@brian_armstrong) January 26, 2025

https://twiter.com/intangiblecoins/status/1882093309507850634

NEW: @TuttleCapital just filed for 10 different leveraged crypto asset ETFs. Including a bunch of memecoin products and assets that don't have ETPs yet. pic.twitter.com/i8X0rSdbK7

— James Seyffart (@JSeyff) January 27, 2025

Follow us on Instagram, and YouTube.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product