A reader asks:

I am a Marine Corps Infantry Veteran and my wife is now an Air Force Officer (struck gold). We got married and bought a home in 2020 benefiting from the low rates at 2.4% and were lucky enough that the home appreciated 25% in 3 years when we were forced to sell due to military orders changing. By then rates were way up and we are now locked into, what I think, is an overheated market at 6.25%. We have orders coming up again and we are struggling with flipping back and forth between buying and selling homes, renting the home we own out, or just calling it quits and selling and renting ourselves until she is out of the military. Any advice on forced timing?

We get a lot of interesting questions on Ask the Compound from members of the armed services. I’m sure this is a topic many service members have grappled with.

Homeownership was already the American Dream but the 2020s took the FOMO to new levels for those who missed out on the greatest housing bull market this country has ever seen.1

If you didn’t own a home it almost felt irresponsible even though no one could have possibly predicted a pandemic would cause the largest home price increase on record.

Here’s the thing — owning a home is not for everyone. This is true regardless of the direction of home prices.

There are many benefits to homeownership. A house is a great inflation hedge. It’s a place to call your own, so there is psychic income involved. You can build equity over time so it’s a decent savings vehicle.

But there are downsides to homeownership.

A house is an illiquid financial asset. You can’t spend it. It’s nearly impossible to calculate the return on investment. There are loads of ancillary costs attached to a home. The frictions involved make it costly to buy and sell. You lose flexibility when owning a home.

Those last two points are the most important variables for this question.

When buying a home there are closing costs and moving costs. Then when you sell you pay those again in addition to realtor fees.

You also have to take into account the fact that the majority of your payments early in the life of a loan go towards servicing the debt.

That wasn’t great when rates were 2.4%. In the first few years of a 30 year fixed rate mortgage you would be paying roughly half of your monthly payment to principal and half to interest.

But things are much worse at higher mortgage rates.

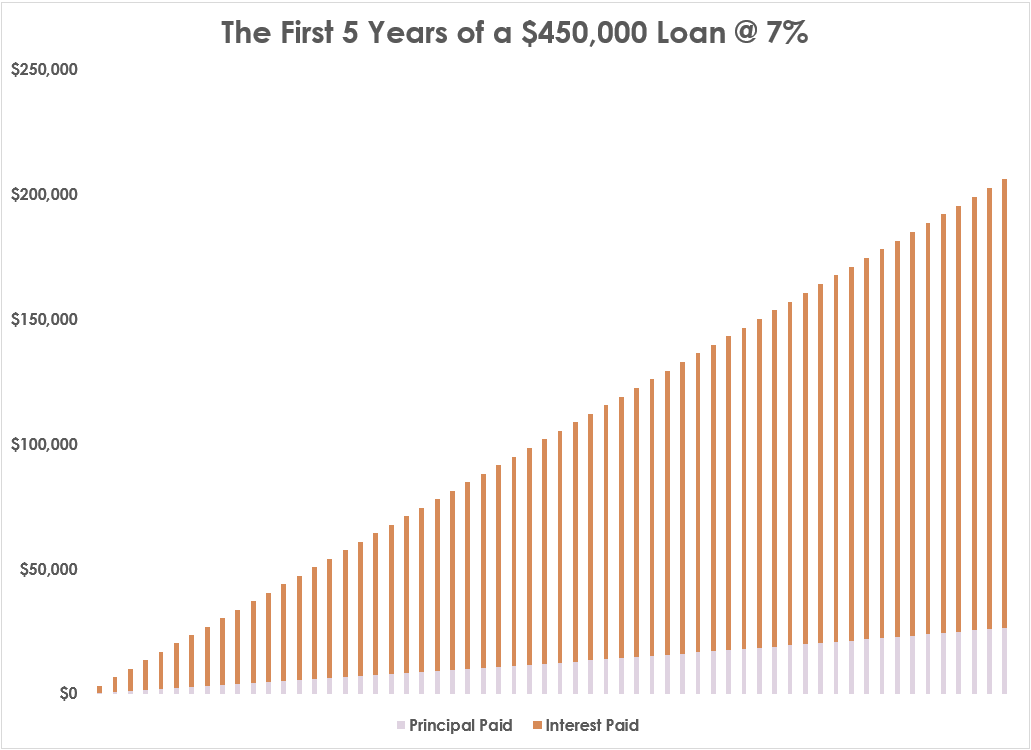

Here’s a look at the breakdown between principal and interest payments in the first 5 years of a 30 year fixed rate mortgage of $450k at prevailing rates of 7%:

Just 12% of the monthly payment goes towards principal repayment at the outset. Even after 60 payments you would still see 17% go to principal while 83% of the monthly payment goes to interest.

On a 7% loan the principal paydown doesn’t match the interest part of the payment until year 20. Obviously, the hope would be you could refinance at some point.

But the main takeaway here is that buying a home and owning it for a few years is a very high hurdle rate after factoring in all fees, expenses and the nature of the payments early in the life of the loan.

You would need to experience some healthy price gains to make the math work. Now, you could also take an interest-only loan but now is simply not a great time to be in the house trading business.

Factor in the fact that demand has slowed to a crawl because buyers don’t want to take on 7% mortgage rates and you could be stuck owning a home you don’t want anymore when you get deployed to another base.

There are plenty of personal finance experts who look down on renting.

Why would you pay someone else’s mortgage for them???

I am a homeowner but it’s not for everyone.

The finances certainly matter in a decision like this but you also have to think about the headache ratio on these choices.

Renting gives you much more flexibility and allows you to avoid the many stresses that exist in the home-buying and selling process.

It’s hard to put a price on flexibility especially when your lifestyle requires it.

Homeownership isn’t for everyone.

We covered this question on the last Ask the Compound of 2024:

We also hit on questions about the optimal savings rate for retirement, covered call option strategies vs. bonds, how to hedge your real estate portfolio and some investment advice for an 18 year old investor who wants to retire a multi-millionaire.

Further Reading:

What is the Historical Rate of Return on Housing?

1I suppose you could talk me into the land grab in the 1800s like Tom Cruise in Far & Away.