“We must base our asset allocation not on the probabilities of choosing the right allocation but on the consequences of choosing the wrong allocation.” – Jack Bogle

One of the most important decisions investors have to make when constructing a portfolio is how to spread their investments between stocks, bonds, cash and other investments. Asset allocation plays a critical role in determining investment performance and risk tolerance.

Historically speaking, stocks have given investors the best odds at increasing their savings over the long-term while bonds have offered an option to reduce the risk of large short-term losses.

Generally the rule of thumb has always been that a stock-heavy portfolio is much more volatile than one that holds a higher weighting in bonds. Perception plays a huge role in how investors view portfolio risk, but lower volatility tends to make investors feel safer.

Let’s look at a simple example to see another way to decrease portfolio risk over time. Assume a young person starts saving at age 30. They plan to save and invest until they retire by age 65, a 35 year time horizon to compound their money. Let’s also assume that our hypothetical saver starts out making $40,000 a year, with 3% annual salary increases for cost of living adjustments.

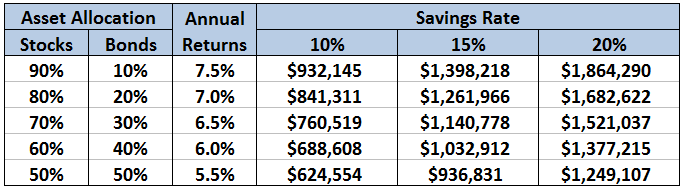

Using long-term return assumptions of 8% for stocks and 3% for bonds, here are the ending balances by asset allocation and savings rates:

What should stand out here is that saving more money reduces risk, either by allowing this investor to take less equity exposure or by increasing the compounded returns in a stock-heavy portfolio.

The ending balance for the 50/50 allocation under a 15% savings rates turns out to be higher than the 90/10 allocation under a 10% savings rate. Jump up to a 20% savings rate and a 60/40 portfolio is nearly in line with a 90/10 portfolio at the 15% rate of savings.

Think of this another way — over 35 years at these assumed rates of return, a 5% annual increase in savings would produce roughly 1.5-2.0% per year in annual investment gains. Portfolio managers would kill for that type of performance boost.

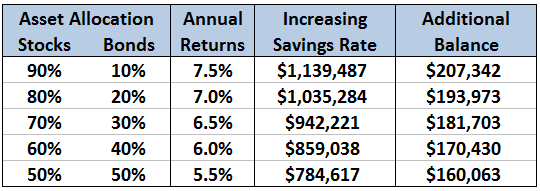

Since not many young people are able to start out saving 15-20% of their income right off the bat, let’s see how the results would change in this example if we slowly bumped up the savings rate each year by 1.5% of the previous year’s rate. So we start out by saving 10% of salary in year one and increase it to 10.15% the next year and 10.30% the year after that and so on (ending up saving 16.59% in the last year).

Here are the results:

The additional balance in the furthest column to the right shows the increase over simply sticking with a 10% savings rate for the entire period. Each of these balances saw a 20%+ improvement over the initial value that didn’t include the incremental increase in the savings rate.

You can quibble with the stock and bond return assumptions, but they are impossible to predict looking 35 years out into the future. And the investment performance is beside the point.

The point is that saving more money reduces risk, regardless of if you define risk as owning more stocks or running out of money.

A difficult concept for many investors to understand is that saving more (or having a large enough portfolio to meet your goals) allows you to take less risk with your investments. There’s no need to be invested 100% in stocks when a 4 percent annual return is sufficient to meet your goals.

Yeah many right now are worried about lower returns going forward. Saving more money is the ultimate solution if this happens.

[…] Asset Allocation […]

Saving more or as much as you can, in the end, is the best form of risk.

Good post.

Mark

Thanks Mark. Not the sexy answer but the right one for the majority of investors.

[…] way of trying to offset the risk of bad market outcomes in (and near) retirement. Ben Carlson at A Wealth of Common Sense has a post up showing the power of increased saving rates to help offset lower market returns. He […]

[…] not a top call or a trading tactic you can implement right now to hedge out your portfolio, but saving more money is still one of the best ways to reduce your risk in the […]

[…] not a top call or a trading tactic you can implement right now to hedge out your portfolio, but saving more money is still one of the best ways to reduce your risk in the markets. Bubble or no bubble, saving more money provides a margin of safety against the […]

[…] of compounding. Every 1% you increase your savings rate could translate into the equivalent of 0.4% in annual investment gains. So a 5% increase in your savings rate could add up to 1.5-2.0% a year to your bottom […]

[…] Further Reading: When Saving Trumps Investing A Simple Way to Reduce Portfolio Risk […]

Thank you for this information.