Today’s Talk Your Book is sponsored by Victory Capital:

On today’s show, we spoke with Michael Mack of Victory Capital to discuss their small cap and large cap free cash flow strategies.

On today’s show, we discuss:

- How to define free cash flow

- The difference between cash flow and net income

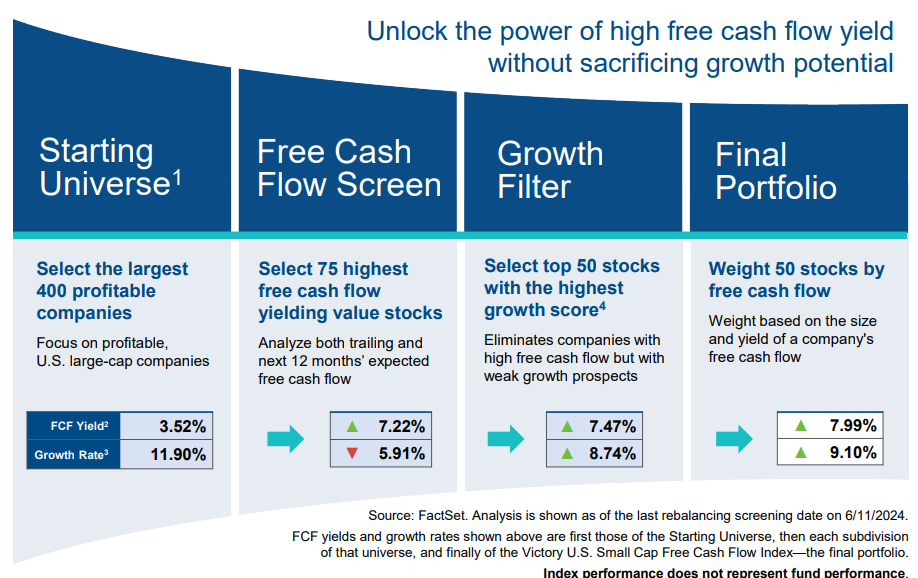

- How the free cash flow screen removes companies from the portfolio

- The valuation of free cash flow strategies

- The typical sector for high free cash flow companies

- The Mag 7 screening into free cash flow strategies

- Why IBM has been a false positive for high free cash flow

- When the strategy will sell a stock and why

- Why there aren’t any Mag 7 stocks in the free cash flow fund today

Listen here:

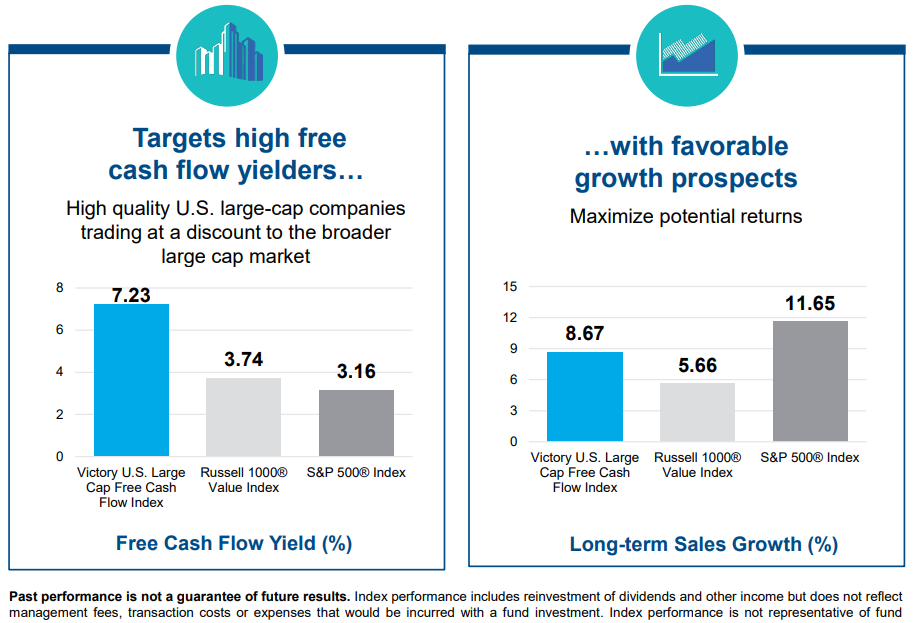

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Remember, all investing involves risk. VictoryShares ETFs are distributed by Foreside Fund Services, LLC. And you can visit victoryshares.com for details and prospectuses

The VictoryShares Free Cash Flow ETF (VFLO) seeks to provide investment results that track the performance of the Victory U.S. Large Cap Free Cash Flow Index before fees and expenses.

The VictoryShares Small Cap Free Cash Flow ETF (SFLO) seeks to provide investment results that track the performance of the Victory U.S. Small Cap Free Cash Flow Index.

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.