I enjoy slicing and dicing historical stock market returns.

I’m not naive enough to assume this helps predict the future. However, studying the past can provide a baseline to help set expectations when it comes to risk and a potential range of outcomes.

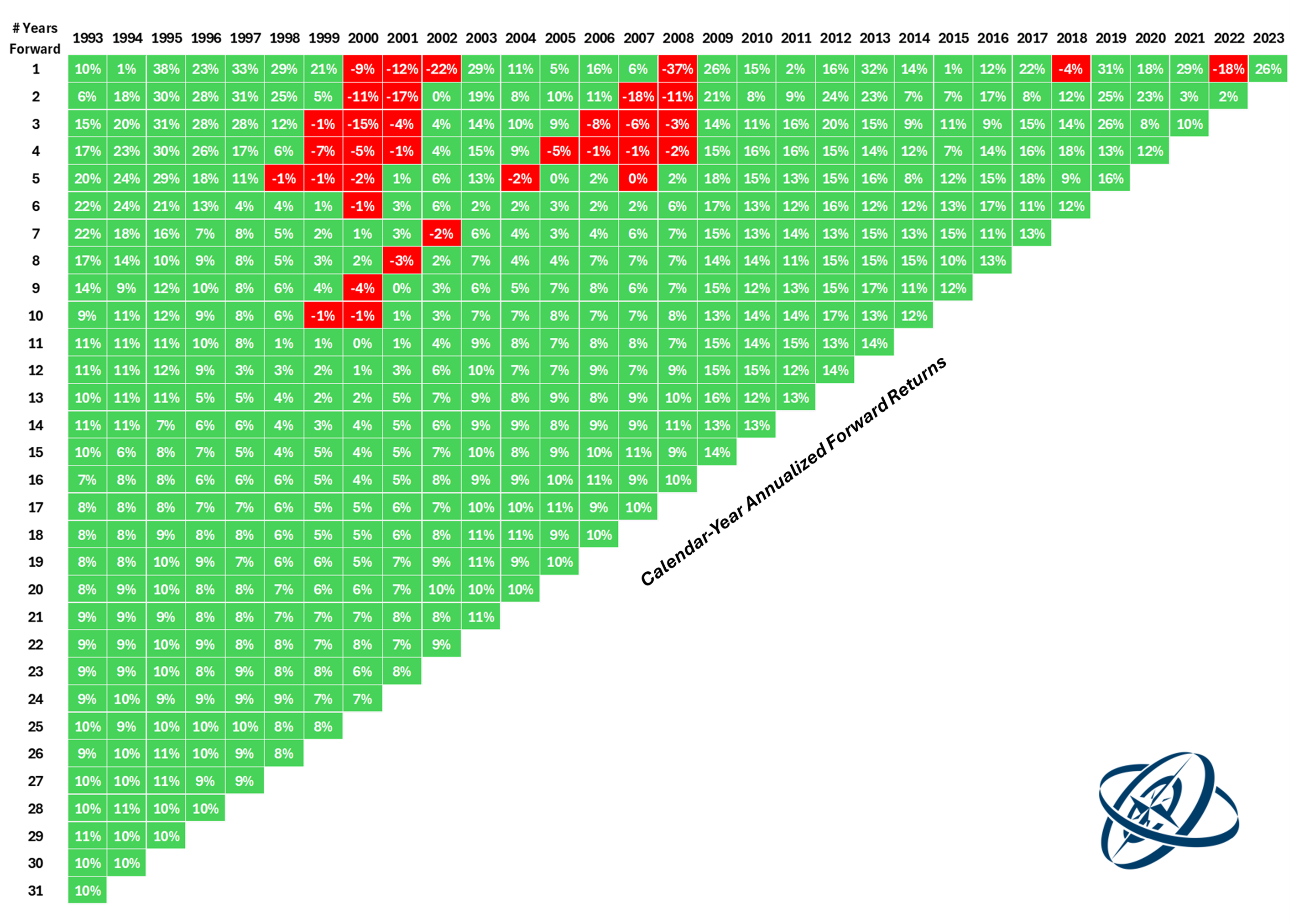

Here’s a different way to look at returns over various time horizons for the S&P 500 going back to 1993:

This is how to read this chart:

Pick a starting year. Then, go down the number of years and the corresponding square will tell you the annualized return from that starting point.

For example, the 9-year annual return starting in 1993 was 14% per year.

You can see there’s been more green than red since 1993 but there were some painful periods for investors.

There were no losses going out 11 years or more but starting in 1999 or 2000 led to a lost decade. You also had multiple time frames with losses going out 2, 3, 4 and 5 years into the future. Five years can feel like an eternity in the stock market.

The range of outcomes is also interesting to consider.

The 10 year annual returns ranged from -1% to 17%. Over 15 years there was a high of 14% and a low of 4%. On a 5 year time horizon the range was -2% to 29% annualized.

Your experience in the stock market can vary drastically depending on your timing.

The good news is that the long term removes a lot of variation from the equation. Look at the returns in the bottom left — they’re all in a fairly tight range.

The 31-year annual return from 1993 through 2023 was around 10% per year, right at the long-term averages. Not bad.

Here’s a sampling of some stuff that’s happened over the past 31 years:

An emerging markets currency crisis in 1998, the Long-Term Capital Management blow-up, the dot-com bubble, 9/11, the housing bubble, the Great Financial Crisis, the European Debt Crisis, the pandemic, and the highest inflationary spike in four decades.

We also sprinkled in a few recessions, two massive market crashes, two bear markets, and ten double-digit corrections.

And the stock market still returned 10% per year.

I don’t know what the returns will look like over the next three decades.

But I am confident there will be plenty of risk, downturns, geopolitical crises, scary headlines and economic contractions.

Regardless of what returns the stock market produces in the future, thinking and acting for the long-term remains the most sane strategy for investors.

Further Reading:

The 60/40 Portfolio Win Rate