After the Great Financial Crisis, everyone was trying to figure out how it would impact the coming wave of millennials entering adulthood.

Millennials were getting blamed for killing everything — napkins, diamond rings, chain restaurants, motorcycles, bar soap and more.

Sure, whatever.

The one that never made sense to me was all the pundits predicting millennials would never buy a home or move out of big cities.

I saw what happened to my friends from college. Get a job. Move to a big city. Get married. Eventually move to the suburbs and buy a home.

It’s the circle of life.

Lo and behold, millennials did buy homes.

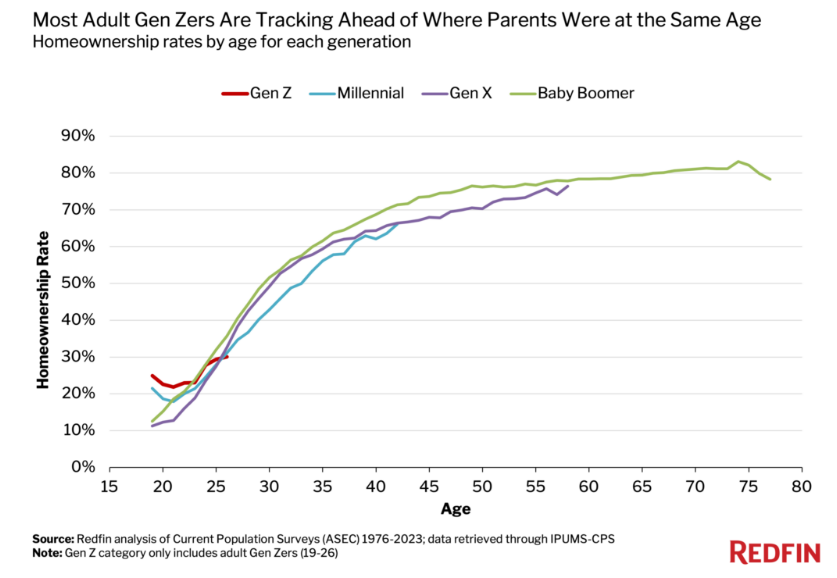

Redfin data shows millennials are more or less on track with previous generations:

It makes sense it took my generation a little longer since more of us went to college and got married later in life than our parents did.

There was also this idea that millennials would never figure out their finances.

Guess what?

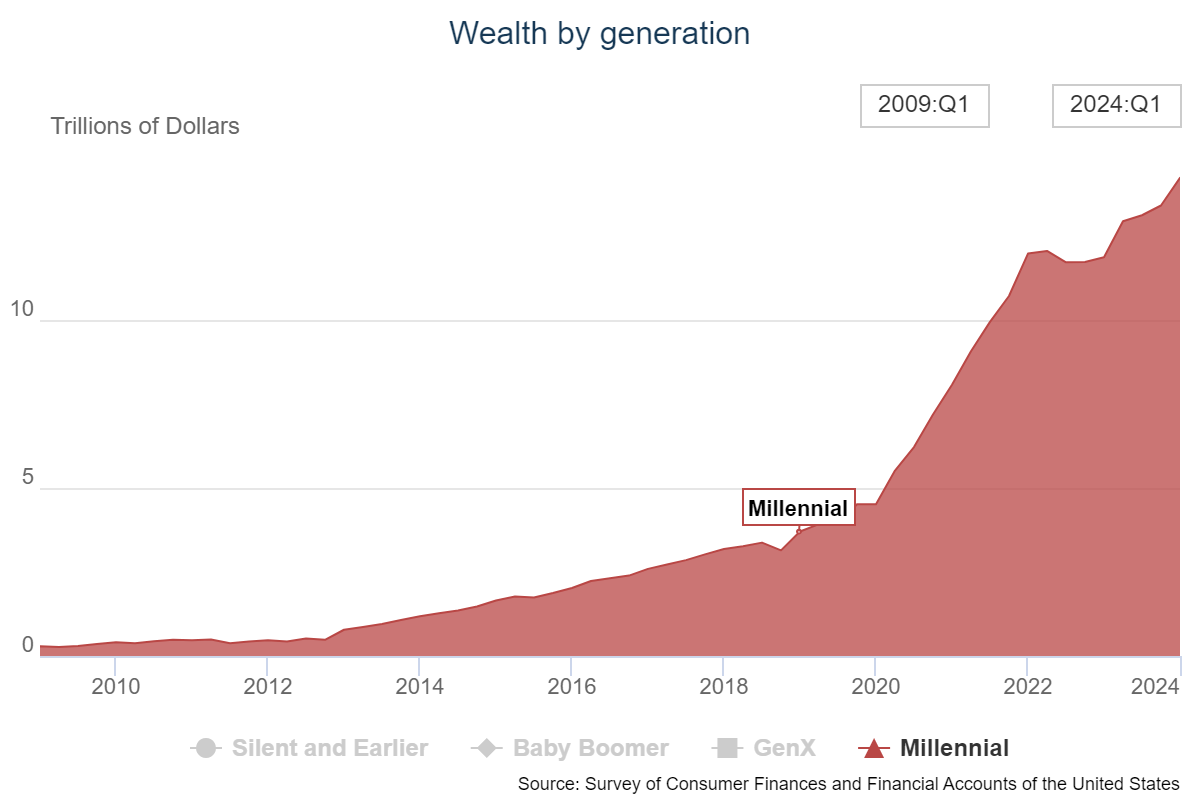

The biggest generation figured it out. And look at the wealth gains we have to show from it:

Baby boomers still control a little more than half the wealth in this country ($78.6 trillion) but millennials have seen their share of wealth go from less than 1% of the total in the U.S. in 2010 to nearly 10% now.

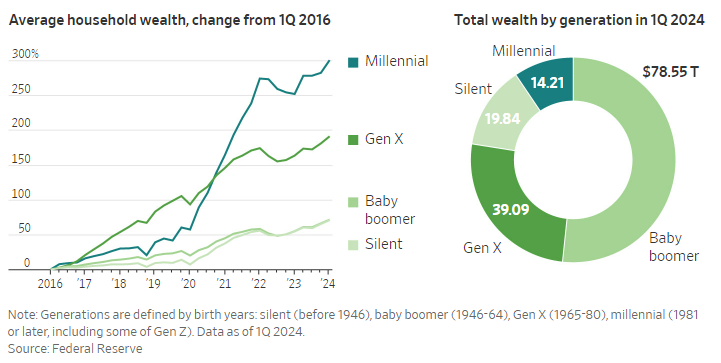

The Wall Street Journal shows millennials have experienced the biggest relative jump in household net worth of any generation since the start of the pandemic:

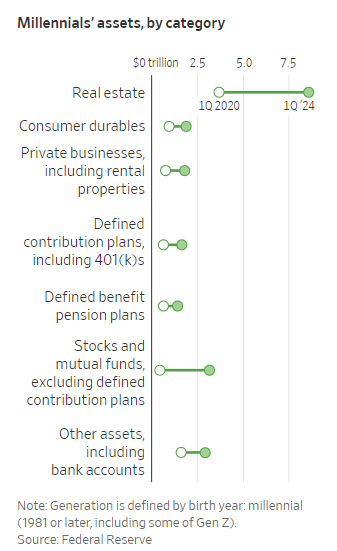

Most of that wealth increase came from real estate:

We’re unlikely to repeat that feat.

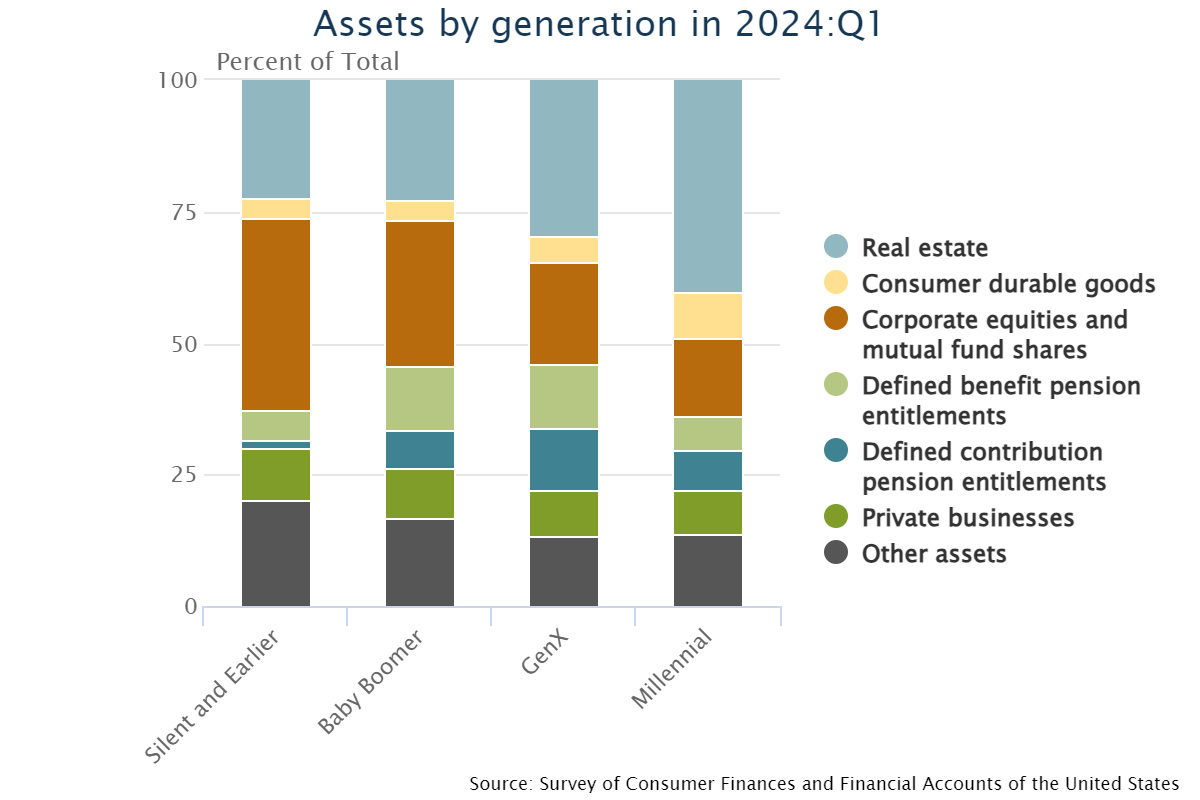

Real estate makes up a much larger portion of financial assets for millennials than the other generations:

I know this seems unsustainable but this is the natural course of an investor’s lifecycle.

The asset mix will change over time as millennials use more of their income (and inheritance) to buy financial assets. In 2003, Gen X had nearly 50% of their wealth tied up in real estate. Millennials currently have 40% of household wealth in housing.

These things evolve as people age.

And although millennials got off to a slow start, the catch-up has been so drastic we are now ahead of baby boomers at the same age. The Journal notes:

In early 2024, millennials and older members of Gen Z had, on average and adjusting for inflation, about 25% more wealth than Gen Xers and baby boomers did at a similar age, according to a St. Louis Fed analysis.

Although housing prices are unlikely to provide the same boost we’ve seen in the 2020s, millennials have other advantages that will one day make them by far the wealthiest generation we’ve ever seen.

Close to 40% of millennials have a college degree (versus 25% for baby boomers and 29% for Gen X). That should lead to higher lifetime incomes.

Plus, a decent portion of that $78 trillion in baby boomer wealth will eventually be passed down to millennials.

Obviously, not every millennial is in the same financial position. There is inequality within generations too. Those who missed out on the biggest housing bull market in history probably feel left behind.

Young people often blame all of life’s problems on the baby boomers or lament the fact that boomers had it so much easier.

This will be millennials someday.

Millennials will be crushed in the future for buying cheap housing the 2010s and getting 3% mortgages in the early-2020s.

Future generations will hate us too.

It’s the generational circle of life.

Like it or not, we’re all becoming our parents.

Further Reading:

The Destiny of Demographics