A reader asks:

I have accumulated quite a bit of the TBIL ETF as readily deployable cash with the added benefit of earning ~5%. My question is – do you see holding too much TBIL as an opportunity cost vs adding more to the S&P 500, especially now that rate cuts are on the horizon?

I’ve been getting a lot of questions in recent months about what to do with an allocation to T-bills.

That 5% yield has felt like a security blanket for many investors. No volatility. Juicy yields.

Now investors are worried about the other side of 5%. The market is pricing in something like 100 basis points in cuts by year-end. The market could be wrong, of course. It’s been wrong all year.

But it seems all but inevitable the Fed cuts in September, November and probably December.

Obviously, there is a difference between readily deployable cash and an allocation to T-bills.

Over the long-run, cash is all but guaranteed to lose out to stocks. From 1928 through 2023, the S&P 500 grew at an annualized rate of 9.8% per year. Three month T-bills were up 3.3% per year in that same time frame.

After inflation, the stock market was up 6.7% per year while cash was barely positive on a real basis, up 0.3% annually.

But on a short-term basis, cash can work as a useful hedge.

In the 96 years ending in 2023, 3-month T-bills outperformed the S&P 500 31 times. So cash beat stocks in one-third of all years.

The average down year for the S&P 500 in that timeframe was a loss of nearly 14%. The average T-bill return in those down years was a gain of 3.4%, good enough for a spread of roughly 17% over stocks.

In 2022, when stocks and bonds were both down double-digits, -18.0% and -17.8%, respectively, cash was up more than 2%.1

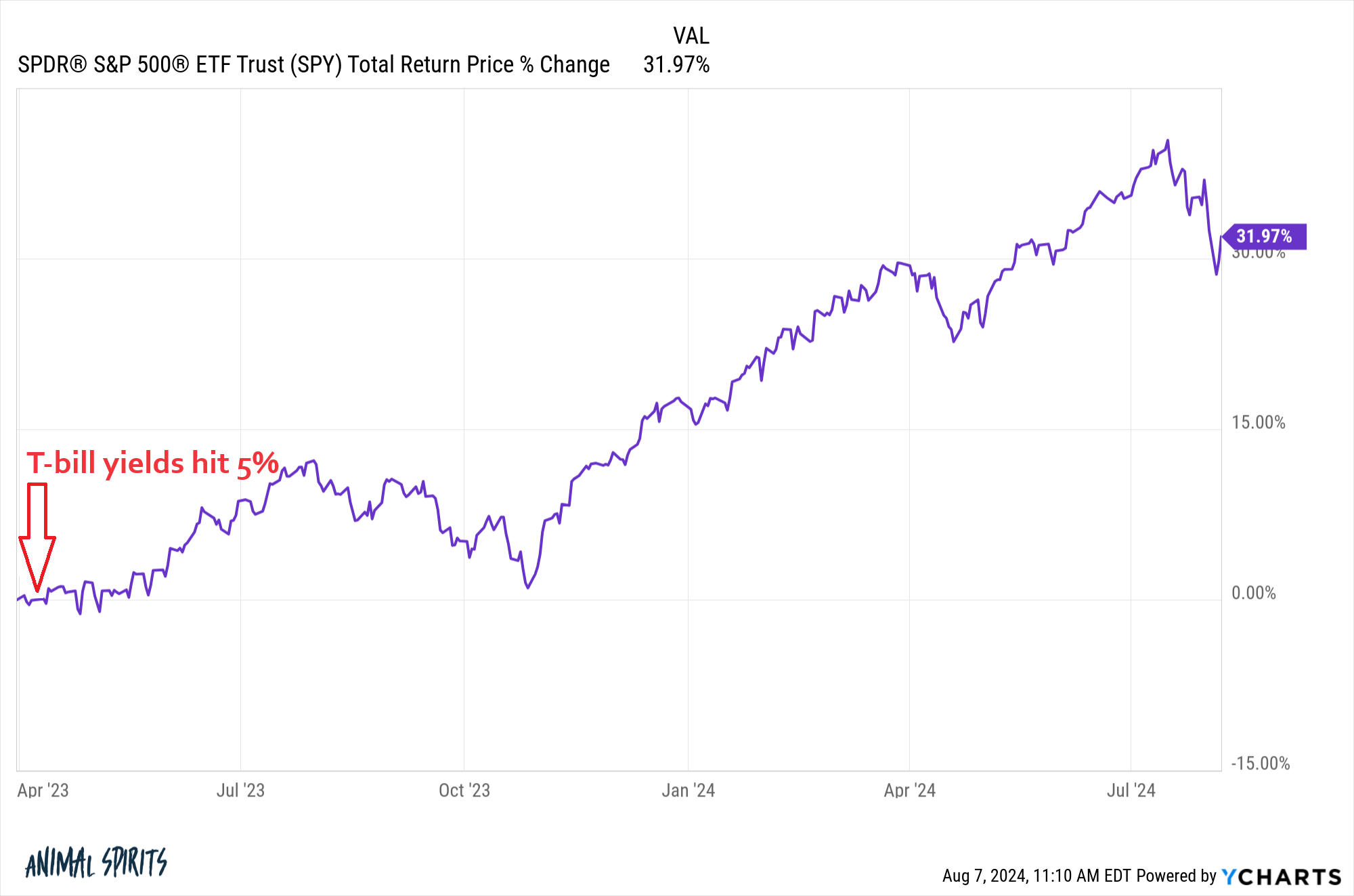

The problem with the current short-run is stocks have beaten T-bills by a handy margin. The 3-month T-bill yield first touched 5% in April 2023. In that time, the S&P 500 is up 32% in total:

While that 5% felt mighty comfortable, there was a huge opportunity cost by accepting that comfort and sitting out of the stock market.

This is what makes market timing so challenging.

If you sold some stocks to sit in cash during the 2022 carnage, you felt pretty good about it. If you sold some stocks to own T-bills when yields hit 5%, you’ve missed out on some healthy gains.

So if you’re sitting on that readily deployable pile of cash, what do you do now?

Unfortunately, there isn’t much good advice when it comes to market timing beyond creating a plan in advance.

If you knew what stocks will do going forward or the timing/magnitude of the rate cuts, this decision would be much easier.

No one knows what the stock market will do. No one knows the path of yields.

Deploying a stockpile of cash requires some combination of market history, context and regret minimization.

The stock market usually goes up. Historically, stocks have been up one year later, roughly three-quarters of the time. Those are pretty decent odds.

But you have to think about the market in the context of where we are currently. We had a pretty decent run in 2023 and stocks are up again in 2024. The panic we experienced on Monday could be a precursor of things to come in terms of volatility.

Most investors trying to time the market would love to put money to work when there is blood in the streets.

This is where regret minimization comes into play.

If you invest all of your cash at once and the market rolls over you’re going to be kicking yourself. If you dollar cost average into the market and it goes up even more you’re going to be kicking yourself. If you wait for a market crash that doesn’t transpire you’re going to be kicking yourself.

My least favorite option is waiting for a crash to deploy cash. Market crashes do happen but they are rare. And the longer you wait for a market correction to occur, the harder it is to put your cash to work.

There is a psychological malfunction that happens to an investor’s brain when missing out on big gains. The longer you wait the bigger the loss has to be before you’re comfortable investing again. So you sit through a 10% correction in hopes of a 20% decline. When the 20% threshold is breached and things seem scary you tell yourself 30% is the number. On and on it goes until market timing turns into a severe cash addiction.

This is why I prefer an automated dollar cost averaging plan. Make the buy decisions ahead of time. Choose a time frame — weekly, every other week, once a month, etc. Split up your purchases into equal chunks and deeply at pre-determined levels.

Most brokerages and fund providers give you the ability to set these purchases in advance.

The time frame or dollar cost averaging interval don’t matter nearly as much as your ability to stick with a plan regardless of what the market does.

And if you want to get more tactical you could always give yourself the ability to crank up your purchases at pre-determined loss levels if the market does crap the bed.

This is not a perfect strategy by any means but the perfect strategy will only be known in hindsight.

Having a plan doesn’t make it any easier to predict which way the markets will go but it does help overcome the psychological burdens of market timing and regret.

You just have to make sure you follow the plan.

We talked about this question on this week’s Ask the Compound:

Mr. Roth IRA himself, Bill Sweet, joined me again to discuss questions about credit unions vs. banks, how the wash sale rule works, student loan forgiveness vs. tax filing status, tax implications from the sale of a rental property and index funds vs. financial advisors.

Further Reading:

The Siren Song of Market Timing

1I’m using 10 year Treasuries as my bond proxy here.