Through the end of May, the S&P 500 has experienced 24 new all-time highs this year alone.

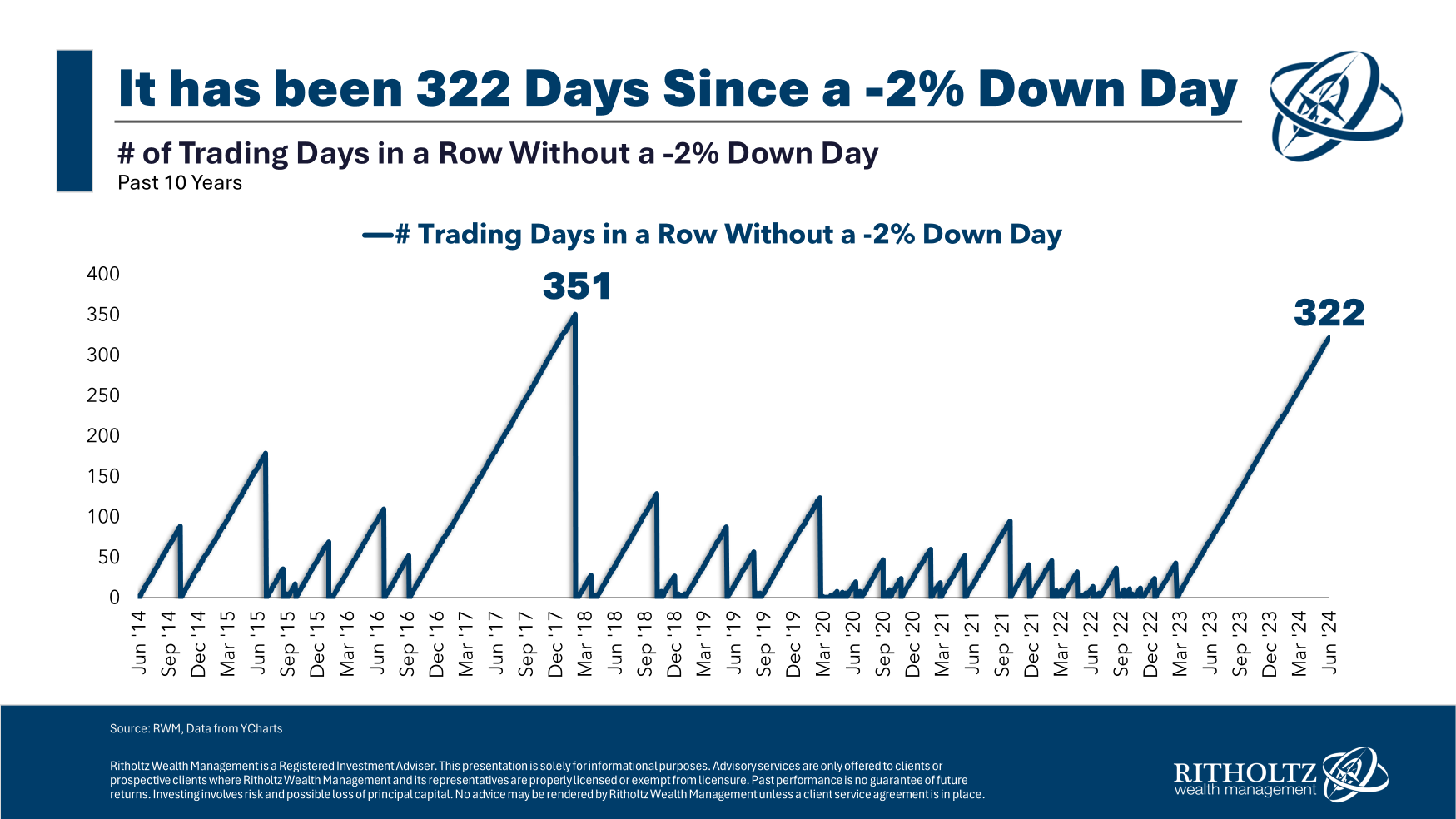

Volatility has been relatively low for some time now. We haven’t had a 2% down day on the S&P 500 in well over 300 trading days:

That’s fast approaching the longest streak without a nasty down day over the past 10 years.

The S&P 500 is up around 11% for the year on a total return basis. That’s pretty good considering it was up more than 26% in 2023.

If you stayed the course by continuing to plow money in your 401k, IRA or brokerage accounts during the 2022 bear market, the market value of your portfolio has never been higher.

Sure, you have to deal with some FOMO and the possibility of greed forcing you to make bad decisions but these are the good times for investors.

Markets are up. Volatility is low. You can earn 5% on your safe assets in T-bills or money markets. There’s not much to complain about when it comes to the financial markets.

I’m not a doomer or someone who tries to predict what the markets will do (especially in the short run) but you should enjoy the good times while they’re here. They won’t last forever. They never do.

In the early-1990s, economist Hyman Minsky published a research paper called The Financial Instability Hypothesis. Minsky wrote, “Over periods of prolonged prosperity, the economy transits from financial relations that make for a stable system to financial relations that make for an unstable system.”

Essentially, stability ultimately leads to instability as investors and businesses throw caution to the wind and take on more risk in the good times, which inevitably leads to the bad times.

Drilling down even further, markets are cyclical.

During the downturns, expectations keep getting revised lower and lower in the midst of bad news. Markets fall and investors get overly pessimistic. The thing is, you don’t even need good news for the tide to turn, just less bad news. It’s not good or bad that matters in the short run but better or worse.

The opposite occurs during uptrends. Expectations keep ratcheting higher and higher as markets rise and investors get overly optimistic. You don’t necessarily need bad news for the good times to end, just less good news.

The key as an investor is to avoid allowing your emotions to match that of the herd.

I like to think about it in terms of lower expectations.

If you lower your return expectations, you’re more likely to stick with your plan when things head south or when greed runs rampant.

Having lower expectations also frees you from the need to constantly predict what’s going to happen next.

If you can’t predict what’s going to happen next, what can you do to prepare?

These two questions can help balance out the dueling emotions of fear and greed

Would I feel comfortable with my current allocation in the event of a steep market sell-off?

Would I feel comfortable with my current allocation in the event of a continuation of the bull market?

I don’t have the ability to predict the length of bull markets or the timing of bear markets.

But I do know you can’t bank on your high watermark in stocks lasting forever. Occasionally, there will be a violent correction that incinerates some of your capital base in the short-term, even if things work out in the long-term.

The time to prepare for that inevitable incineration is when things are going well, not during the actual correction.

Further Reading:

A Necessary Evil in the Stock Market