These are the trailing total returns for the U.S. stock market1 over various time frames:

Year to date: +11%

One year: +30%

Five years: +94%

Ten years: +223%

Fifteen years: +679%

Not bad considering we’ve had two bear markets in the past four years.

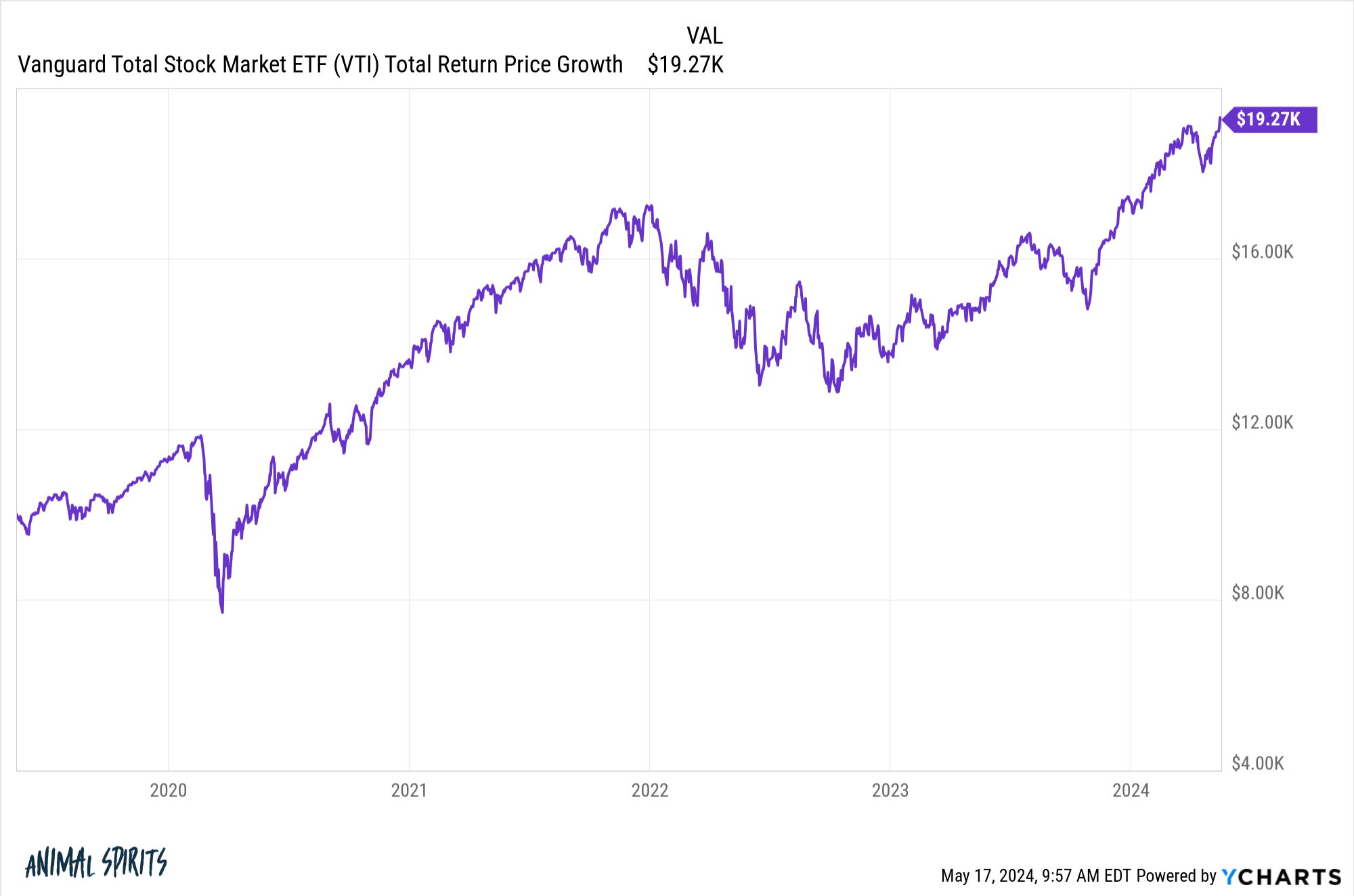

If you put $10,000 into the U.S. stock market five years ago, your money has essentially doubled:

Now look at the returns by year:

2019: +31%

2020: +21%

2021: +26%

2022: -20%

2023: +26%

2024: +11%

The bear market in 2022 was painful but seems like a distant memory given the strength of the market ever since.

Since the start of 2019, the U.S. stock market is up more than 16% per year.

Looking at these numbers, it seems that we should be due for some bad returns or, at the very least, a pause in the action.

Markets are cyclical. Bad stuff tends to follow good stuff and vice versa…eventually.

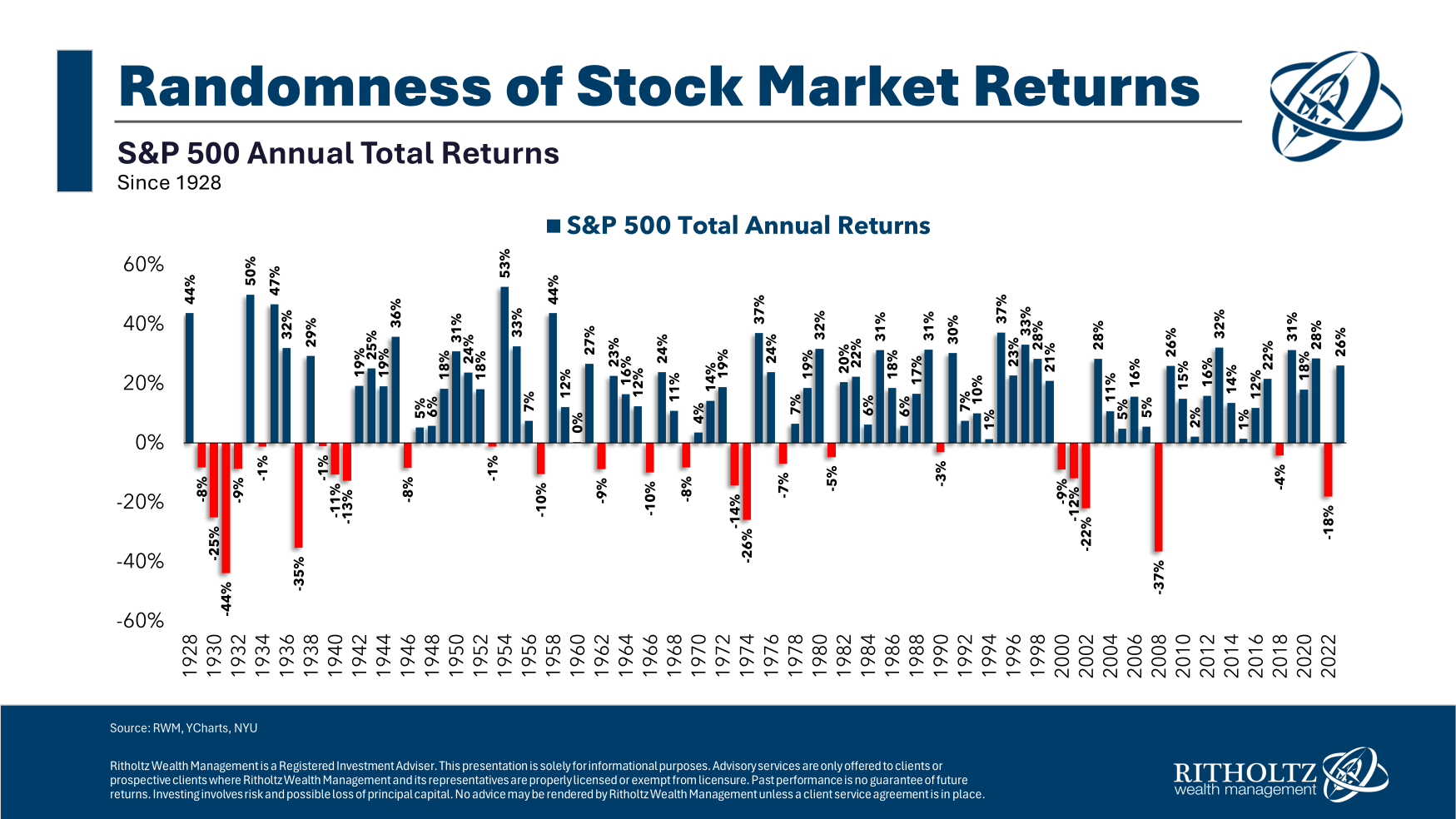

We can’t expect the good times to last forever but you can’t set your watch to these things. The stock market is random, especially over the short-run. Just look at the calendar year returns for the S&P 500 since 1928:

They’re all over the map.

You can’t predict what’s going to happen next based on what just happened. Investing would be a lot easier if you could but it’s not.

A coin is no more likely to come up heads just because tails has hit five times in a row. Just because the roulette wheel was red ten times in a row, doesn’t make it any more likely than usual that black is coming up next.

The gambler’s fallacy is the belief that random events are more or less likely to occur because of the outcomes of previous events.

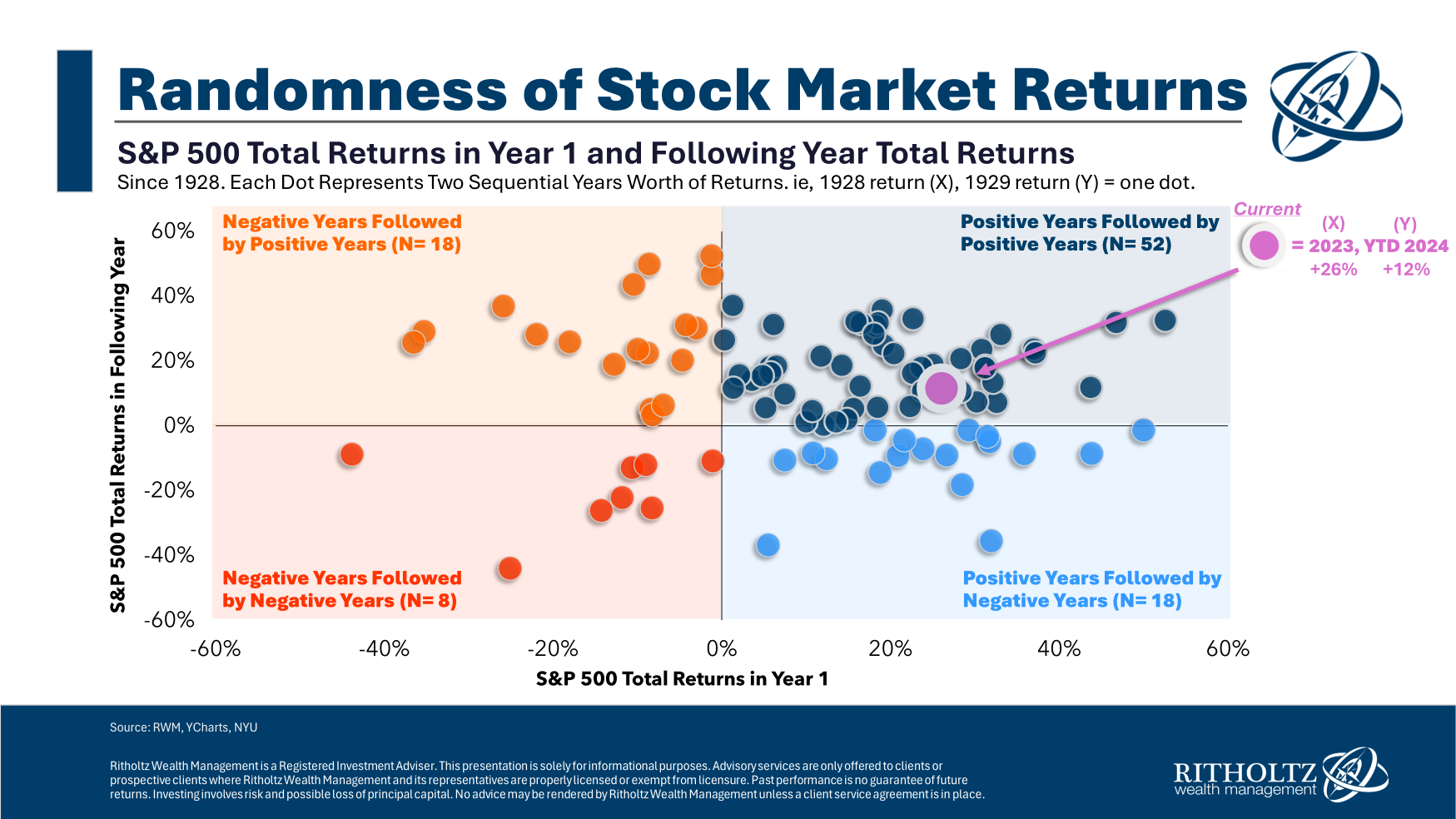

Look at how this plays out in the stock market:

There’s no real predictive power based on what happened previously.

Sometimes good years lead to bad years. Sometimes bad years lead to good years. Sometimes good years lead to good years. Sometimes bad years lead to bad years.

Mean reversion can be a powerful force in the stock market.

But over the short-run things are still pretty random when it comes to market returns.

Michael and I talked stock market performance in recent years and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

30 Years of Financial Market Returns

Now here’s what I’ve been reading lately:

- What a car says about its driver (Irrelevant Investor)

- The wealth of younger Americans is historically high (American Progress)

- Why we love music (Greater Good)

- You don’t need 0% rates for speculation to occur (Sherwood News)

- Josh’s investment philosophy (Downtown Josh Brown)

- My favorite restaurant turns 10 (MLive)

Books:

1I’m using the Vanguard Total U.S. Stock Maret ETF (VTI) here.