The season 3 finale of Lost was one of the most mind-blowing episodes of television I’ve ever watched.

It completely broke the mold of the show from flashbacks to flashforwards. We have to go back is a line that’s etched into my memory for good:

I was blown away.1

We have to go back is how many people feel about the housing market these days.

Like many middle-aged people, I am addicted to Zillow. I check prices whenever I travel to other cities and regularly check housing prices in my area (even though I wouldn’t dream of giving up my 3% mortgage or the house we live in).

My reaction is always the same: I can’t believe prices are so high! Seriously, you’re going to ask for that much for a house in Grand Rapids, MI ?!

The sticker shock is real.

First-time homebuyers would love to see pre-pandemic prices and mortgage rates again. We might get lower mortgage rates in the future but I wouldn’t hold your breath on prices.

While Jack figured out a way to get back to the island in Lost, we’ve likely entered a new normal for housing prices.

We’re likely not going back.

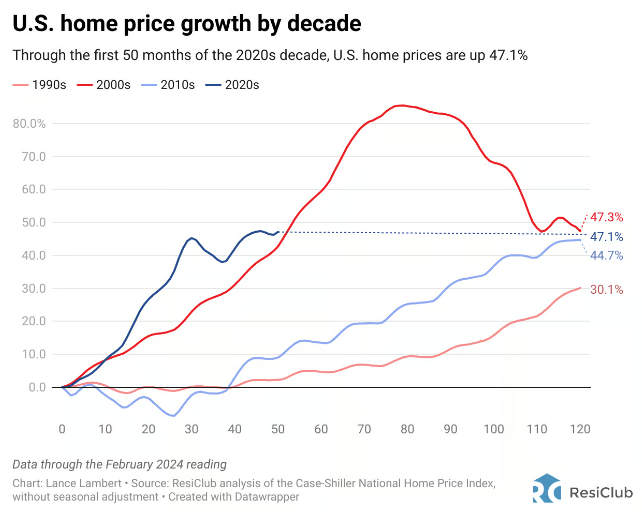

Lance Lambert at ResiClub looked at home price growth by decade going back to the 1990s:

We’ve essentially pulled forward a decade’s worth of growth into a few short years in the 2020s.

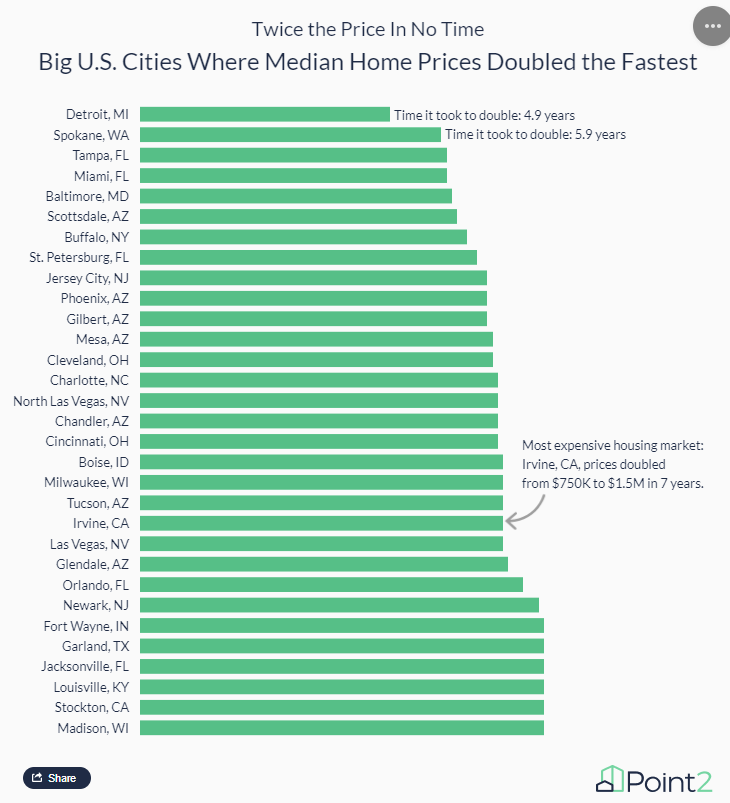

Point 2 Homes looked at the largest cities in the U.S. to determine how long it has taken homes in those areas to double in price. Nearly 70 cities have seen their prices double in less than 10 years.

It took less than five years for housing prices to double in Detroit, and it took just six years for them to double in Miami, Tampa, Baltimore, and Scottsdale.

Here’s the list of the fastest growers:

I’m not saying prices can’t or won’t fall. They can and probably will in certain areas. It’s just impossible to see a complete retracement of prices back to the pre-pandemic days.

Not only are prices higher, but replacement costs are higher. Wages in the construction industry are higher. Then there are those tens of millions of millennials who are in their household formation years.

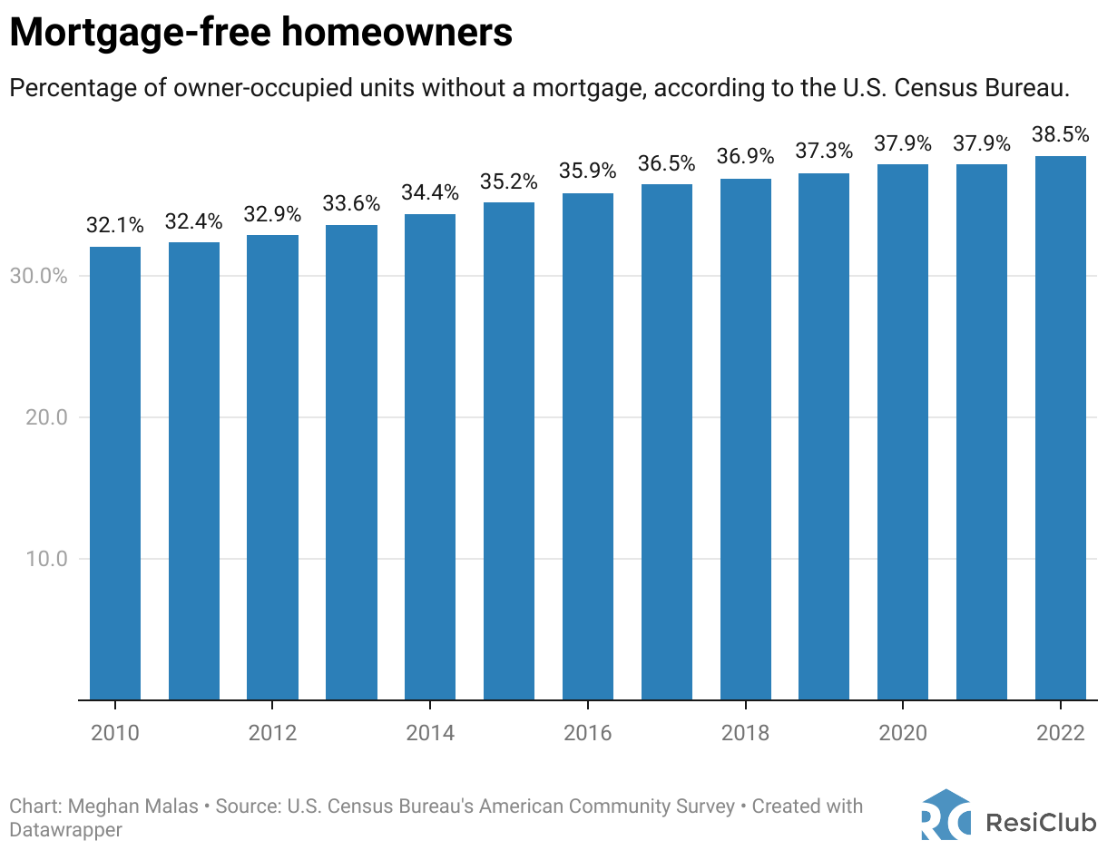

Plus people don’t simply sell their homes for firesale prices just because. This is especially true when you consider nearly 40% of all homeowners have their house paid off free and clear:

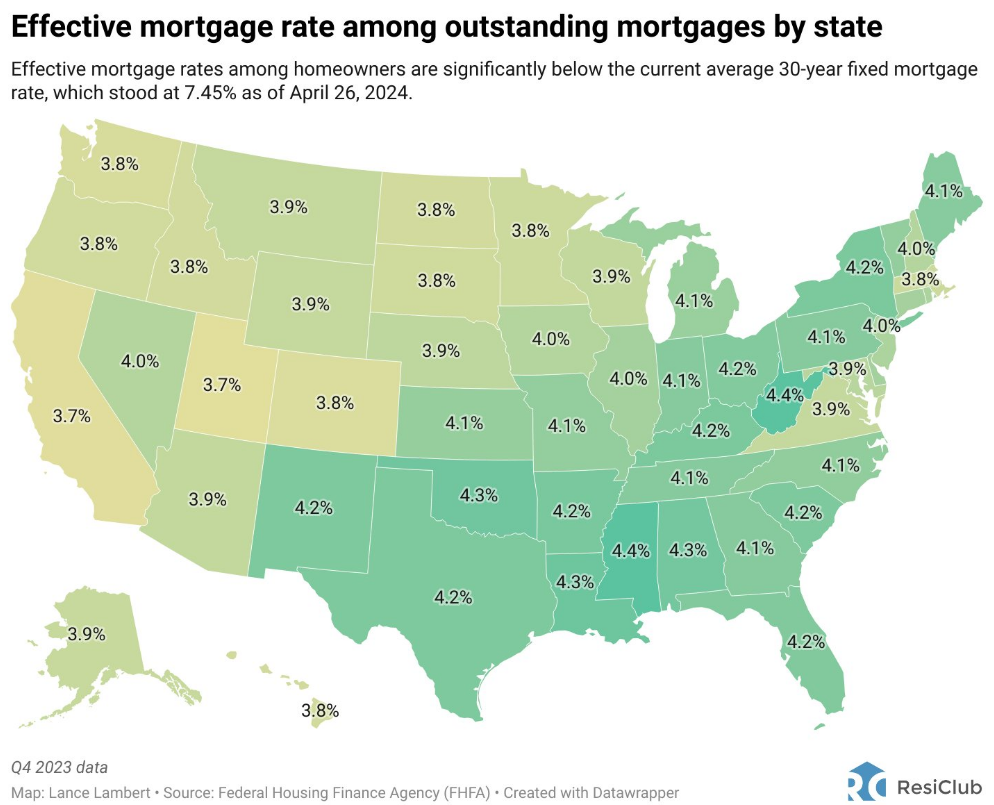

And the majority of people who do have mortgage debt have it at favorable borrowing costs of less than 4%:

Short of an asteroid strike2 or a generational financial crisis, we’re not going back.

Maybe prices will stagnate for the rest of the decade. They could even go a little lower in certain areas. Hopefully rates will come down in the years ahead to make the borrowing costs easier to stomach.

The good news for homeowners is that your house is now worth a lot more than it was when you bought it.

The bad news for homebuyers is that your new house is going to cost a lot more than it did just a few short years ago.

Get used to the new normal of higher housing prices.

Michael and I talked about crazy high housing prices, Lost and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Who is Buying a House in This Market?

Now here’s what I’ve been reading lately:

- The Rithholtz Way (Downtown Josh Brown)

- Dollar cost averaging for your health (A Teachable Moment)

- A case study of successful retirement (Humble Dollar)

- The antidote to envy (More to That)

- The Godfather of American comedy (The Atlantic)

- Clickbait vs. reality (Security Analysis)

Books:

1Not by the final season though. Just dreadful. I hated it. They had no idea how to land the plane on this show (pun intended).

2And even then housing prices might not crash because it will take out supply.