Today’s Animal Spirits is brought to you by YCharts:

See here for more information on YChart’s Advisor Pulse newsletter

On today’s show, we discuss:

- Why Americans suddenly stopped hanging out

- Pods, passive flows, and punters

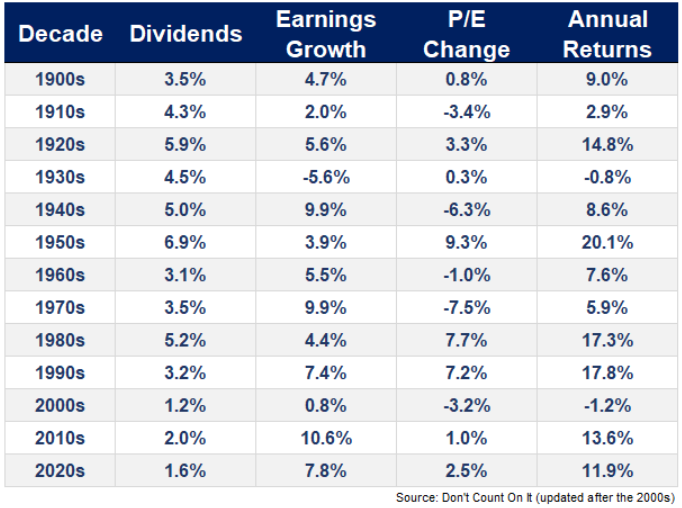

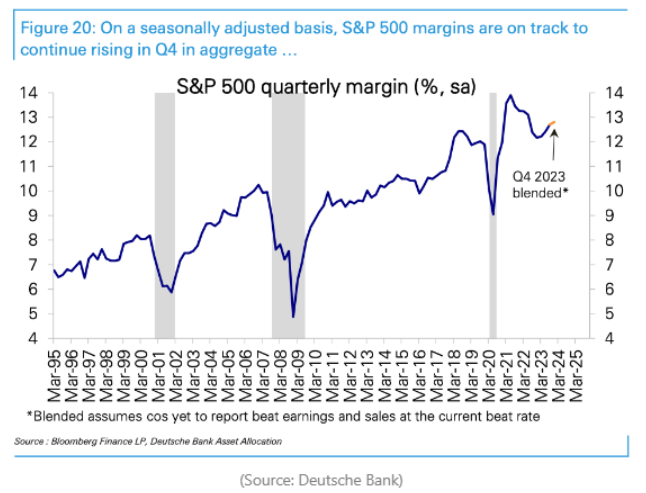

- What’s driving the stock market returns?

- Why not 100% equity?

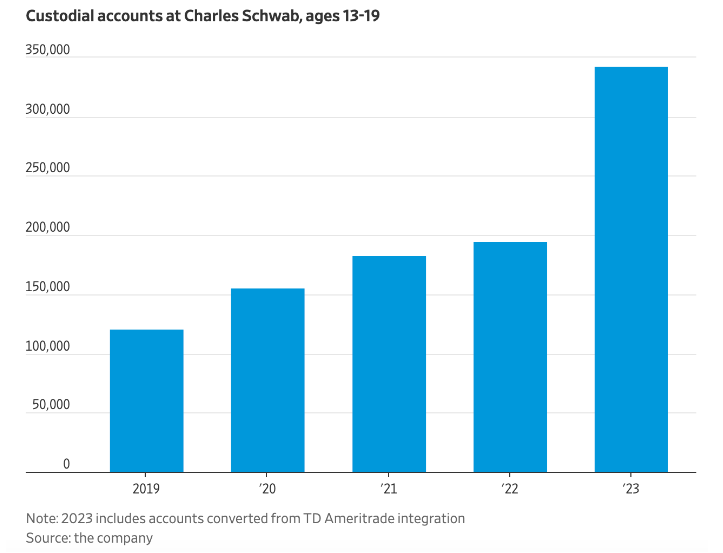

- These teenagers know more about investing than you do

- Young adults are getting used to living on a financial cliff

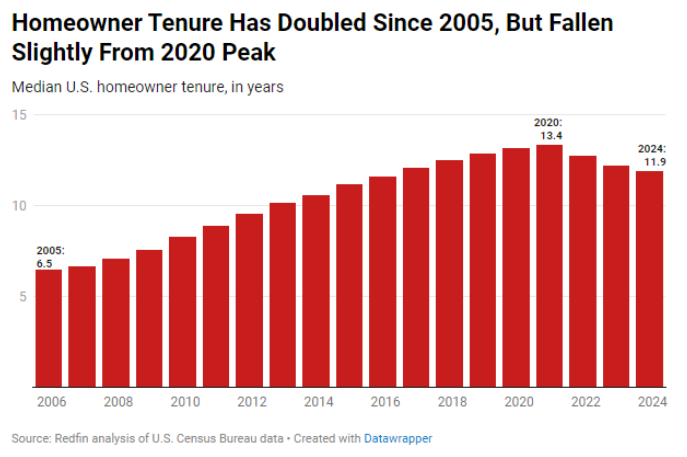

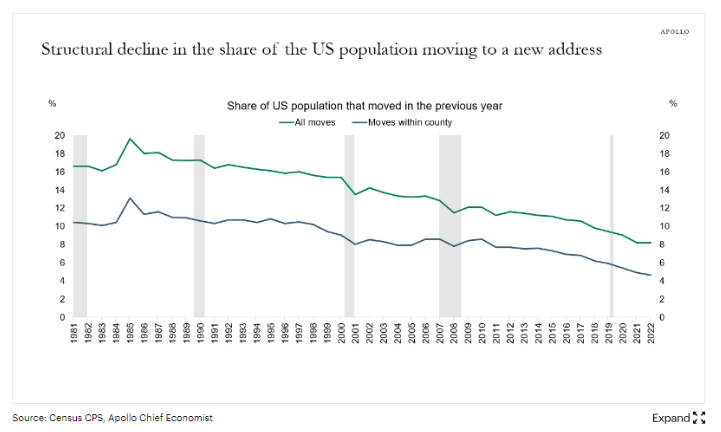

- Homeowners today stay in their homes twice as long as they did in 2005, driven largely by older Americans aging in place

- Why the heck is everyone moving to Beverlywood

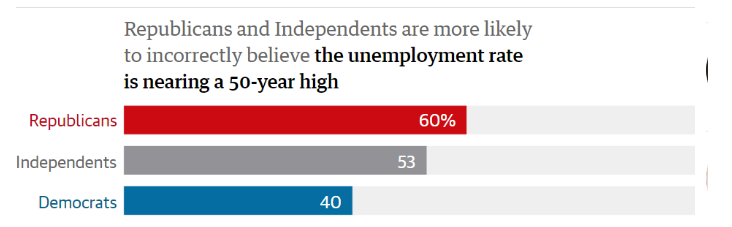

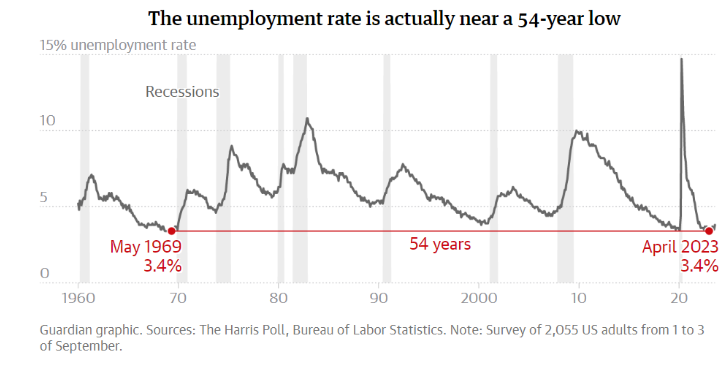

- US economy going strong under Biden – Americans don’t believe it

- Dave Ramset tells millions what to do with their money. People under 40 say he’s wrong

- The day I put $50,000 in a shoe box and handed it to a stranger

Listen here:

Recommendations:

- The Good Shepard

- American Assassin

- 22 Jump Street

- Ed Zwick

- Hits, Flops & Other Illusions by Ed Zwick

- True Detective

- Mr. and Mrs. Smith

Charts:

Tweets:

This is absolutely unreal…

Abercrombie & Fitch has risen another 15% over the last few weeks and has now ~8x in less than 18 months

It's the best performing stock in the S&P 1500 Index, even outperforming Nvidia $NVDA by a huge margin

Absolutely no one could have predicted… pic.twitter.com/osI2LkUz9y

— Triple Net Investor (@TripleNetInvest) February 14, 2024

Update: in 2022, the average family in the US spent 9.9% of their income on food (groceries and dining out). This is the exact same percent they spent in 2019, before the pandemic and all the food inflation

% of income spent on food

2019: 9.9%

2020: 8.7%

2021: 9.5%

2022: 9.9% https://t.co/1v315xB5HL— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) September 8, 2023

Bitcoin ETF from small fund no one had heard of until a month ago, scoops up 1 billion in assets in 30 days with 8 other competitors in the mix.

Tells you something about demand for this product. https://t.co/XqAKdn6V1r

— Fred Krueger (@dotkrueger) February 15, 2024

Roughly 70% of Bitcoin supply still hasn’t moved in at least a year while ETFs are seeing $500mm of inflows a day

Don’t need to be an economics PHD to know what’s set up to happen next

— Will (@WClementeIII) February 14, 2024

Here we are. When nobody believed in this technology, we, as a group of Cornellians, were in a small office in Brooklyn, knowing that this new way of issuing, owning, and transferring assets would ultimately prove to be critical, not just for individuals, but also for… pic.twitter.com/fGwdetKOMA

— John Wu 🔺 (@John1wu) February 14, 2024

Website traffic for home builders hits a new all-time high post Super Bowl 👀

(conversions still lagging – but wow are people "on the hunt" for a new place to call home)@awealthofcs pic.twitter.com/Xe603BkTo3

— Kevin Oakley (@koakley81) February 19, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.