Today’s Animal Spirits is brought to you by Kraneshares:

See here for Kraneshare’s latest 2024 outlooks on China, the carbon market, and managed futures.

See here to register for the Future Proof Retreat in March!

On today’s show, we discuss:

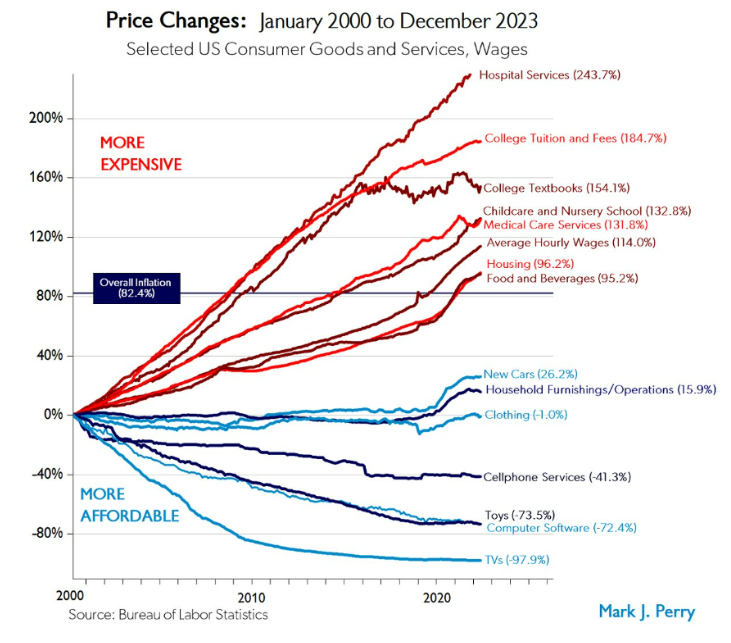

- Plummeting inflation raises new risk for Fed: Rising real interest rates

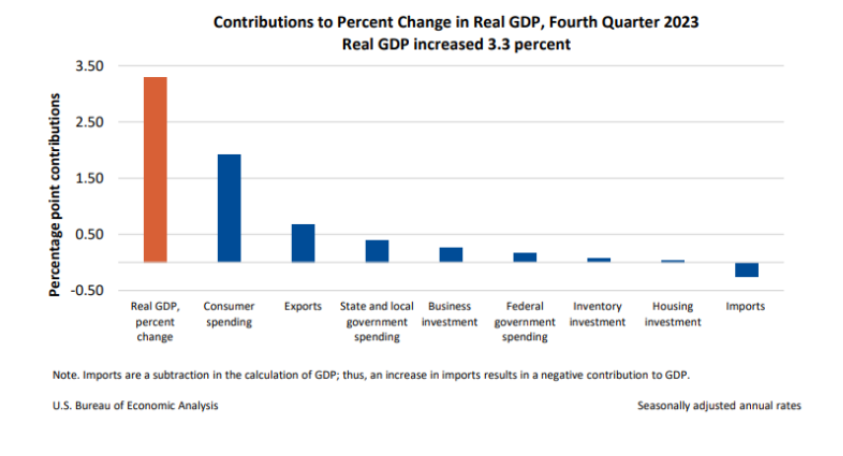

- GDP, fourth quarter and year 2023

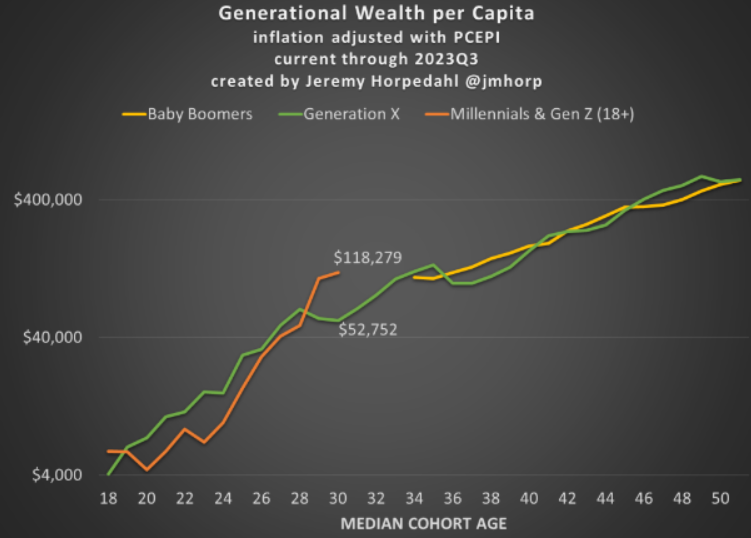

- Young people have a lot more wealth than we thought

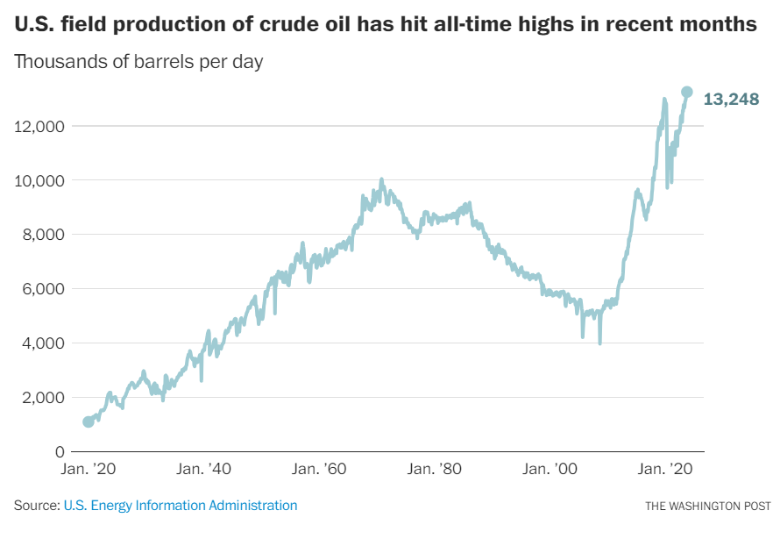

- The secret both parties want to keep about U.S. energy

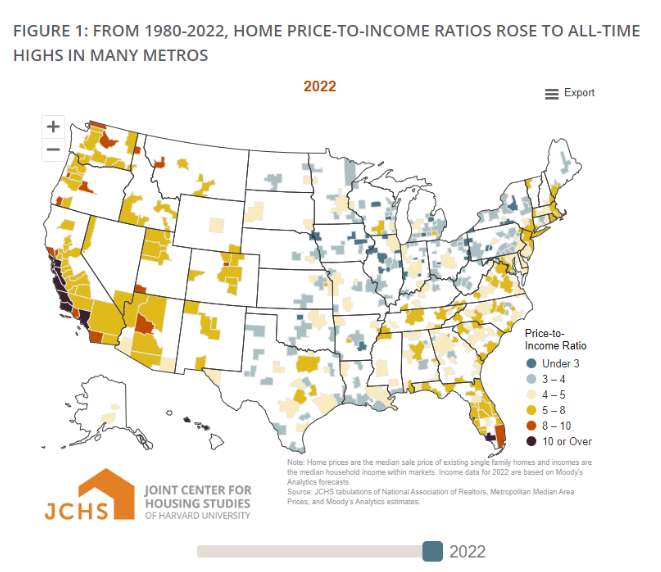

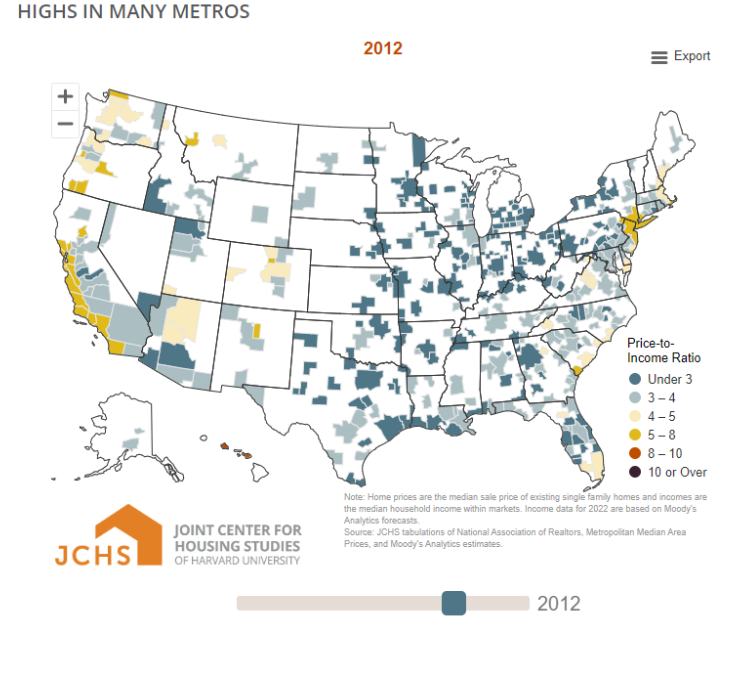

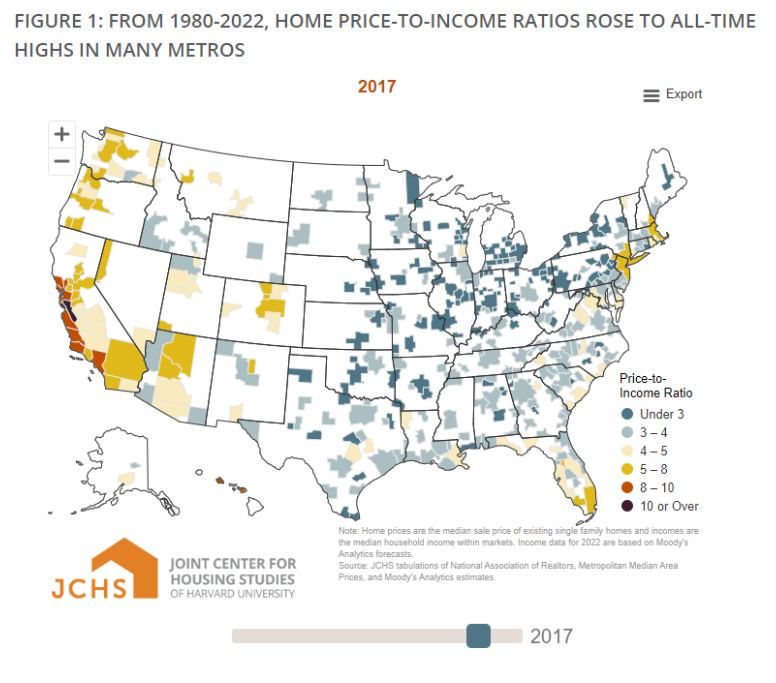

- Home price to income ratio reaches record high

- 5 Gen Xers share what it’s really like to plan for retirement: ‘My generation is going to have a harder time than boomers’

- DR Horton earnings

- American Express earnings

- Keeping a midlife crisis from wrecking your retirement plan

- Netflix wrestles with its age of empire

- Florida to borrow billions to backstop insurers after hurricanes

Listen here:

Recommendations:

Charts:

Tweets:

The S&P 500 hit an all-time high for the 3rd day in a row today. Here's a stat for you:

Historically, the S&P has been within 5% of an all-time high on 44% of all trading days versus the 40% of the time it has been 10% or more below an all-time high.

Check out the chart: pic.twitter.com/gbuA4jGcWS

— Bespoke (@bespokeinvest) January 23, 2024

Are you ready for this? Money invested when the market is at all time highs has outperformed money invested on any given day. pic.twitter.com/dwMcVrDkfG

— Peter Mallouk (@PeterMallouk) January 23, 2024

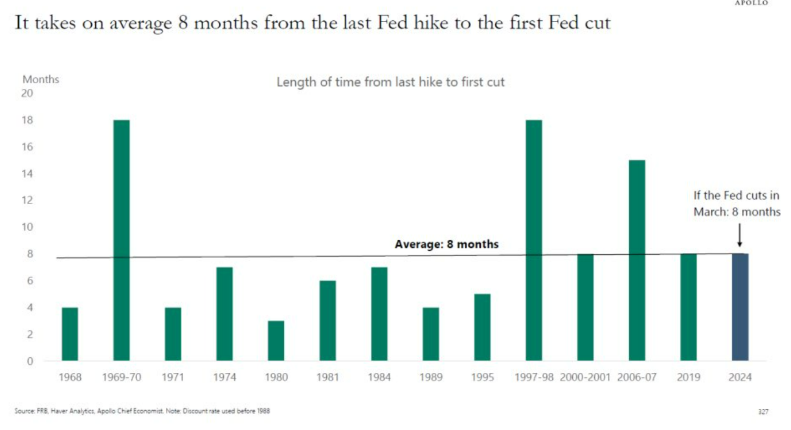

Will the Fed really cut rates with stocks near ATHs?

I found 20 times (since 1980) they cut rates when the S&P 500 was within 2% of ATHs.

Higher a year later? 20 times. Whoa. pic.twitter.com/9iXp3ymeL3

— Ryan Detrick, CMT (@RyanDetrick) January 27, 2024

I know this can't last but right now we have:

5% nominal wage growth

6% nominal GDP growth

and 3% inflation

And the Fed is going to cut interest rates w/stocks at all-time highs pic.twitter.com/zRj23LFYcJ

— Ben Carlson (@awealthofcs) January 25, 2024

Data would like a word. Or better yet, a picture. https://t.co/sIXO2Ve7KK pic.twitter.com/HuZkJZw4FW

— Arin Dube (@arindube) January 26, 2024

Core PCE inflation annual rates:

1 month: 2.1%

3 months: 1.5%

6 months: 1.9%

12 months: 2.9%All looking reasonably good. pic.twitter.com/ID6zkV1Nfn

— Jason Furman (@jasonfurman) January 26, 2024

REDFIN: “Homebuyers on a $3,000 Monthly Budget Have Gained $40,000 in Purchasing Power Since Mortgage Rates Peaked Last Fall”@Redfin https://t.co/HUkezQGU4j pic.twitter.com/XaYh5Tn38u

— Carl Quintanilla (@carlquintanilla) January 29, 2024

REDFIN: “Homebuyers on a $3,000 Monthly Budget Have Gained $40,000 in Purchasing Power Since Mortgage Rates Peaked Last Fall”@Redfin https://t.co/HUkezQGU4j pic.twitter.com/XaYh5Tn38u

— Carl Quintanilla (@carlquintanilla) January 29, 2024

$NFLX, who's reporting its Q4 tomorrow, is apparently the clear streaming leader when it comes to TV show content quality.

Visualizing the number of TV shows available on each major video streaming platform in the United States as of January 2024, ranked by IMDb quality rating: pic.twitter.com/Xr6ND8N6Kl

— Quartr (@Quartr_App) January 22, 2024

Longtime collaborators Ben Affleck and Matt Damon are teaming up once again. Affleck will direct Damon in the kidnapping thriller, Animals, for Netflix. pic.twitter.com/IawZdPbpEa

— Netflix (@netflix) January 25, 2024

Peacock: Way ahead on subscribers and revenue, but waaaaaaay behind on profit. These points are connected, but cume losses now 5x what was originally pitched to investors in 2020, and 2023 operating profit ($2.7B), versus ($2.5B) in 2022 pic.twitter.com/w8zSuKi01t

— Matthew Ball (@ballmatthew) January 25, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.