Today’s Animal Spirits is brought to you by YCharts:

See here for our YCharts year-end strategy session recap.

On today’s show, we discuss:

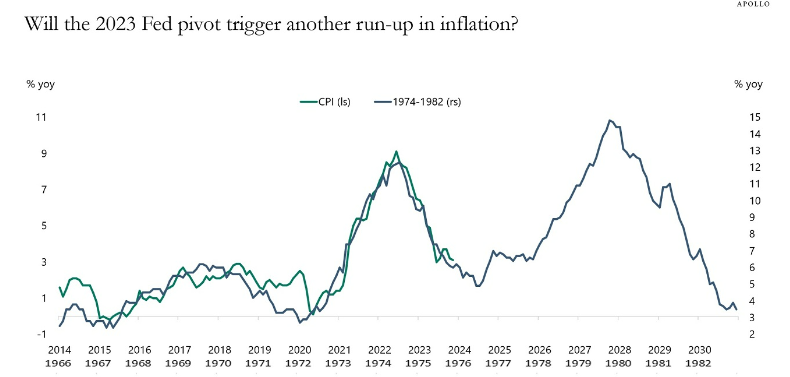

- A second mountain in inflation?

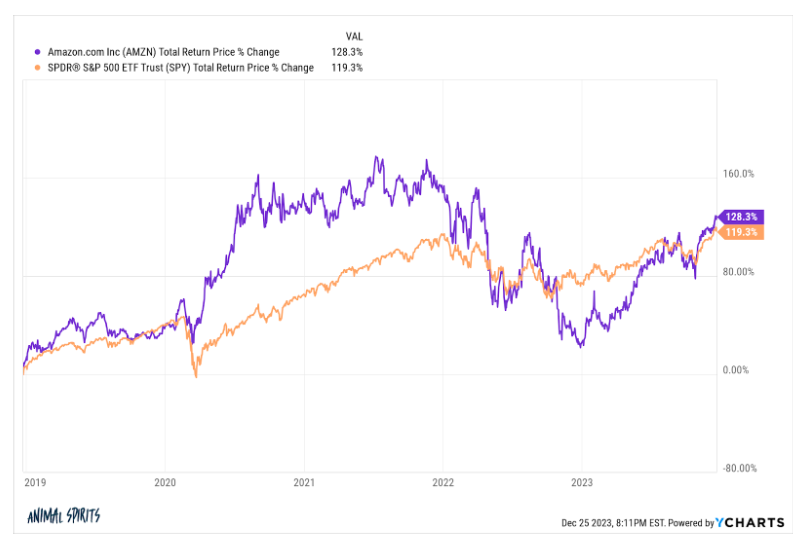

- Cuban: Tech bubble worse now than 15 years ago

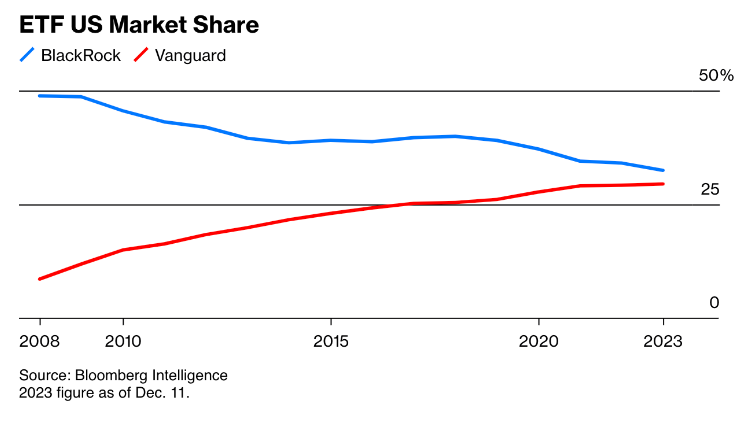

- Vanguard is closer than ever to ending BlackRocks ETF reign

- Housing market update: Declining mortgage rates lure sellers off sidelines, paving way for 2024 buyers

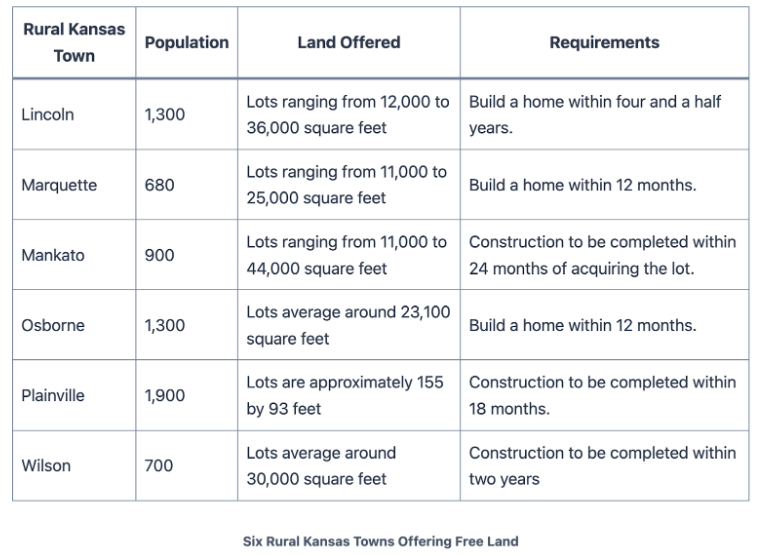

- Free land in the US: 16 small towns where it is still possible

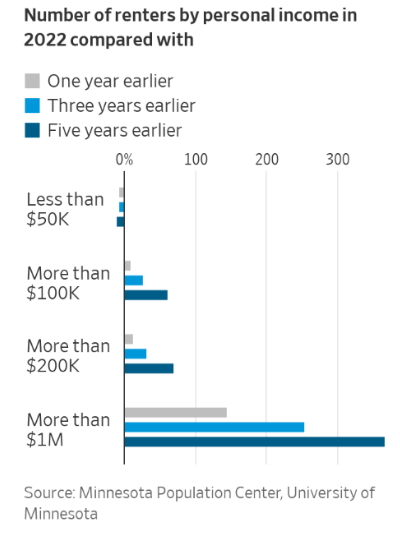

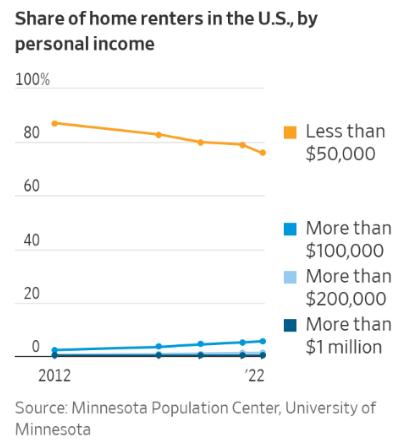

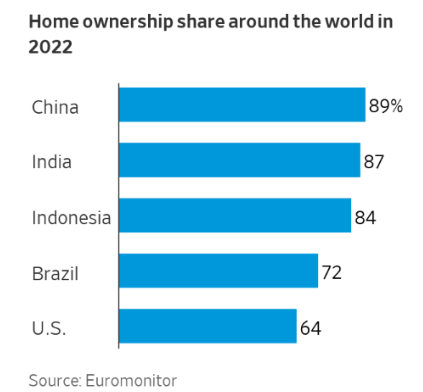

- The rise of the forever renters

- Bird may be bankrupt, but shared micromobility is doing just fine

- Zombie TV has come for cable

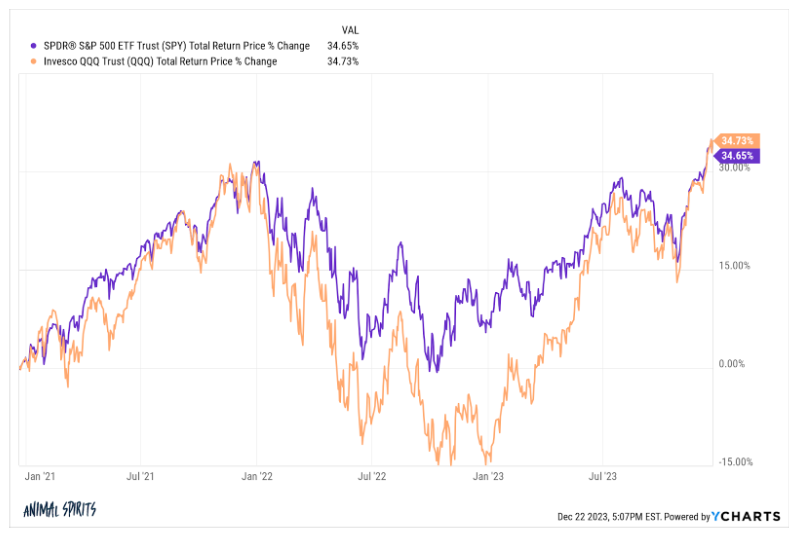

- Discussing leveraged/inverse fund performance

Listen here:

Recommendations:

Charts:

Tweets:

Of course that’s your contention. It’s your first Xmas on Twitter. First you’re gonna start an argument about whether or not Die Hard is Xmas movie. Then you’re gonna be poking holes in the Home Alone plot. Next you’re gonna be regurgitating theories on Mr McCallister’s job… pic.twitter.com/crCwZJpkA5

— Ben Carlson (@awealthofcs) December 23, 2023

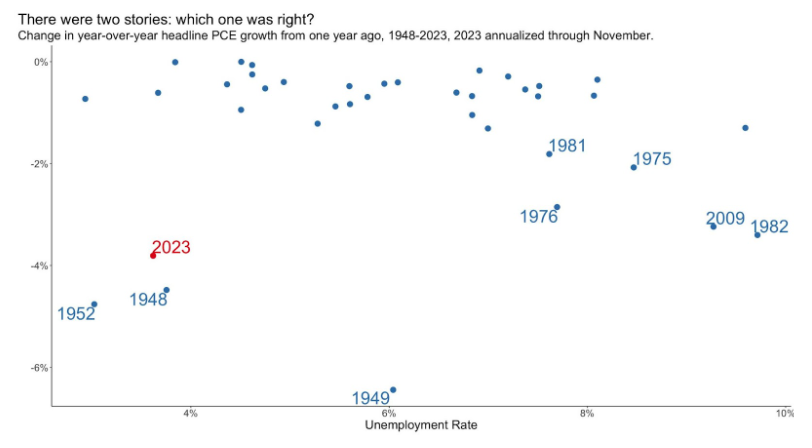

Core PCE inflation is up 1.87% at an annual rate over the last six months as of November. Between used car & truck prices and housing rents, there is room for inflation to remain benign. We continue to see the Fed cutting its policy rate in March. pic.twitter.com/BK3WNOTiJs

— RenMac: Renaissance Macro Research (@RenMacLLC) December 22, 2023

Wow. And there you have it. Six-month core PCE is at 1.87 percent, under the Federal Reserve's 2 percent target.

I was cautiously optimistic about 2023 – I have some 'soft landing' blog posts from a year ago – but this disinflation is far beyond what I imagined. Let's dig in. /1 pic.twitter.com/NvAa5lq7Sv

— Mike Konczal (@mtkonczal) December 22, 2023

We’re baaack.

Best 0% finance deals right NOW: pic.twitter.com/atWlpsqB8I

— Car Dealership Guy (@GuyDealership) December 20, 2023

Active managers are increasingly leaning on the benchmark, which suggests waning conviction.

via BofA Savita pic.twitter.com/18ecDzymy8

— Daily Chartbook (@dailychartbook) December 21, 2023

Earnings breadth (the percent of S&P 500 with earnings growth) hit a cycle low in 2023 but broke back above 60% with the 3Q earnings season — creating a cycle breadth bottom that likely enables equity market recovery. pic.twitter.com/6HRG3eF3jL

— Gina Martin Adams (@GinaMartinAdams) December 23, 2023

Recessions are becoming less common. pic.twitter.com/DoWTk7xoDB

— Peter Berezin (@PeterBerezinBCA) December 24, 2023

Square has come out with its own wage growth tracker https://t.co/WBrUU6B0Xr pic.twitter.com/G0tkbcEyQ4

— Joe Weisenthal (@TheStalwart) October 4, 2023

These new S&P stablecoin reports are pretty good tbh.

Crypto won't love the down-rating of Tether and DAI, but if you read through to the actual reports — and view it from a US-based institutional perspective — the analysis is reasonable.

Regardless, it's great to see…

— Matt Hougan (@Matt_Hougan) December 19, 2023

Bought a primary house 2 weeks ago for our family of 6 during the "worst time to buy a house"

Our mortgage payment tripled (ouch) & rate is above 8% (lol)

Also sent over 4k letters to find a house. (Ended up a waste)

AMA

— Joe Cassandra (@JoeCassandra) December 11, 2023

The Lions have notified season-ticket holders that 2024 pricing will come with an average 30% increase, and as much as an 85% bump for certain Ford Field seats.https://t.co/QkUuJjQS1s

— Front Office Sports (@FOS) December 19, 2023

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.