Today’s Animal Spirits is brought to you by YCharts and The College for Financial Planning:

See here for YChart’s Top 23 Charts of 2023

See here to learn more about The College for Financial Plannings Chartered Retirement Plans Specialist designation

On today’s show, we discuss:

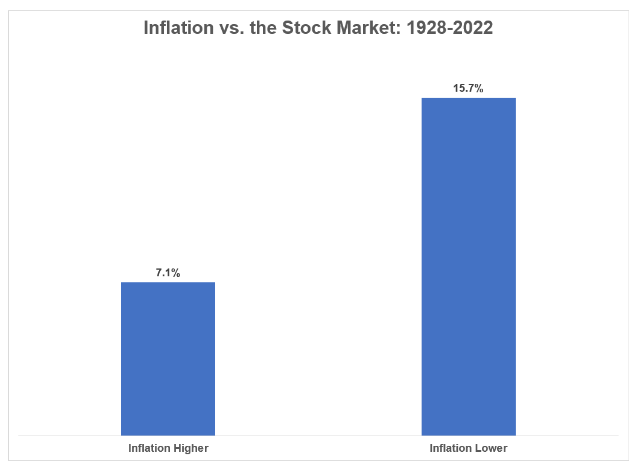

- You’re better off going all in on stocks than bonds, new research finds

- Beyond the status quo: A critical assessment of lifecycle investment advice

- Mutual fund outflows top $400B, set for second-worst year on record

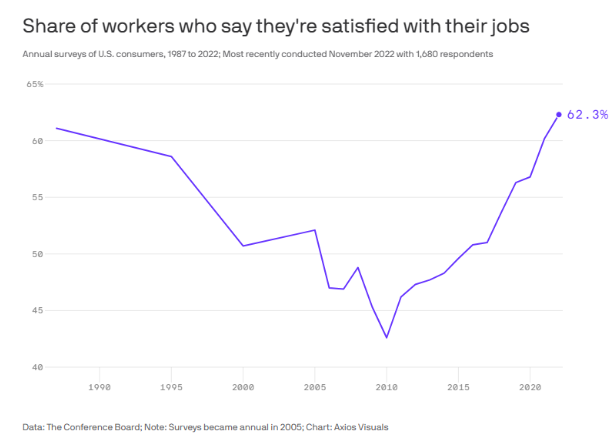

- Americans haven’t been this happy at work since the 1980s

- Six minutes that will change everything

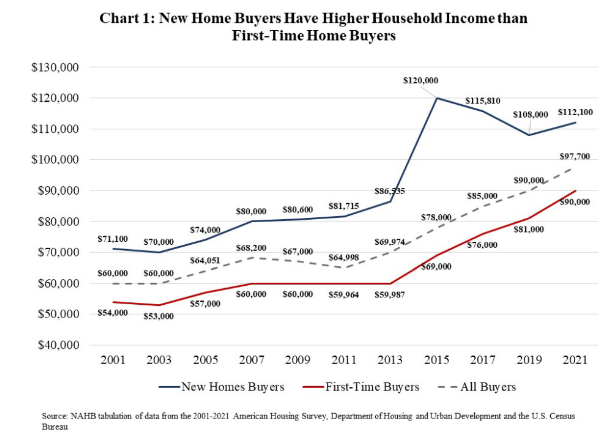

- Characteristics of home buyers

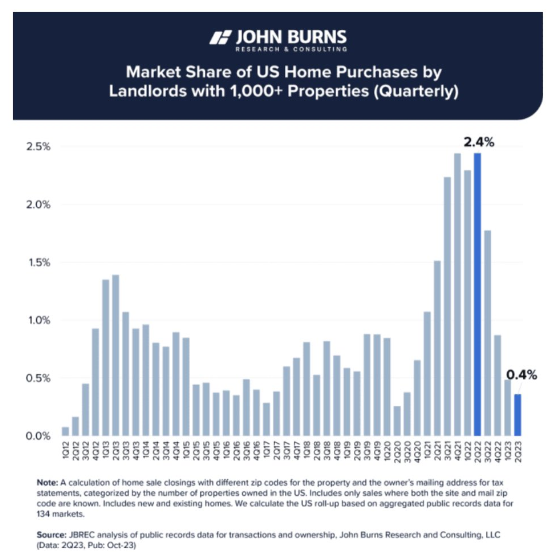

- No, Wall Street investors haven’t bought 44% of homes this year

- Boomers seem to have traded in the child-raising village for traveling. Now Millenial parents say they have no one to support them

- Godzilla, Mario, and the next wave of Japanese global hits

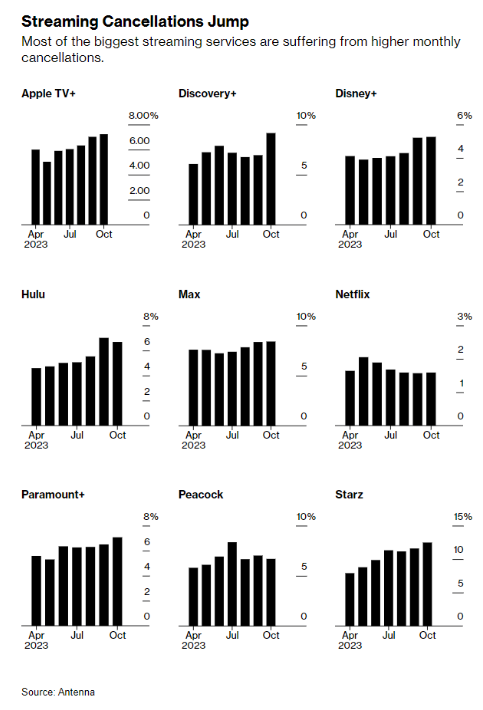

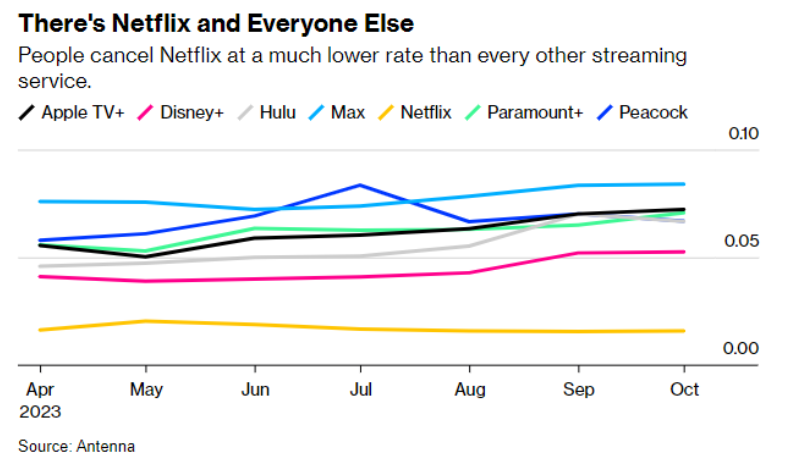

- Zombie TV has come for Cable

- All Grey’s Anatomy seasons to be available on Disney, Netflix gets window on 14 Disney series as part of licensing deal

Listen here:

Recommendations:

- Demolition Man

- Mighty Ducks

- Painfortainment

- Monarch: Legacy of Monsters

- Leave the World Behind

- May December

- 10 Things I Hate About You

- The Dark Knight

Charts:

Tweets:

The US unemployment rate has been less than 4% for 22 months straight

That's the longest stretch below 4% since the late-1960s

The unemployment rate never got lower than 4% once in the 1970s, 80s or 90s pic.twitter.com/o6izPjJxHq

— Ben Carlson (@awealthofcs) December 8, 2023

* lowest annual hourly earnings growth since June 2021 #NFP

* highest participation since Feb 2020 https://t.co/FlGqiEtKEJ— Carl Quintanilla (@carlquintanilla) December 8, 2023

Shelter again was the largest factor in the monthly increase. If we exclude shelter, we've had 2 months of mild deflation. pic.twitter.com/Op7kmDkxTn

— Patrick Horan☘️✝️ (@Pat_Horan92) December 12, 2023

A 2024 prediction:

I'm bullish on consumer sentiment

Falling gas prices, falling mortgage rates, the inflation rate is stabilizing, we're seeing real wage growth, the Fed is probably gonna cut rates

Comeback time

And 7 other things I think I think:https://t.co/d66jB6awLa pic.twitter.com/eJW1JhLXw2

— Ben Carlson (@awealthofcs) December 11, 2023

I can't be the only one following the many upsetting global events via social media concluding that this is the most poisonous and least productive way to conduct important conversations that humans have ever been a part of. I used to think the TV of the 1980s/1990s was bad,but…

— Dan Carlin (@HardcoreHistory) December 8, 2023

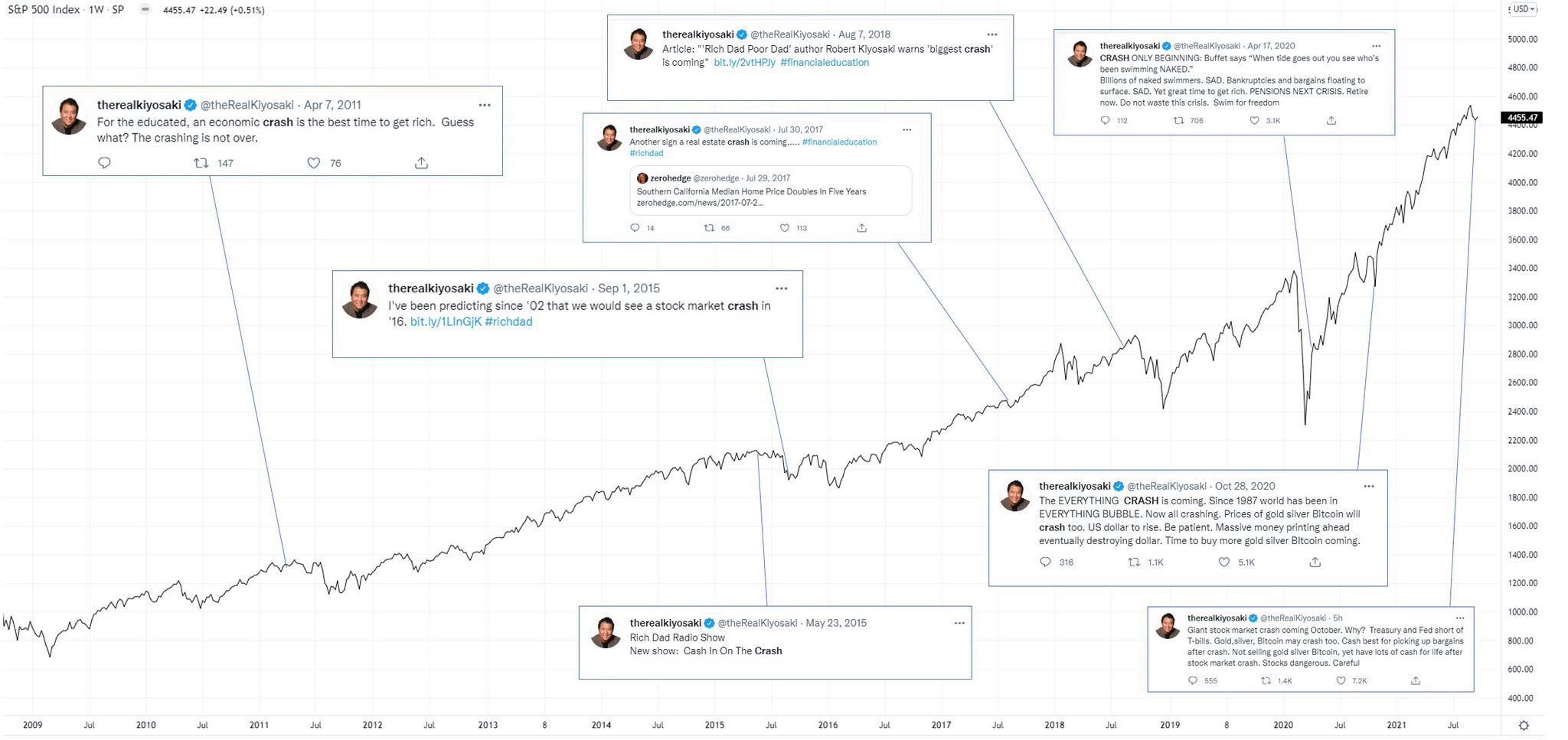

FYI. Bank Credit just sold off like 2008. Get some cash out of banks as you need cash. This may be the start of the biggest crash in history. Hope I am wrong yet no time to play Russian Roulette with your life.

— Robert Kiyosaki (@theRealKiyosaki) December 10, 2023

FINK: “BlackRock was mentioned by some candidates in last night’s debate more than inflation or the national debt. That’s a sad commentary on the state of American politics. Now I know why they call this the political silly season."@FT $BLK https://t.co/8wn4zm2YWi

— Carl Quintanilla (@carlquintanilla) December 8, 2023

*$850bil* swing from bond mutual funds to ETFs since Fed began raising rates in March 2022…

Mutual funds -$504bil

ETFs +$348bil

Numerous drivers here incl tax loss harvesting, lower fees, expanding product choice, etc.

Mutual funds = dying

via @Todd_Sohn pic.twitter.com/ESYR8nIJeB

— Nate Geraci (@NateGeraci) December 5, 2023

Someone is launching a 4x S&P 500 ETN with the ticker $XXXX, which would be a leveraged amt record in the US. We are so back. Maybe too back? h/t @Todd_Sohn pic.twitter.com/cbQDYSYrEc

— Eric Balchunas (@EricBalchunas) December 4, 2023

what recession? pic.twitter.com/dUhzJcmO36

— Justin Wolfers (@JustinWolfers) December 8, 2023

Maybe some piece of this will break in 2024 but the fact that the unemployment rate may have stabilized in the high 3%’s, worker income growth around 5%, and core PCE trending around 2-2.5% with the Fed in a position to cut is so perfect that nobody would have believed it: pic.twitter.com/8F9pNvq6GK

— Conor Sen (@conorsen) December 9, 2023

the Covid economy could’ve never recovered, inflation could’ve spiraled, the fed could’ve responded to inflation too harshly and sent the country into a recession. none of that happened. it’s incredible.

— Matt (@worsematt) December 11, 2023

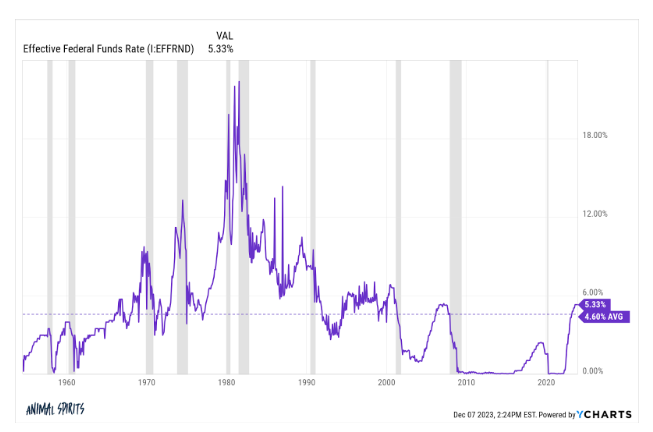

This was basically the top in rates

Unanimous economists lose again pic.twitter.com/g1GMQLdZ3R

— Ben Carlson (@awealthofcs) December 6, 2023

$71 million of BTC longs were liquidated in the past hour. pic.twitter.com/593sKXyFRe

— Ryan Rasmussen (@RasterlyRock) December 11, 2023

These ads are deeply malicious

They attempt to establish a sense of insurmountable hopelessness to trigger people into YOLOing lottery ticket shitcoins and cumtokens https://t.co/GibtsqSSqi

— BuccoCapital Bloke (@buccocapital) December 6, 2023

It doesnt matter what interest rates are or the housing affordability index says or where we are in the cycle.

Buy a home you can afford with your person. Make it yours & fill it with love. Have a couple kids if you want & nourish them until they are ready to fly. THAT is a…

— Pearl (@ppearlman) November 30, 2023

I inherited $246,000 from my late mother and used $142,000 to pay off our mortgage. If we divorce, can I claim this money back from my husband? https://t.co/FjxAKjNzMF

— MarketWatch (@MarketWatch) December 9, 2023

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.