“A great deal of data, and all my experience, tell me that the only thing we can predict about cycles is their inevitability.” – Howard Marks

Howard Marks has the uncanny ability to take the complex topic of investing and translate the big picture ideas into simple terms. This is a rare trait in the financial industry.

My biggest takeaway from his classic book, The Most Important Thing is the importance of understanding cycles from a psychological point of view. Here is how Marks explains this concept in the book:

I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.

The problem is that although markets are cyclical each cycle is different in terms of duration, fundamentals, market leadership and where we stand in the business cycle. So it’s very difficult to convince yourself that (a) the good times will eventually end and (b) the bad times won’t last forever.

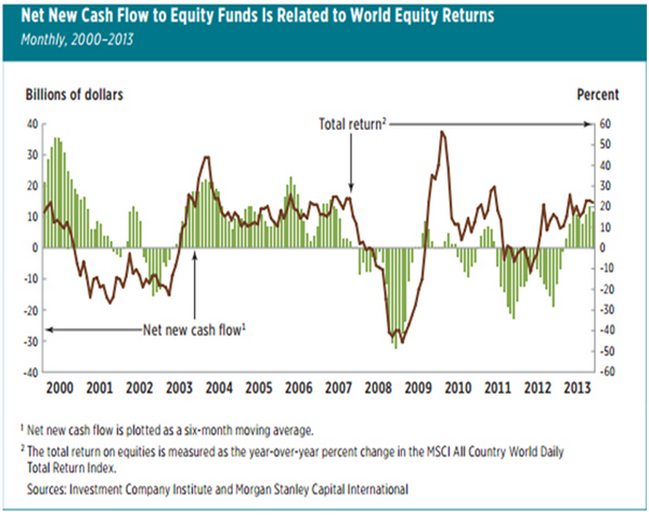

Thus, many investors sell after stocks have gone down and buy after a run up in prices. Rick Ferri recently shared the following graph that shows this in practice:

This shows both stock market performance and flows into and out of equity funds. Stocks go up, money pours in; stocks go down, money exits the markets, the opposite of a rational buy low, sell high strategy.

It’s almost like a chicken and the egg conundrum – do markets cycle because of fear and greed or do investors become fearful and greedy because markets cycle?

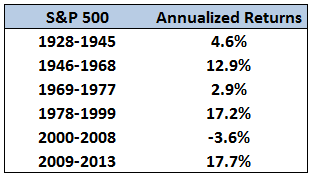

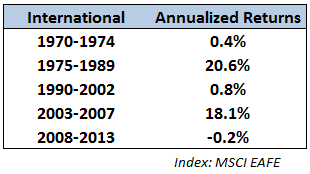

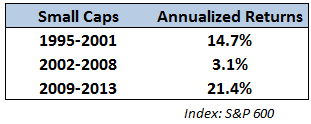

Here are some historical market performance numbers to see this cyclicality in practice over longer time horizons.

The S&P 500:

International stocks:

Small cap stocks:

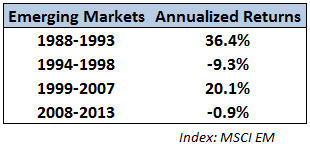

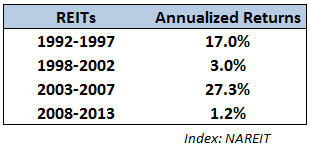

Emerging market stocks:

And finally real estate investment trusts:

Looking at the ups and downs of these numbers gives you a sense of what investors are feeling when they finally capitulate:

Returns have been terrible for a number of years now. I’m done.

Look at how great these returns are. I’m in.

Greed is a very powerful force which drives investor attitudes towards risk, but it’s the losses that seem to resonate and leave the most scars with investors. No one bails out of the market because they’re making money even if it’s relatively less than others. People bail out all the time when they lose money.

This is why diversification is so important. It helps smooth out the bad points of the cycle so you don’t completely give up on your investment plan at the wrong time.

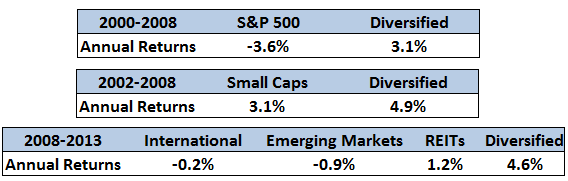

Let’s see how a diversified portfolio of these same asset classes would have performed when compared to the most recent dry spells for each market. For simplicity’s sake, I’ll just assume an equal weighting between the five asset classes used above for this basic example.

Here’s how the equal-weighted portfolio looked against the down cycles for each market:

In each instance the diversified option substantially improved performance in some of the worst cycles for each of these asset classes. Of course, you wouldn’t have hit it big when any of these markets had extraordinary years, but diversification is about balance and persistence, not all-or-nothing.

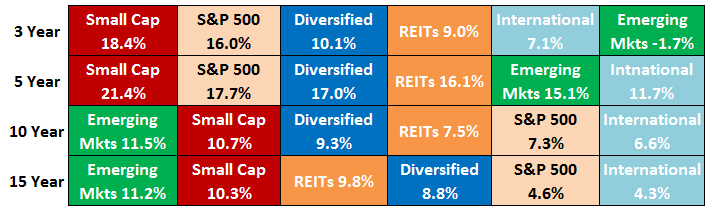

Investors diversify because the future is uncertain. No one knows how these cycles will play out and which asset classes will rule in any given year. Take a look at the 3, 5, 10 and 15 year annual numbers through 2013 to see how diversification leads to more steady performance over time:

A diversified portfolio is never too hot, never too cold. You’ll always end up hating at least one asset class. In fact, between 1995 and 2013, almost 60% of all annual periods saw at least one of these markets end the year in negative territory. And nearly 40% of the time two or more asset classes lost money.

But the overall diversified portfolio was positive 75% of the time. The negative cycles in one market are more than offset by the positive cycles in the others.

These are just a handful of the broadest markets, but you could substitute nearly any successful investment strategy and you would find similar periods of underperformance.

Most investment professionals will tell you that the main benefit of diversification is earning the highest return for a given level of risk (defined as volatility).

This makes sense, but the biggest benefit investors receive from diversification is a reduced risk of bailing out of their investment plan at the worst possible stage of a market’s cycle.

Further Reading:

Why does the cycle of fear and greed persist?

A lesson in diversification and regret minimization

[…] Diversification Through Cycles […]

reassuring information on global diversification.

thanks.

[…] An excellent article about diversification and the benefits it provides courtesy of A Wealth of Common Sense. […]

[…] more on how diversification lowers risk and smooths investment cycles, check out this post from Ben at A Wealth of Common […]

[…] Why diversification helps to smooth our emotions. (A Wealth of Common Sense) […]

[…] This post from A Wealth of Common Sense makes a very compelling case for diversification. It also happens to be a powerful argument for Tactical Asset Allocation. […]

[…] How Diversification Helps Us Handle Our Emotions from Ben Carlson […]

[…] Diversification smooths the cycles – A Wealth of Common Sense […]

[…] Diversification smooths the cycles – A Wealth of Common Sense […]

[…] Carlson, an experienced portfolio manager and financial blogger wrote a series of notes recently (https://awealthofcommonsense.com/diversification-investment-cycles/) on the subject which illustrate the merits of diversification. To summarise the first part which […]

[…] Further Reading: Global Diversification: Accepting Good Enough to Avoid Terrible How Diversification Smooths Investment Cycles […]

[…] “ This shows both stock market performance and flows into and out of equity funds. Stocks go up, money pours in; stocks go down, money exits the markets, the opposite of a rational buy low, sell high strategy. It’s almost like a chicken and the egg conundrum – do markets cycle because of fear and greed or do investors become fearful and greedy because markets cycle?” […]