“The stock market has predicted nine out of the last five recessions.” – Paul Samuelson

The worst historical periods for investment returns have tended to cluster around major economic events such as the Great Depression, the highly inflationary environment of the 1970s and more recently the Great Recession.

Stocks are said to be forward looking so technically they should price in the possibility of future recessions or economic expansions.

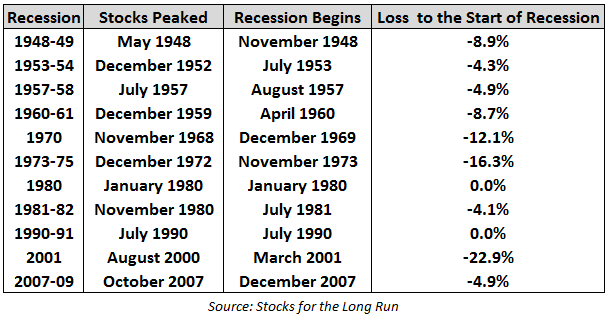

Here’s the data from Professor Jeremy Siegel to show this in practice:

This shows how the Dow Jones Industrial Average has front run the past eleven recessions. Stocks dropped an average of about 8% leading up to the start of each recession so it does appear that investors were prescient by selling before the economy slowed.

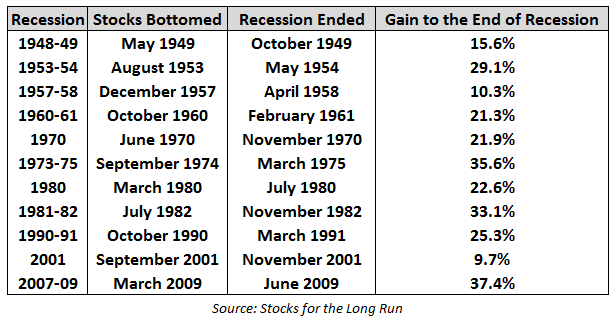

On the flip side, stocks also tend to climb a wall of worry and rise before the economic downturn is over in anticipation of the return of growth as you can see here:

So stocks rose an average of nearly 24% before the end of the post-World War II recessions. This is why you can’t exactly sit around and wait for things to get better before investing when things look bleak. By the time the coast is clear you’ve already missed a nice chunk of gains (although we never truly know a recession has ended until much later when the data is finally released).

A pretty solid track record for stocks based on these numbers.

But stocks don’t always call every move in economic activity correctly. GDP growth isn’t the only factor that investors rely upon to gauge the attractiveness of stocks. Emotions play a larger role than most realize and there are always reasons for investors to get anxious.

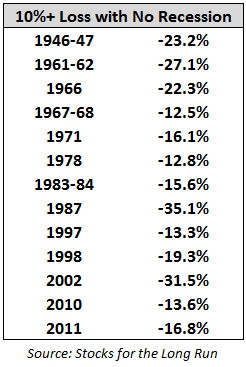

That’s why we’ve had thirteen instances of the market selling off in excess of a 10% loss in that time frame with no recession in the following twelve months:

Hence, the Paul Samuelson quote from above. This data shows that the market falls an average of 20% every five years without the economy ever going into a recession. Stocks can be forward looking, but who knows what investors are actually pricing in at any given point in time.

The stock market is full of participants that have conflicting goals, time horizons, tolerance for risk and ability to control their emotions. Add this all up and the market will most likely go in whatever direction it pleases.

Over the long-term, the trend has always been up and to the right. Over shorter time frames who knows what will happen.

Sometimes the stock market and the economy are in synch with one another, but other times they march to their own tune. It’s difficult to use one to predict the other with any precision.

Can stocks fall in anticipation of a recession? Yes.

Can stocks fall for other reasons? Yes.

Can you or I predict the timing of next correction in the market or start of the next recession? Slim chance.

Stocks can and will fall for a number of reasons. But you have to be a glutton for punishment if your investment plan relies on your ability to consistently call these moves.

Further Reading:

The difference between a crash and a correction

The truth about stocks and the economy

[…] Recession and Correction […]

I think more than anything that a price correction could occur more than a recession or severe bear market.

As I understand it, and still consider myself a student of the market (and will most likely always have this approach, to keep me humble) the overall yield curve is a good indicator.

http://www.capinv.com/another-correction-or-next-bear-market/

There is a great take on this statement here, though the numbers may be a little off for present data, the sentiment remains.

In facing the unknown whims of the market, as investors one must keep your personal investing rules in check to help you make your own decisions with regards to how you will allocate your new capital into more equities, or to wait for calmer waters.

Since we cannot know everything, we need to understand what we know, and what can make us draw incorrect assumptions. This is where I feel that the various mental models that Charlie Munger helped popularize can turn the tide over time towards steady success.

If there is an uncertain future, at the very least, put in money that you could flush down the toilet and not bat an eye about. Too much leverage, and risk on unproven ideas is folly.

We must take care, lest borne away by a torrent of passion we make shipwreck of conscience.

Well said. Thanks. I’m a huge fan of Munger’s approach as well.

The one problem with the yield curve these days is that the Fed is holding down short rates. But you are right that this has been a telling indicator in the past and is still worth watching.

Great article. This shows timing the market is a tough and almost impossible task.

[…] You don’t need a recession to see a correction in stocks. (A Wealth of Common Sense) […]

[…] Money Buy Happiness? (Time) Do We Need a Recession for a Meaningful Correction in Stocks? (Wealth of Common Sense) Bond Shortfall of $460 Billion Seen Boosting Debt Markets (Bloomberg) The Eccentric Genius Whose […]

[…] away – USA Today Debt Risk Shifting to Investors as Bank Regulations Bite – Bloomberg Do We Need a Recession for a Meaningful Correction in Stocks? – AWOCS Treasury 30-Year Rally Ebbs in June Before $13 Billion Bond Sale – Bloomberg […]

[…] Do We Need a Recession for a Meaningful Correction in Stocks? (WealthOfCommonSense) […]

[…] Do We Need a Recession for a Meaningful Correction in Stocks? (A Wealth of Common Sense) […]

[…] Interest in MLPs (Fidelity) • Do We Need a Recession for a Meaningful Correction in Stocks (A Wealth of Common Sense) but see also The Problem with Market Timing (Rick Ferri) • The Investor Class Gets Another Raise […]

[…] Recessions and U.S. stock market declines do not always go hand in hand A Wealth of Common Sense […]

[…] Es braucht nicht immer eine Rezession, damit Aktienmärkte über 10% korrigieren. (Englisch, AWealthofCommonSense) […]

[…] You don’t need a recession to see a correction in stocks. (A Wealth of Common Sense) […]

[…] Not particularly new, but interesting nevertheless https://awealthofcommonsense.com/need-recession-meaningful-correction-stocks/ […]

[…] Not particularly new, but interesting nevertheless https://awealthofcommonsense.com/need-recession-meaningful-correction-stocks/ […]

[…] Do we need a recession for a meaningful correction in stocks? by A Wealth of Common Sense […]

[…] Reading: Do We Need a Recession for a Meaningful Correction in Stocks? The Origins of Economic […]

if you got a shred truck you will fine during recession

http://www.axo.cc/recession-opportunity/en

[…] years away. It could be dangerous to completely rule out a bear market for this reason alone. As Jeremy Siegel showed in Stocks For the Long Run, since World War II, there have actually been five bear markets with losses […]

[…] 23% prior to the recession, and “only” 15% during the recession. The chart below from Ben Carlson’s blog shows how stocks anticipate a […]