A reader asks:

You talked about how baby boomers have so much money for a generation, and anecdotally so many financial plans that I run for our folks have them with way more than they need…they are diligent savers and investors. So we have all these boomers with excessive savings/investments that are unwilling to turn the switch to actually spend that money.

So my question becomes: do we have a permanent floor of higher inflation in the future due to boomers actually spending that cash that they have in retirement, realizing they can’t take it to the grave OR as they pass it to the next generation who are more comfortable with the spending side of the equation—that could create this persistent higher inflation rate for people over the next decade or two?

I did inquire about the wealth profile of baby boomers in a recent piece.

It is true that boomers control most of the wealth in this country (52% according to Federal Reserve data).

This is what I wrote in that previously mentioned post:

There is no precedent for the boomer generation. We’ve simply never had a demographic this big with this much wealth live this long before.

We have no historical data to look back at when it comes to trying to quantify the inflationary impact here.

If all of the boomers said screw the kids and their inheritance and spent down all of their savings, sure you could argue that would be inflationary.

But with boomers living longer than previous generations, that could force them to spread that spending out over many years, which would mute the impact.

It is possible it will be the millennials that will spend more money.

Jean Twenge at The Atlantic took a sledgehammer to the idea that all millennials are broke.

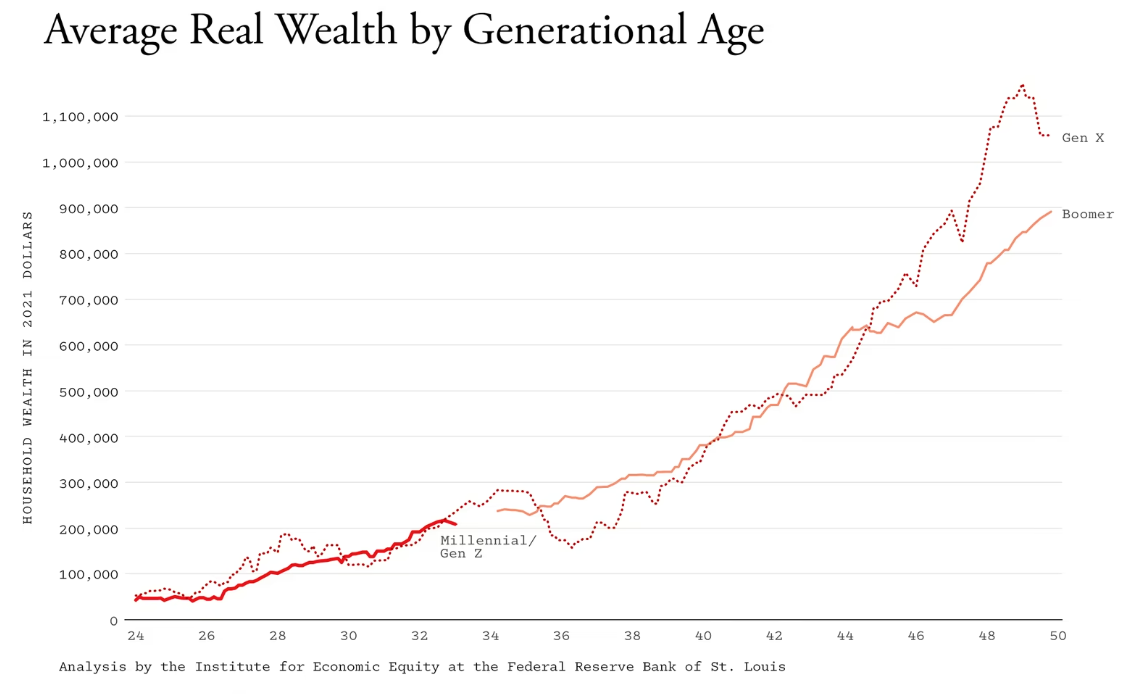

If you look at the long-term trend of wealth, adjusted for inflation, millennials are right on track relative to previous generations at the same point in their lives:

And look at the Reality Bites generation — Gen X has surpassed the boomers by age 50!

The inflation-adjusted median income for millennials is around $10,000 higher than the boomers had at the same age. And when they were in the 25-to-39 year age range, 50% of boomers owned a home. That number is 48% for millennials.

Millennials love to complain but as a whole, they are doing fine.

The counter-argument here would be all of the stuff that’s now more expensive for millennials — housing, college, daycare, etc.

But millennials will be the biggest, richest generation at some point. It’s inevitable.

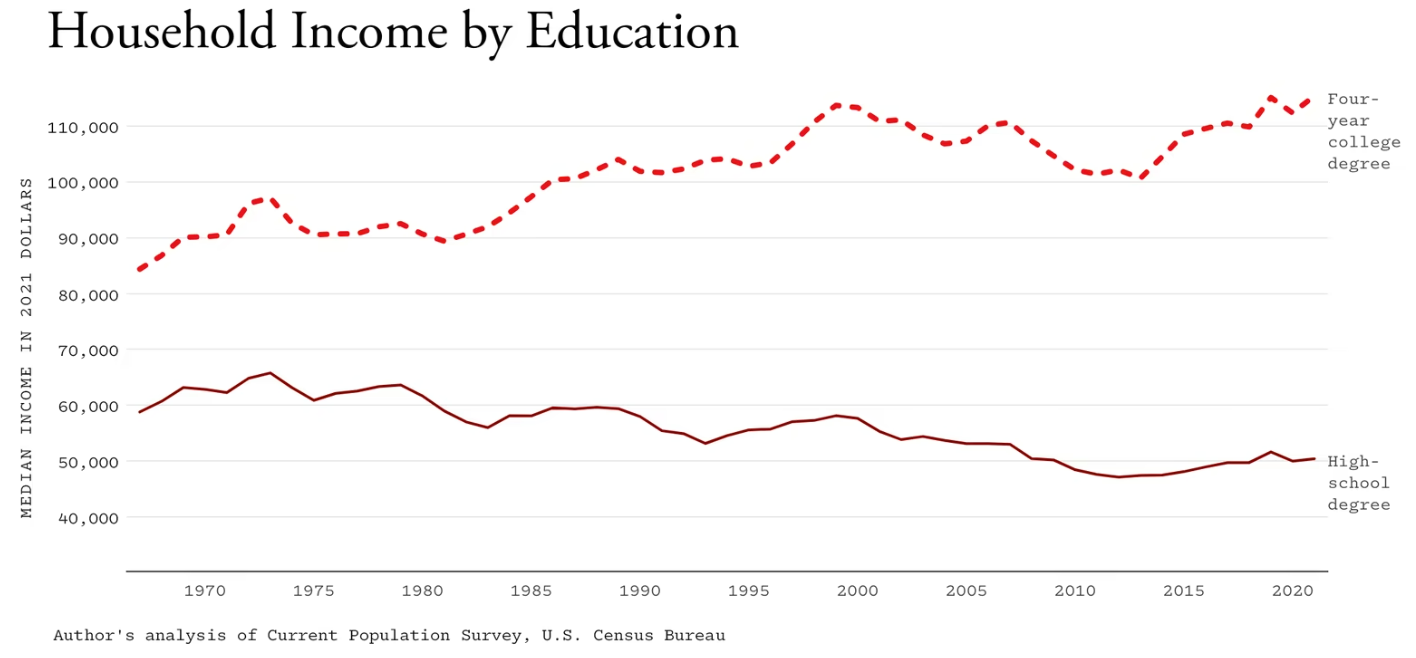

My generation1 is the most well-educated generation in history and that means higher average incomes that are only going to increase over time:

So let’s assume millennials are going to spend more freely and control vast sums of wealth in the future from some combination of their own earnings and an inheritance from their boomer parents.

Will that translate into a floor under the inflation rate?

It’s possible.

Researchers at The IMF looked at the relationship between aging and inflation:

We found that the larger the proportion of young and old in the total population, the higher inflation. Put another way, when the working-age population is larger, the effect is disinflationary. This link between age and inflation holds for a large number of countries across all time periods.

These effects are large enough to explain most of trend inflation. For instance, the baby boomers increased inflation by an estimated 6 percentage points in the United States between 1955 and 1975 and lowered it by 5 percentage points between 1975 and 1990, when they entered working life. Trend inflation is currently low and stable as the decreasing share of young people offsets the effects of the increasing share of old people in the population.

We have a large proportion of old people, which should be inflationary.

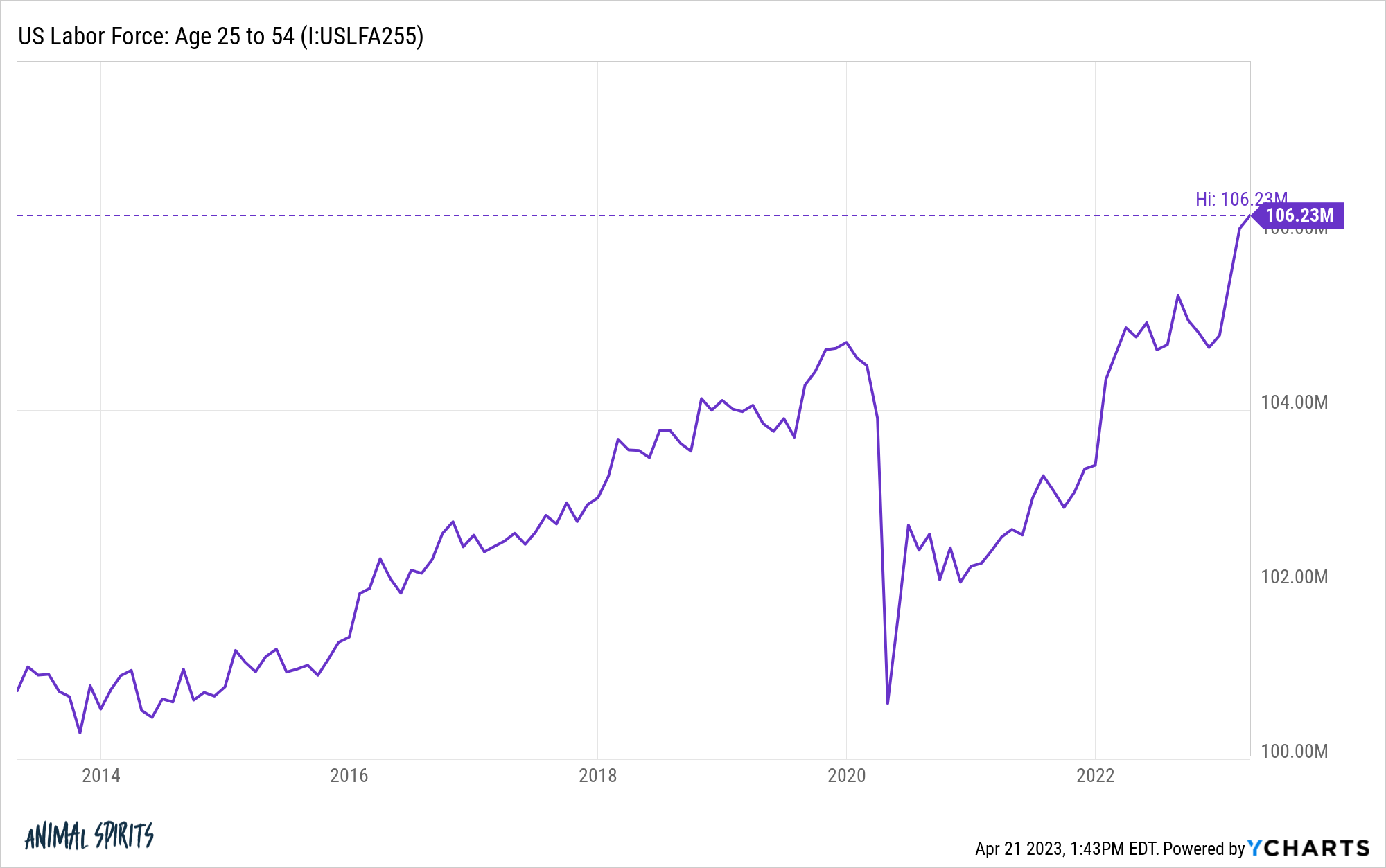

But we also have a large proportion of working-age people, which should be disinflationary.

All of which is to say, this is a complicated topic that doesn’t have a clearcut answer (welcome to finance).

Inflation could be higher if boomers spend down all of their savings or millennials don’t save as much.

Or AI could prove to be a deflationary force that offsets any inflationary effects of large demographics.

If the past 10 years have taught us anything about macroeconomics, it’s that there is a lot we still don’t know about inflation.

The Fed tried its damnedest to increase inflation in the 2010s by keeping rates low.

It didn’t work.

A pandemic hits, supply chains get disrupted, the government spends trillions of dollars and inflation goes bananas.

Now the Fed has aggressively raised rates to increase unemployment and slow inflation.

Inflation has slowed but the labor market remains strong.

In the immortal words of Cousin Eddie, “She falls down a well, her eyes go crossed. She gets kicked by a mule, they go back. I don’t know.”

Predicting inflation is hard. Knowing the demographic makeup of the country probably doesn’t make it any easier to predict its future path.

Michael and I spoke about generational wealth and much more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Demographics vs. the Stock Market

Now here’s what I’ve been reading lately:

- The complexity illusion (Prime Cuts)

- What beat the S&P 500 over the past 3 decades? (Morningstar)

- What really matters (Ramp Capital)

- Lucky in life (Irrelevant Investor)

- The mansion next door (Accidentally Retired)

1I don’t feel like a millennial but was born in 1981 so technically I’m on of the oldest millennials in the country.