Six questions I’m thinking about right now:

Is inflation falling because things are normalizing or because we’re going into a recession?

This is going to be one of the hardest economic questions to answer in the coming months as inflation falls.

One thing is for sure — we are NOT in a recession right now.

The 4th quarter of last year saw real GDP grow at an annualized pace of 2.9%. On the whole, the U.S. economy grew 2.1% in 2022 (even after accounting for inflation).

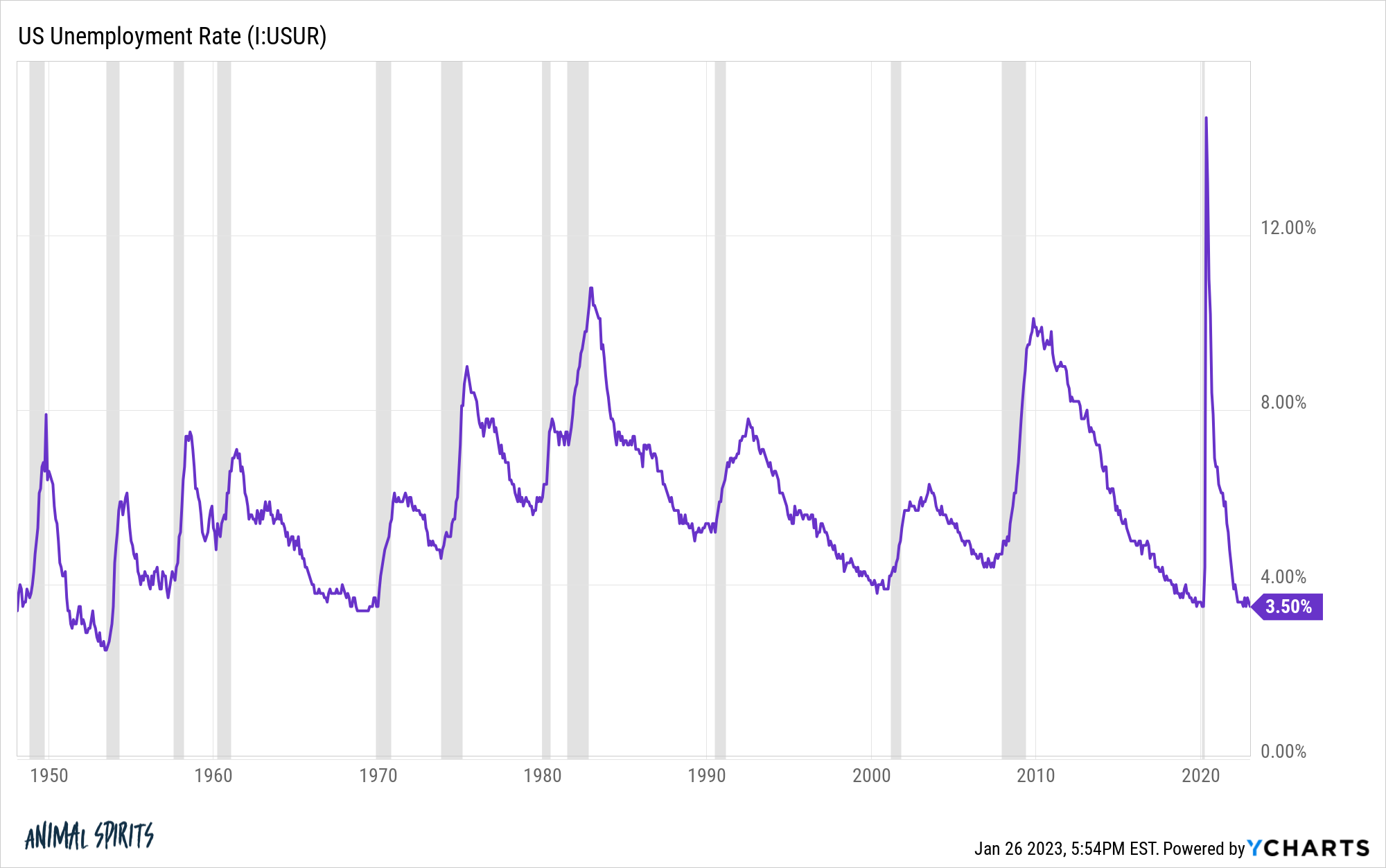

Combine this with a 3.5% unemployment rate and it would be impossible to call the current environment a slowdown.

But it is possible that higher interest rates for longer will eventually lead to problems. Maybe households will blow through all of their pandemic savings. Maybe the Fed will push things too far.

Everyone has been worrying about a recession for more than a year now already so it’s not like these risks are unknown.

The problem is it’s going to be difficult to know the difference between a hard landing and a soft landing as inflation comes down.

If inflation continues to fall both economic camps — hard landers and soft landers — will assume they’re right until things either stabilize or overshoot to the downside.

Is the housing market already bottoming?

I’m not going to predict where housing prices go from here because a lot of it is contingent on where mortgage rates go.

But the housing sector — construction, building supplies, furniture, banks, realtors, title companies, etc. — makes up roughly 20% of the economy.

A slowdown in housing sector is bad for economic growth.

Goldman Sachs seems to think the worst is behind us in terms of housing’s drag on growth (via the WSJ):

Housing’s drag on the economy peaked at the end of last year, and is likely to be less of weight going forward, the Wall Street bank’s economists said in research published this week.

Housing subtracted 1.1 percentage points from annualized gross domestic product growth last quarter, but will subtract just 0.25 percentage point by the fourth quarter of 2023, they said.

Housing stocks as a group are up almost 30% since this summer. A positive surprise from increased housing activity would be a big boost to the economy.

We just need mortgage rates back at 5% or so and I think that will happen.

Does monetary policy work on a lag or not as well as they think?

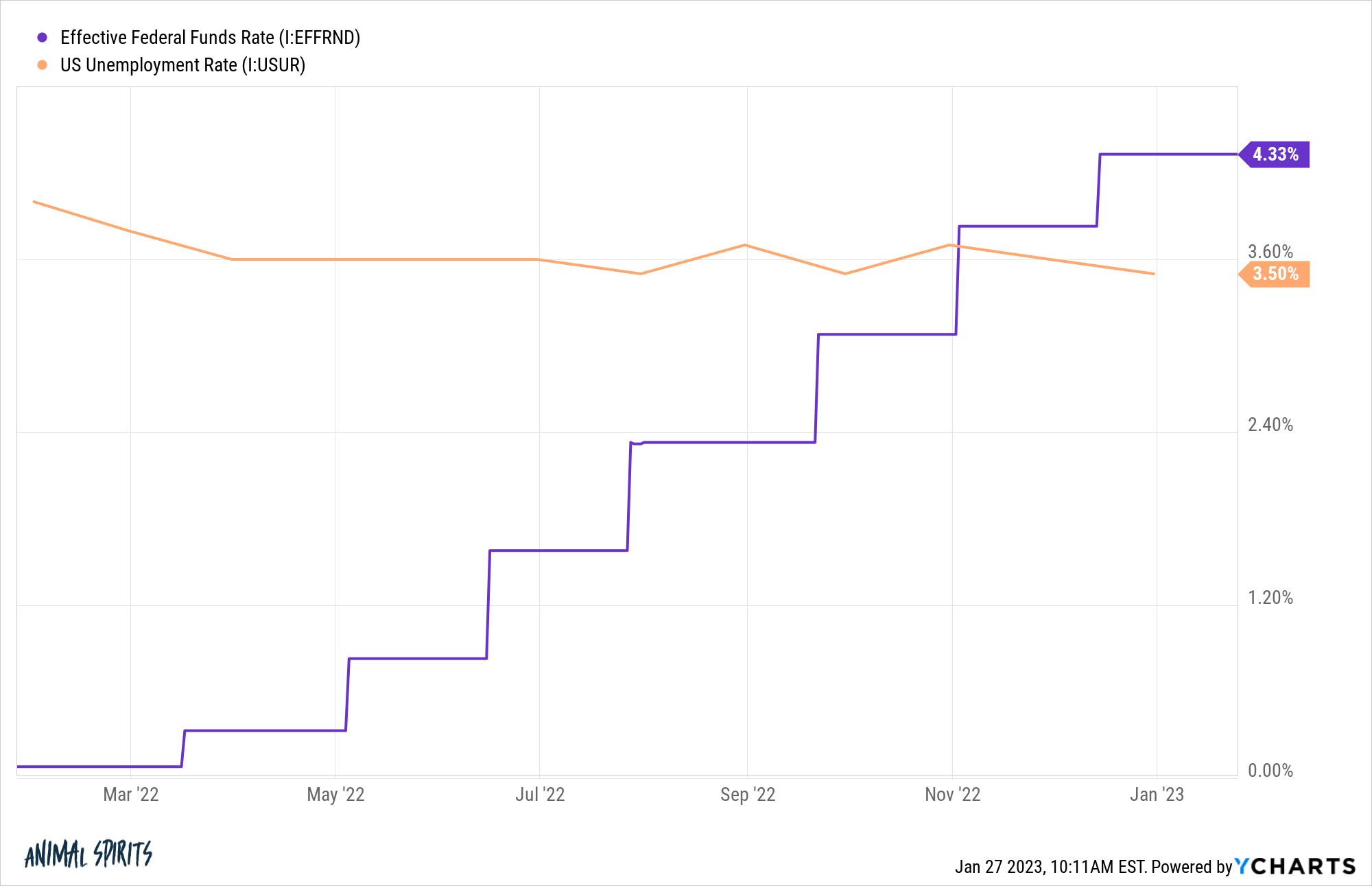

It feels like the Fed has been raising rates for some time now but their first hike was only 10 months ago.

The unemployment rate was 3.8% going into that first rate hike decision.

Since then Jerome Powell and company have gone on one of the most aggressive rate hiking cycles in history.

Yet the unemployment rate has fallen to 3.5%. Federal Reserve officials have stated on numerous occasions they would prefer to have the labor market soften (have people lose their jobs) to bring inflation down.

Well inflation has come down and the labor market remains strong.

For most of the 2010s, the Fed kept rates low in an effort to make inflation higher. It never happened.

Now they’re keeping rates higher to slow the labor market. It hasn’t happened (yet).

Obviously, if the Fed keeps hiking eventually the economy is going to slow. But maybe monetary policy doesn’t have as much of an impact on the economy as they would like to think.

The Fed’s actions probably have a bigger impact in the short-term on financial markets than economic activity.

Are all workers really lazier these days?

The new get-off-my-lawn complaint is that no one wants to work anymore.

Young people are all lazy and don’t want to go to the office!

Quiet quitting is a real problem!

Give me a break.

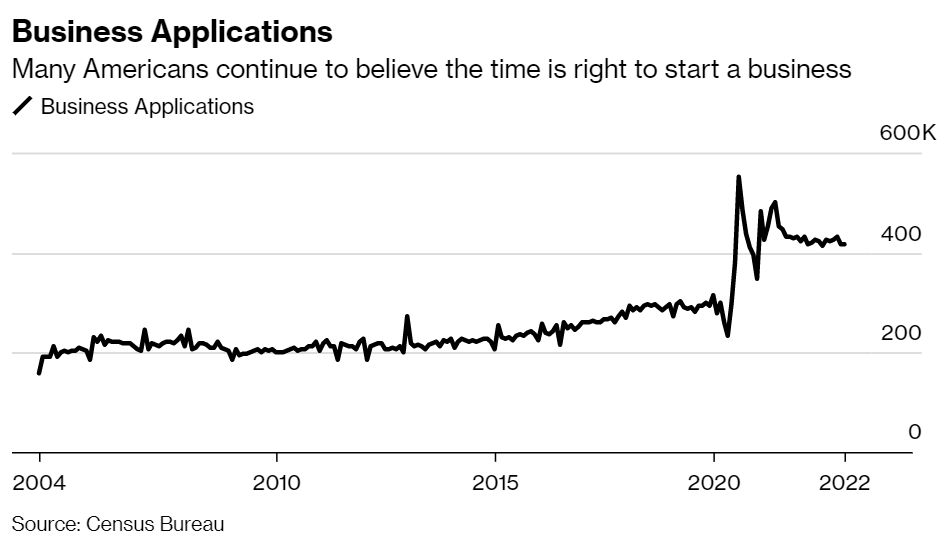

Bloomberg data shows people continue to start new businesses at a record clip compared to pre-pandemic days:

About 5.1 million applications were filed last year, down from the record 5.4 million in 2021, but up from 3.5 million in 2019.

On average, it means that almost 14,000 businesses were created every day in 2022.

This shot up during the pandemic but remains strong:

It’s likely never been easier to start a business but it’s not like it’s easy work. Running your own business is hard.

Oh and the unemployment rate in the U.S. is now lower than it was at any point in the 1970s, 1980s, 1990s or the first decade of this century:

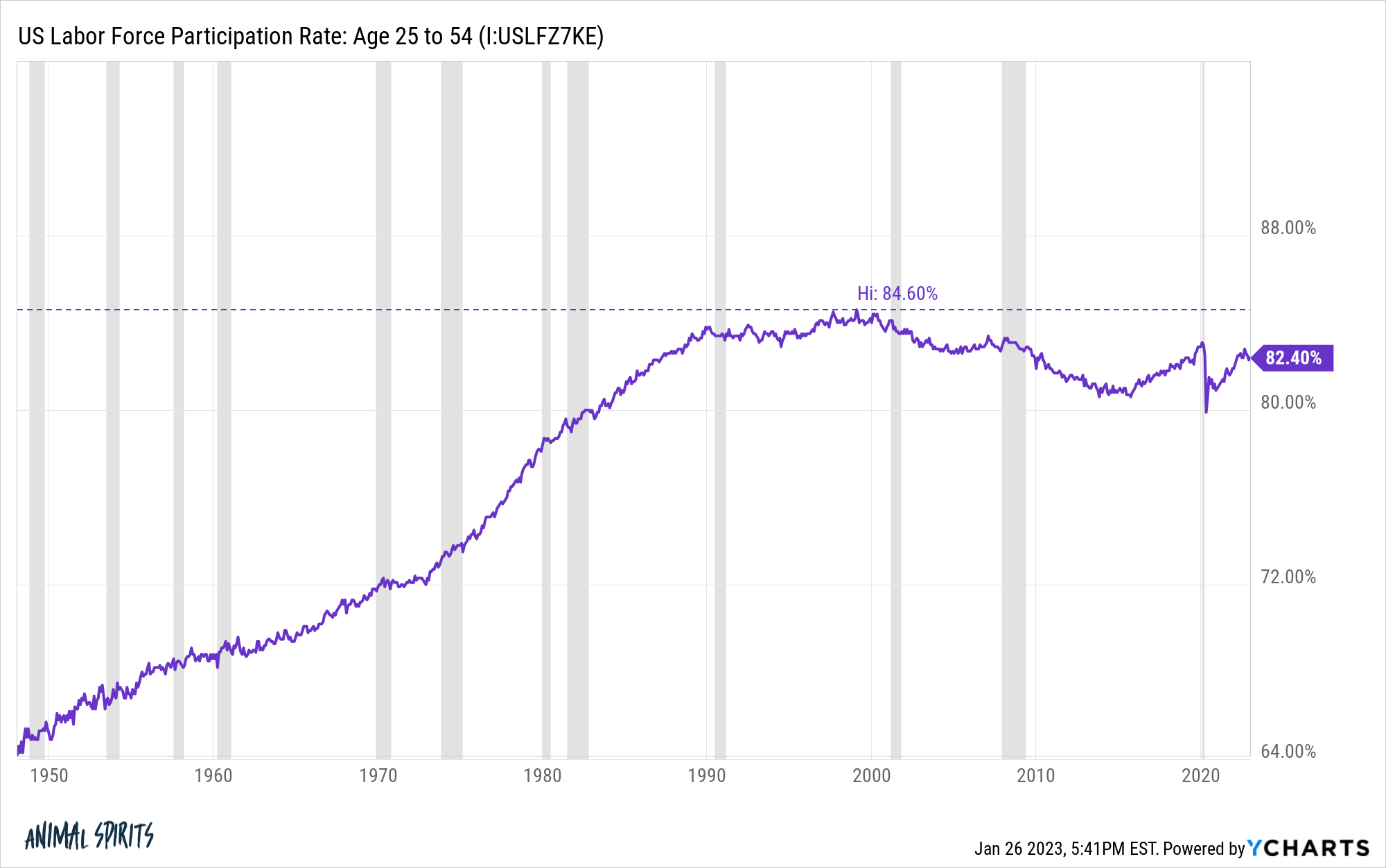

And don’t give me the labor force participation rebuttal.

The LFPR for the working-age population (ages 25-54) is right back to where it was before the pandemic, much higher than it was in the 50s, 60s, 70s or 80s and within spitting distance of the highs seen in the 90s.

Yes older people are dropping out of the labor force but that’s because we have 10,000 baby boomers retiring every day from now until the end of this decade.

There have always been people who are unfulfilled in their jobs and there always will be but people are still going to work.

Same as it ever was.

Do the tech layoffs tell us anything about the U.S. economy?

It seems like we can’t go a single day without another tech firm announcing another series of layoffs.

In recent weeks we’ve seen a wave of layoffs from the likes of Google, Microsoft, Amazon, Spotify and a whole host of other companies.

This says more about tech companies overhiring during the boom than anything about what’s happening in the economy.

The Wall Street Journal documented the insane hiring binge big tech embarked on during the pandemic:

From its fiscal year-end in September 2019 to September 2022, Apple’s workforce grew by about 20% to approximately 164,000 full-time employees. Meanwhile, over roughly the same period, the employee count at Amazon doubled, Microsoft’s rose 53%, Google parent Alphabet Inc.’s increased 57% and Facebook owner Meta’s ballooned 94%.

Amazon had something like 600,000 workers in 2018. By 2021 that number was more than 1.6 million.

Can you blame them?

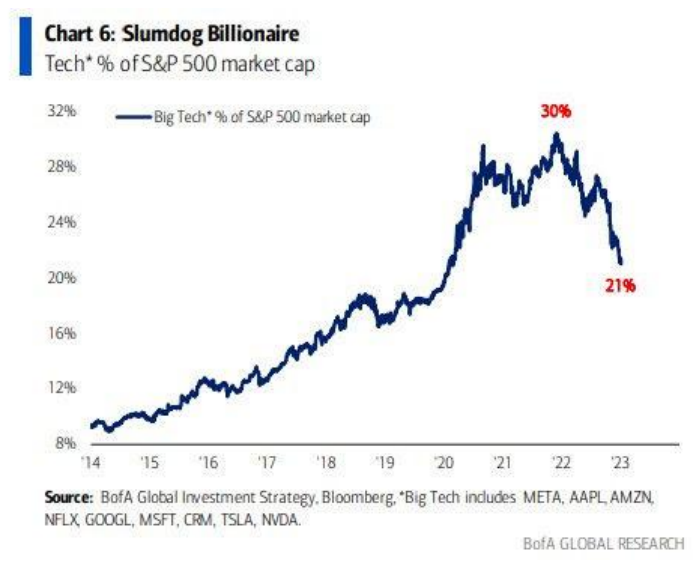

Not really. Look at the ginormous run tech had in recent years that is now unwinding a bit:

Tech CEOs will blame interest rates and an oncoming recession but the truth is they overhired. Plain and simple.

Why didn’t Bitcoin go to $10k or lower?

Bitcoin is still down more than 60% from all-time highs but it’s on a nice little run this year, up almost 40%.

With all of the shenanigans in crypto I’m surprised it didn’t go much lower during the freefall.

If you would have told me everything that happened in crypto last year what with firms going under left and right, leverage leaving the system at a rapid pace and then the cherry on top with the FTX debacle I would have assumed Bitcoin would easily go below $10k.

It never really came close. Maybe it still has another leg down from here but the resiliance of this asset is worth noting.

Bitcoin is obviously not a store of value or an inflation hedge or a payment system or any of the things we’ve been promised now for years.

The most bullish thing about Bitcoin might be the fact that it simply won’t die.

Michael and I touched on these questions and a lot more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

What If We Don’t Get a Recession This Year?

Now here’s what I’ve been reading lately:

- Drinking 8 pints of beer a day used to be routine (Atlas Obscura)

- ChatGBT is everything you want bitcoin to be (Reformed Broker)

- A new chapter at Netflix (Stratechery)

- How long is the long-term? (Retirement Researcher)

- What’s a long-term investor to do right now? (WSJ)