One of the biggest worries about the economy these days is the fact that inflation is still relatively low. Fed Chair Janet Yellen said as much this past week:

With inflation running at around 1 percent, at this point I think the risk is greater that we should be worried about inflation undershooting our goal and getting inflation back up to 2 percent.

Many economic thinkers from this generation are used to seeing inflation closer to 2-3% annually, which is what we experienced throughout the 1990s and 2000s.

Yet if you look back historically, sustained inflation is really more or less a post-1940 phenomenon. As the late Peter Bernstein wrote in his terrific book Against the Gods (emphasis mine):

From 1800 to 1940, the cost of living had risen an average of only 0.2% a year and had actually declined on 69 occasions. In 1940 the cost-of-living index was only 28% higher than it had been 140 years earlier. After 1872, over the next 23 years the prices of U.S. goods and services fell almost uninterruptedly by some 40%.

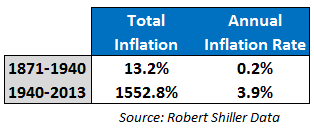

Here’s the breakdown of inflation from 1871 to 1940 and 1940 to 2013 using Robert Shiller’s extensive database of historical financial information:

As much fun as it is for people to complain about the Fed, that late-1800s cost of living data is a prime example of why we are better off having a central bank to manage our money supply, short-term interest rates and oversee the commercial banking system. They’re not perfect by any stretch of the imagination, but the alternative is a series of severe depressions, deflationary busts and runs on the banks.

Obviously there was some inflation back then to make up for those times that price levels declined. It just wasn’t sustained like we’ve witnessed for the past 70 years or so.

You could get nit-picky with data that goes all the way back to the late-1800s. There have been changes in industry make-up, the components that make up economic growth are completely different, the work force is much more diverse and even how the government calculates CPI data has gone through many iterations over the years.

Of course, I’m not sure there’s much you can do with this information since future inflation is the only thing that really matters to investors.

The trend of late seems to be cheaper smartphones and computers (things we use for entertainment) but more expensive education, healthcare and food (things we use for everyday life).

It may seem counterintuitive to want rising price levels, but workers should actually hope for some inflation over time since it generally means rising wages, an increase in living standards and a growing economy.

As Ray Dalio says, “The economy works like a simple machine but many people don’t understand it.” In the most basic sense, higher wages lead to higher prices which lead to more money in someone else’s pockets. It becomes a bit of a self-fulfilling prophecy. Along with debt, it’s how the economy is able to expand over time.

Source:

Against the Gods: The Remarkable Story of Risk

[…] Inflation […]

[…] Further Reading: When Will the U.S. Have It’s Next Recession? Inflation is a Relatively New Phenomenon […]

[…] Reading: Inflation is a Relatively New Phenomenon Fat Tails and Hyper-inflationary […]