Today’s Animal Spirits is brought to you by Masterworks and Composer:

See here to learn more about investing in contemporary art and here for important disclosures

See here for more info on Composers’ rules-based strategies

On today’s show we discuss:

- Future Proof

- Dalio on inflation

- Buying the dip on international stocks

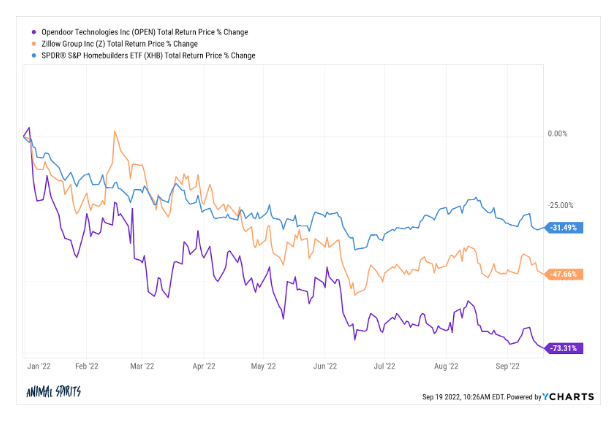

- Opendoor getting hit with losses

- Homebuyers might as well take the plunge

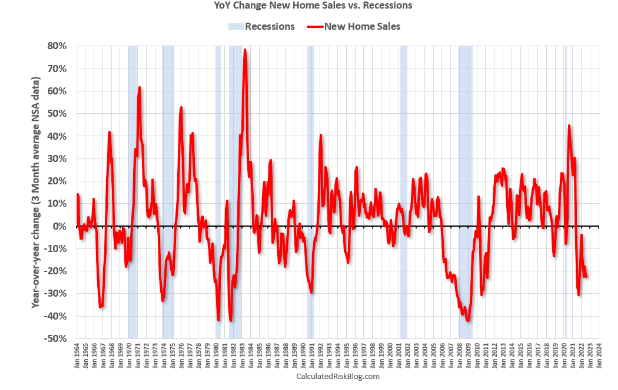

- Calculated Risk on predicting the next recession

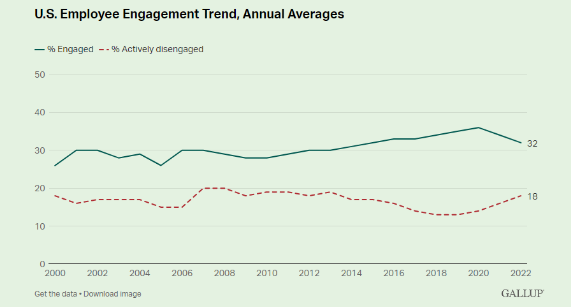

- Is quiet quitting real?

- FedEx guides down

- Happiness, satisfaction, perceptions, and valuation differences across genders

Listen here:

Recommendations:

- Two Business Lessons From Patagonia’s Yvon Chouinard (AWOCS)

- Let My People Go Surfing by Yvon Chouinard

- Where the Crawdads Sing

- Up in the Air

- House of the Dragon

- Barbarian

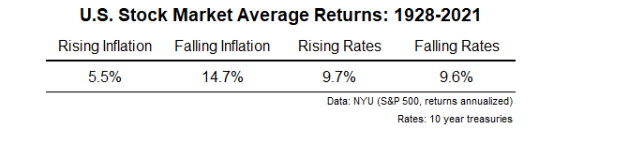

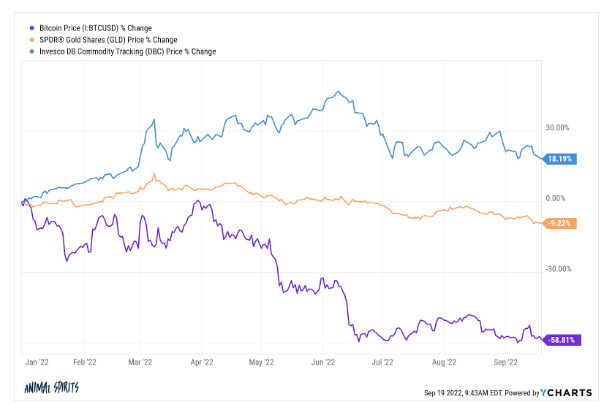

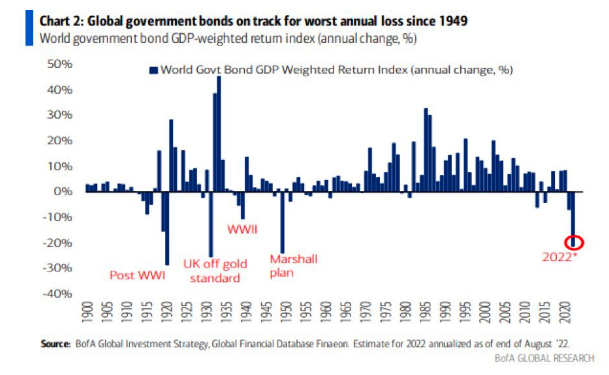

Charts:

Tweets:

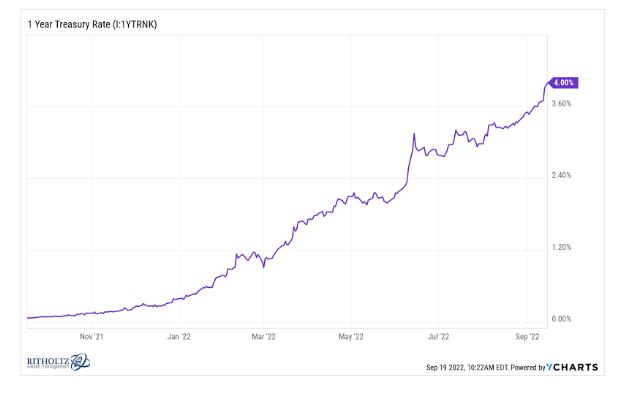

The one-year Treasury closed today at 4%.

One year ago, it was at 0.07%.

Wild.

— Eddy Elfenbein (@EddyElfenbein) September 15, 2022

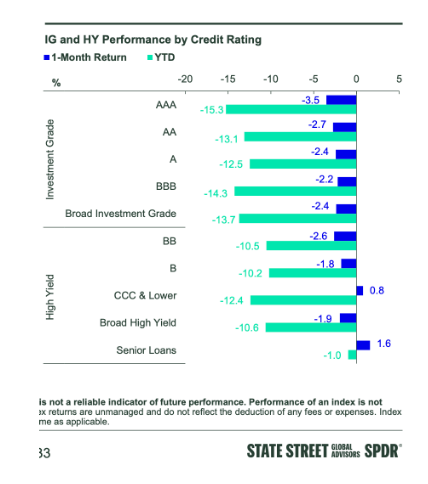

U.S. investment-grade bond yields are the highest since 2009, at an average 5.14%. pic.twitter.com/XIuQELONAY

— Lisa Abramowicz (@lisaabramowicz1) September 19, 2022

Q: What will happen if China stops buying US Treasuries?

A: It already did–a decade ago.China has been a net seller of US Treasuries for over a decade and now holds only 4% of all outstanding US Treasuries–down from 14% 10 years ago, per data from the US Treasury. pic.twitter.com/1OcFdMvIyj

— Jeffrey Kleintop (@JeffreyKleintop) September 18, 2022

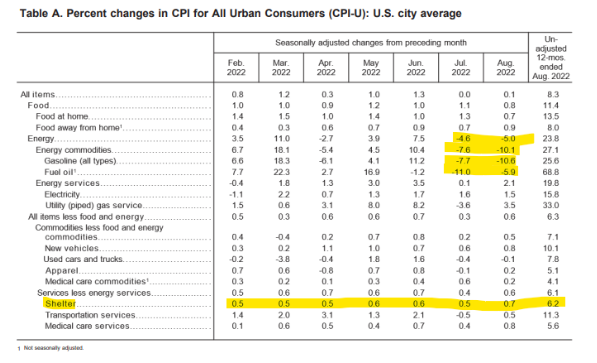

Food at home CPI increased up to 13.5% in August, compared to 13.1% in July, the highest since February 1979.

— unusual_whales (@unusual_whales) September 16, 2022

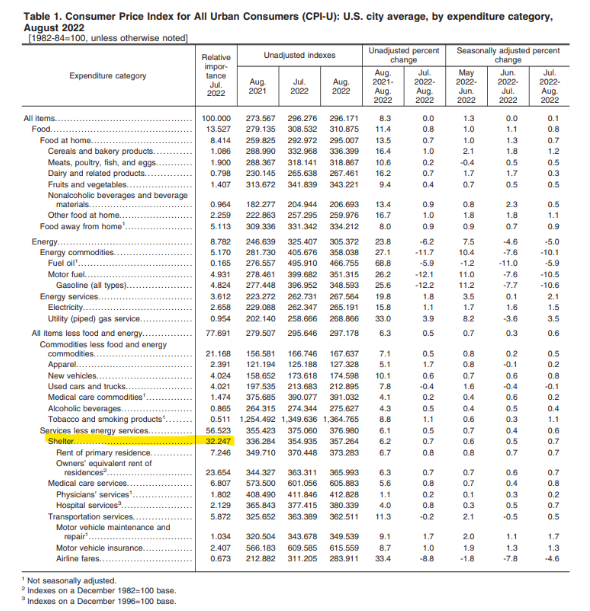

The rent inflation reported in the CPI (including the M/M number) is ~90% a story about what happened last year, not current conditions.

— Matthew C. Klein (@M_C_Klein) September 13, 2022

Since 2019-end, owner's equivalent rent (the biggest component of CPI) is up a cumulative 10.8% and Apartment List's national median rent is up a cumulative 24.2%, implying CPI shelter has a lot of catching up to do.

— Samuel Lee (@svrnco) September 13, 2022

University of Michigan: The median expected year-ahead inflation rate declined to 4.6%, the lowest reading since last September.

At 2.8%, median long run inflation expectations fell below the 2.9-3.1% range for the first time since July 2021. https://t.co/vozt57nkTN

— Nick Timiraos (@NickTimiraos) September 16, 2022

The housing shortage went national during the pandemic. Not a single state added more units than new households. pic.twitter.com/AE0Y3hPk2s

— Josh Lehner (@lehnerjw) September 16, 2022

Let's dig into OpenDoor properties in Las Vegas.🎲

— Lance Lambert (@NewsLambert) September 16, 2022

About half of US income is earned by households making more than $100,000 per year, with most owning their own homes. So the largest expense for these households isn’t rising even w/tighter Fed policy, but wages are going up, perhaps explaining why core inflation is so sticky: MS

— Lisa Abramowicz (@lisaabramowicz1) September 19, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: