Today’s Animal Spirits is brought to you by YCharts:

See here for YCharts Highlights, Lowlights, and insights from 1H 2022

On today’s show we discuss:

- GDP is still relatively new

- One of the few benefits of inflation

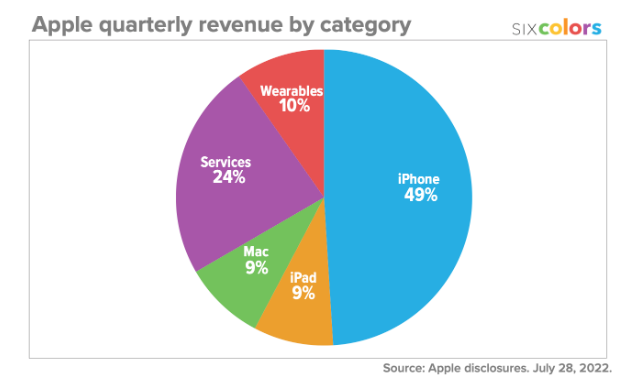

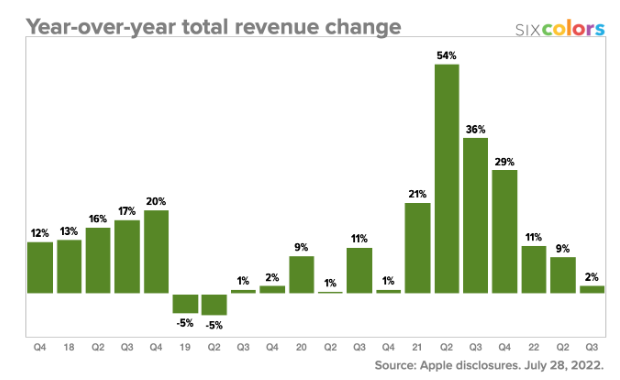

- AAPL earnings

- Retail is betting on tech

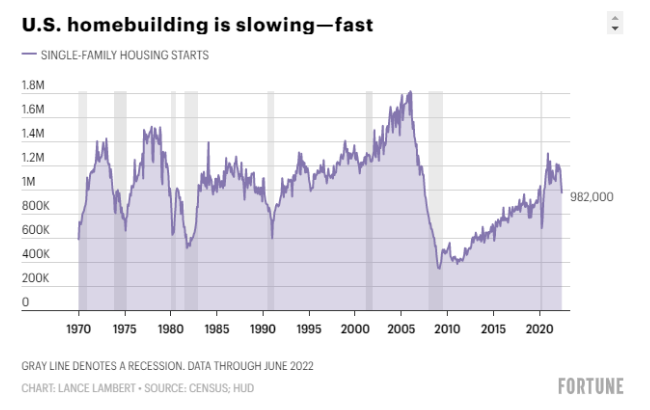

- A housing recession is the first domino to fall

- Dan Green on housing

- AMZN earnings

- MSFT earnings

- V earnings

- SPOT earnings

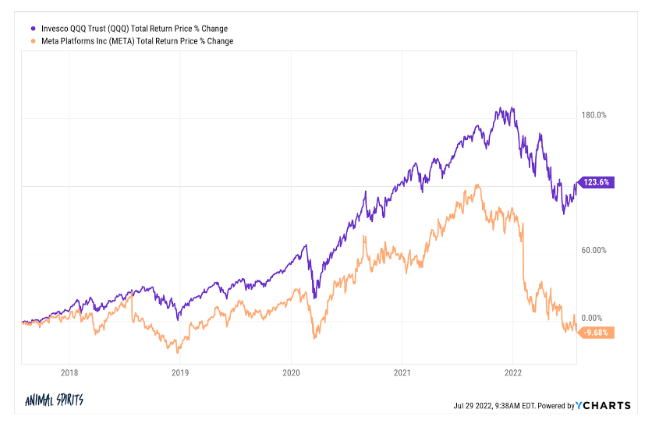

- META earnings

- SHOP earnings

- Overdraft fees are costing consumers billions

- Millennials didn’t move away from where they grew up

Future Proof Festival

Listen here:

Recommendations:

- Blackbird

- Predator

- City Slickers

- Close Encounters of The Third Kind

- There Will Be Blood

- The Craig Kilborn Podcast

Charts:

Tweets:

Recessions have not been "redefined."https://t.co/R42GCfU1An

This is such an FAQ that I asked it when I first became a financial reporter in 1987.

I got the same answer 35 (yes, thirty-five) years ago. pic.twitter.com/Ig5j3EYtA5

— Jason Zweig (@jasonzweigwsj) July 27, 2022

Given all the discussion this week, I thought it'd be interesting to look back at the one example we have of a two-quarter contraction in G.D.P. that was *not* labeled a recession by NBER: Q2 and Q3, 1947.

— Ben Casselman (@bencasselman) July 27, 2022

Rare to see: Fed is actively hiking rates (blue line) while GDP is contracting (bottom) … typically in prior recessions (red bars), Fed has been cutting rates as GDP has declined pic.twitter.com/nmrYG3TBc0

— Liz Ann Sonders (@LizAnnSonders) August 1, 2022

“No Recession In Today’s #GDP Indicators.” – @yardeni pic.twitter.com/rRGQJFsWJD

— Carl Quintanilla (@carlquintanilla) July 27, 2022

B of A: “The recent debate about whether the US is already in a recession is a distraction. Rip roaring payroll, strong GDI and strong final sales all suggest ‘recession’ is still a forecast, not a reality.” [Harris] pic.twitter.com/kuKQ9ry8De

— Carl Quintanilla (@carlquintanilla) July 29, 2022

Fun facts: In the first six months of the 1981-82 recession, we lost 1,046k jobs, in the first six months of the 1990-01 recession we lost 690k jobs, in 2001 we lost 761k jobs, in 2007-09, we lost 705k jobs. In 2022 we gained 2,740k jobs.

— Dean Baker (@DeanBaker13) July 29, 2022

Durable Goods Orders in the United States increased 1.90 percent in June of 2022 over the previous month. https://t.co/G4gyxTou0U pic.twitter.com/JDEbwTcNA6

— TRADING ECONOMICS (@tEconomics) July 27, 2022

Stepping back from the ultra high frequency debates this picture from @WSJ is a great reminder of just how much better economic policy has gotten over the last eighty years compared to what came before. Both better understanding and institutional progress. https://t.co/RBlb89Z6hT pic.twitter.com/X9p5CLn46I

— Jason Furman (@jasonfurman) July 30, 2022

10-year Treasurys recorded the biggest one-month yield decline since **March 2020**–Dow Jones Market Data.

At 2.642% today

— Gunjan Banerji (@GunjanJS) July 29, 2022

Of the 86 prior days where the Nasdaq rallied 4%+, nearly half occurred from 2000 to 2002. pic.twitter.com/fW59tPf61T

— Bespoke (@bespokeinvest) July 28, 2022

The S&P 500 gained 3.9% on the day of the Fed hike and following day.

That is officially the best rally after a hike going back to 1970 (Bloomberg data).

— Ryan Detrick, CMT (@RyanDetrick) July 28, 2022

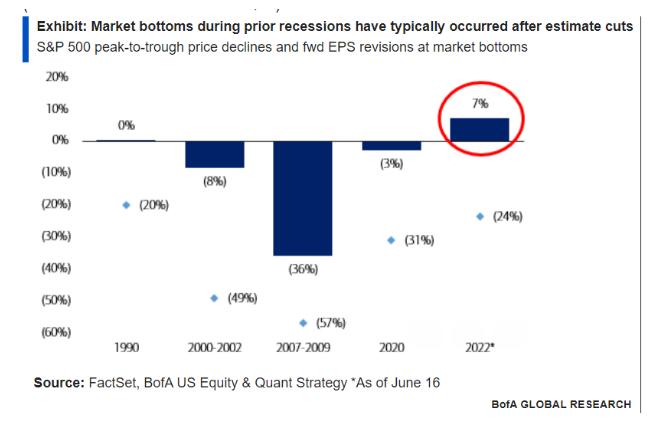

5. There has never been a recession without a 4Q GAAP EPS decline. In most recessions, Y/Y EPS growth has ⬇️ <-20%.

That's critical because the market tends to⬆️ faster when EPS growth is ⬇️(markets anticipate reversals), EXCEPT when EPS growth has been <-20% (SPX -9.8% GPA). 5/5 pic.twitter.com/5NN7K5yAcW— Ed Clissold (@edclissold) July 25, 2022

S&P 500 2023 EPS expectations falling off a cliff. pic.twitter.com/5rgLtWGo0V

— Gina Martin Adams (@GinaMartinAdams) July 29, 2022

Proceeds from IPOs of technology companies have amounted to $512M, down from $58.7B last year.

— Ryan Petersen (@typesfast) July 27, 2022

mortgage rates have been exceptionally volatile in 2022.

so far this year the standard deviation of the weekly change in the 30-year FRM is 18 basis points, highest since 2008 and third highest in the past half century pic.twitter.com/BlgX03CU7I— 📈 Len Kiefer 📊 (@lenkiefer) July 29, 2022

Incredible story. Tiger Global-backed start up MissFresh just told staff its run out of money. At same time, unpaid suppliers have occupied its offices in protest. Reminder: was listed at $3bn valuation last year – in @FT https://t.co/Sfp4OK3wEy

— Murad Ahmed (@muradahmed) July 28, 2022

$AMZN pic.twitter.com/FoPH59IOAF

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) July 28, 2022

Meanwhile….

The median real revenue growth for the FAANG stocks has officially turned negative for the first time in almost 2 decades. pic.twitter.com/CAUP6VZQU7

— Otavio (Tavi) Costa (@TaviCosta) July 29, 2022

Give those mega caps a ribbon!

This earnings season is on pace to be the first time since at least 2015 that AAPL AMZN GOOGL, and MSFT all reported in the same week and all 4 had positive reactions to their reports. https://t.co/7Q06UdGTS9 pic.twitter.com/84flXtW0Di

— Bespoke (@bespokeinvest) July 29, 2022

*BEST BUY DROPS 11% AS 2Q COMPARABLE SALES TO DECLINE ABOUT 13%

— zerohedge (@zerohedge) July 27, 2022

The first recession where leisure/hospitality companies are doing earnings beats and raises I guess: pic.twitter.com/HX8hpBJ5eW

— Conor Sen (@conorsen) July 27, 2022

Just a crushingly sad paragraph:https://t.co/QGOOHDHmn3 pic.twitter.com/VDBiVMArW4

— Sarah Halzack (@sarahhalzack) July 26, 2022

Once people get used to a certain luxury, they take it for granted. Then they begin to count on it. Finally, they reach a point where they can’t live without it. pic.twitter.com/4t2hz9xGOE

— Yuval Noah Harari (@harari_yuval) July 12, 2022

What a chart, via @sarafischer.

Streaming gets “the highest percentage since [Nielsen] began its monthly reports in June 2021.” pic.twitter.com/5ke1dHRbek

— Carl Quintanilla (@carlquintanilla) July 26, 2022

The ultimate hunt between Predator and Prey began centuries ago. Stream #PreyMovie Aug 5, only on @Hulu. pic.twitter.com/yyDmIPX2pH

— 20th Century Studios (@20thcentury) August 1, 2022

Michael B. Jordan's Creed III has officially been delayed from Nov. 23, 2022 to March 3, 2023. pic.twitter.com/OgLc2aPxRa

— Rotten Tomatoes (@RottenTomatoes) July 28, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: