A couple of weeks ago I gave a talk to my hometown Traverse City Economic Club.

This was the first time I gave this presentation (and my first in-person talk since the onset of the pandemic) about 8 of the biggest myths of investing.

I thought it would be worth sharing so here are the slides:

Loading...

Loading...

Here’s a quick explanation of each:

Myth #1: You have to time the market to be successful.

Not true…if you have a long time horizon. See here:

Myth #2: You should wait until the dust settles to invest your money.

The last few years offer a good explanation for how the stock market works in general:

- In 2020 the economy was terrible yet the stock market boomed.

- In 2022 the economy is on fire yet the stock market is selling off.

What gives?

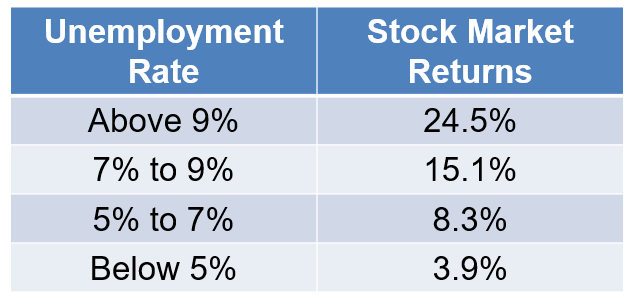

I guess you could blame everything that happens on the Fed but look at this chart I pulled from my first book on the annualized returns at different unemployment levels:

Investing when things look bleak can lead to amazing returns. Investing when things are wonderful typically leads to lower returns.

Obviously, this is an oversimplification, but it makes sense that returns would be higher when the economy is in trouble. That’s when prices are lower!

And when the economy is firing on all cylinders, prices have likely already moved higher.

The stock market also does a decent job of front-running the economy.

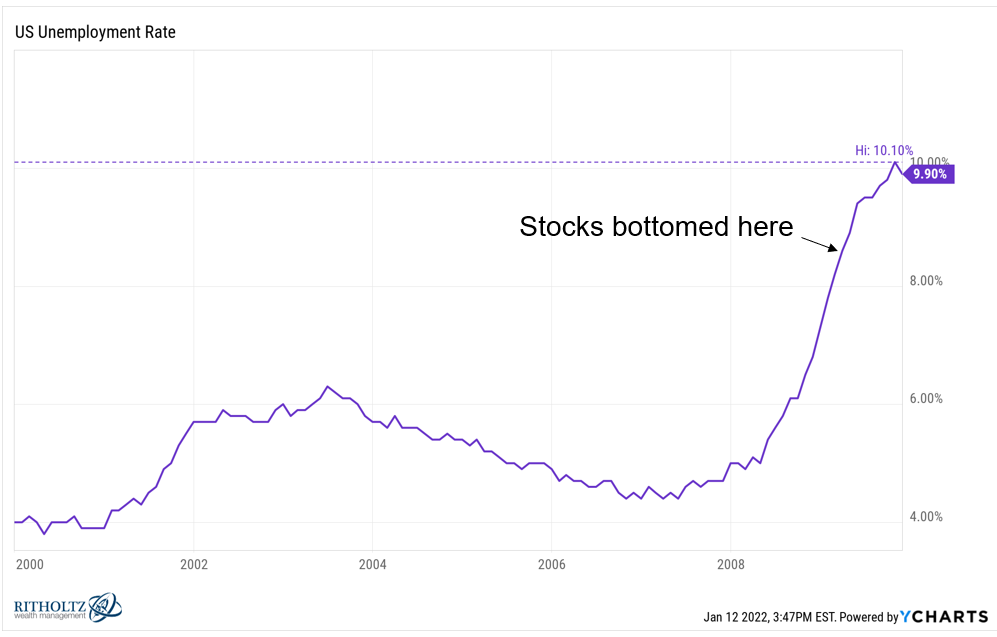

In 2009, the stock market bottomed in early March. The unemployment rate continued to rise until it parked in October, 8 months later:

By the time the unemployment rate peaked, stocks were already up nearly 60% from the bottom.

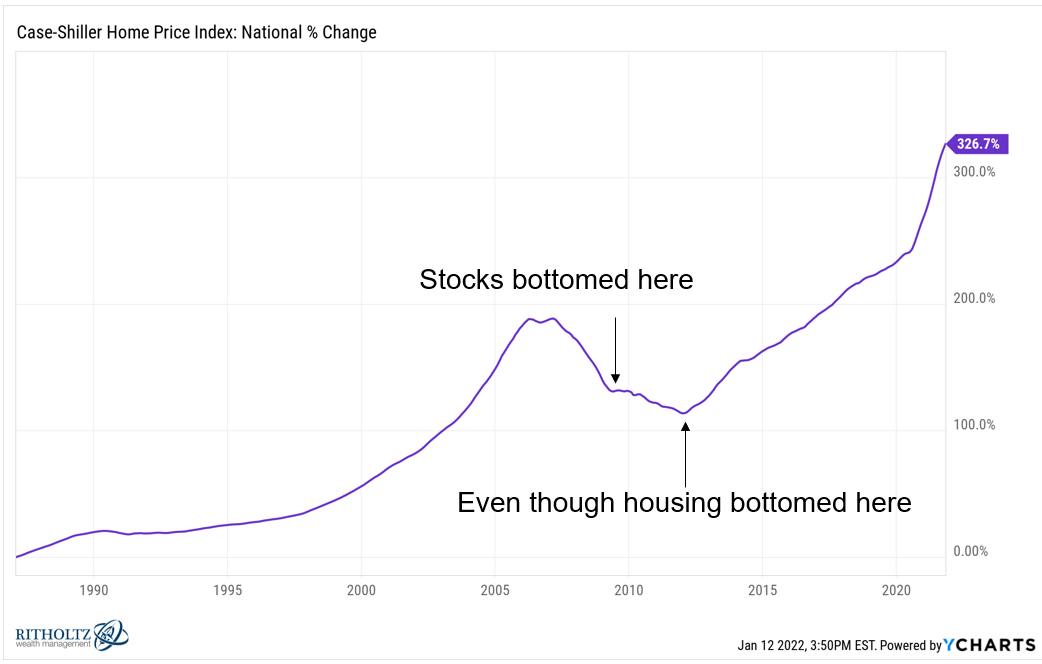

Or how about housing prices after the biggest housing crash we’ve ever seen? They didn’t bottom for three years after the stock market:

Stocks were already up well over 100% by then.

If you wait for things to be perfect you’re going to miss out because the stock market doesn’t care about good or bad, only better or worse.

Myth #3: Just wait for things to return to “normal” to invest.

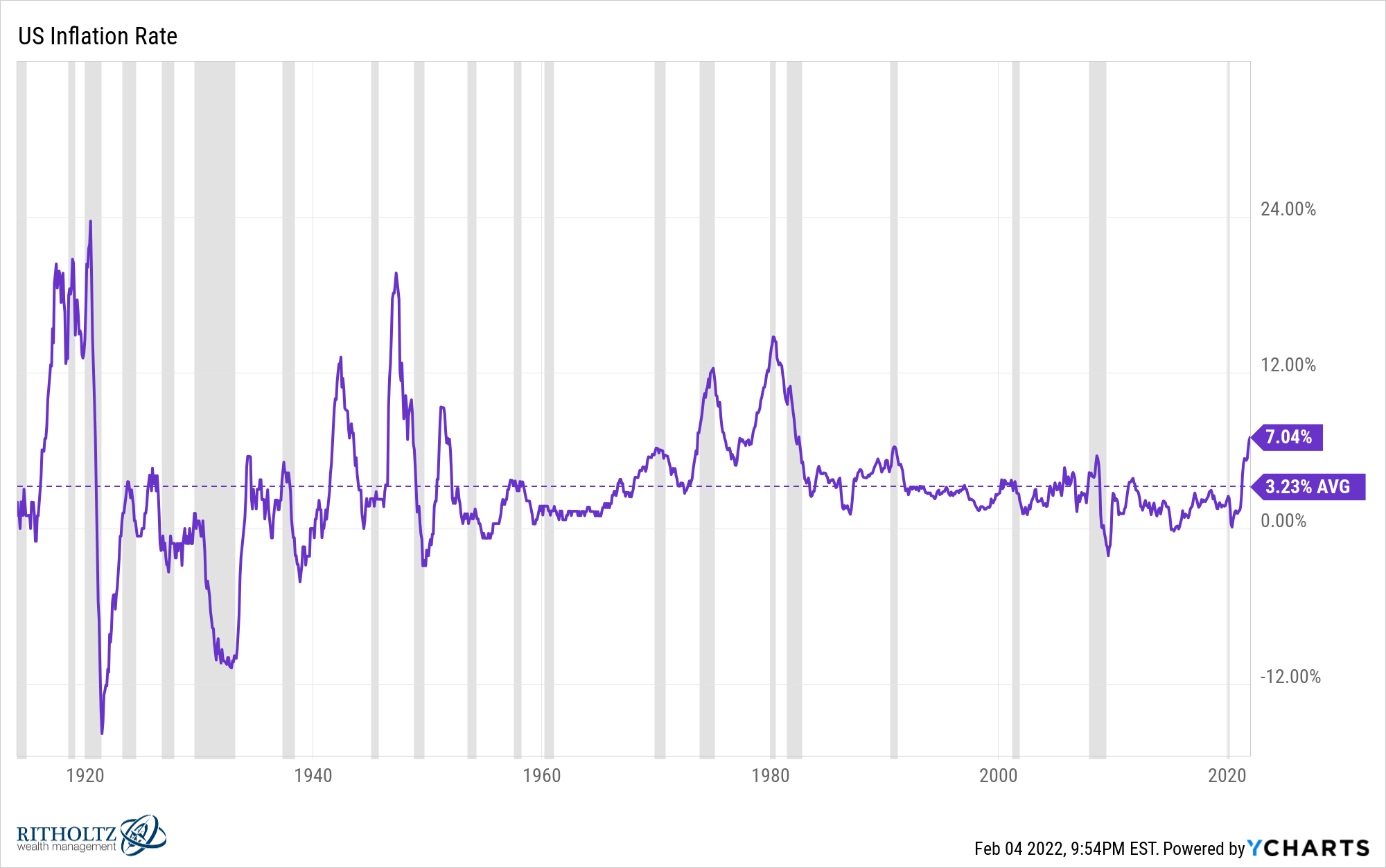

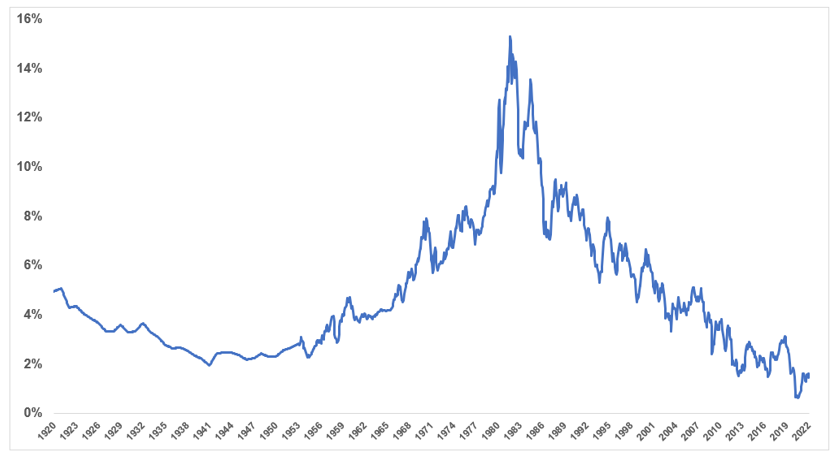

This is the U.S. inflation rate over the last 100+ years:

Now here is a look at 10 year treasury yields over a similar time frame:

I’m having trouble figuring out when inflation or interest rates were normal on these charts.

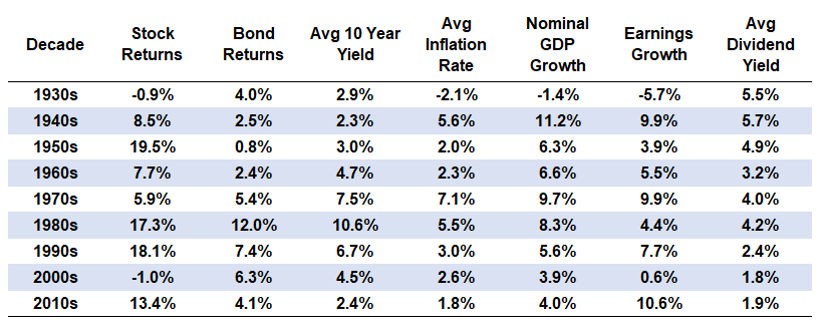

Here’s a breakdown of financial market returns, bond yields, the inflation rate, economic growth, earnings growth and dividend yields by decade going back to the 1930s:

Which one of these environments was normal?

There is no such thing as normal in the markets or the economy. The only constant is change.

Myth #4: A higher yield makes for a safer investment.

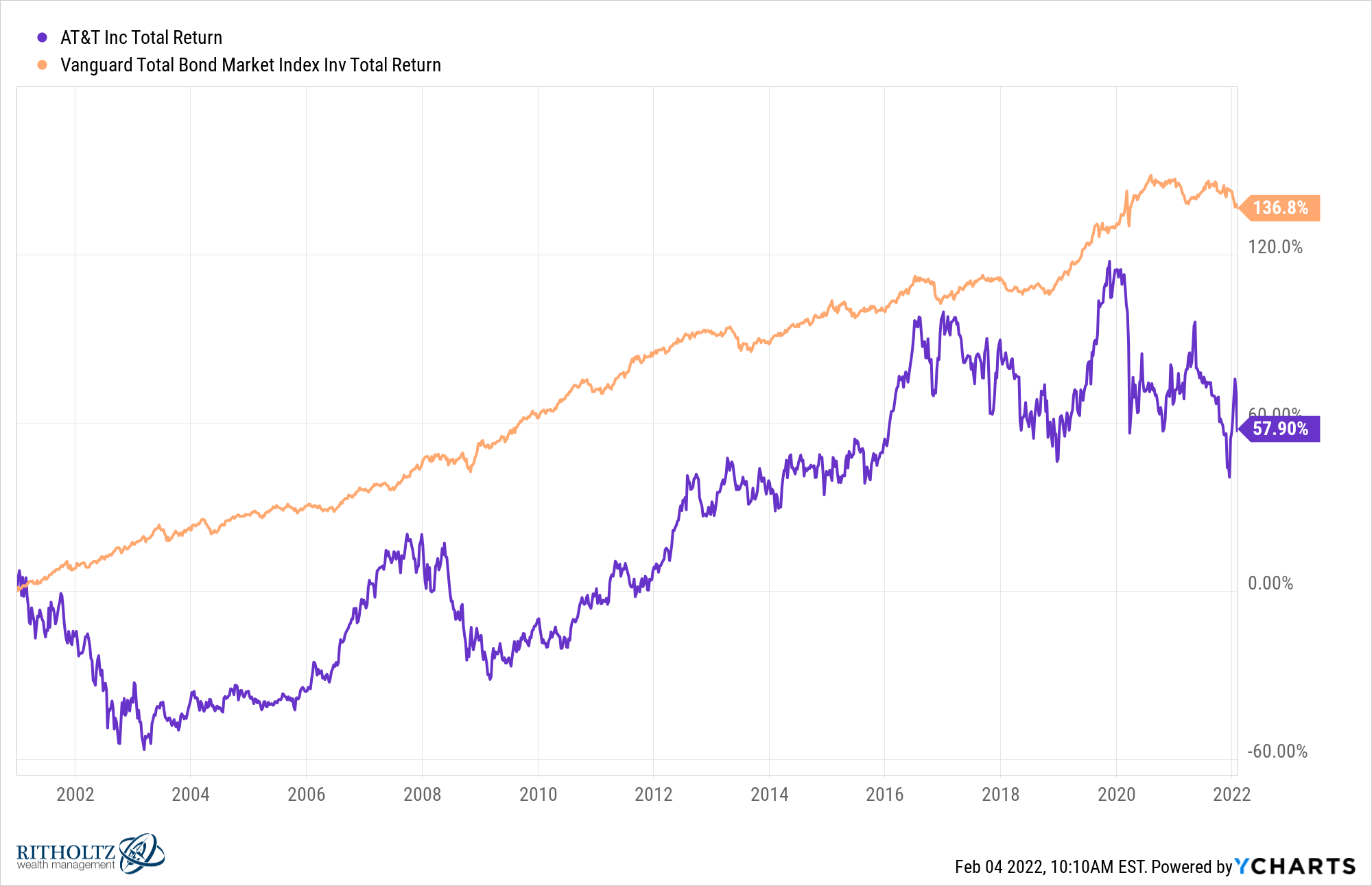

This is the average dividend yield for AT&T going back to the turn of the century:

Five percent is not bad, right? Just clip that coupon every year.

Now here’s the price chart:

The stock is more than 50% off prices from 2000 (and 40% off prices from 2017). Yes, you still earned those dividend payments but your returns were dreadful.

In fact, you underperformed a simple total bond market fund but with way more volatility:

Now I’m not saying you should avoid investing in dividend-paying stocks.

A basket of dividend growth stocks can be a wonderful addition to the right portfolio.

You just can’t bank on yield alone to save you when investing over the long-term. Total returns are the only ones that matter.

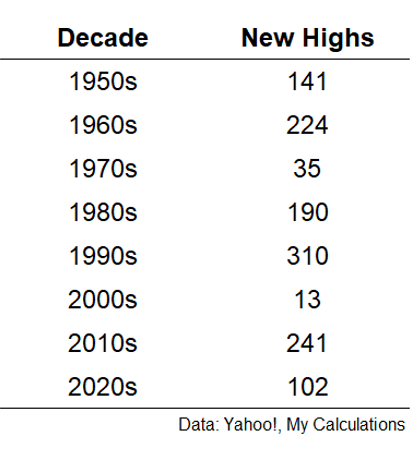

Myth #5: New highs mean the stock market is going to crash.

I know it seems scary when the stock market is at all-time highs because one of those highs will be THE high before a bear market.

But all-time highs are perfectly normal:

Over the last 100 years or so, 1 out of every 20 days the market has been open has closed at an all-time high.

Myth #6: The stock market is like a casino.

Whenever the stock market falls it feels like the powers that be are out to get you. People always compare the stock market to a casino when they lose money.

This analogy has never made sense to me.

At the casino, the longer you gamble, the greater your odds of walking away a loser. The casino has better odds than you. It’s math.

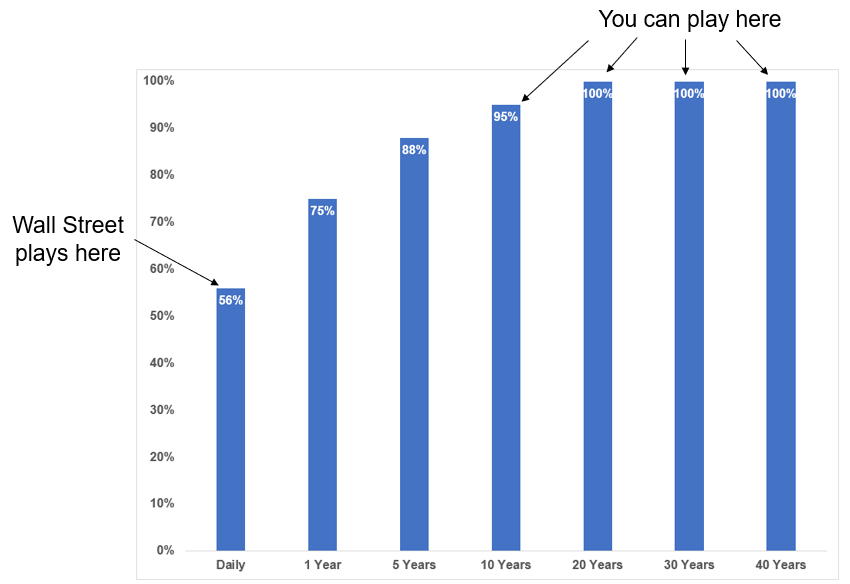

But in the stock market, the longer you invest the greater your odds of success:

On a daily basis, it’s basically a coin flip between positive or negative returns. But extend your holding period and your probability of seeing gains has increased throughout history.

The longer your time horizon in the stock market, the greater your chances of walking away a winner.

If casinos operated this way they would go out of business.

Myth #7: Risk is quantifiable.

My biggest problem when working in the institutional investment complex was everyone’s overreliance on math equations to define risk.

I understand the need to benchmark. And risk-adjusted returns can help investors get a better handle on what’s going on in a portfolio or individual strategy.

But an over-reliance on quantitative measures can be a deterrent if you assume it can help you better predict what’s going to happen in the future.

While I am a data junkie, there has to be a qualitative aspect to investing as well.

Buffett once said, “Risk comes from not knowing what you’re doing.”

Carl Richards wrote, “Risk is what’s left when you’ve thought of everything.”

For individual investors these are the only two questions that truly matter:

(1) Am I on track to reach my financial goals?

(2) How do I minimize the probability that I won’t reach these goals?

You can never give yourself 100% assurance on these questions but that’s why planning is a process, not an event.

Myth #8: Complex problems require complex solutions.

Let’s say you have a $1 million portfolio. This is the annual income you would earn on this money if you put the entire amount into 10 year treasuries over time:

- 1960: $47,000

- 1970: $78,000

- 1980: $108,000

- 1990: $82,000

- 2000: $67,000

- 2010: $37,000

- Now: $19,000

Interest rates are rising but they’re still lower than they’ve been 99% of the time historically.

Because of this low rate environment, there will be plenty of investors and salespeople pushing for more complexity to make up for paltry yields.

But when you boil it down, there are really only two options for investors:

(1) Take more risk

(2) Lower your expectations

The financial markets are a complex adaptive system but you don’t need to fight complex with complex to succeed.

Simple is often more effective when solving complex problems like the markets.

Further Reading:

Why Simple Beats Complex

Update — Here’s a video of my presentation: