This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

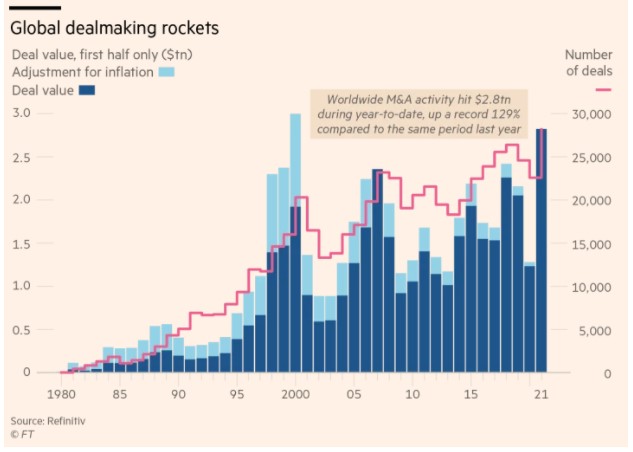

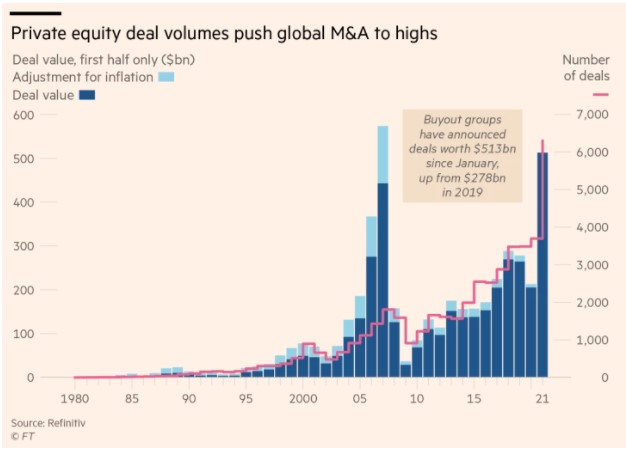

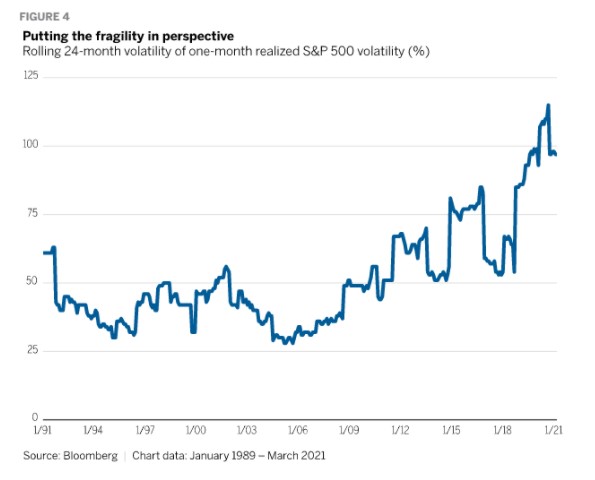

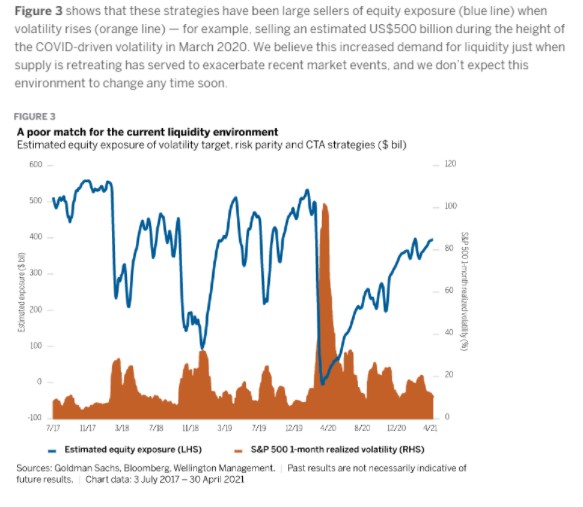

- Faster markets

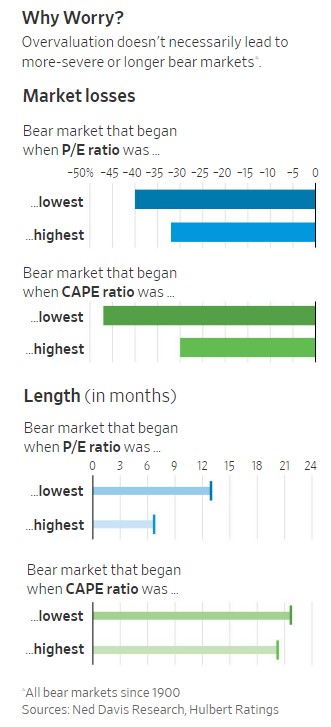

- Why bear markets from high valuations aren’t necessarily worse

- Robinhood’s S-1 disclosures

- The benefits of taking a break from social media

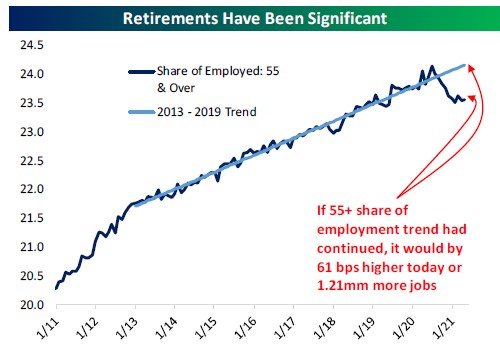

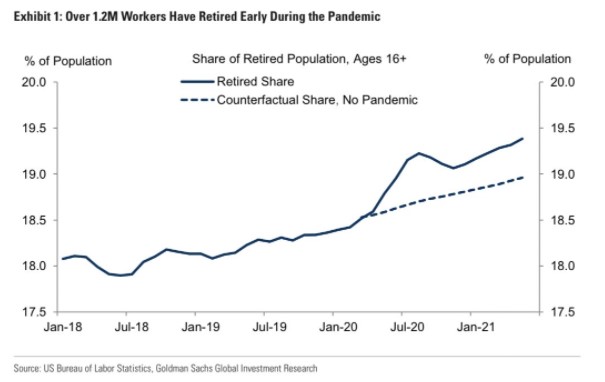

- The pandemic caused a wave of early retirees

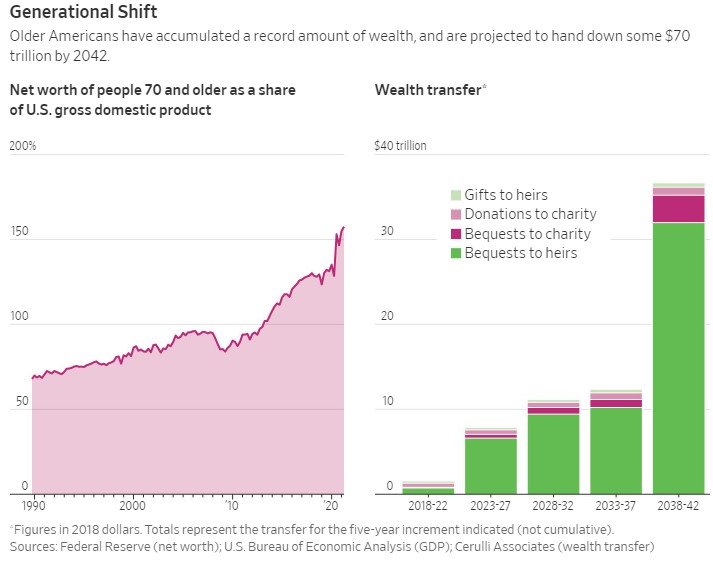

- The coming tidal wave of inheritance money

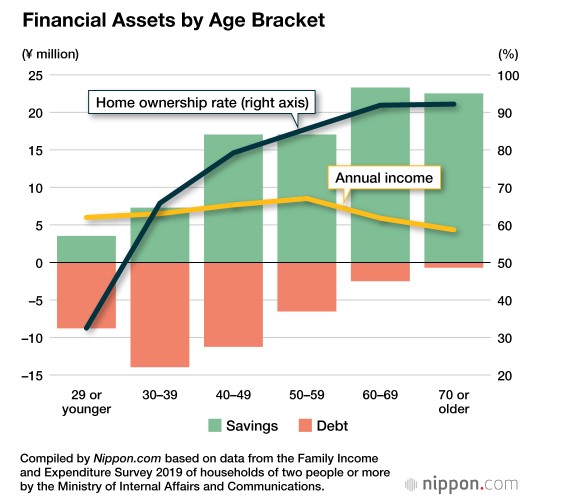

- How are so many people so financially secure in Japan?

- Why do we still have so many tariffs in place?

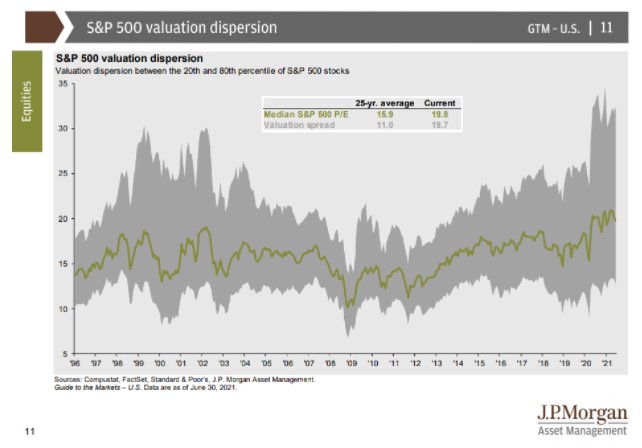

- Dispersion in valuations

- Something I was wrong about

- The great migration from California to Austin

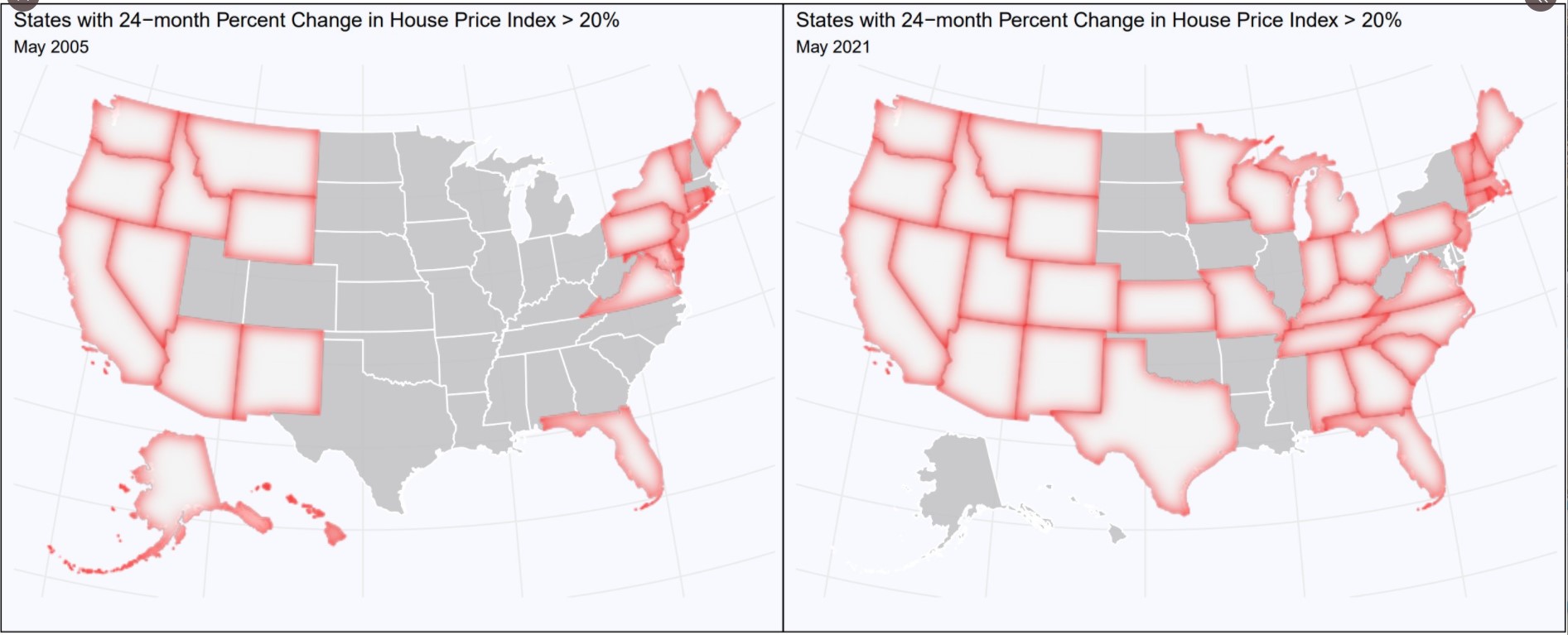

- Housing gains are greater now than in the housing bubble

- Addictive personalities vs. social media

- Substack is going to create opportunities for young people

- Some thoughts on The Tomorrow War and more

Listen here:

Stories mentioned:

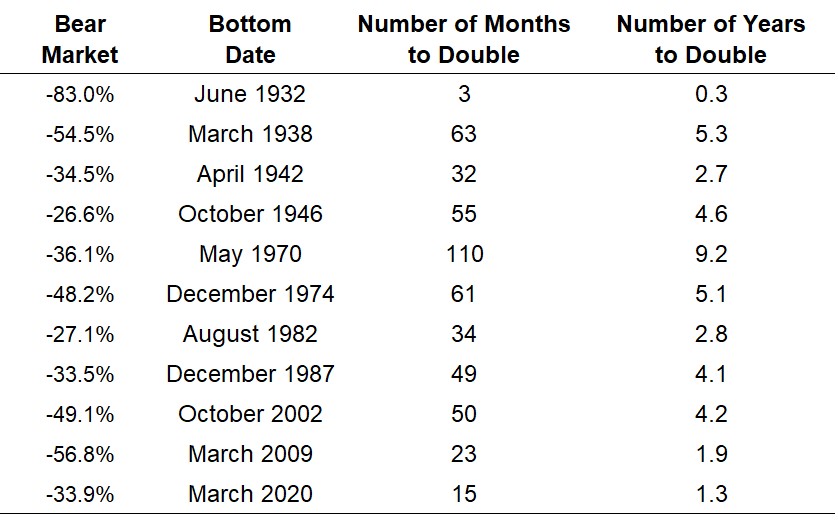

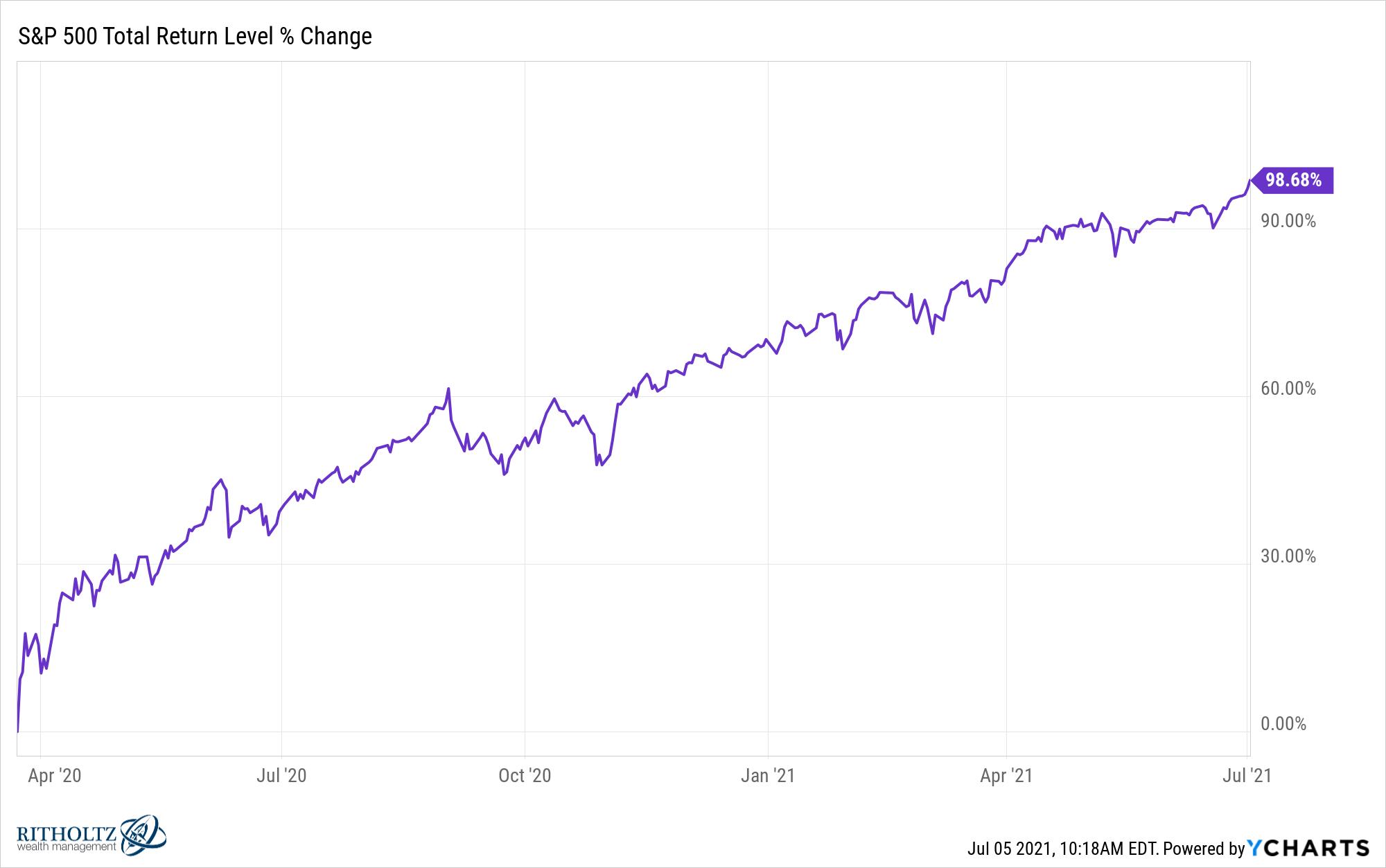

- How long might the next bear market last?

- Robinhood S-1

- Robinhood’s investors have fun

- Will Robinhood become the Facebook of finance?

- The pandemic made a lot of people retire early

- The time has come for older Americans to give away their wealth

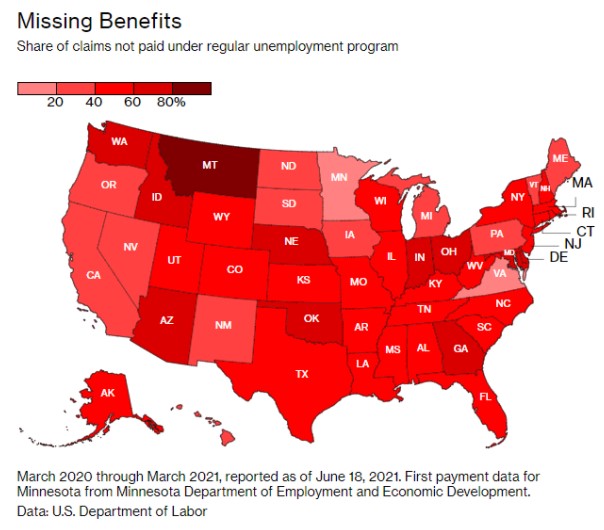

- U.S. unemployment rescue left at least 9 million without help

- Few financial worries for older people in Japan

- Private equity breaks 40-year record with $500 bln of deals

- Californians are fueling Austin’s housing frenzy

- You really need to quit Twitter

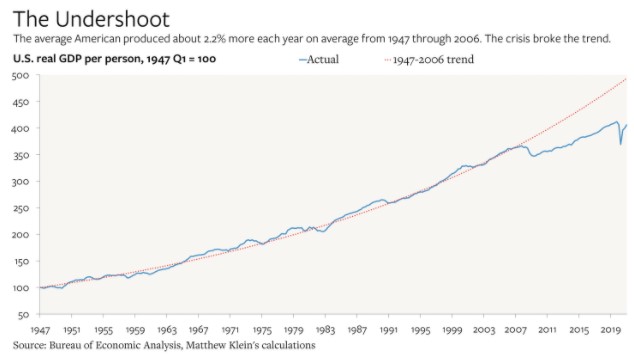

- Let’s overshoot

Books mentioned:

- Ocean Prey by John Sandford

- Noise by Daniel Kahneman

- Once Upon a Time in Hollywood by Quentin Tarantino

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: