On this week’s Animal Spirits with Michael and Ben we discuss:

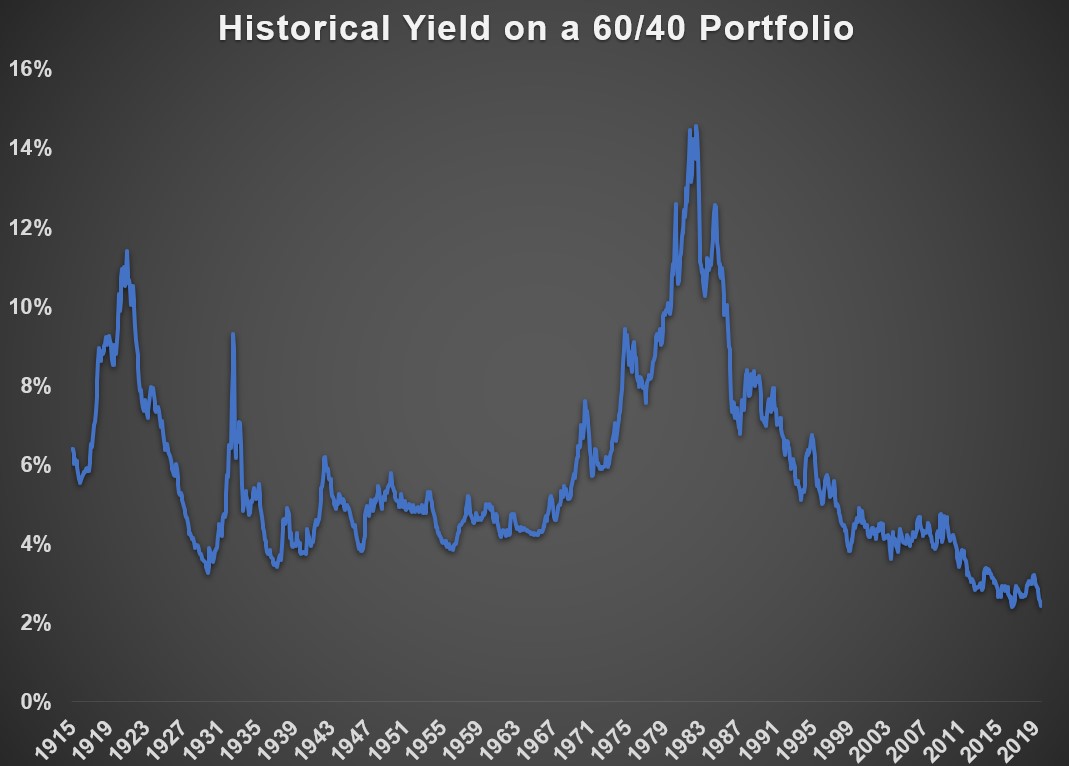

- Can the 60/40 portfolio ever really die?

- Why stock matter more than bonds for long-term returns

- Why don’t rich people just stop working?

- Did Carl Icahn ruin Blockbuster?

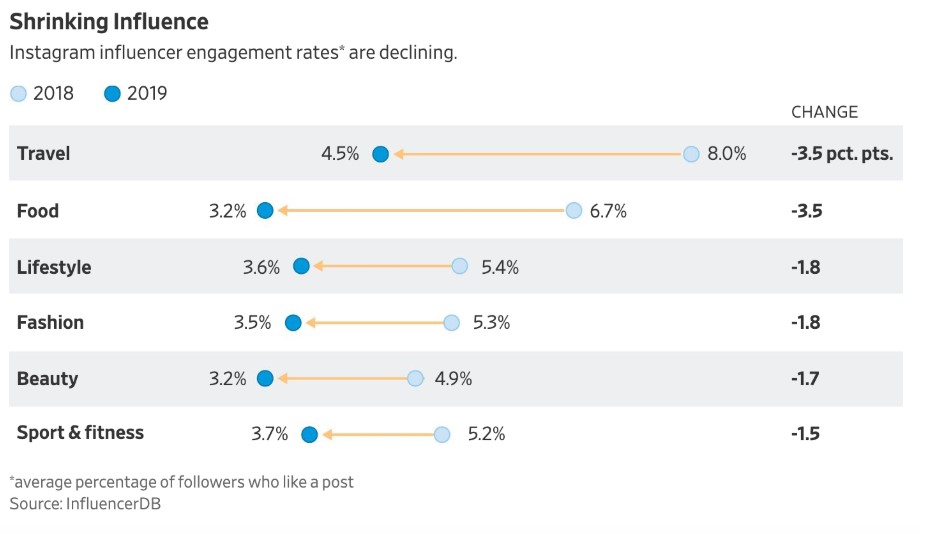

- Is anyone listening when influencers tell us what to buy?

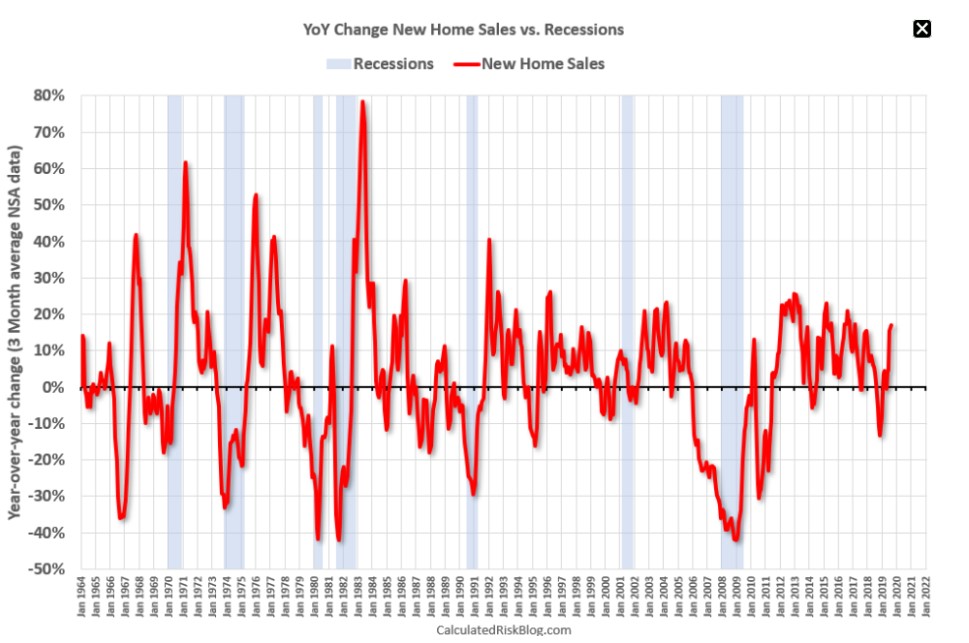

- What if the recession is still a few years away?

- Buybacks and earnings growth

- The best predictor of stock fund returns

- What age are people the least happy in life?

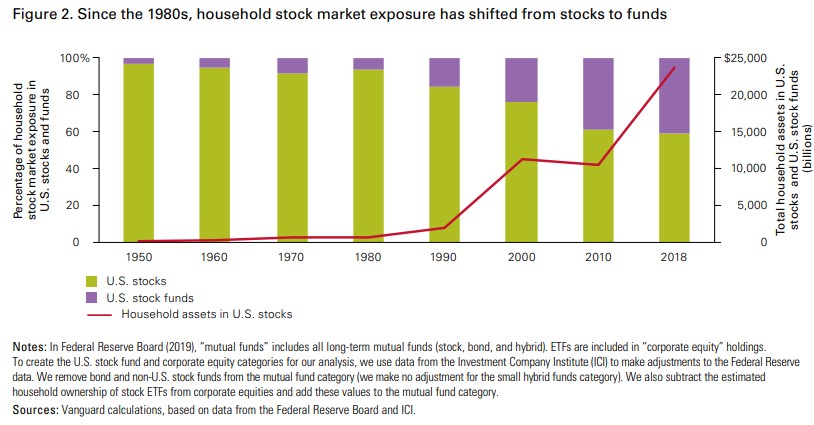

- The huge shift from individual stocks to stock funds

- Was Disney Plus a no-brainer?

- QE on the DL

- Will QE ever really go away?

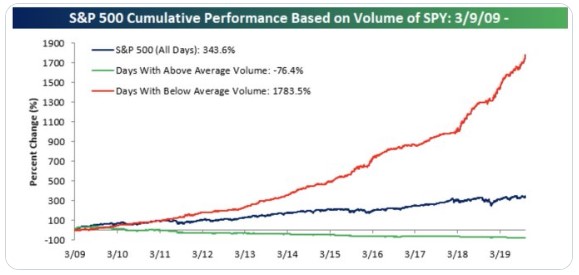

- Does the market care about the volume of trading?

- Is Office Space properly rated?

- Is Paul Rudd the least polarizing actor on the planet?

- Netflix vs. Blockbuster and much more

Listen here:

Stories mentioned:

- Bank of America declares the end of the 60/40 portfolio

- A eulogy for the 60/40 portfolio

- 60/40 has worked even when bond returns were low

- Why don’t rich people just stop working?

- Carl Icahn is making another landmark deal

- Online influencers tell you what to buy

- Housing and recessions

- The best predictor of stock fund returns

- A questionable theory about Trump trades

- Study finds 45 is the least happy age

- What is a mutual fund worth

- Bob Iger bets big on streaming

- Understanding household trading behavior

- Finding meaning in quantitative easing

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: